PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906052

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906052

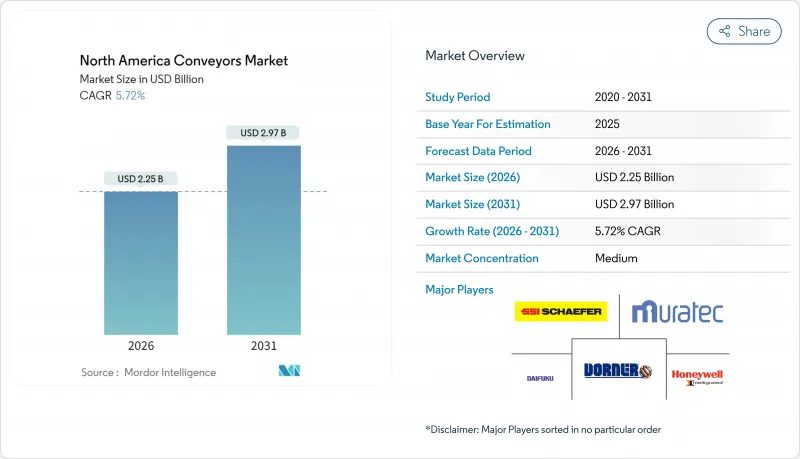

North America Conveyors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America conveyors market size in 2026 is estimated at USD 2.25 billion, growing from 2025 value of USD 2.13 billion with 2031 projections showing USD 2.97 billion, growing at 5.72% CAGR over 2026-2031.

Rising investment in automated material-handling technology, continuous growth in e-commerce parcel shipments, and federal tax incentives aimed at revitalizing domestic manufacturing continue to drive capital toward new installations and retrofits. Persistent labor shortages, leaving more than 600,000 factory positions vacant and warehouse turnover rates above 49%, reinforce the business case for conveyors that minimize manual touchpoints. Manufacturers also favor conveyors because they integrate easily with robotics and warehouse management software, improving throughput without requiring an increase in headcount. Meanwhile, end users see energy-efficient drives and predictive maintenance analytics lowering lifetime operating costs, even when raw material prices fluctuate. Together, these factors anchor steady replacement demand and create headroom for innovative vertical and modular layouts that fit tight urban footprints.

North America Conveyors Market Trends and Insights

Rapid Growth of E-commerce and Omnichannel Fulfillment Hubs

Fulfillment centers now feature conveyors capable of moving more than 10,000 parcels per hour, switching seamlessly between bulk and individual-pick workflows. Modular, high-throughput sorters are ideal for mezzanine and multi-level buildings, where rented space typically commands USD 15+ per square foot annually. Computer-vision scanners and AI-enabled sensors dynamically adjust belt speed and diverter angles based on package size, reducing mis-sort rates and operator touches. Retailers extending click-and-collect and ship-from-store programs require flexible systems that can redirect inventory within seconds, ensuring they keep same-day delivery promises. Pharmaceutical and automotive suppliers mimic these high-velocity designs to manage SKU proliferation without enlarging footprints. Recent compact cross-belt sorters launched by Interroll underscore the trend toward narrower frames and energy-efficient drives that reduce power consumption while increasing parcel throughput.

Automation and Industry 4.0 Adoption Driving Smart Conveyors

Networked conveyors equipped with edge sensors collect continuous data on vibration, temperature, and current draw, which is then fed into cloud analytics that predict failures up to 10 days in advance, resulting in a 30% reduction in unplanned stops. Wireless protocols enable adjacent zones to auto-throttle their speed to avoid jams, maintaining a balanced flow across the entire line. Digital-twin simulations model proposed layout changes, reducing commissioning time and ensuring bottlenecks are identified and resolved before hardware arrives. Voice-enabled human-machine interfaces shorten adjustment cycles for line leaders who can issue hands-free commands while monitoring multiple work areas. Facilities that pair conveyors with autonomous mobile robots (AMRs) orchestrate pick paths and transfer points in real-time, demonstrating that conveyors and AMRs operate best as complementary assets rather than substitutes.

High Initial Capital Expenditure for Automated Systems

A turnkey automated conveyor line ranges from USD 50,000 to USD 500,000, excluding electrical upgrades or floor reinforcements. Annual service contracts can equal 10-15% of purchase cost, complicating ROI models for firms with thin margins. Many small manufacturers adopt a modular approach, buying basic belt sections first and adding sort modules later, though that can create layout compromises. Equipment leasing and SBA-backed loans ease cash-flow strain yet still tie up credit lines that owners prefer to earmark for core production machinery. Despite these hurdles, payback periods often fall below three years once labor savings and quality gains are tallied, making financing conversations easier when interest rates stabilize.

Other drivers and restraints analyzed in the detailed report include:

- Labor Shortages and Rising OSHA Penalties Boosting Ergonomic Designs

- Tax Incentives Under U.S. Industrial Bills Accelerating Conveyor Investments

- Volatility in Raw Material Prices Inflating Total Cost of Ownership

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Overhead conveyors garnered faster interest as tight urban real estate costs reached USD 15 per sq ft in 2024, catalyzing a 7.06% CAGR through 2031 for this category. Belt units still dominated the North America conveyor market, with a 44.15% share in 2025, due to their broad compatibility across assembly, warehousing, and packaging lines. Roller models remain indispensable for handling heavy loads exceeding 1,000 lb per linear foot, which is common in automotive stamping. Pallet systems serve standardized unit loads, while niche variants, such as chain, screw, or pneumatic systems, address food or pharma environments that require wash-down or explosion-proof features. Lightweight alloy tracks and low-friction drives enable ceiling-mounted loops, freeing valuable floor area. Integrated lift sections now transfer totes between tiers without the need for lifts or AGVs, thereby compressing pick-path length and reducing travel time. Safety upgrades, including enclosed chain returns and auto-lube stations, help overhead layouts meet strict OSHA guidelines, reducing downtime for manual maintenance.

Innovation centers on magnetic-levitation tracks that virtually eliminate mechanical wear; pilot deployments focus on electronics assembly, where class-100 clean-room standards prohibit particulates. While commercial rollout remains limited, suppliers expect cost curves to fall as volume scales over the decade, potentially displacing chain-based overhead designs in sensitive sectors.

Unit handling systems held a 59.20% share of the North America conveyor market in 2025, a lead driven by discrete-item flows in e-commerce and pharma packaging. Growth at 6.18% CAGR outpaces bulk handling as the region's manufacturing pivots from low-value commodities toward high-mix, low-volume goods. Vision-guided diverters read barcodes on the fly, steering cartons into the correct chutes with sub-millimeter accuracy, which is crucial for electronics and auto parts. While bulk systems still move ore and grain at 1,000 t/h in the mining belts of the western provinces, capital budgeting increasingly rewards flexible unit lines that allow SKU proliferation without requiring overhauls. Modular sections lock together via quick-connect shafts, allowing for weekend reconfiguration during seasonal peaks. Integration with WMS platforms provides real-time inventory snapshots and triggers automated replenishment, trimming working capital tied up in safety stock. High-density accumulation zones buffer downstream palletizers, preventing line starve-outs when labeling or wrapping slows.

Advanced algorithms track dwell time per zone; if product backups exceed parameters, upstream belts automatically decelerate, smoothing the flow and eliminating the need for manual intervention. This real-time tuning ensures that fragile food packages remain intact and minimizes rework.

The North America Conveyors Market Report is Segmented by Product Type (Belt, Roller, Pallet, and More), Conveyor Class (Unit Handling Conveyors and Bulk Handling Conveyors), Drive Mechanism (AC Electric Motor Driven, DC Electric Motor Driven, and More), End-User Industry (Airport, Retail and E-Commerce Fulfillment, Automotive, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Daifuku Co., Ltd.

- Schaefer Systems International, Inc.

- Murata Machinery USA, Inc.

- Honeywell Intelligrated Inc.

- Dorner Manufacturing Corporation

- BEUMER Corporation

- Bastian Solutions, LLC

- Interlake Mecalux, Inc.

- KNAPP Inc.

- Swisslog Logistics, Inc.

- Kardex Remstar, LLC

- Viastore Systems Inc.

- Hytrol Conveyor Company, Inc.

- Material Handling Systems, Inc.

- Precision, Inc.

- Interroll Holding AG

- FlexLink AB

- Fives Intralogistics Corp.

- Siemens Logistics LLC

- TGW Systems Inc.

- Dematic Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid growth of e-commerce and omnichannel fulfillment hubs

- 4.2.2 Increasing demand for handling larger volumes of goods and improving productivity

- 4.2.3 Automation and Industry 4.0 adoption driving smart conveyors

- 4.2.4 Expansion of food and beverage processing requiring hygienic conveyor solutions

- 4.2.5 Tax incentives under U.S. industrial bills accelerating conveyor investments

- 4.2.6 Labor shortages and rising OSHA penalties boosting zero-pressure and ergonomic designs

- 4.3 Market Restraints

- 4.3.1 High initial capital expenditure for automated systems

- 4.3.2 Volatility in raw material prices inflating total cost of ownership

- 4.3.3 Space constraints in legacy facilities limiting conveyor layouts

- 4.3.4 Preference for plug-and-play AMRs in micro-fulfillment sites

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Intensity of Competitive Rivalry

- 4.8.5 Threat of Substitutes

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product Type

- 5.1.1 Belt

- 5.1.2 Roller

- 5.1.3 Pallet

- 5.1.4 Overhead

- 5.1.5 Other Specialized Conveyors

- 5.2 By Conveyor Class

- 5.2.1 Unit Handling Conveyors

- 5.2.2 Bulk Handling Conveyors

- 5.3 By Drive Mechanism

- 5.3.1 AC Electric Motor Driven

- 5.3.2 DC Electric Motor Driven

- 5.3.3 Hydraulic Driven

- 5.3.4 Pneumatic Driven

- 5.4 By End-User Industry

- 5.4.1 Airport

- 5.4.2 Retail and E-commerce Fulfillment

- 5.4.3 Automotive

- 5.4.4 General Manufacturing

- 5.4.5 Food and Beverage

- 5.4.6 Pharmaceuticals

- 5.4.7 Mining and Quarrying

- 5.4.8 Other End-User Industries

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Daifuku Co., Ltd.

- 6.4.2 Schaefer Systems International, Inc.

- 6.4.3 Murata Machinery USA, Inc.

- 6.4.4 Honeywell Intelligrated Inc.

- 6.4.5 Dorner Manufacturing Corporation

- 6.4.6 BEUMER Corporation

- 6.4.7 Bastian Solutions, LLC

- 6.4.8 Interlake Mecalux, Inc.

- 6.4.9 KNAPP Inc.

- 6.4.10 Swisslog Logistics, Inc.

- 6.4.11 Kardex Remstar, LLC

- 6.4.12 Viastore Systems Inc.

- 6.4.13 Hytrol Conveyor Company, Inc.

- 6.4.14 Material Handling Systems, Inc.

- 6.4.15 Precision, Inc.

- 6.4.16 Interroll Holding AG

- 6.4.17 FlexLink AB

- 6.4.18 Fives Intralogistics Corp.

- 6.4.19 Siemens Logistics LLC

- 6.4.20 TGW Systems Inc.

- 6.4.21 Dematic Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment