PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913424

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913424

Secondary Alkane Sulfonate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

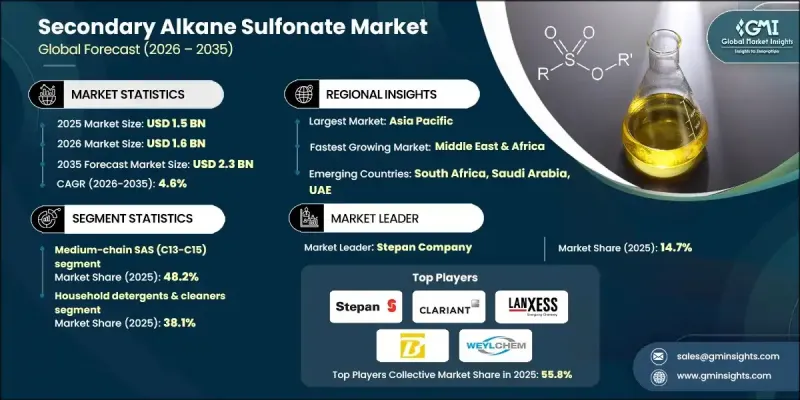

The Global Secondary Alkane Sulfonate Market was valued at USD 1.5 billion in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 2.3 billion by 2035.

Secondary alkane sulfonates are synthetic anionic surfactants known for their exceptional foaming, emulsifying, and cleaning capabilities, making them widely used in detergents and other cleaning formulations. They are environmentally sustainable, being biodegradable, which aligns with increasing consumer demand and regulatory mandates for eco-friendly cleaning solutions. Rising awareness of sustainable products, coupled with regulatory pressures against non-biodegradable surfactants, is driving further expansion in the Secondary Alkane Sulfonate Market. Meanwhile, the Middle East and Africa are emerging as the fastest-growing regions, benefiting from urbanization, higher disposable incomes, and rising demand for premium cleaning products.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.5 billion |

| Forecast Value | $2.3 billion |

| CAGR | 4.6% |

The medium-chain SAS (C13-C15) accounted for 48.2% share in 2025 and is expected to grow at a CAGR of 4.7% through 2035. These medium-chain variants are favored for their balance of biodegradability, performance, and cost efficiency, delivering reliable results in both personal care and cleaning applications.

The household detergents and cleaners segment held 38.1% share in 2025. Their dominance is fueled by growing urbanization, consumer preference for sustainable products, and stricter regulations driving innovations in eco-friendly formulations.

North America Secondary Alkane Sulfonate Market is expected to grow at a CAGR of 4.6% from 2026 to 2035. Increased consumer awareness of sustainable solutions, alongside trends in chemical recycling and waste reduction, is propelling demand for environmentally friendly surfactants across both household and industrial cleaning sectors.

Key companies in the Global Secondary Alkane Sulfonate Market include BIG SUN Chemical Corporation, Clariant AG, LANXESS AG, S.C. Johnson & Son, Shaoxing Shangyu Simo Research Institute of Organic Chemistry, Stepan Company, WeylChem Performance Products GmbH, among others. Leading players in the Global Secondary Alkane Sulfonate Market are adopting strategies to strengthen their presence by focusing on product innovation, expanding production capacities, and enhancing R&D for sustainable surfactant solutions. Companies are forming strategic partnerships, acquiring regional manufacturers, and leveraging technological advancements to improve efficiency and reduce environmental impact. Marketing initiatives emphasizing biodegradability and regulatory compliance help brands differentiate their offerings, while geographic expansion into high-growth regions ensures access to new consumer bases and industrial applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for biodegradable surfactants

- 3.2.1.2 Growth in household & personal care industries

- 3.2.1.3 Superior performance in hard water conditions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw material price volatility

- 3.2.2.2 Competition from alternative surfactants

- 3.2.3 Market opportunities

- 3.2.3.1 Development of bio-based SAS from renewable feedstocks

- 3.2.3.2 Emerging applications development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Short-chain SAS (C10-C12)

- 5.3 Medium-chain SAS (C13-C15)

- 5.4 Long-chain SAS (C16-C18)

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Personal care products

- 6.2.1 Shampoos & hair care

- 6.2.2 Shower gels & body washes

- 6.2.3 Liquid hand soaps

- 6.2.4 Facial cleansers

- 6.2.5 Toothpastes

- 6.2.6 Others

- 6.3 Household detergents & cleaners

- 6.3.1 Dishwashing liquids

- 6.3.2 Liquid laundry detergents

- 6.3.3 All-purpose cleaners

- 6.3.4 Sanitary & bathroom cleaners

- 6.3.5 Floor cleaners

- 6.3.6 Others

- 6.4 Industrial & institutional (i&i) cleaning

- 6.4.1 Metal cleaners

- 6.4.2 Automotive cleaners

- 6.4.3 Food processing cleaners

- 6.4.4 Healthcare disinfectant cleaners

- 6.4.5 Others

- 6.5 Textile & leather processing

- 6.5.1 Textile dyeing & finishing

- 6.5.2 Leather tanning & dyeing

- 6.5.3 Others

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

- 7.6.4 Rest of Middle East and Africa

Chapter 8 Company Profiles

- 8.1 BIG SUN Chemical Corporation

- 8.2 Clariant AG

- 8.3 LANXESS AG

- 8.4 S.C. Johnson & Son

- 8.5 Shaoxing Shangyu Simo Research Institute of Organic Chemistry

- 8.6 Stepan Company

- 8.7 WeylChem Performance Products GmbH

- 8.8 Others