PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913427

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913427

Pressure Sensitive Adhesives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

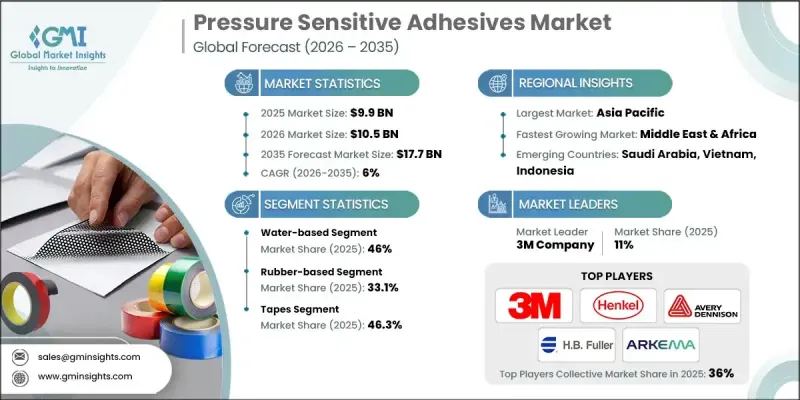

The Global Pressure Sensitive Adhesives Market was valued at USD 9.9 billion in 2025 and is estimated to grow at a CAGR of 6% to reach USD 17.7 billion by 2035.

The market has steadily grown alongside rising demand in packaging, e-commerce, automotive, electronics, and healthcare applications. Pressure-sensitive adhesives provide fast, clean, and efficient bonding without requiring curing, heat, or additional processing time, making them ideal for modern manufacturing and logistics trends emphasizing lightweight design, automation, and operational flexibility. Growth from 2021 to 2024 was particularly driven by surging parcel volumes fueled by e-commerce expansion and global supply chain demands, with courier tapes and labels maintaining high adoption across Asia, North America, and Europe. Regulatory shifts in Europe and North America, including VOC and solvent restrictions, have accelerated the transition from traditional solvent-based PSAs to water-based, hot-melt, acrylic, and bio-based chemistries that support sustainability and recyclability.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $9.9 Billion |

| Forecast Value | $17.7 Billion |

| CAGR | 6% |

The water-based PSA segment accounted for 46% share in 2025 and is expected to grow at a CAGR of 5.7% through 2035. Adoption of water-based and hot-melt technologies is rising as converters and brand owners prioritize cleaner solutions, faster processing, and energy efficiency. Regulatory pressure in North America and Europe continues to encourage a shift away from traditional solvent-based systems. UV-cured chemistries are also gaining traction for specialized applications requiring rapid curing and precise coating under high-temperature conditions.

The tapes segment held a 46.3% in 2025 and is forecast to grow at a CAGR of 4.6% through 2035. Tapes and labels lead usage primarily in packaging, logistics, automotive, and construction, while high-value segments like graphics, films, and laminates cater to premium demands. Brand owners increasingly require PSAs capable of adhering to low-energy plastics, coated films, and recycled materials, driving the demand for specialty tapes, security labels, protective films, and surface-protectant laminates.

North America Pressure Sensitive Adhesives Market generated USD 2.4 billion in 2024 and is estimated to reach USD 4.4 billion by 2034, growing at a CAGR of 6.1%. The U.S. remains the central market in the region, supported by advanced manufacturing, e-commerce logistics, healthcare consumables, and high-performance automotive and electronics tapes. Both global adhesive majors and regional converters are transitioning toward sustainable, low-VOC technologies to meet growing regulatory and consumer demands.

Key players operating in the Global Pressure Sensitive Adhesives Market include Wacker Chemie AG, Evonik Industries AG, Franklin International, Inc., Momentive Performance Materials Inc., LG Chem Ltd., Beardow Adams (Adhesives) Limited, 3M Company, Henkel AG & Co. KGaA, Avery Dennison Corporation, H.B. Fuller Company, Arkema S.A. (Bostik), Dow Inc., BASF SE, Sika AG, Ashland Inc., Mactac LLC, Toyo Ink SC Holdings Co., Ltd., Nippon Paint Holdings Co., Ltd., Illinois Tool Works Inc. (ITW), and Sun Chemical Corporation. Companies in the Global Pressure Sensitive Adhesives Market are employing multiple strategies to strengthen their presence and market position. They focus heavily on research and development to introduce innovative, sustainable, and high-performance adhesive solutions. Geographic expansion into emerging markets allows firms to access growing industrial and e-commerce sectors. Strategic partnerships with converters, packaging companies, and industrial manufacturers enhance distribution channels and product adoption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Product

- 2.2.4 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growth in e-commerce packaging and labeling volumes

- 3.2.1.2 Shift toward lightweight, modular product designs

- 3.2.1.3 Stricter VOC rules favor low-emission chemistries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw material price volatility and supply risks

- 3.2.2.2 Recycling, liner waste and end-of-life issues

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of medical, hygiene and wearable devices

- 3.2.3.2 EVs and electronics miniaturization in Asia Pacific

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Technology, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Water-based

- 5.2.1 Acrylic emulsion

- 5.2.2 Vinyl acetate-based

- 5.2.3 Others

- 5.3 Solvent-based

- 5.3.1 Acrylic solvent-based

- 5.3.2 Rubber solvent-based

- 5.3.3 Others

- 5.4 Hot melt

- 5.4.1 Styrenic block copolymers (SBC)

- 5.4.2 Ethylene vinyl acetate (EVA)

- 5.4.3 Polyolefin-based

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Product, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Rubber-based

- 6.3 Acrylic

- 6.4 Silicone

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Tapes

- 7.2.1 Packaging tapes

- 7.2.2 Masking tapes

- 7.2.3 Double-sided tapes

- 7.2.4 Medical tapes

- 7.2.5 Electrical tapes

- 7.2.6 Others

- 7.3 Labels

- 7.3.1 Product labels

- 7.3.2 Barcode labels

- 7.3.3 Security labels

- 7.3.4 Others

- 7.4 Graphics

- 7.4.1 Signage

- 7.4.2 Vehicle wraps

- 7.4.3 Wall graphics

- 7.4.4 Floor graphics

- 7.4.5 Others

- 7.5 Films & laminates

- 7.5.1 Protective films

- 7.5.2 Decorative films

- 7.5.3 Window films

- 7.5.4 Others

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Wacker Chemie AG

- 9.2 Evonik Industries AG

- 9.3 Franklin International, Inc.

- 9.4 Momentive Performance Materials Inc.

- 9.5 LG Chem Ltd.

- 9.6 Beardow Adams (Adhesives) Limited

- 9.7 3M Company

- 9.8 Henkel AG & Co. KGaA

- 9.9 Avery Dennison Corporation

- 9.10 H.B. Fuller Company

- 9.11 Arkema S.A. (Bostik)

- 9.12 Dow Inc.

- 9.13 BASF SE

- 9.14 Sika AG

- 9.15 Ashland Inc.

- 9.16 Mactac LLC

- 9.17 Toyo Ink SC Holdings Co., Ltd.

- 9.18 Nippon Paint Holdings Co., Ltd.

- 9.19 Illinois Tool Works Inc. (ITW)

- 9.20 Sun Chemical Corporation