PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913431

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913431

Diagnostic Ultrasound Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

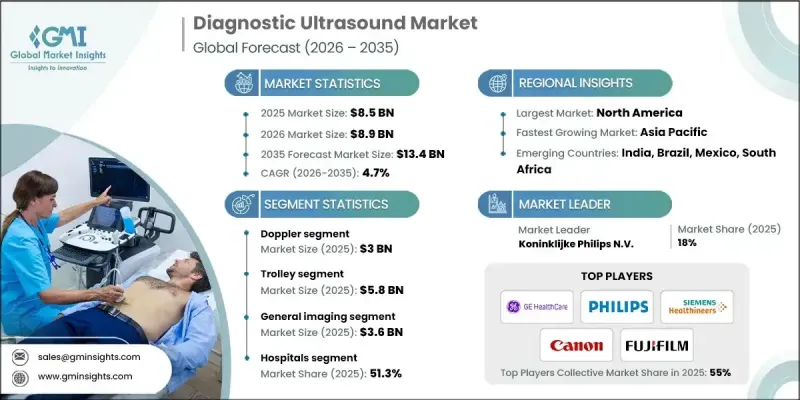

The Global Diagnostic Ultrasound Market was valued at USD 8.5 billion in 2025 and is estimated to grow at a CAGR of 4.7% to reach USD 13.4 billion by 2035.

Market growth is driven by multiple factors, including a rising geriatric population in both developed and emerging regions, the growing prevalence of chronic illnesses, increasing birth rates in certain countries, and continuous technological innovations in ultrasound devices. Diagnostic ultrasound is a non-invasive imaging technology that generates high-resolution images of internal organs using ultra-high-frequency sound waves. It is widely used to examine the abdomen, heart, musculoskeletal system, and other body parts. Technology is particularly valued for fetal monitoring during pregnancy and for guiding minimally invasive procedures such as biopsies. Increasing rates of cardiovascular diseases, cancer, and other chronic conditions are driving demand for safe, cost-effective imaging solutions. The development of portable and point-of-care ultrasound systems is improving accessibility and enabling faster real-time diagnostics in hospitals and outpatient settings, enhancing both efficiency and patient outcomes.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $8.5 Billion |

| Forecast Value | $13.4 Billion |

| CAGR | 4.7% |

The Doppler segment reached USD 3 billion in 2025. Doppler ultrasound is a specialized modality that measures blood flow within vessels by detecting changes in sound wave frequency. Available in formats such as color, power, and spectral Doppler, it is widely used for cardiovascular, vascular, and obstetric applications, providing critical real-time hemodynamic information. Its role in diagnosing cardiovascular disorders, monitoring fetal health, and assessing vascular conditions drives its dominance in the diagnostic ultrasound market.

The trolley segment reached USD 5.8 billion in 2025. Trolley-based ultrasound systems are traditional cart-mounted devices designed for comprehensive hospital and diagnostic center use. Equipped with multiple transducers and advanced imaging features, including Doppler, 3D/4D, and contrast-enhanced ultrasound, these systems are ideal for high-volume settings that require detailed imaging and seamless workflow integration.

North America Diagnostic Ultrasound Market accounted for 33.8% share in 2025. The region's share is supported by advanced healthcare infrastructure, early adoption of innovative imaging technologies, and the presence of leading manufacturers. Established reimbursement policies, consistent investment in imaging facilities, and the growing use of ultrasound in cardiology, obstetrics, and emergency care contribute to its strong market position.

Key players operating in the Global Diagnostic Ultrasound Market include Siemens Healthineers AG, Canon Medical Systems Corporation, Alpinion Medical Systems, Butterfly Network, Konica Minolta Inc., General Electric Company (GE Healthcare), Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Samsung Electronics Co., Ltd., Clarius Mobile Health, Hologic, Inc., CHISON Medical Technologies, Koninklijke Philips N.V., SonoScape, Esaote SpA, and FujiFilm Holdings Corporation. Companies in the Global Diagnostic Ultrasound Market strengthen their position through continuous product innovation, expanding their portfolio of advanced imaging modalities such as Doppler, 3D/4D, and point-of-care devices. Strategic partnerships with hospitals, clinics, and research institutions help expand adoption and enhance brand visibility. R&D investment drives miniaturization, portability, and software-enabled diagnostic capabilities. Firms also focus on improving workflow integration, user-friendly interfaces, and AI-based imaging analytics to deliver more accurate and faster diagnostics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Technology trends

- 2.2.3 Portability trends

- 2.2.4 Application trends

- 2.2.5 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing geriatric population base in developed as well as developing regions

- 3.2.1.2 Increasing incidence of chronic diseases

- 3.2.1.3 Increasing birth rates in developing countries

- 3.2.1.4 Technological innovations and advancements in diagnostic ultrasound devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dearth of skilled professionals especially in developing and underdeveloped regions

- 3.2.2.2 Barriers impeding use of diagnostic ultrasound in developing economies

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of AI and advanced imaging technologies

- 3.2.3.2 Increasing applications in preventive and primary care

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2025

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 2D

- 5.3 3D and 4D

- 5.4 Doppler

Chapter 6 Market Estimates and Forecast, By Portability, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Trolley

- 6.3 Compact/handheld

Chapter 7 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 General imaging

- 7.3 Cardiology

- 7.4 OB/GYN

- 7.5 Other application

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Maternity centers

- 8.4 Other End Use

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alpinion Medical Systems

- 10.2 Butterfly Network

- 10.3 Canon Medical Systems Corporation

- 10.4 CHISON Medical Technologies

- 10.5 Clarius Mobile Health

- 10.6 Esaote SpA

- 10.7 FujiFilm Holdings Corporation

- 10.8 General Electric Company (GE Healthcare)

- 10.9 Hologic, Inc.

- 10.10 Konica Minolta Inc.

- 10.11 Koninklijke Philips N.V. (BioTelemetry, Inc.)

- 10.12 Samsung Electronics Co. Ltd.

- 10.13 Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- 10.14 Siemens Healthineers AG

- 10.15 SonoScape