PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913468

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913468

Betaine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

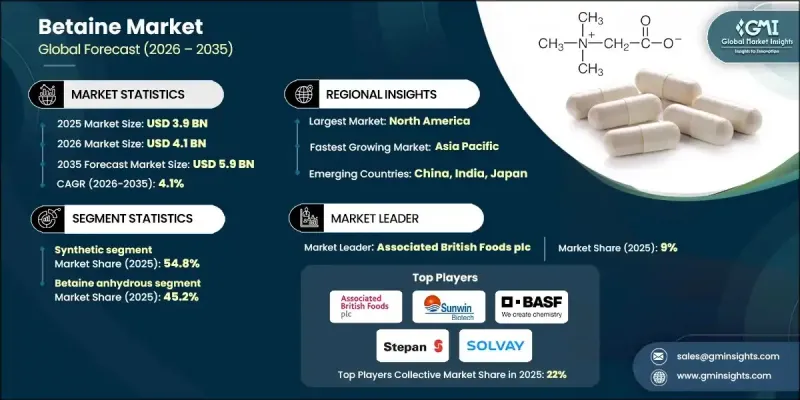

The Global Betaine Market was valued at USD 3.9 billion in 2025 and is estimated to grow at a CAGR of 4.1% to reach USD 5.9 billion by 2035.

Market development is supported by the broadening use of betaine across multiple end-use industries, including nutrition-focused, consumer-oriented, and industrial sectors. Increasing recognition of betaine's functional versatility has strengthened its role as a key ingredient with nutritional, performance-enhancing, and formulation-related benefits. Long-term growth is reinforced by structural trends such as global population expansion, higher protein consumption linked to intensified animal production, and a growing shift toward ingredients perceived as natural and environmentally responsible. Scientific validation of betaine's functional value continues to strengthen confidence across commercial applications. The market outlook also reflects steady innovation efforts focused on refining formulations, improving production efficiency, and advancing purification methods. These developments are enabling suppliers to enhance product consistency, expand usage potential, and address evolving regulatory and consumer expectations, thereby supporting sustained demand across established and emerging application areas.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.9 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 4.1% |

Growing preference for naturally sourced betaine has become a major factor shaping market dynamics. Betaine derived from sugar beet sources is gaining increased traction, particularly in regions where sustainability credentials and ingredient transparency influence purchasing decisions and pricing structures.

The synthetic betaine segment held 54.8% share in 2025. This segment continues to benefit from cost efficiency and scalable production capabilities, which support its widespread use in applications where pricing competitiveness and volume requirements remain critical.

The betaine anhydrous segment held 45.2% share in 2025. This water-free crystalline form is valued for its high concentration, strong stability profile, and suitability for dry formulation systems. Its performance characteristics support demand across nutrition-focused, pharmaceutical, and feed-related product formats where moisture control is essential.

North America Betaine Market held 28.8% share in 2025. The region maintains a strong consumption base, supported by established regulatory clarity and consistent demand across multiple application segments. Consumer interest in clean-label and naturally positioned ingredients continues to support the adoption of premium products.

Key companies active in the Global Betaine Market include BASF, Associated British Foods plc, Evonik Industries AG, Stepan Company, AMINO GmbH, Nutreco, Solvay, INOLEX, Inc., Merck KGaA, The Lubrizol Corporation, Fengchen Group Co., Ltd., Kao Corporation, Sunwin Biotech Shandong Co., Ltd., Orison Chemicals Limited, and Prasol Chemicals Limited. Companies operating in the Global Betaine Market are strengthening their market position through a combination of product innovation, supply chain optimization, and strategic expansion. Many players are investing in advanced processing technologies to improve yield, purity, and formulation flexibility. Portfolio diversification is being used to address both cost-sensitive and premium demand segments. Firms are also focusing on sustainability initiatives, including responsible sourcing and reduced environmental impact, to align with evolving regulatory and consumer expectations. Geographic expansion and long-term partnerships with end-use industries are improving market reach and demand stability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Type, 2022-2035 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Synthetic

- 5.3 Natural

- 5.3.1 Photosynthetic Bacteria

- 5.3.2 Plant Sourced

- 5.3.3 Animal Sourced

- 5.4 Semi-synthetic

Chapter 6 Market Estimates and Forecast, By Form, 2022-2035 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 Betaine anhydrous

- 6.2.1 Powder

- 6.2.2 Granules

- 6.3 Betaine hydrochloride

- 6.4 Betaine monohydrate

- 6.4.1 Crystalline

- 6.4.2 Solution-based

Chapter 7 Market Estimates and Forecast, By Purity, 2022-2035 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 High purity

- 7.3 Standard purity

- 7.4 Low purity

- 7.5 Customized purity

Chapter 8 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion & Tons)

- 8.1 Key trends

- 8.2 Animal feed

- 8.2.1 Poultry

- 8.2.2 Swine

- 8.2.3 Aquaculture

- 8.2.4 Ruminants

- 8.2.5 Others

- 8.3 Food & beverages

- 8.3.1 Bakery & confectionery

- 8.3.2 Sports nutrition & energy drinks

- 8.3.3 Functional foods

- 8.4 Personal care & cosmetics

- 8.4.1 Skin care

- 8.4.2 Hair care

- 8.4.3 Oral care

- 8.5 Pharmaceuticals

- 8.6 Industrial applications

- 8.6.1 Chemical intermediates

- 8.6.2 Detergents & surfactants

- 8.6.3 Agricultural formulations

Chapter 9 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion & Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 AMINO GmbH

- 10.2 BASF

- 10.3 Kao Corporation

- 10.4 Stepan Company

- 10.5 Solvay

- 10.6 Associated British Foods plc

- 10.7 Nutreco

- 10.8 The Lubrizol Corporation

- 10.9 INOLEX, Inc.

- 10.10 Sunwin Biotech Shandong Co., Ltd.

- 10.11 Merck KGaA

- 10.12 Evonik Industries AG

- 10.13 Fengchen Group Co., Ltd.

- 10.14 Orison Chemicals Limited

- 10.15 Prasol Chemicals Limited