PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913479

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1913479

Track Laying Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

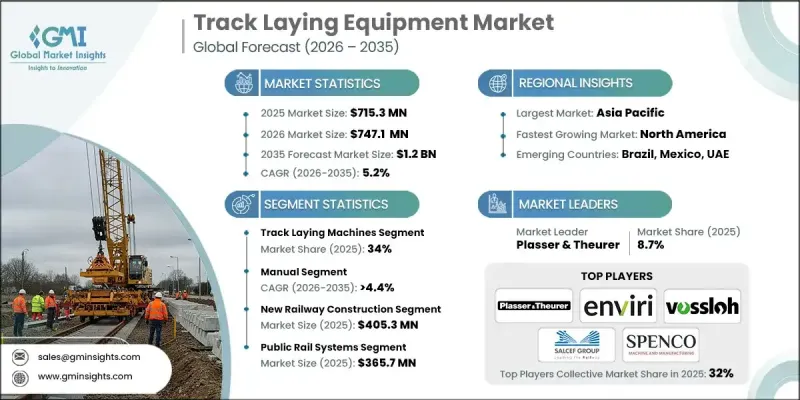

The Global Track Laying Equipment Market was valued at USD 715.3 million in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 1.2 billion by 2035.

Market expansion is fueled by large-scale railway network development, accelerating urban population growth, and rising spending on new rail corridors as well as upgrades of older rail assets. Rail authorities, metro operators, and freight service providers are increasingly focused on improving construction accuracy, lowering lifecycle costs, and meeting strict project delivery schedules. As a result, the adoption of modern track laying solutions is becoming essential to achieve consistent build quality, improve workforce productivity, and enhance long-term track performance. The market outlook is further strengthened by the growing emphasis on safety compliance and precision-based installation across new rail lines and rehabilitation projects. Continued investments in urban transit, freight connectivity, and long-distance rail routes are creating sustained demand for efficient equipment that supports faster deployment while maintaining engineering standards. The track laying equipment market continues to gain traction as rail infrastructure remains a priority for economic growth and mobility development across both mature and emerging regions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $715.3 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 5.2% |

Advancements in equipment design and digital integration are reshaping how rail tracks are installed and maintained. The shift toward semi-automated and automated machinery, combined with intelligent control systems and connected monitoring platforms, is enabling more consistent output and reduced dependency on manual intervention. Enhanced accuracy, improved asset utilization, and reduced downtime are becoming key advantages for operators adopting next-generation track laying solutions. Increasing deployment across urban rail systems and long-distance corridors is reinforcing demand for technologically advanced equipment that supports efficiency and durability throughout the project lifecycle.

The track laying machines segment held 34% share in 2025. This dominance is attributed to the segment's ability to support rapid installation of rails and sleepers while maintaining alignment precision and construction consistency. High utilization across metro rail projects, freight lines, and large infrastructure developments has positioned track laying machines as a core component of modern rail construction workflows.

The manual segment held 55% share in 2025 and is anticipated to grow at a CAGR of 4.4% from 2026 to 2035. Strong adoption is driven by affordability, operational simplicity, and suitability for standard rail construction and maintenance activities. Many contractors and rail authorities continue to rely on manual equipment due to its flexibility and lower upfront investment, particularly in regions where large-scale automation is still developing.

China Track Laying Equipment Market held 42% share in 2025. Asia-Pacific emerged as the leading regional market, supported by extensive rail network expansion, high infrastructure spending, and increasing adoption of advanced track construction solutions. Ongoing investments in rail modernization and technology integration are reinforcing the region's strong market position.

Key participants active in the Global Track Laying Equipment Market include Plasser & Theurer, Matisa, Harsco Rail, Vossloh, Weihua Group, Balfour Beatty Rail, Enviri, Salfec, Spenco, and Tampertec. Companies operating in the Track Laying Equipment Market are focusing on technology-driven differentiation to strengthen their competitive position. Leading manufacturers are investing in product innovation to enhance precision, reliability, and operational efficiency while reducing total ownership costs for customers. Strategic collaborations with rail authorities and infrastructure contractors are being pursued to secure long-term supply agreements and repeat business. Many players are expanding their regional footprints through localized manufacturing, service centers, and aftermarket support to improve responsiveness and customer retention. Digital integration, including advanced diagnostics and condition-based maintenance solutions, is also being prioritized to deliver value-added services.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment

- 2.2.3 Technology

- 2.2.4 Application

- 2.2.5 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid expansion of rail infrastructure worldwide

- 3.2.1.2 Technological advancements in track laying and maintenance equipment

- 3.2.1.3 Government investments and modernization programs

- 3.2.1.4 Urbanization, industrialization, and growing freight demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital expenditure and cost of equipment

- 3.2.2.2 Skilled labor shortage and training requirements

- 3.2.3 Market opportunities

- 3.2.3.1 Automation and digitalization of rail construction and maintenance

- 3.2.3.2 Emerging markets and greenfield rail projects

- 3.2.3.3 Upgrading and modernizing existing rail infrastructure

- 3.2.3.4 Adoption of digital and automated track laying solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. Federal Railroad Administration (FRA) Regulations

- 3.4.1.2 Canada Transport Standards

- 3.4.2 Europe

- 3.4.2.1 Germany TUV & BaFin Compliance

- 3.4.2.2 France DGITM Guidelines

- 3.4.2.3 United Kingdom ORR Regulations

- 3.4.2.4 Italy Ministry of Infrastructure & Transport Compliance

- 3.4.3 Asia Pacific

- 3.4.3.1 China MIIT Guidelines

- 3.4.3.2 Japan MLIT Standards

- 3.4.3.3 South Korea MOLIT Regulations

- 3.4.3.4 India Ministry of Railways & BIS Guidelines

- 3.4.4 Latin America

- 3.4.4.1 Brazil ANTT & DENIT Regulations

- 3.4.4.2 Mexico SCT & FERROCARRILES Guidelines

- 3.4.5 Middle East and Africa

- 3.4.5.1 UAE Roads & Transport Authority (RTA) Guidelines

- 3.4.5.2 Saudi Arabia General Authority for Transport (GAT) Regulations

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Automation & robotics

- 3.7.1.2 AI & machine learning

- 3.7.1.3 Internet of things (IoT)

- 3.7.2 Emerging technologies

- 3.7.2.1 Hyper-connected rail networks

- 3.7.2.2 Robotics-as-a-service (RaaS) for track laying

- 3.7.2.3 AI-driven predictive maintenance & dynamic resource allocation

- 3.7.1 Current technological trends

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use case scenarios

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Equipment, 2022 - 2035 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Track Laying Machines

- 5.3 Tamping Machines

- 5.4 Ballast Regulators

- 5.5 Sleeper Laying Machines

- 5.6 Welding Machines

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2022 - 2035 ($ Mn, Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automated

- 6.4 Fully Automated

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2035 ($ Mn, Units)

- 7.1 Key trends

- 7.2 New Railway Construction

- 7.3 Track Maintenance

- 7.4 Upgrades and Modernization

Chapter 8 Market Estimates & Forecast, By End Use, 2022 - 2035 ($ Mn, Units)

- 8.1 Key trends

- 8.2 Public Rail Systems

- 8.3 Private Freight Companies

- 8.4 Private Passenger Operators

- 8.5 Defense

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Belgium

- 9.3.7 Netherlands

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 Singapore

- 9.4.6 South Korea

- 9.4.7 Vietnam

- 9.4.8 Indonesia

- 9.4.9 Malaysia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Global Player

- 10.1.1 Balfour Beatty Rail

- 10.1.2 Enviri

- 10.1.3 Harsco Rail

- 10.1.4 Matisa

- 10.1.5 Plasser & Theurer

- 10.1.6 Salfec

- 10.1.7 Spenco

- 10.1.8 Tampertec

- 10.1.9 Vossloh

- 10.1.10 Weihua Group

- 10.2 Regional Player

- 10.2.1 Alstom Track Solutions

- 10.2.2 CRRC Railway Equipment

- 10.2.3 CSR Zhuzhou

- 10.2.4 Kinki Sharyo

- 10.2.5 Lloyds Register Rail

- 10.2.6 Orenstein & Koppel

- 10.2.7 Robel

- 10.2.8 Shandong Railway Construction Machinery

- 10.2.9 VAE Group

- 10.2.10 ZTR Rail

- 10.3 Emerging Players

- 10.3.1 Gulf Rail Technologies

- 10.3.2 Metro Track Systems

- 10.3.3 RailTech Innovations

- 10.3.4 RapidRail Machinery

- 10.3.5 TrackTech Solutions