PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928865

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928865

EMEA and India Indoor Pool Dehumidification Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

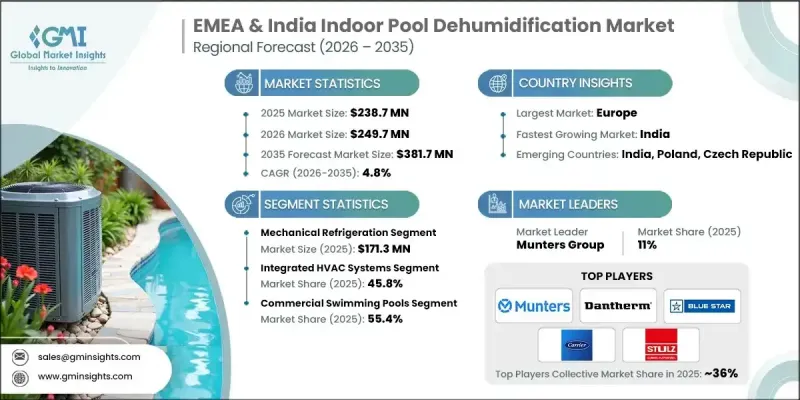

EMEA & India Indoor Pool Dehumidification Market was valued at USD 238.7 million in 2025 and is estimated to grow at a CAGR of 4.8% to reach USD 381.7 million by 2035.

Demand is shaped by the rapid expansion of hospitality, wellness, and recreational infrastructure across Europe, the Middle East, Africa, and India. Developers and facility owners are placing greater importance on effective humidity management to safeguard building materials and enhance user comfort. Indoor swimming environments require controlled moisture levels to limit condensation, corrosion, and air quality issues. Growth in tourism-related developments continues to support the construction of spa facilities and indoor aquatic centers. Regulatory frameworks across European regions are reinforcing the adoption of compliant dehumidification technologies by mandating strict moisture control standards. Together, these factors are positioning indoor pool dehumidification as a critical building system rather than an optional upgrade, with long-term investments focused on efficiency, automation, and operational reliability.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $238.7 Million |

| Forecast Value | $381.7 Million |

| CAGR | 4.8% |

The mechanical refrigeration systems segment generated USD 171.3 million in 2025 and is forecast to grow at a CAGR of 5% from 2026 to 2035 due to their dependable performance and accuracy in humidity control. These systems are widely adopted in large-scale aquatic facilities due to their ability to manage excess moisture effectively while supporting temperature regulation. Technological improvements in compressors and heat exchange components are enhancing energy performance and ensuring stable indoor conditions. Automated sensors and control platforms enable real-time monitoring, which lowers maintenance needs and supports consistent system operation over long periods.

The integrated HVAC solutions segment held 45.8% share in 2025 and is expected to grow at a CAGR of 5.1% between 2026 and 2035. This segment is gaining traction because it delivers ventilation, heating, and dehumidification through a unified platform. Centralized management enhances energy efficiency while maintaining a balanced humidity level and optimal thermal comfort. Increasing investments in hospitality properties, wellness destinations, and sports infrastructure across EMEA and India are accelerating the adoption of integrated systems that reduce operating costs and simplify facility management.

Germany Indoor Pool Dehumidification Market reached USD 69.5 million in 2025 and is projected to grow at a CAGR of 5.2% from 2026 to 2035. The country's strong regulatory environment emphasizes moisture control and indoor air quality, which sustains steady demand across public and commercial facilities. High energy prices are encouraging the use of efficient dehumidification technologies, while year-round operation requirements are driving investment in advanced systems for commercial properties.

Key companies active in the EMEA & Indoor Pool Dehumidification Market include Blue Star Limited, Carrier India, Dantherm Group, Dectron, Desiccant Rotors International, Kirloskar Pneumatic Company Limited, Klima Global, Koch Applied Solutions, Microwell, Munters, Seibu Giken, STULZ GMBH, Thermax Limited, Vacker Group, and VENCO Havalandrma. Companies operating in the Global EMEA & Indoor Pool Dehumidification Market are strengthening their positions through product innovation, regional expansion, and system integration strategies. Manufacturers are focusing on energy-efficient designs and smart control technologies to meet regulatory requirements and reduce lifecycle costs. Strategic partnerships with construction firms and HVAC contractors are being used to secure early involvement in large projects. Many players are expanding localized manufacturing and service networks to improve delivery timelines and after-sales support.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Capacity

- 2.2.4 Installation configuration

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Strong growth of hospitality and wellness projects

- 3.2.1.2 Strict moisture and condensation control regulations in European building codes

- 3.2.1.3 Rising public investment in aquatic sports infrastructure in Europe

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 High dependence on imported components in Middle East and Indian markets

- 3.2.2.2 Energy consumption concerns in regions with high electricity tariffs

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for energy-optimized systems aligned with European sustainability goals

- 3.2.3.2 Retrofit of aging indoor pools across Western and Northern Europe

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS Code - 8479)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter';s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 Europe

- 4.2.1.2 India

- 4.2.1.3 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2022 - 2035, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Mechanical refrigeration

- 5.3 Ventilation-based

- 5.4 Desiccant

- 5.5 Hybrid

- 5.6 Heat pump

Chapter 6 Market Estimates & Forecast, By Capacity, 2022 - 2035, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Small capacity: 20-100 L/day

- 6.3 Medium capacity: 100-500 L/day

- 6.4 Large capacity: 500-2,000 L/day

- 6.5 Industrial capacity: 2,000+ L/day

Chapter 7 Market Estimates & Forecast, By Installation Configuration, 2022 - 2035, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Ceiling-mounted units

- 7.3 Wall-mounted systems

- 7.4 Freestanding/tower units

- 7.5 Integrated HVAC systems

Chapter 8 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Commercial swimming pools

- 8.3 Residential pools

- 8.4 Therapeutic and rehabilitation pools

- 8.5 Competition and training facilities

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Europe

- 10.2.1 Germany

- 10.2.2 UK

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.3 India

- 10.4 MEA

- 10.4.1 Saudi Arabia

- 10.4.2 UAE

- 10.4.3 South Africa

Chapter 11 Company Profiles

- 11.1 Blue Star Limited

- 11.2 Carrier India

- 11.3 Dantherm Group

- 11.4 Dectron

- 11.5 Desiccant Rotors International

- 11.6 Kirloskar Pneumatic Company Limited

- 11.7 Klima Global

- 11.8 Koch Applied Solutions

- 11.9 Microwell

- 11.10 Munters

- 11.11 Seibu Giken

- 11.12 STULZ GMBH

- 11.13 Thermax Limited

- 11.14 Vacker Group

- 11.15 VENCO HavalandIrma