PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928875

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928875

Camera Lens Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

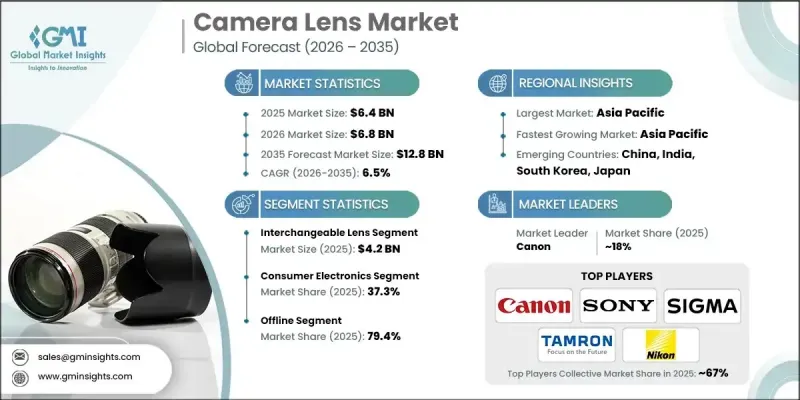

The Global Camera Lens Market was valued at USD 6.4 billion in 2025 and is estimated to grow at a CAGR of 6.5% to reach USD 12.8 billion by 2035.

The expansion of content creation, social media video production, and vlogging is fueling demand for high-quality camera lenses. Creators increasingly require lenses that deliver professional-level imagery, sharp focus, and superior low-light performance. Frequent content uploads and the growing popularity of online platforms are prompting users to invest in advanced imaging equipment. Photography and videography education, workshops, and skill development programs are encouraging wider adoption of lenses. Technological advancements such as optical stabilization, wide apertures, and improved coatings attract both hobbyists and professional photographers. The rising popularity of mirrorless cameras, which offer compact designs without sacrificing image quality, is further boosting market growth. These systems rely on interchangeable lenses, creating demand for a wide array of focal lengths and specialized optics. Both amateur and professional users benefit from enhanced creative flexibility and performance in photography and videography.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $6.4 Billion |

| Forecast Value | $12.8 Billion |

| CAGR | 6.5% |

The interchangeable lens segment generated USD 4.2 billion in 2025 and is expected to grow at a CAGR of 6.6% through 2035. Its dominance stems from versatility and superior image quality across a range of photography applications. Users can swap lenses to achieve different compositions and creative effects, while advanced optics, anti-reflective coatings, and stabilization systems improve clarity in varied lighting conditions.

The consumer electronics segment accounted for 37.3% share in 2025 and is forecast to grow at a CAGR of 6.8% from 2026 to 2035. This growth is driven by the integration of camera lenses in smartphones, tablets, wearable devices, and webcams. Consumers demand high-quality imaging for social media, video streaming, and photography, prompting the adoption of compact, efficient lenses with features like autofocus, optical zoom, and low-light capability.

China Camera Lens Market reached USD 6.9 billion in 2025 and is projected to grow at a CAGR of 5.3% from 2026 to 2035. The demand is fueled by smartphone and mirrorless camera adoption, with urban users and content creators seeking versatile lenses for photography and short-form video. Domestic manufacturers benefit from local production advantages, offering technologically advanced products at competitive prices, while e-commerce expansion improves accessibility to premium and specialized lens options.

Major players in the Global Camera Lens Market include Sony Corporation, Carl Zeiss, Nikon Corporation, Sigma Corporation, Panasonic, Fujifilm Holdings Corporation, Tamron Co., Viltrox Co., Canon, Schneider Kreuznach, RICHO Imaging Co., Leica Camera, Samyang Optics, Voigtlander, and Yongnuo. Companies in the Global Camera Lens Market strengthen their foothold by investing in research and development to launch lenses with advanced features such as optical stabilization, low-light optimization, and wide-aperture performance. Strategic partnerships with camera manufacturers and content creators enable tailored solutions for professional and enthusiast users. Expansion into emerging markets increases brand presence, while leveraging e-commerce platforms enhances product accessibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Price Range

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of content creation, vlogging, and social media video production

- 3.2.1.2 Growing adoption of mirrorless cameras across professional and enthusiast users

- 3.2.1.3 Technological advancements in optical stabilization and autofocus systems

- 3.2.2 Pitfalls & Challenges

- 3.2.2.1 High cost of professional-grade and specialty lenses

- 3.2.2.2 Compatibility fragmentation across camera mounts and brands

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for compact and lightweight lenses

- 3.2.3.2 Growth of third-party lens manufacturers offering cost-effective alternatives

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics (HS Code - 9002)

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter';s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Built-in lens

- 5.3 Interchangeable lens

Chapter 6 Market Estimates & Forecast, By Price Range, 2022 - 2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By End Use, 2022 - 2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Professional users

- 7.3 Individuals

- 7.4 Manufacturers

- 7.4.1 Consumer Electronics

- 7.4.2 Automotive

- 7.4.3 Medical

- 7.4.4 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.3 Offline

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Canon

- 10.2 Carl Zeiss

- 10.3 Fujifilm Holdings Corporation

- 10.4 Leica Camera

- 10.5 Nikon Corporation

- 10.6 Panasonic

- 10.7 RICHO Imaging Co.

- 10.8 Samyang Optics

- 10.9 Schneider Kreuznach

- 10.10 Sigma Corporation

- 10.11 Sony Corporation

- 10.12 Tamron Co.

- 10.13 Viltrox Co.

- 10.14 Voigtlander

- 10.15 Yongnuo