PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928882

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928882

Renewable Diesel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

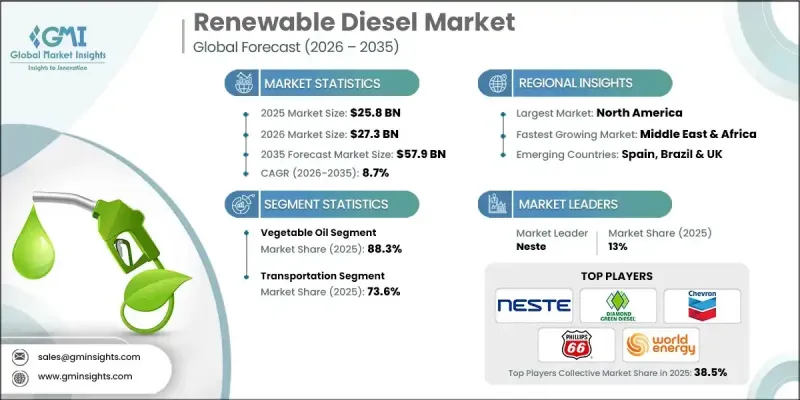

The Global Renewable Diesel Market was valued at USD 25.8 billion in 2025 and is estimated to grow at a CAGR of 8.7% to reach USD 57.9 billion by 2035.

Rising global demand for fuels with lower lifecycle greenhouse gas emissions is continuing to accelerate their adoption. Renewable diesel gains strong momentum due to its compatibility with existing diesel engines and fuel distribution systems, which supports a smooth transition without requiring large capital investments. Governments, industries, and fleet operators increasingly prioritize energy solutions that balance emissions reduction with operational reliability. Renewable diesel is positioned as a strategic option for enhancing fuel security while addressing climate commitments. Supportive regulatory frameworks, combined with volatile crude oil markets and geopolitical uncertainty, reinforce the need for diversified and domestically sourced fuel alternatives. The market also benefits from growing interest among energy producers due to renewable diesel's strong performance characteristics and its ability to meet regulatory and corporate sustainability requirements without compromising efficiency. These combined factors establish renewable diesel as a central component of the global transition toward lower-carbon energy systems.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $25.8 Billion |

| Forecast Value | $57.9 Billion |

| CAGR | 8.7% |

Renewable diesel is described as a low-carbon fuel produced from biomass-based resources and offers chemical equivalence to conventional diesel. This allows immediate use across existing infrastructure while supporting emissions reduction and energy resilience goals. Policy support and regulatory incentives continue to strengthen development activity and encourage adoption across multiple end-use sectors seeking to reduce dependence on petroleum-based fuels.

The vegetable oil feedstock segment accounted for 88.3% share in 2025 and is projected to grow at a CAGR of 9.9% through 2035. Rising demand for renewable and sustainable inputs supports the continued dominance of this segment, as such feedstocks align with decarbonization objectives and deliver performance characteristics comparable to traditional diesel when processed through advanced refining technologies.

The transportation segment held 73.6% share in 2025 and is forecast to grow at a CAGR of 8.5% from 2026 to 2035. Fleet operators increasingly adopt renewable diesel to meet emissions targets while maintaining reliability and performance standards. Regulatory compliance and corporate sustainability commitments continue to strengthen demand within this application segment.

United States Renewable Diesel Market held 90.3% share in 2025 and is expected to generate USD 26.3 billion by 2035. Strong policy support and regulatory frameworks continue to incentivize low-carbon fuel adoption across multiple industries, reinforcing renewable diesel's role as a practical alternative to petroleum-based fuels.

Prominent companies active in the Global Renewable Diesel Market include Neste, Valero, Chevron, Shell, World Energy, TotalEnergies, BP, Phillips 66, Marathon Petroleum, Repsol, Diamond Green Diesel, Preem AB, Cargill, Eni, Gevo, Imperial Oil, Petrobras, LanzaJet, HollyFrontier, and Carolina Renewable Products. Companies operating in the Renewable Diesel Market strengthen their market position through capacity expansion, strategic partnerships, and investment in advanced refining technologies. Many players focus on securing long-term feedstock supply agreements to ensure production stability and cost control. Geographic expansion and integration across the value chain help improve market access and resilience. Firms also emphasize regulatory compliance and certification to align with evolving sustainability standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.1.1 Quantified market impact analysis

- 1.3.1.1.1 Mathematical impact of growth parameters on forecast

- 1.3.1.1 Quantified market impact analysis

- 1.3.2 Scenario analysis framework

- 1.3.1 Key trends for market estimates

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Feedstock trends

- 2.4 Application trends

- 2.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Cost structure analysis

- 3.6 Porter';s analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

- 3.7.1 Political factors

- 3.7.2 Economic factors

- 3.7.3 Social factors

- 3.7.4 Technological factors

- 3.7.5 Legal factors

- 3.7.6 Environmental factors

- 3.8 Emerging opportunities & trends

- 3.8.1 Digitalization & IoT integration

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis and future outlook

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Feedstock, 2021 - 2034 (USD Billion & MT)

- 5.1 Key trends

- 5.2 Animal Fat

- 5.3 Vegetable Oil

- 5.4 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion & MT)

- 6.1 Key trends

- 6.2 Transportation

- 6.3 Power Generation

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion & MT)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Spain

- 7.3.4 UK

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Indonesia

- 7.4.4 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 BP

- 8.2 Cargill

- 8.3 Carolina Renewable Products

- 8.4 Chevron

- 8.5 Diamond Green Diesel

- 8.6 Eni

- 8.7 Gevo

- 8.8 HollyFrontier

- 8.9 Imperial Oil

- 8.10 LanzaJet

- 8.11 Marathon Petroleum

- 8.12 Neste

- 8.13 Petrobras

- 8.14 Phillips 66

- 8.15 Preem AB

- 8.16 Repsol

- 8.17 Shell

- 8.18 TotalEnergies

- 8.19 Valero

- 8.20 World Energy