PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928902

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928902

Metalworking Fluids Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

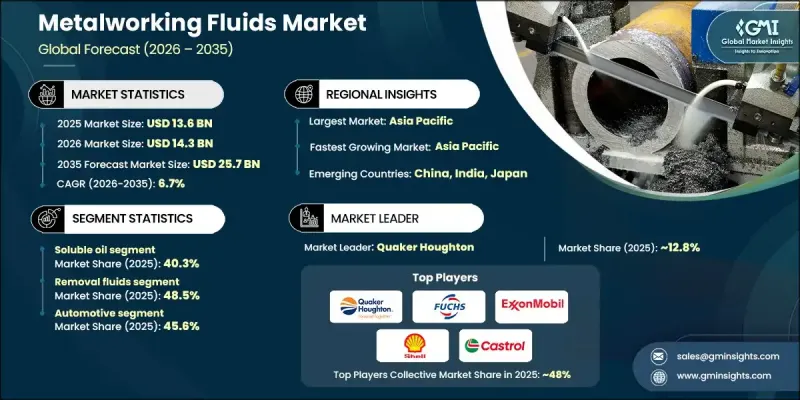

The Global Metalworking Fluids Market was valued at USD 13.6 billion in 2025 and is estimated to grow at a CAGR of 6.7% to reach USD 25.7 billion by 2035.

Metalworking fluids are described as specialized lubricants and coolants essential for machining, grinding, forming, and surface treatment processes. These products, available as neat oils, soluble oils, semi-synthetic, and fully synthetic fluids, provide vital functions such as friction reduction, heat dissipation, chip removal, corrosion protection, and tool life enhancement. Soluble oils dominate the market with broad adoption due to their cost-effectiveness, emulsion stability, and suitability across diverse machining operations. Market growth is propelled by expanding automotive and aerospace manufacturing, rising demand for high-precision components, and advances in machining technologies. Increasing focus on bio-based and sustainable formulations, along with enhanced performance characteristics for high-speed and complex metalworking, is further driving global demand. Continuous innovation in thermal stability, lubricity, and surface finish quality ensures that metalworking fluids remain indispensable in modern manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $13.6 billion |

| Forecast Value | $25.7 billion |

| CAGR | 6.7% |

The soluble oil segment accounted for 40.3% share in 2025 and is expected to grow at a CAGR of 6.5% from 2026 to 2035. Soluble oils are favored due to their ability to provide a balanced combination of cooling efficiency, lubrication performance, and cost-effectiveness. These fluids offer excellent emulsion stability and versatility, supporting applications like milling, drilling, turning, and grinding. Their water-based formulation ensures efficient heat dissipation while maintaining sufficient lubrication for moderate-duty operations, making them a preferred choice for general machining requirements.

The removal fluids segment held a 48.5% share in 2025 and is projected to grow at a CAGR of 7.2% from 2026 to 2035. Their dominance is driven by the fundamental need for cutting, grinding, milling, drilling, and turning operations across automotive, aerospace, and general engineering sectors. Removal fluids provide critical lubrication, cooling, chip management, and tool protection, ensuring consistent productivity in metal removal processes. They remain the backbone of machining operations due to their wide applicability across various metals and operational conditions.

U.S. Metalworking Fluids Market generated USD 2.6 billion in 2025. Growth in North America, particularly in the United States, is supported by a strong industrial base encompassing automotive manufacturing, aerospace component fabrication, and machinery production. The demand for high-performance fluids, including removal, semi-synthetic, and forming fluids, is sustained by the requirement for precision, efficiency, and reliability in engine, transmission, and structural component manufacturing. Advanced infrastructure, established production facilities, and stringent quality standards continue to drive regional market adoption.

Key players operating in the Global Metalworking Fluids Market include Quaker Houghton, ExxonMobil, FUCHS Petrolub SE, Blaser Swisslube, Chevron (Caltex), TotalEnergies, Idemitsu Kosan, Shell (Shell Lubricants), Milacron (Cimcool), Master Fluid Solutions, Yushiro Chemical, Petron Corporation, Oemeta Chemische Werke, Phoenix Petroleum Philippines, and BP Castrol. Companies in the Global Metalworking Fluids Market are strengthening their positions by focusing on product innovation, sustainability, and technical support. Leading manufacturers are developing high-performance synthetic and semi-synthetic fluids with improved thermal stability, lubricity, and emulsion life to meet the demands of modern machining operations. Strategic collaborations with OEMs and industrial partners enable customized solutions tailored to specific metalworking processes. Expansion into emerging regions, coupled with efficient supply chain management, allows companies to widen their global footprint.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product

- 2.2.2 Application

- 2.2.3 End Use

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Neat oil

- 5.3 Soluble oil

- 5.4 Semi-synthetic fluid

- 5.5 Synthetic fluid

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Removal fluids

- 6.3 Forming fluids

- 6.4 Protecting fluids

- 6.5 Treating fluids

Chapter 7 Market Estimates and Forecast, By End Use, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Aerospace

- 7.4 Construction

- 7.5 Electrical & power

- 7.6 Agriculture

- 7.7 Marine

- 7.8 Healthcare

- 7.9 Others

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Quaker Houghton

- 9.2 FUCHS Petrolub SE

- 9.3 ExxonMobil

- 9.4 Shell (Shell Lubricants)

- 9.5 BP Castrol

- 9.6 Chevron (Caltex)

- 9.7 TotalEnergies

- 9.8 Idemitsu Kosan

- 9.9 Yushiro Chemical

- 9.10 Blaser Swisslube

- 9.11 Master Fluid Solutions

- 9.12 Milacron (Cimcool)

- 9.13 Oemeta Chemische Werke

- 9.14 Petron Corporation

- 9.15 Phoenix Petroleum Philippines