PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928905

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928905

Methyl Ethyl Ketone (MEK) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

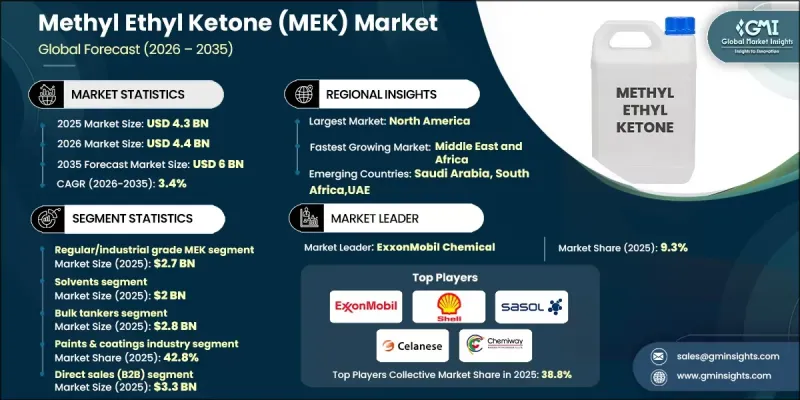

The Global Methyl Ethyl Ketone (MEK) Market was valued at USD 4.3 billion in 2025 and is estimated to grow at a CAGR of 3.4% to reach USD 6 billion by 2035.

MEK, commonly known as butanone, is a colorless, highly volatile liquid with a sharp, sweet odor and flammable properties. It is widely recognized for its excellent solvency, rapid evaporation, and capacity to dissolve resins, coatings, adhesives, and inks. The market growth is primarily fueled by demand from industries such as paints and coatings, adhesives, printing inks, rubber processing, and chemical manufacturing. Expanding sectors, including construction, automotive production, and packaging, are supporting sustained consumption, driving steady market expansion. Regional growth varies due to manufacturing density, environmental regulations, and trends toward solvent substitution. To stay competitive, suppliers focus on reliable supply chains, cost efficiency, and compliance with safety and environmental standards. MEK remains an essential industrial solvent for surface coatings, protective finishes, and specialized chemical applications across diverse manufacturing sectors.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.3 Billion |

| Forecast Value | $6 Billion |

| CAGR | 3.4% |

The regular or industrial-grade MEK segment generated USD 2.7 billion in 2025. Industrial-grade MEK is preferred for broad applications, including coatings, adhesives, and cleaning processes, due to its versatile, general-purpose performance. In contrast, electronic-grade MEK is tailored for high-purity applications in semiconductor production and circuit cleaning, while pharmaceutical-grade MEK meets the stringent purity and safety standards required for drug manufacturing.

In terms of packaging, the bulk tankers segment reached USD 2.8 billion in 2025. Bulk tankers serve large industrial buyers needing high volumes of MEK, offering cost-effective transportation and handling. Intermediate Bulk Containers (IBCs) provide a balance between volume and convenience, widely used in medium-scale operations for easier storage and logistics.

North America Methyl Ethyl Ketone (MEK) Market accounted for USD 2.2 billion in 2025 and is projected to reach USD 3.1 billion by 2035. The market in this region is influenced by stringent environmental regulations, driving lower VOC emissions and cleaner solvent adoption. A mature industrial base ensures stable demand for MEK in coatings, adhesives, and chemical manufacturing, though growth is moderated as manufacturers explore alternative solvents in response to regulatory pressures.

Key players in the Global Methyl Ethyl Ketone (MEK) Market include Celanese Corporation, Solvay S.A., Arkema S.A., Eastman Chemical Company, ExxonMobil Corporation, Genomatica, LanzaTech (Carbon Capture to Chemicals), SK Energy, PTT Global Chemical Public Company Limited, Vertec Biosolvents, Idemitsu Kosan Co., Ltd., LG Chem Ltd., Maruzen Petrochemical Co., Ltd., Sasol Limited, Shell Chemicals (Shell Plc), PetroChina Company Limited, Nouryon, Cetex Petrochemicals, and Mitsubishi Chemical Corporation. Companies in the Global Methyl Ethyl Ketone (MEK) Market strengthen their presence through strategic investments in production efficiency, sustainability, and technological innovation. Manufacturers focus on expanding production capacity while optimizing cost structures to remain competitive. Research and development initiatives target cleaner solvent alternatives, improved solvent performance, and regulatory compliance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Purity Grade

- 2.2.2 Application

- 2.2.3 Packaging Type

- 2.2.4 End Use Industry

- 2.2.5 Distribution Channel

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand from paints and coatings industry

- 3.2.1.2 Expansion of manufacturing activities

- 3.2.1.3 Automotive and aerospace sector growth

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Raw material price volatility

- 3.2.2.2 High flammability and volatility

- 3.2.3 Market opportunities

- 3.2.3.1 Development of low-emission and sustainable MEK grades

- 3.2.3.2 Expansion in packaging and labeling applications

- 3.2.3.3 Adoption of solvent recovery and recycling systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By grade

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Grade, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Regular/Industrial Grade MEK

- 5.3 Electronic grade MEK

- 5.4 Pharmaceutical grade MEK

- 5.5 Urethane grade MEK

- 5.6 ACS reagent grade MEK

- 5.7 HPLC grade MEK

Chapter 6 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Solvents

- 6.3 Anti-skinning agent in oil/latex paints

- 6.4 Adhesives & sealants

- 6.5 Printing inks

- 6.6 Resins

- 6.7 Chemical intermediates

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By Packaging Type, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Bulk (tankers)

- 7.3 Intermediate bulk container (IBC)

- 7.4 Drums

- 7.5 Pails & small containers

- 7.6 Specialty packaging

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Paints & coatings industry

- 8.3 Automotive

- 8.4 Construction

- 8.5 Packaging

- 8.6 Electronics & semiconductors

- 8.7 Pharmaceuticals & healthcare

- 8.8 Aerospace

- 8.9 Textiles & leather

- 8.10 Rubber industry

- 8.11 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Direct sales (B2B)

- 9.3 Online platforms/E-commerce

- 9.4 Others

Chapter 10 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Arkema S.A.

- 11.2 Genomatica

- 11.3 LanzaTech (Carbon Capture to Chemicals)

- 11.4 Vertec Biosolvents

- 11.5 Celanese Corporation

- 11.6 Cetex Petrochemicals

- 11.7 Eastman Chemical Company

- 11.8 ExxonMobil Corporation

- 11.9 INEOS Group

- 11.10 Idemitsu Kosan Co., Ltd.

- 11.11 LG Chem Ltd.

- 11.12 Maruzen Petrochemical Co., Ltd.

- 11.13 Nouryon

- 11.14 PTT Global Chemical Public Company Limited

- 11.15 Sasol Limited

- 11.16 Shell Chemicals (Shell Plc)

- 11.17 Solvay S.A.

- 11.18 SK Energy

- 11.19 PetroChina Company Limited

- 11.20 Mitsubishi Chemical Corporation