PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928908

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928908

Peracetic Acid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

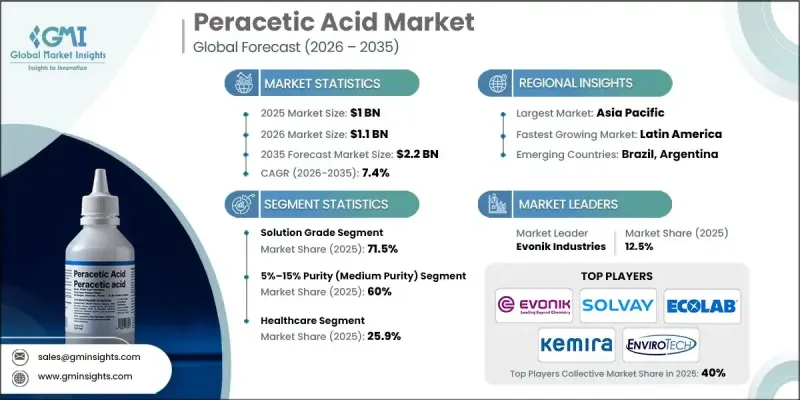

The Global Peracetic Acid Market was valued at USD 1 billion in 2025 and is estimated to grow at a CAGR of 7.4% to reach USD 2.2 billion by 2035.

Growth is supported by rising demand for environmentally responsible disinfectants and increasing enforcement of food safety and sanitation regulations, particularly in developing economies. Regulatory bodies are tightening requirements around wastewater treatment and industrial discharge, which is accelerating adoption across municipal and industrial applications. Peracetic acid is gaining preference as concerns rise over the health and environmental impact of conventional disinfectants, especially those associated with harmful residual byproducts. Its effectiveness, biodegradability, and compatibility with regulatory frameworks are strengthening its position across multiple end-use sectors. The healthcare sector continues to demonstrate consistent demand as infection prevention remains a priority, encouraging wider use of peracetic acid in sterilization and sanitation processes. Together, these factors are reinforcing long-term growth and expanding the application scope of peracetic acid globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 7.4% |

The solution-grade peracetic acid segment held 71.5% share and is expected to grow at a CAGR of 7.2% through 2035. This grade maintains its leading position due to its broad end-use compatibility across sanitation, healthcare, and industrial disinfection. Ready-to-use formulations support rapid deployment and simplify operational processes, which continues to drive preference for solution-grade products.

The 5%-15% purity range accounted for 60% share in 2025 and is forecast to grow at a CAGR of 7.1% by 2035. This purity level is widely adopted because it offers an effective balance between antimicrobial performance, regulatory compliance, and safe handling characteristics, making it suitable for a wide range of sanitation and disinfection applications.

North America Peracetic Acid Market held 30.1% share in 2025. Regional growth is supported by evolving regulatory frameworks that emphasize approved disinfectants and controlled residual levels, particularly across food processing, healthcare, and industrial sanitation operations.

Key companies operating in the Global Peracetic Acid Market include Solvay, Evonik Industries, Ecolab, Kemira, FMC Corporation, Diversey Holdings, Mitsubishi Gas Chemical Company, Hydrite Chemical Co., Enviro Tech Chemical Services, Spartan Chemical Company, Inc., Christeyns, Sopura S.A., Biosan LLC, Airedale Chemical, Acuro Organics Limited, Loeffler Chemical Corporation, National Peroxide Limited, and SEITZ GmbH. Companies in the Global Peracetic Acid Market are strengthening their competitive positions through capacity expansion, product optimization, and regulatory alignment. Manufacturers are investing in formulation improvements to enhance stability, safety, and application efficiency. Strategic focus on environmentally friendly and low-residue solutions is helping companies align with tightening regulations. Firms are expanding distribution networks and forming partnerships with industrial and municipal clients to secure long-term supply agreements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Purity

- 2.2.4 End Use industry

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By Product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Solution grade

- 5.3 Distilled grade

- 5.4 Others

Chapter 6 Market Estimates and Forecast, By Purity, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 <5% Purity (Low Purity)

- 6.3 5%-15% Purity (Medium Purity)

- 6.4 >15% Purity (High Purity)

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Healthcare

- 7.2.1 Hospital Surface Disinfection

- 7.2.2 Surgical Instrument Sterilization

- 7.2.3 Dialysis Equipment Disinfection

- 7.2.4 Pharmaceutical Clean Room Sanitation

- 7.3 Food & Beverage Processing

- 7.3.1 Meat and Poultry Processing

- 7.3.2 Beverage Sanitation

- 7.3.3 Dairy Equipment Cleaning

- 7.3.4 Fruit & Vegetable Washing

- 7.4 Water Treatment

- 7.4.1 Municipal Water Treatment

- 7.4.2 Wastewater Treatment

- 7.4.3 Industrial Water Treatment

- 7.4.4 Aquaculture Water Treatment

- 7.5 Pulp & Paper

- 7.5.1 Pulp Bleaching

- 7.5.2 Paper Machine System Disinfection

- 7.5.3 Recycled Fiber Treatment

- 7.5.4 Slimicide & Deodorizing Agent Use

- 7.6 Agriculture

- 7.6.1 Post-Harvest Produce Disinfection

- 7.6.2 Animal Housing Sanitation

- 7.6.3 Irrigation Water Treatment

- 7.6.4 Agricultural Equipment Disinfection

- 7.7 Pharmaceuticals

- 7.7.1 API Synthesis

- 7.7.2 Cleanroom Surface Sanitation

- 7.7.3 Pharma Equipment Sterilization

- 7.7.4 Packaging Equipment Disinfection

- 7.8 Chemical Processing

- 7.8.1 Oxidizing Agent

- 7.8.2 Polymerization Catalyst

- 7.8.3 Organic Synthesis Intermediate

- 7.8.4 Wastewater Disinfection

- 7.9 Petrochemical / Oil & Gas

- 7.9.1 Refinery Wastewater Disinfection

- 7.9.2 Pipeline Sludge & Biofilm Removal

- 7.9.3 Desulfurization Processes

- 7.9.4 Cooling Water System Treatment

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Acuro Organics Limited

- 9.2 Airedale Chemical

- 9.3 Biosan LLC

- 9.4 Christeyns

- 9.5 Diversey Holdings

- 9.6 Ecolab

- 9.7 Enviro Tech Chemical Services

- 9.8 Evonik Industries

- 9.9 FMC Corporation

- 9.10 Hydrite Chemical Co.

- 9.11 Kemira

- 9.12 Loeffler Chemical Corporation

- 9.13 Mitsubishi Gas Chemical Company

- 9.14 National Peroxide Limited

- 9.15 SEITZ GmbH

- 9.16 Solvay

- 9.17 Sopura S.A.

- 9.18 Spartan Chemical Company, Inc.

- 9.19 Others