PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928910

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928910

Asia Pacific Composite Insulators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

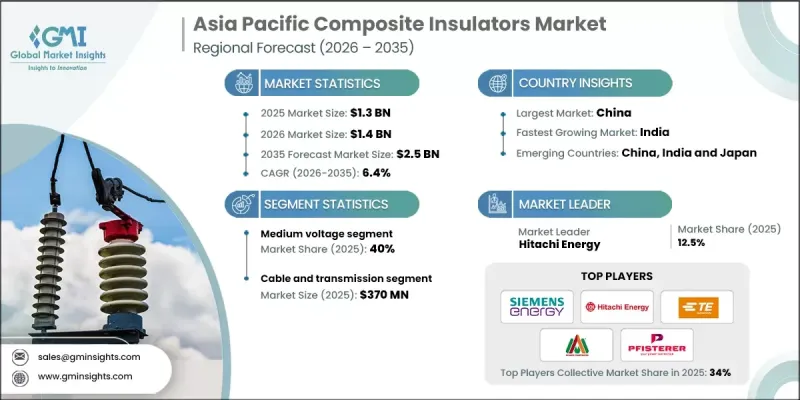

Asia Pacific Composite Insulators Market was valued at USD 1.3 billion in 2025 and is estimated to grow at a CAGR of 6.4% to reach USD 2.5 billion by 2035.

Market participants describe growth as strongly supported by large-scale upgrades of transmission networks and government-backed initiatives focused on reinforcing aging power infrastructure and reducing electricity disruptions. Policies aimed at modernizing transmission and distribution systems, along with rising capital inflows for grid expansion, are said to be creating a favorable business environment. Rapid urban development and industrialization across the region are acknowledged as major contributors to rising electricity demand, prompting higher investments in dependable insulation technologies. Composite insulators are described as well-suited for challenging operating conditions, including areas with high moisture, pollution exposure, and varying climates, which continues to support adoption. The market outlook is further shaped by the growing integration of renewable power into existing grids, as utilities increasingly seek insulation solutions that can maintain performance under environmental stress. Continuous improvements in grid architecture and the adoption of advanced components are also enabling compliance with ecological standards while supporting long-term network expansion.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 6.4% |

The high-voltage category is expected to grow at a CAGR of 6% through 2035. Industry commentary highlights that the rapid buildout of high-voltage networks and focused efforts to improve supply reliability are accelerating the deployment of composite insulators across transmission and distribution systems. Supportive regulatory frameworks, combined with technological advancements and grid-stability initiatives, are reinforcing demand within this voltage range.

The switchgear application generated USD 310 million in 2025. This segment is described as gaining strong momentum due to the increasing focus on operational safety and system reliability within power networks. Investments aimed at extending equipment life cycles and improving performance, along with the evolution of intelligent grid infrastructure, are driving the uptake of advanced switchgear solutions that incorporate composite insulation.

China Composite Insulators Market accounted for 35% share in 2025 and generated USD 486.7 million. Market observers attribute this position to rising power consumption, continuous expansion of transmission corridors, modernization of grid systems, population growth, and policy-driven goals supporting clean energy development. The broader regional landscape is expected to benefit from the ongoing transition toward renewable power, increasing adoption of smart grid technologies, and government initiatives designed to strengthen electricity infrastructure.

Companies active across the Asia Pacific Composite Insulators Market include Siemens Energy, Aditya Birla Power Composites Ltd., Zhongrui Electric Co., Ltd., TE Connectivity, Saravana Global Energy Limited, PFISTERER Holding SE, CNC ELECTRIC GROUP CO., LTD., Hitachi Energy, Navitas Insulators Pvt Ltd., Yamuna Power & Infrastructure Ltd., SPARK INSULATORS PVT LTD, Advait Energy Transitions Limited, Xiangyang Guowang Composite Insulators Co., Ltd., Nooa Electric Co., Ltd., Cowin Electrical Co., Ltd., Jilin Nengxing Electrical Equipment Co. Ltd., Nanjing Electric Technology Group Co., Ltd., DCI, DECCAN ENTERPRISES PRIVATE LIMITED, CYG Insulator Co., Ltd., and Wenzhou Jieni Electric Co., Ltd. Companies operating in the Asia Pacific Composite Insulators Market are strengthening their market positions through a combination of capacity expansion, product innovation, and strategic partnerships. Many players are focusing on developing advanced materials that improve durability, electrical performance, and environmental resistance to meet evolving grid requirements. Localization of manufacturing and supply chains is frequently adopted to reduce costs and improve responsiveness to regional demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research approach

- 1.2 Quality commitment

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research Trail & Confidence Scoring

- 1.3.1 Research Trail Components

- 1.3.2 Scoring Components

- 1.4 Data Collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by country

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

- 1.9 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Business trends

- 2.3 Voltage trends

- 2.4 Application trends

- 2.5 Product trends

- 2.6 End-Use trends

- 2.7 Rating trends

- 2.8 Installation trends

- 2.9 Country trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Key factors affecting the value chain

- 3.1.3 Disruptions

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter';s analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of composite insulators

- 3.8 Emerging opportunities & trends

- 3.8.1 Digital transformation with IoT technologies

- 3.8.2 Emerging market penetration

- 3.9 Investment analysis & future outlook

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by country, 2025

- 4.2.1 China

- 4.2.2 India

- 4.2.3 Japan

- 4.2.4 South Korea

- 4.2.5 Australia

- 4.3 Strategic initiatives

- 4.3.1 Key partnerships & collaborations

- 4.3.2 Major M&A activities

- 4.3.3 Product innovations & launches

- 4.3.4 Market expansion strategies

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Voltage, 2022 - 2035, (USD Million)

- 5.1 Key trends

- 5.2 High Voltage

- 5.3 Medium Voltage

- 5.4 Low Voltage

Chapter 6 Market Size and Forecast, By Application, 2022 - 2035, (USD Million)

- 6.1 Key trends

- 6.2 Cables and transmission lines

- 6.3 Switchgears

- 6.4 Transformer

- 6.5 Bus Bars

- 6.6 Others

Chapter 7 Market Size and Forecast, By Product, 2022 - 2035, (USD Million)

- 7.1 Key trends

- 7.2 Pin Insulators

- 7.3 Suspension insulators

- 7.4 Shackle insulators

- 7.5 Other insulators

Chapter 8 Market Size and Forecast, By End-Use, 2022 - 2035, (USD Million)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial & Industrial

- 8.4 Utilities

Chapter 9 Market Size and Forecast, By Rating, 2022 - 2035, (USD Million)

- 9.1 Key trends

- 9.2 ≤ 11 kV

- 9.3 > 11 kV to ≤ 22 kV

- 9.4 > 22 kV to ≤ 33 kV

- 9.5 > 33 kV to ≤ 72.5 kV

- 9.6 > 72.5 kV to ≤145 kV

- 9.7 > 145 kV to ≤ 220 kV

- 9.8 > 220 kV to ≤ 400 kV

- 9.9 > 400 kV to ≤ 800 kV

- 9.10 > 800 kV to ≤ 1,200 kV

- 9.11 > 1,200 kV

Chapter 10 Market Size and Forecast, By Installation, 2022 - 2035, (USD Million)

- 10.1 Key trends

- 10.2 Distribution

- 10.3 Transmission

- 10.4 Substation

- 10.5 Railways

- 10.6 Others

Chapter 11 Market Size and Forecast, By Country, 2022 - 2035, (USD Million)

- 11.1 Key trends

- 11.2 China

- 11.3 Japan

- 11.4 India

- 11.5 South Korea

- 11.6 Australia

Chapter 12 Company Profiles

- 12.1 Aditya Birla Power Composites Ltd.

- 12.2 Advait Energy Transitions Limited

- 12.3 CNC ELECTRIC GROUP CO.,LTD.

- 12.4 Cowin Electrical Co.,Ltd.

- 12.5 CYG Insulator Co.,Ltd.

- 12.6 DCI

- 12.7 DECCAN ENTERPRISES PRIVATE LIMITED

- 12.8 Hitachi Energy

- 12.9 Jilin Nengxing Electrical Equipment Co. Ltd.

- 12.10 Nanjing Electric Technology Group Co., Ltd.

- 12.11 Navitas Insulators Pvt Ltd.

- 12.12 Nooa Electric Co., Ltd.

- 12.13 PFISTERER Holding SE

- 12.14 Saravana Global Energy Limited

- 12.15 Siemens Energy

- 12.16 SPARK INSULATORS PVT LTD

- 12.17 TE Connectivity

- 12.18 Wenzhou Jieni Electric Co., Ltd.

- 12.19 Xiangyang Guowang Composite Insulators Co., Ltd.

- 12.20 Yamuna Power & Infrastructure Ltd.

- 12.21 Zhongrui Electric Co., Ltd.