PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928915

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928915

Monochloroacetic Acid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

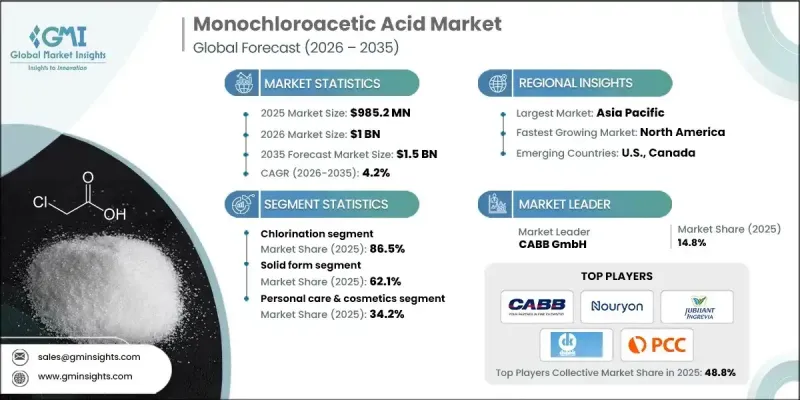

The Global Monochloroacetic Acid Market was valued at USD 985.2 million in 2025 and is estimated to grow at a CAGR of 4.2% to reach USD 1.5 billion by 2035.

The industry is experiencing steady growth due to its increasing utility across multiple sectors. Monochloroacetic acid serves as a critical intermediate in the production of pharmaceuticals, surfactants, dyes, and agrochemicals. Its role as a building block for specialty chemicals, including carboxymethyl cellulose and herbicides, highlights its significance in chemical manufacturing. The compound's high reactivity, cost-effectiveness, and versatility make it an ideal choice for chemical synthesis. Rising demand in agriculture for crop protection solutions, coupled with expansion in pharmaceutical production and investment in drug development, further supports market growth. However, the industry faces challenges such as fluctuating raw material costs, environmental concerns linked to chlorinated compounds, and strict regulatory frameworks. Increasing emphasis on safety and sustainable production methods is influencing manufacturers to adopt greener practices, indirectly shaping market trends.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $985.2 Million |

| Forecast Value | $1.5 Billion |

| CAGR | 4.2% |

The chlorination segment accounted for 86.5% share in 2025 and is expected to maintain a CAGR of 4.2% through 2035. The market continues to benefit from improvements in production techniques, including energy-efficient and eco-friendly chlorination processes that minimize by-product formation while enhancing yield. Growing demand for high-purity monochloroacetic acid in pharmaceuticals, personal care products, and agricultural applications is driving this shift toward optimized manufacturing processes.

In terms of product form, the solid monochloroacetic acid segment held 62.1% share in 2025 and is anticipated to grow at a CAGR of 4.2% between 2026 and 2035. Solid forms offer advantages such as precise dosing, stability, and ease of handling, making them preferred for pharmaceuticals, specialty chemicals, and agricultural products. Advances in solid-state processing and storage solutions are further supporting longer shelf life, simplified transportation, and better operational efficiency for manufacturers.

North America Monochloroacetic Acid Market held 28.2% share in 2025. This growth is fueled by evolving technologies, stringent environmental regulations, and a well-developed chemical infrastructure. Increasing applications in pharmaceuticals, personal care, and agriculture, along with a shift toward sustainable production, are driving demand. Companies in the region are adopting cleaner manufacturing practices to comply with environmental standards while enhancing efficiency and output.

Leading players in the Global Monochloroacetic Acid Market include CABB GmbH, Jubilant Ingrevia Limited, PCC Group, Merck KGaA, Denak Co., Ltd., Nouryon, Shandong Minji Chemical Co., Ltd., Xuchang Dongfang Chemical Co., Ltd., Shiv Chem Industries, Niacet Corporation, and Puyang Tiancheng Chemical Co., Ltd. Companies in the Monochloroacetic Acid Market are employing several key strategies to strengthen their position. These include expanding production capacities, adopting advanced and eco-friendly manufacturing technologies, forming strategic partnerships, and investing in R&D for high-purity products. Firms are also focusing on improving supply chain efficiency, exploring new geographic markets, and enhancing their product portfolios to meet growing demand across industries. By prioritizing sustainability, technological innovation, and strategic alliances, market players are solidifying their foothold and driving long-term growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Manufacturing process

- 2.2.3 Product form

- 2.2.4 End Use Industry

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By monochloroacetic acid class

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Manufacturing Process, 2022-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Chlorination process

- 5.3 Hydrolysis process

Chapter 6 Market Estimates and Forecast, By Product Form, 2022-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Solid forms

- 6.3 Liquid forms

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2022-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Personal care & cosmetics

- 7.2.1 Hair care products

- 7.2.2 Skin care formulations

- 7.3 Agriculture & crop protection

- 7.3.1 Herbicide manufacturing

- 7.3.2 Pesticide synthesis

- 7.3.3 Plant growth regulators

- 7.4 Food & beverage

- 7.4.1 Food thickeners & stabilizers

- 7.4.2 Food packaging coatings

- 7.5 Pharmaceuticals & healthcare

- 7.5.1 Active pharmaceutical ingredients

- 7.5.2 Pharmaceutical excipients

- 7.5.3 Medical device adhesives

- 7.6 Oil & gas

- 7.6.1 Drilling fluids & mud additives

- 7.6.2 Enhanced oil recovery

- 7.7 Textiles & paper

- 7.7.1 Textile printing & dyeing

- 7.7.2 Paper manufacturing & coating

- 7.7.3 Textile finishing

- 7.8 Construction & building materials

- 7.8.1 Cement additives & retarders

- 7.8.2 Tile adhesives & grouts

- 7.8.3 Gypsum board production

- 7.9 Detergents & cleaning products

- 7.9.1 Liquid detergents

- 7.9.2 Industrial cleaners

- 7.9.3 Household cleaning products

- 7.10 Water treatment

- 7.10.1 Ion-exchange resins

- 7.10.2 Chelating agents

- 7.11 Paints, coatings & inks

- 7.11.1 Automotive coatings

- 7.11.2 Printing inks

- 7.11.3 Industrial coatings

Chapter 8 Market Estimates and Forecast, By Region, 2022-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 CABB GmbH

- 9.2 Denak Co., Ltd.

- 9.3 Jubilant Ingrevia Limited

- 9.4 Merck KGaA

- 9.5 Niacet Corporation

- 9.6 Nouryon

- 9.7 PCC Group

- 9.8 Puyang Tiancheng Chemical Co. Ltd

- 9.9 Shandong Minji Chemical Co., Ltd.

- 9.10 Shiv Chem Industries

- 9.11 Xuchang Dongfang Chemical Co. Ltd.