PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928916

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928916

Automotive Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

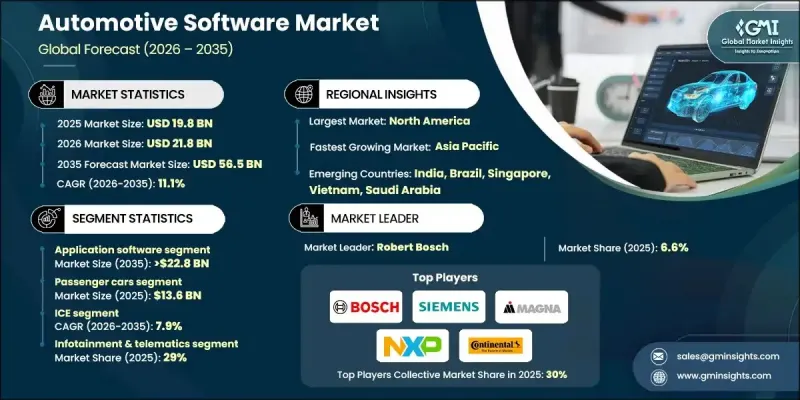

The Global Automotive Software Market was valued at USD 19.8 billion in 2025 and is estimated to grow at a CAGR of 11.1% to reach USD 56.5 billion by 2035.

The industry is transformed as automakers shift from traditional hardware-focused architectures to software-defined vehicles, where key features, performance, and differentiation rely on software solutions. This evolution is fueling demand for operating systems, middleware, and applications throughout the entire vehicle lifecycle. The rise of electric and electrified vehicles has added software complexity in areas such as battery management, energy optimization, thermal systems, and power electronics. Compared with internal combustion engine vehicles, EVs require more software content per unit, further expanding the market. Regulatory mandates for safety and consumer expectations for advanced driving assistance are accelerating the adoption of ADAS, relying on real-time software for sensor integration, decision-making, and control. Connected vehicle platforms, over-the-air updates, and telematics are generating recurring revenue and enhancing vehicle functionality beyond the point of sale. Vehicle architectures are evolving toward centralized and zonal computing, increasing software integration and efficiency across systems.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $19.8 Billion |

| Forecast Value | $56.5 Billion |

| CAGR | 11.1% |

The passenger car segment held 68% share and was valued at USD 13.6 billion in 2025. Passenger vehicles are increasingly leveraging software-defined architectures, enabling advanced infotainment, ADAS, and personalized OTA updates. These capabilities enhance user experience, allow continuous vehicle upgrades, and extend lifecycle value, positioning software as a key differentiator for automakers.

The internal combustion engine (ICE) segment is expected to grow at a CAGR of 7.9% between 2026 and 2035. Despite the rise of EVs, ICE vehicles continue to rely on software to monitor engine performance, emissions compliance, and mechanical safety. Manufacturers release software updates to improve efficiency, ensure regulatory compliance, and introduce incremental enhancements, maintaining ongoing demand for automotive software solutions.

U.S. Automotive Software Market reached USD 3.8 billion in 2025. Automakers and EV startups in the U.S. are prioritizing software-defined architectures, centralized computing, and over-the-air functionality. Continuous software innovation allows companies to differentiate their vehicles digitally, providing competitive advantages over hardware-focused upgrades and enhancing vehicle features throughout the lifecycle.

Key players operating in the Global Automotive Software Market include Continental, Aptiv, HARMAN International, NVIDIA, Robert Bosch, Siemens, Denso, Magna International, and NXP Semiconductors. Companies in the Global Automotive Software Market are strengthening their positions through strategic innovation, partnerships, and expansion into new markets. Investment in research and development enables them to offer advanced software platforms for connected, electric, and autonomous vehicles. Strategic collaborations with OEMs and technology firms enhance product integration and accelerate adoption. Over-the-air software deployment, cybersecurity features, and continuous updates create recurring revenue opportunities and improve customer loyalty. Geographic expansion, targeted acquisitions, and open-platform ecosystems allow firms to access broader markets while maintaining technological leadership and competitive differentiation.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Offering

- 2.2.3 Vehicle

- 2.2.4 Propulsion

- 2.2.5 Deployment mode

- 2.2.6 Sales channel

- 2.2.7 Application

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook & strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Software-defined vehicles

- 3.2.1.3 Electric vehicle adoption

- 3.2.1.4 ADAS and safety regulations

- 3.2.1.5 Connected vehicles and OTA

- 3.2.1.6 Vehicle electrification regulations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Software complexity and integration challenges

- 3.2.2.2 Cybersecurity and data privacy concerns

- 3.2.3 Market opportunities

- 3.2.3.1 Subscription-based software monetization

- 3.2.3.2 Centralized and zonal architectures

- 3.2.3.3 AI and data analytics integration

- 3.2.3.4 Emerging markets and new mobility models

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 United States: NHTSA Automotive Cybersecurity Best Practices

- 3.4.1.2 Canada: Canadian Motor Vehicle Safety Standards (CMVSS)

- 3.4.2 Europe

- 3.4.2.1 United Kingdom: UNECE Regulation No. 13 - Vehicle Braking and Stability Systems

- 3.4.2.2 Germany: ISO 26262 - Functional Safety of Electrical and Electronic Systems in Road Vehicles

- 3.4.2.3 France: UNECE Regulation No. 79 - Steering and Vehicle Control Systems

- 3.4.2.4 Italy: ISO 21434 - Road Vehicles Cybersecurity Engineering

- 3.4.2.5 Spain: ISO 14001 - Environmental Management Systems

- 3.4.3 Asia Pacific

- 3.4.3.1 China: GB/T 38628 - Automotive Software and OTA Update Security Requirements

- 3.4.3.2 Japan: ISO 26262 - Functional Safety of Electrical and Electronic Systems in Road Vehicles

- 3.4.3.3 India: AIS 155 - Cybersecurity and OTA Requirements for Automotive Software

- 3.4.4 Latin America

- 3.4.4.1 Brazil: ABNT NBR ISO 26262 - Functional Safety for Road Vehicles

- 3.4.4.2 Mexico: NOM-194-SCFI - Vehicle Safety and Performance Standards

- 3.4.4.3 Argentina: ISO 9001 - Quality Management Systems for Automotive Software Development

- 3.4.5 Middle East & Africa

- 3.4.5.1 United Arab Emirates: UNECE Regulation No. 155 - Cybersecurity and Cybersecurity Management Systems

- 3.4.5.2 South Africa: ISO 26262 - Functional Safety of Electrical and Electronic Systems in Road Vehicles

- 3.4.5.3 Saudi Arabia: SASO Automotive Technical Regulations - Cybersecurity and Software Compliance

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.8.1 Development cost structure

- 3.8.2 R&D cost analysis

- 3.8.3 Marketing & sales costs

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.11 Future market outlook & opportunities

- 3.12 Automotive Software Architecture & Stack Analysis

- 3.12.1 Automotive software stack architecture

- 3.12.2 Centralized vs zonal E/E architecture impact

- 3.12.3 Hardware-software decoupling trends

- 3.13 OEM Software Strategy & Build-vs-Buy Framework

- 3.13.1 OEM in-house software development trends

- 3.13.2 Build vs buy vs co-develop decisions

- 3.13.3 Impact on Tier-1 and independent software vendors

- 3.14 Software Monetization & Revenue Models

- 3.15 Automotive Software Buyer & Procurement Analysis

- 3.16 Data, Cloud & OTA Ecosystem Dependencies

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Offering, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Operating system

- 5.3 Middleware

- 5.4 Application software

Chapter 6 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric vehicle

- 7.3.1 BEV

- 7.3.2 PHEV

- 7.3.3 FCEV

Chapter 8 Market Estimates & Forecast, By Deployment mode, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Cloud based

- 8.3 On premises

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 Safety systems

- 10.3 Infotainment & telematics

- 10.4 Powertrain & chassis

- 10.5 Body control & comfort

- 10.6 Others

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Portugal

- 11.3.9 Croatia

- 11.3.10 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Singapore

- 11.4.7 Thailand

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

- 11.6.4 Turkey

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Robert Bosch

- 12.1.2 NVIDIA

- 12.1.3 Siemens

- 12.1.4 Continental

- 12.1.5 Aptiv

- 12.1.6 NXP Semiconductors

- 12.1.7 Denso

- 12.1.8 Magna International

- 12.1.9 HARMAN International

- 12.1.10 Qualcomm Technologies

- 12.1.11 Intel

- 12.1.12 Samsung Electronics

- 12.2 Regional Players

- 12.2.1 Valeo

- 12.2.2 ZF Friedrichshafen

- 12.2.3 Hitachi Astemo

- 12.2.4 Panasonic Automotive

- 12.2.5 Renesas Electronics

- 12.2.6 Tata Elxsi

- 12.2.7 KPIT Technologies

- 12.2.8 Luxoft

- 12.2.9 Elektrobit

- 12.2.10 TomTom

- 12.3 Emerging / Disruptor Players

- 12.3.1 BlackBerry

- 12.3.2 Mobileye

- 12.3.3 Aurora Innovation

- 12.3.4 Wind River Systems

- 12.3.5 Sonatus

- 12.3.6 CARIAD

- 12.3.7 Arrival Software

- 12.3.8 ECARX