PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928924

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928924

Sulfosuccinate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

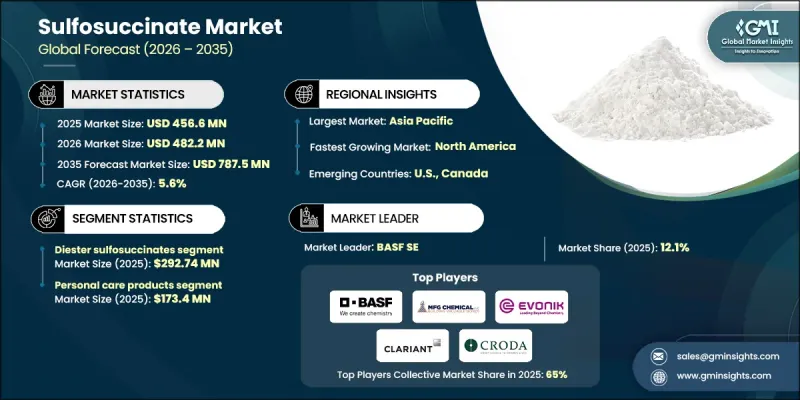

The Global Sulfosuccinate Market was valued at USD 456.6 million in 2025 and is estimated to grow at a CAGR of 5.6% to reach USD 787.5 million by 2035.

Market momentum is driven by the growing preference for mild and readily biodegradable surfactants across personal care, household, and industrial formulations. Demand is supported by the shift toward gentle cleansing solutions that align with environmental compliance while maintaining dependable performance under demanding conditions. Regulatory frameworks and sustainability-driven policies are increasingly influencing formulation choices, encouraging the use of surfactants with verified safety, biodegradability, and low toxicity. Rising consumption of personal care and cosmetic products is pushing brands to reformulate toward gentler systems, particularly for sensitive-use applications, while rapid economic growth in Asia Pacific and regulatory oversight in Europe continue to reinforce adoption. Industrial and institutional cleaning standards are also becoming more stringent, requiring surfactants that deliver effective wetting, penetration, and minimal residue. Sustainability goals and green chemistry principles are reshaping surfactant selection, with manufacturers prioritizing materials that meet strict biodegradability and environmental performance criteria. These trends indicate that regulatory policy and sustainability requirements are actively shaping market demand rather than serving as secondary considerations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $456.6 Million |

| Forecast Value | $787.5 Million |

| CAGR | 5.6% |

The diester sulfosuccinates dominate performance-focused formulations due to their strong emulsification and wetting characteristics. Continuous innovation across this segment is focused on improving foam control, enhancing solubility under varied temperature conditions, and achieving higher purity levels suitable for advanced applications. These improvements are supporting broader adoption across both consumer-facing and industrial systems.

The personal care applications segment held a significant share in 2025, supported by demand for dermatologically compatible cleansing and mild surfactant systems. Household cleaning products utilize sulfosuccinates to improve foam quality and cleaning efficiency while maintaining user safety. Industrial cleaning applications benefit from their effective wetting behavior and low-residue performance, aligning with compliance expectations in regulated environments. Additional demand stems from a wide range of industries, including pharmaceuticals, textiles, agriculture, food processing, coatings, oil and gas, paper, leather, adhesives, mining, and metal processing.

U.S. Sulfosuccinate Market was valued at USD 104.8 million in 2025 and is forecast to reach USD 180.8 million by 2035. Growth in the region is supported by reformulation initiatives, sustainability-driven product development, and strong demand from high-specification industrial and institutional cleaning sectors. Regulatory encouragement toward safer chemical alternatives continues to support steady volume growth and premium-value expansion.

Key companies active in the Global Sulfosuccinate Market include Stepan Company, Croda International, The Dow Chemical Company, Evonik Industries AG, Clariant AG, Huntsman Corporation, DuPont, Henkel AG, KAO Corporation, Air Products and Chemicals, MFG Chemical, and Cytec Industries. Companies operating in the Sulfosuccinate Market are strengthening their market position through targeted strategies focused on sustainability, innovation, and geographic expansion. Manufacturers are investing in research and development to enhance product mildness, biodegradability, and performance consistency. Portfolio optimization toward compliant and environmentally preferred formulations is a core priority. Firms are expanding production capabilities, improving supply chain resilience, and forming strategic partnerships with personal care and industrial formulators.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Form

- 2.2.3 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Explosives Market, By Product Type, 2022-2035(USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 Diester sulfosuccinates

- 5.2.1 Dioctyl sodium sulfosuccinate

- 5.2.2 Sodium diisotridecyl sulfosuccinate

- 5.2.3 Dilauryl sodium sulfosuccinate

- 5.2.4 Ditridecyl sodium sulfosuccinate

- 5.2.5 Others

- 5.3 Monoester sulfosuccinates

- 5.3.1 Ammonium lauryl sulfosuccinate

- 5.3.2 Disodium lauryl sulfosuccinate

- 5.3.3 Ethoxylated monoalkyl sulfosuccinates

- 5.3.4 Cocomonoethanolamide sulfosuccinate

- 5.4 Others

Chapter 6 Pyrotechnics Market, By Form, 2022-2035(USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Liquid formulations

- 6.3 Paste formulations

- 6.4 Powder formulations

Chapter 7 Pyrotechnics Market, By Application, 2022-2035(USD Million, Kilo Tons)

- 7.1 Key trends

- 7.2 Dishwashing liquid

- 7.3 Household detergents & cleaners

- 7.3.1 Laundry detergents

- 7.3.2 Hard surface cleaners

- 7.3.3 Fabric & textile care

- 7.3.4 Others

- 7.4 Industrial cleaners

- 7.4.1 Metal cleaning & degreasing

- 7.4.2 Institutional & industrial (I&I) cleaning

- 7.4.3 Automotive cleaners

- 7.4.4 Others

- 7.5 Personal care products

- 7.5.1 Shampoos

- 7.5.2 Body care & lotions

- 7.5.3 Cosmetics

- 7.5.4 Hair care products

- 7.5.5 Others

- 7.6 Pharmaceutical

- 7.6.1 Oral laxatives

- 7.6.2 Tablet formulation

- 7.6.3 Others

- 7.7 Food & beverage

- 7.7.1 Food emulsifier

- 7.7.2 Beverage processing

- 7.7.3 Others

- 7.8 Agricultural chemicals

- 7.8.1 Agrochemical emulsifiers

- 7.8.2 Adjuvants

- 7.8.3 Others

- 7.9 Textile processing

- 7.9.1 Dyeing & leveling

- 7.9.2 Textile sizing

- 7.9.3 Textile auxiliaries

- 7.10 Leather processing

- 7.10.1 Leather finishing

- 7.10.2 Leather dyeing

- 7.11 Paper & pulp

- 7.12 Paints, coatings & inks

- 7.13 Oil & gas

- 7.14 Adhesives & sealants

- 7.15 Mining & mineral processing

- 7.16 Metalworking & lubrication

- 7.17 Others (antifog, wallpaper removers, germicidal preparations)

Chapter 8 Market Size and Forecast, By Region, 2022-2035(USD Million, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 The Dow Chemical Company

- 9.2 Huntsman Corporation

- 9.3 MFG Chemical

- 9.4 Stepan Company

- 9.5 Cytec Industries

- 9.6 Air Products and Chemicals

- 9.7 Evonik Industries AG

- 9.8 Clariant AG

- 9.9 Dupont

- 9.10 Croda International

- 9.11 KAO Corporation

- 9.12 Henkel AG