PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928935

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928935

Electric Vehicle Battery Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

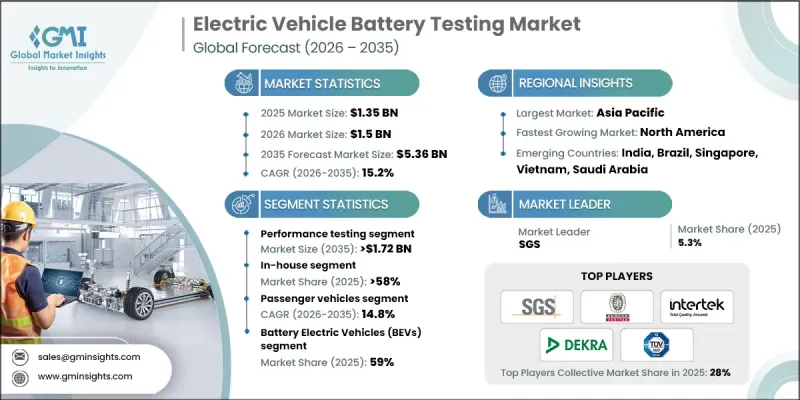

The Global Electric Vehicle Battery Testing Market was valued at USD 1.35 billion in 2025 and is estimated to grow at a CAGR of 15.2% to reach USD 5.36 billion by 2035.

Market expansion is tied to the accelerating production of electric vehicles worldwide, which is pushing battery manufacturers and suppliers to adopt advanced testing solutions to confirm safety, reliability, and performance. As battery designs evolve toward higher energy density, compact form factors, and new chemical compositions, the financial and safety risks associated with failure continue to rise. Manufacturers are prioritizing comprehensive validation across multiple operating conditions to ensure product consistency during mass production. Testing demand is further strengthened by the need to evaluate long-term durability, degradation behavior, abuse tolerance, and thermal stability across cell, module, and pack levels. Battery testing has become an essential component of risk management strategies as the cost of battery replacement remains high. What was once a compliance-driven activity is now viewed as a strategic investment to protect brand reputation, reduce warranty exposure, and improve overall product quality across the electric mobility ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.35 Billion |

| Forecast Value | $5.36 Billion |

| CAGR | 15.2% |

The performance testing segment held 38% share in 2025 and is projected to reach USD 1.72 billion by 2035. This segment focuses on assessing how efficiently batteries deliver power under varying load conditions and operating environments. Lifecycle evaluation has expanded beyond basic charge cycles to include accelerated aging, predictive degradation analysis, and advanced battery health modeling, supporting longer vehicle usage expectations.

The passenger vehicle segment is expected to grow at a CAGR of 14.8% throughout 2034. Rising adoption of electric passenger cars continues to increase demand for batteries that meet strict requirements related to driving range, charging performance, durability, and safety. Manufacturers depend on extensive testing protocols to ensure consistent performance and align with consumer expectations for reliability.

US Electric Vehicle Battery Testing Market was valued at USD 232.2 million in 2025 and is expected to record strong growth from 2026 to 2035. Increasing emphasis on safety validation and regulatory compliance is driving demand for advanced testing services. Manufacturers are expanding internal and outsourced testing capabilities to support faster commercialization while managing growing technical and compliance challenges.

Key companies active in the Global Electric Vehicle Battery Testing Market include SGS, UL Solutions, Intertek, TUV SUD, Bureau Veritas, DEKRA, Eurofins, DNV, Applus+, and Element. Companies operating in the Global Electric Vehicle Battery Testing Market are reinforcing their market position by expanding technical capabilities and service breadth. Investments in advanced testing infrastructure, automation, and simulation tools allow faster and more precise validation. Strategic partnerships with battery manufacturers and vehicle OEMs support long-term service agreements and recurring revenue. Many players are broadening global laboratory networks to serve customers across regions with consistent standards. A strong focus on safety, reliability, and time-to-market optimization helps testing providers differentiate their offerings while supporting the evolving requirements of next-generation electric vehicle batteries.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Testing

- 2.2.3 Sourcing

- 2.2.4 Vehicle

- 2.2.5 Propulsion

- 2.2.6 Component

- 2.2.7 End use

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook & strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Growth in global electric vehicle production

- 3.2.1.3 Stringent battery safety and regulatory standards

- 3.2.1.4 Increasing battery energy density and system complexity

- 3.2.1.5 OEM focus on quality assurance and warranty risk reduction

- 3.2.1.6 Expansion of global battery manufacturing capacity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital cost of advanced testing infrastructure

- 3.2.2.2 Long testing cycles and time-to-market pressures

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of third-party battery testing services

- 3.2.3.2 Advancements in digital and automated testing technologies

- 3.2.3.3 Emergence of next-generation battery chemistries

- 3.2.3.4 Expansion of battery lifecycle and second-life applications

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 United States: NHTSA Automotive Cybersecurity Best Practices

- 3.4.1.2 Canada: Canadian Motor Vehicle Safety Standards CMVSS

- 3.4.2 Europe

- 3.4.2.1 UK: UNECE Regulation No. 13 Vehicle Braking and Stability Systems

- 3.4.2.2 Germany: ISO 26262 Functional Safety of Electrical and Electronic Systems in Road Vehicles

- 3.4.2.3 France: UNECE Regulation No. 79 Steering and Vehicle Control Systems

- 3.4.2.4 Italy: ISO 21434 Road Vehicles Cybersecurity Engineering

- 3.4.2.5 Spain: ISO 14001 Environmental Management Systems

- 3.4.3 Asia Pacific

- 3.4.3.1 China: GB/T 38628 Electric Vehicle Battery Testing and OTA Update Security Requirements

- 3.4.3.2 Japan: ISO 26262 Functional Safety of Electrical and Electronic Systems in Road Vehicles

- 3.4.3.3 India: AIS 155 Cybersecurity and OTA Requirements for Automotive Software

- 3.4.4 Latin America

- 3.4.4.1 Brazil: ABNT NBR ISO 26262 Functional Safety for Road Vehicles

- 3.4.4.2 Mexico: NOM-194-SCFI Vehicle Safety and Performance Standards

- 3.4.4.3 Argentina: ISO 9001 Quality Management Systems

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE: UNECE Regulation No. 155 Cybersecurity and Cybersecurity Management Systems

- 3.4.5.2 South Africa: ISO 26262 Functional Safety of Electrical and Electronic Systems in Road Vehicles

- 3.4.5.3 Saudi Arabia: SASO Automotive Technical Regulations Cybersecurity and Software

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Testing Standards & Protocols

- 3.11.1 Battery testing standards & protocols

- 3.11.2 Certification vs validation vs homologation testing

- 3.11.3 Mandatory vs OEM-specific test requirements

- 3.12 Battery Chemistry-Specific Testing

- 3.12.1 Testing requirements by battery chemistry

- 3.12.2 Thermal runaway & abuse testing evolution by chemistry

- 3.13 Lifecycle Phase-Based Testing

- 3.14 Digital, AI & Simulation-Based Testing

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Testing, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Performance testing

- 5.3 Safety testing

- 5.4 Lifecycle testing

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Sourcing, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 In-house

- 6.3 Outsourcing

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 Battery Electric Vehicles (BEVs)

- 8.3 Plug-in Hybrid Electric Vehicles (PHEVs)

- 8.4 Hybrid Electric Vehicles (HEVs)

Chapter 9 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 Battery Cells

- 9.3 Battery Modules

- 9.4 Battery Packs

- 9.5 Battery Management Systems (BMS)

Chapter 10 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 Automotive OEMs

- 10.3 Battery manufacturers

- 10.4 Research and development institutes

- 10.5 Third-party testing service providers

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.3.8 Portugal

- 11.3.9 Croatia

- 11.3.10 Benelux

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Singapore

- 11.4.7 Thailand

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

- 11.6.4 Turkey

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 ALS

- 12.1.2 Applus+

- 12.1.3 Bureau Veritas

- 12.1.4 DEKRA

- 12.1.5 DNV

- 12.1.6 Element Materials Technology

- 12.1.7 Eurofins

- 12.1.8 Intertek

- 12.1.9 SGS

- 12.1.10 TUV SUD

- 12.1.11 UL Solutions

- 12.2 Regional Players

- 12.2.1 AVL

- 12.2.2 CSA

- 12.2.3 FEV

- 12.2.4 Instron

- 12.2.5 KEMA Labs

- 12.2.6 Nemko

- 12.2.7 NTS (National Technical Systems)

- 12.2.8 Tektronix

- 12.2.9 VDE Testing and Certification

- 12.3 Emerging / Disruptor Players

- 12.3.1 Arbin Instruments

- 12.3.2 AVILOO

- 12.3.3 Bitrode

- 12.3.4 Chroma ATE

- 12.3.5 Digatron

- 12.3.6 Espec

- 12.3.7 Hioki

- 12.3.8 Keysight Technologies

- 12.3.9 Maccor

- 12.3.10 Weiss Technik