PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1929005

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1929005

Automotive Tires E-Retailing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

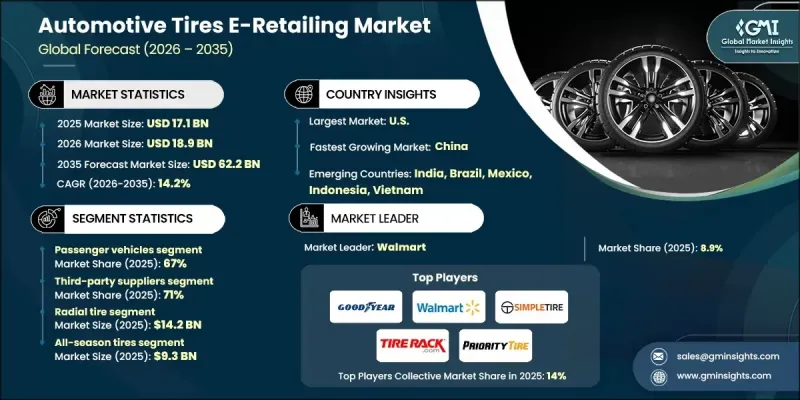

The Global Automotive Tires E-Retailing Market was valued at USD 17.1 billion in 2025 and is estimated to grow at a CAGR of 14.2% to reach USD 62.2 billion by 2035.

Market growth is shaped by the rapid integration of visual and interactive digital commerce tools across online tire retail platforms. Digital retail experiences are becoming more immersive, allowing customers to better evaluate products before purchase and make informed decisions with higher confidence. This shift is improving engagement levels, lowering product return rates, and strengthening conversion performance for online sellers. The growing use of advanced digital showrooms and configuration tools is enabling tire sellers to differentiate themselves while improving overall customer satisfaction in a competitive landscape. Subscription-based offerings focused on tire replacement cycles, maintenance scheduling, and seasonal usage patterns are also reshaping purchasing behavior. These models allow customers to move away from one-time purchases in favor of flexible, cost-efficient service plans. The model is gaining traction among users seeking convenience and predictable expenses. Predictive analytics are further supporting this evolution by enabling retailers to recommend timely replacements based on usage data, supporting higher lifetime customer value. Artificial intelligence-driven recommendation engines continue to influence purchasing decisions and redefine how consumers approach online tire buying.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $17.1 Billion |

| Forecast Value | $62.2 Billion |

| CAGR | 14.2% |

The passenger vehicle segment held 67% share in 2025 and is forecast to grow at a CAGR of 14% from 2026 to 2035. Market demand is supported by rising vehicle ownership and longer vehicle usage cycles, which are driving consistent replacement needs. Online platforms are increasingly preferred due to ease of price comparison, access to user feedback, and simplified purchasing workflows. As more vehicles remain in operation for extended periods, demand for replacement tires through digital channels continues to rise. Consumers are prioritizing convenience and speed, and e-retailing platforms are meeting these expectations through streamlined access and purchasing efficiency.

The third-party suppliers segment held a 71% share in 2025 and is expected to grow at a CAGR of 13.5% from 2026 to 2035. Their leadership position is supported by broad product assortments covering multiple brands, specifications, and pricing tiers. These suppliers can offer competitive pricing while maintaining performance and safety standards due to strong procurement networks and volume-based sourcing strategies. This value-driven proposition aligns well with online buyer expectations and continues to reinforce their market presence.

United States Automotive Tires E-Retailing Market held 82% share in 2025, generating USD 4 billion. Strong vehicle ownership levels and consistent replacement demand are sustaining online tire sales across the country. Consumers are increasingly turning to digital channels that offer wide product availability, competitive pricing, and home delivery services. Retailers are further supporting sales momentum through loyalty incentives and flexible digital payment solutions that enhance affordability and convenience.

Key companies operating in the Global Automotive Tires E-Retailing Market include Tire Rack, Amazon, Walmart Tires, Discount Tire Direct, Goodyear, SimpleTire, Priority Tire, Pep Boys, Tires-easy, and NTB. These companies are actively shaping the competitive environment through platform innovation and service expansion. Companies in the automotive tires e-retailing market are reinforcing their competitive position through digital optimization, customer-centric services, and supply chain efficiency. Many players are investing in advanced data analytics to personalize recommendations and improve demand forecasting. Expanding private-label offerings and exclusive partnerships is helping improve margins and brand loyalty. Retailers are also enhancing fulfillment capabilities through faster delivery options and expanded installation networks. Subscription services and flexible payment plans are being used to encourage repeat purchases and long-term engagement.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality Commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research Trail & Confidence Scoring

- 1.3.1 Research Trail Components

- 1.3.2 Scoring Components

- 1.4 Data Collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.7.1 Quantified market impact analysis

- 1.7.1.1 Mathematical impact of growth parameters on forecast

- 1.7.1 Quantified market impact analysis

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Tire

- 2.2.3 Manufacturing

- 2.2.4 Vehicle

- 2.2.5 Distribution channel

- 2.2.6 Sales model

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Expansion of online tire marketplaces

- 3.2.1.2 Rising preference for direct-to-consumer sales

- 3.2.1.3 Growing digitalization in automotive retail

- 3.2.1.4 Increased consumer preference for convenience

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High return rates due to incorrect size selection

- 3.2.2.2 Limited physical inspection before purchase

- 3.2.2.3 Dependence on last-mile logistics & installers

- 3.2.2.4 Price competition among online sellers

- 3.2.3 Market opportunities

- 3.2.3.1 AI-based tire recommendation engines

- 3.2.3.2 Subscription & tire-as-a-service models

- 3.2.3.3 Growth of EV-specific tire demand

- 3.2.3.4 Expansion in emerging markets

- 3.2.3.5 Partnerships with installers & service networks

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 FMVSS - Federal Motor Vehicle Safety Standards (Tires)

- 3.4.1.2 Canada Vehicle Safety Standards (CVSS)

- 3.4.2 Europe

- 3.4.2.1 UNECE R117 / E-Mark Certification

- 3.4.2.2 EUDR - EU Deforestation Regulation

- 3.4.2.3 Tyre Labelling Regulation (EU 2020/740)

- 3.4.3 Asia Pacific

- 3.4.3.1 China Compulsory Certification (CCC) for Tires

- 3.4.3.2 Extended Producer Responsibility (EPR)

- 3.4.3.3 Japan Industrial Standards (JIS) for Tires

- 3.4.4 Latin America

- 3.4.4.1 INMETRO Tire Certification & Labeling

- 3.4.4.2 IRAM / Local Tire Standards

- 3.4.4.3 Vehicle & Tire Relevance to Euro Standards

- 3.4.5 MEA

- 3.4.5.1 Tire Identification Labels with RFID

- 3.4.5.2 SASO Tire Performance & Heat Resistance Standards

- 3.4.5.3 EPR Tire Recycling / Waste Management Standards

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Patent analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Cost breakdown analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Import and export

- 3.11.3 Major import countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Consumer buying journey & decision factors

- 3.13.1 Key online decision parameters (price, reviews, fitment tools)

- 3.13.2 Role of AI-based tire recommendation engines

- 3.13.3 Comparison tools, user reviews, and ratings impact

- 3.13.4 Payment preferences

- 3.14 Future market outlook & structural shifts

- 3.14.1 Shift toward omnichannel tire retailing

- 3.14.2 Growth of subscription-based tire services

- 3.14.3 Direct OEM-to-consumer acceleration

- 3.14.4 Consolidation outlook among e-retail platforms

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Tire, 2022 - 2035 ($Mn & Units)

- 5.1 Key trends

- 5.2 All-season tires

- 5.3 Summer tires

- 5.4 Winter tires

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Manufacturing, 2022 - 2035 ($Mn & Units)

- 6.1 Key trends

- 6.2 Radial tire

- 6.3 Bias tire

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn & Units)

- 7.1 Key trends

- 7.2 Passenger car

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicle

- 7.3.1 Light commercial vehicle (LCV)

- 7.3.2 Medium commercial vehicle (MCV)

- 7.3.3 Heavy commercial vehicle (HCV)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 ($Mn & Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Third-party suppliers

Chapter 9 Market Estimates & Forecast, By Sales Model, 2022 - 2035 ($Mn & Units)

- 9.1 Key trends

- 9.2 Direct-to-Consumer (D2C)

- 9.3 Online-to-Offline (O2O)

- 9.4 Marketplace with Installed Services

Chapter 10 Market Estimates & Forecast, By Region, 2022-2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Denmark

- 10.3.8 Finland

- 10.3.9 Norway

- 10.3.10 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Amazon Tires

- 11.1.2 Costco Tires

- 11.1.3 Discount Tire Direct

- 11.1.4 Goodyear

- 11.1.5 Pep Boys

- 11.1.6 Sam’s Club Tires

- 11.1.7 SimpleTire

- 11.1.8 Tire Rack

- 11.1.9 TireBuyer

- 11.1.10 Walmart Tires

- 11.2 Regional Champions

- 11.2.1. 4 Wheel Parts

- 11.2.2 BJ’s Tire Center

- 11.2.3 BJ’s Wholesale Club Tires

- 11.2.4 Discounted Wheel Warehouse

- 11.2.5 Fountain Tire

- 11.2.6 Les Schwab Tires

- 11.2.7 NTB (National Tire & Battery)

- 11.2.8 Priority Tire

- 11.2.9 Tire Kingdom

- 11.2.10 Tires-easy.com

- 11.3 Emerging Players

- 11.3.1. 123 Tire

- 11.3.2 AlloTire

- 11.3.3 BestOne Tire & Auto

- 11.3.4 Blackcircles

- 11.3.5 CarParts.com Tires

- 11.3.6 Falken Tires Online

- 11.3.7 Just Tires

- 11.3.8 Oponeo

- 11.3.9 Tyremarket

- 11.3.10 WheelMax