PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936479

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936479

End-to-End Neural Network Autonomous Driving System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

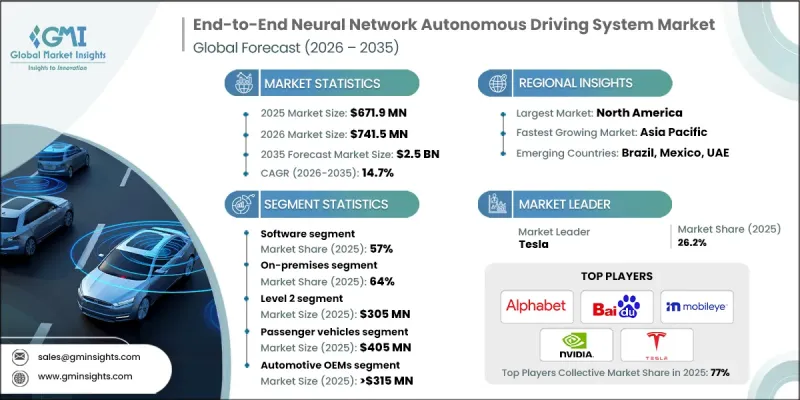

The Global End-to-End Neural Network Autonomous Driving System Market was valued at USD 671.9 million in 2025 and is estimated to grow at a CAGR of 14.7% to reach USD 2.5 billion by 2035.

Market growth reflects the accelerating shift toward autonomous mobility, the rising emphasis on road safety and operational efficiency, and the growing flow of capital into AI-driven vehicle intelligence. Automakers and mobility operators increasingly rely on end-to-end neural network systems to support real-time vehicle perception, decision execution, and control accuracy. These systems enable vehicles to respond instantly to dynamic driving conditions while optimizing energy usage and reducing human intervention. As autonomous deployments scale globally, industry stakeholders continue to prioritize intelligent software architectures that improve safety, adaptability, and long-term cost efficiency. Continuous progress in AI computing, data training capabilities, and software-defined vehicle platforms is reshaping how autonomous intelligence is designed, deployed, and upgraded. The market benefits from an ecosystem that blends onboard processing, cloud-supported model development, and seamless vehicle integration, positioning end-to-end neural network solutions as a foundational requirement for fully autonomous driving operations.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $671.9 Million |

| Forecast Value | $2.5 Billion |

| CAGR | 14.7% |

Advancements in deep learning architectures, real-time sensor data processing, integrated perception-to-control pipelines, and cloud-assisted model optimization are redefining autonomous driving performance. These technologies allow vehicles to interpret complex environments, make rapid driving decisions, and execute actions with reduced latency and improved precision. End-to-end neural network systems unify perception, planning, and control within a single learning framework, which enhances system reliability while lowering engineering complexity. AI-native platforms also support continuous improvement through data-driven training cycles, enabling vehicles to adapt to diverse road conditions and operational scenarios. As software-defined vehicles gain traction, these intelligent systems help manufacturers reduce development timelines, improve vehicle efficiency, and meet evolving safety requirements across multiple markets.

The software segment held 57% share in 2025 and is projected to register a CAGR of 15.2% from 2026 to 2035. Software solutions remain central to autonomous driving performance because they manage perception modeling, sensor fusion, motion planning, and vehicle control logic. Advanced neural networks transform raw sensor inputs into actionable driving decisions, enabling precise and safe vehicle operation. Automotive manufacturers and autonomous service providers increasingly adopt comprehensive software platforms that integrate efficiently with AI processors, sensor hardware, and cloud-based training environments. Continuous software upgrades and over-the-air deployment capabilities further strengthen the dominance of this segment.

The on-premises deployment model accounted for 64% share in 2025 and is expected to grow at a CAGR of 13.8% through 2035. This dominance reflects the industry's preference for localized computing that delivers ultra-low latency, enhanced cybersecurity, and direct system oversight. On-premises architectures enable vehicles to perform neural network inference and safety-critical driving tasks independently of external connectivity. Given the computational intensity and mission-critical nature of autonomous driving operations, localized deployment ensures compliance, reliability, and consistent performance across varying operating conditions.

North America End-to-End Neural Network Autonomous Driving System Market held 83% share, generating USD 215.4 million in 2025. The country maintains its leadership position due to strong participation from automotive manufacturers, autonomous technology developers, and mobility operators, supported by sustained investment in AI-enabled vehicle systems. High adoption of onboard neural processing, continuous software updates, and large-scale autonomous fleet initiatives continues to drive market expansion across the region.

Prominent companies active in the Global End-to-End Neural Network Autonomous Driving System Market include NVIDIA, Tesla, Baidu, Mobileye, Huawei Technologies, Alphabet, Zoox, Aurora Innovation, XPeng Motors, and Cruise. To strengthen their position, companies in the end-to-end neural network autonomous driving system space focus on accelerating AI model innovation, expanding proprietary data training pipelines, and deepening integration between software and vehicle hardware. Strategic investments in high-performance computing platforms and custom AI chips allow firms to enhance real-time processing efficiency. Many players prioritize scalable software architectures that support rapid deployment across multiple vehicle platforms. Partnerships with automotive manufacturers and mobility operators help accelerate commercialization and global reach. Continuous over-the-air updates enable ongoing system improvement and regulatory compliance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Level of Automation

- 2.2.4 Deployment Mode

- 2.2.5 Vehicle

- 2.2.6 End Use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing adoption of autonomous vehicles

- 3.2.1.2 Advancements in AI & deep learning

- 3.2.1.3 Increasing investment in sensor technologies & onboard computing

- 3.2.1.4 Rising demand for safer and more efficient mobility

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory and safety concerns

- 3.2.2.2 High development and deployment costs

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of autonomous fleets & robotaxis

- 3.2.3.2 Cloud-based AI training & OTA updates

- 3.2.3.3 Rising demand for AI compute platforms and cloud-based model training

- 3.2.3.4 Emerging markets and smart mobility ecosystem

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.: NHTSA, DOT, and AI Safety Regulations

- 3.4.1.2 Canada: Transport Canada & Motor Vehicle Safety Regulations

- 3.4.2 Europe

- 3.4.2.1 Germany: BMDV & Autonomous Driving Act

- 3.4.2.2 France: Ministry of Transport & AI Mobility Frameworks

- 3.4.2.3 UK: Department for Transport (DfT) & AV Regulations

- 3.4.2.4 Italy: Ministry of Infrastructure & Transport Regulations

- 3.4.3 Asia Pacific

- 3.4.3.1 China: Ministry of Industry and Information Technology (MIIT)

- 3.4.3.2 Japan: MLIT & Autonomous Vehicle Guidelines

- 3.4.3.3 South Korea: Ministry of Land, Infrastructure and Transport (MOLIT)

- 3.4.3.4 India: Ministry of Road Transport and Highways (MoRTH)

- 3.4.4 Latin America

- 3.4.4.1 Brazil: National Traffic Department (DENATRAN)

- 3.4.4.2 Mexico: Ministry of Communications and Transport

- 3.4.5 Middle East and Africa

- 3.4.5.1 UAE: RTA & National AI Strategy

- 3.4.5.2 Saudi Arabia: Ministry of Communications and Transport

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Use case scenarios

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($ Bn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 Perception

- 5.2.2 Decision

- 5.2.3 Control

- 5.3 Hardware

- 5.3.1 Sensors

- 5.3.2 GPUs

- 5.3.3 AI Chips

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Level of Automation, 2022 - 2035 ($ Bn)

- 6.1 Key trends

- 6.2 Level 2

- 6.3 Level 3

- 6.4 Level 4

- 6.5 Level 5

Chapter 7 Market Estimates & Forecast, By Deployment Model, 2022 - 2035 ($ Bn)

- 7.1 Key trends

- 7.2 On-Premises

- 7.3 Cloud-Based

Chapter 8 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($ Bn)

- 8.1 Key trends

- 8.2 Passenger vehicles

- 8.2.1 Hatchbacks

- 8.2.2 Sedans

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicles (LCV)

- 8.3.2 Medium commercial vehicles (MCV)

- 8.3.3 Heavy commercial vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By End Use, 2022 - 2035 ($ Bn)

- 9.1 Key trends

- 9.2 Automotive OEMs

- 9.3 Fleet Operators

- 9.4 Mobility Service Providers

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($ Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Belgium

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Singapore

- 10.4.6 South Korea

- 10.4.7 Vietnam

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Player

- 11.1.1 Alphabet

- 11.1.2 Aurora Innovation

- 11.1.3 Baidu

- 11.1.4 Cruise (GM)

- 11.1.5 Huawei Technologies

- 11.1.6 Mobileye

- 11.1.7 NVIDIA Corporation

- 11.1.8 Tesla, Inc.

- 11.1.9 XPeng Motors

- 11.1.10 Zoox (Amazon)

- 11.2 Regional Player

- 11.2.1 AutoX

- 11.2.2 Hyundai Motor Group

- 11.2.3 Nuro, Inc.

- 11.2.4 Pony.ai

- 11.2.5 SAIC Motor Corporation

- 11.2.6 Tata Elxsi

- 11.2.7 Wayve Technologies

- 11.2.8 ZF Friedrichshafen AG

- 11.3 Emerging Players

- 11.3.1 DeepRoute.ai

- 11.3.2 Momenta

- 11.3.3 Oxbotica

- 11.3.4 PlusAI

- 11.3.5 WeRide