PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936487

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936487

AI in Automotive Cybersecurity Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

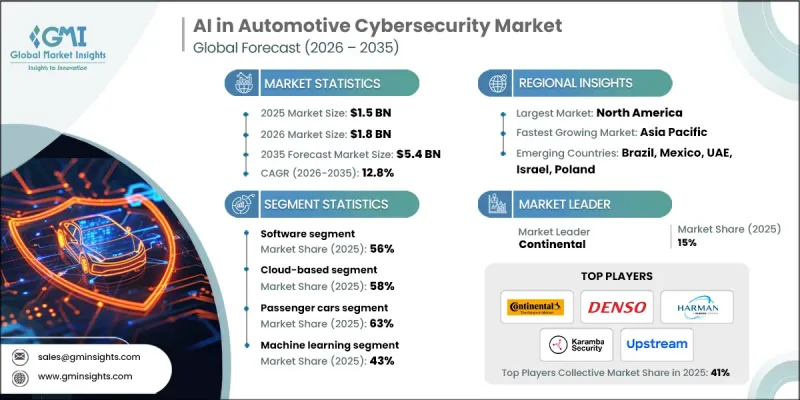

The Global AI in Automotive Cybersecurity Market was valued at USD 1.5 billion in 2025 and is estimated to grow at a CAGR of 12.8% to reach USD 5.4 billion by 2035.

The rapid proliferation of connected vehicles, autonomous driving technologies, and software-centric vehicle platforms drives market growth. Modern vehicles now rely heavily on complex software architectures, with electronic control units containing more than 100 million lines of code, significantly increasing system exposure to cyber risks. As vehicles become more digitally integrated, cybersecurity has evolved into a critical design and operational priority. Artificial intelligence is increasingly deployed to monitor, analyze, and respond to cyber threats in real time, enabling proactive defense mechanisms rather than reactive protection. The transition toward software-defined vehicles represents a fundamental transformation of automotive design, where software governs core functionality, remote feature management, and continuous performance enhancement. The rising cost burden associated with traditional manual software updates, estimated at USD 450 million to USD 500 million annually for original equipment manufacturers, is accelerating the adoption of AI-enabled cybersecurity platforms that support remote updates, threat mitigation, and system integrity in an increasingly connected automotive ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $1.5 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 12.8% |

The dominance of the software segment reflects the industry-wide movement toward code-driven vehicle architectures where digital platforms control critical functions rather than mechanical components. Software-based cybersecurity solutions are designed to secure embedded firmware, protect in-vehicle applications, and establish trusted execution environments that verify authorized code operation. These solutions also manage encryption protocols and authentication processes that ensure secure data exchange and update delivery. Artificial intelligence enhances these platforms by continuously analyzing in-vehicle network behavior to identify anomalies and potential intrusions. The rapid expansion of software content within vehicles, now exceeding 100 million lines of code across multiple systems, continues to drive demand for advanced software-focused cybersecurity solutions that can scale with increasing system complexity.

The hardware-based solutions segment held 27% share in 2025, reinforcing its role as a foundational layer of vehicle security. These solutions integrate physical security mechanisms directly into vehicle electronics to protect critical systems from tampering and unauthorized access. Hardware components are engineered to securely store cryptographic credentials, execute encryption processes, and establish trusted boot environments that prevent compromised software from running. Additional hardware security elements support unique device authentication and offload complex cryptographic operations to preserve overall vehicle performance. Together, these technologies form a secure physical backbone that complements AI-driven software defenses.

The cloud-based deployment segment reached a significant share in 2025 as automotive cybersecurity strategies increasingly rely on centralized platforms to manage large-scale vehicle fleets. Cloud-enabled solutions provide real-time threat intelligence, system-wide analytics, and rapid deployment of security updates across distributed vehicle networks. This approach supports connected vehicle services and remote software delivery by enabling centralized communication management and scalable data processing. Aggregating cybersecurity data from millions of vehicles allows for advanced machine learning analysis that identifies emerging threats and coordinates rapid response actions without requiring physical intervention.

United States AI in Automotive Cybersecurity Market held a notable share in 2025, driven by high-value vehicles equipped with advanced digital features, contributing to elevated per-unit cybersecurity investment. Extensive transportation infrastructure supports advanced vehicle connectivity, while a well-established cybersecurity ecosystem enables the development of specialized automotive protection solutions. Investments in connected mobility infrastructure are increasing the need for robust cybersecurity frameworks to safeguard vehicle communications, digital road systems, and intelligent traffic management platforms.

Key companies operating in the AI in Automotive Cybersecurity Market include NVIDIA, Robert Bosch, Continental, BlackBerry, Harman International, Denso, Upstream Security, Trillium Secure, Karamba Security, and GuardKnox Cyber Technologies. Companies in the AI in Automotive Cybersecurity Market are strengthening their competitive position through continuous innovation, strategic collaborations, and platform expansion. Leading players are investing in AI-driven threat detection, behavioral analytics, and automated response systems to stay ahead of evolving cyber risks. Many firms are forming partnerships with automakers, software vendors, and cloud service providers to integrate security solutions directly into vehicle architectures. Portfolio diversification across software, hardware, and cloud-based offerings is enabling vendors to address varied customer requirements. In parallel, companies are expanding global delivery capabilities and emphasizing regulatory compliance to support international deployments.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.3 Research trail and confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Best estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicles

- 2.2.4 Technology

- 2.2.5 Deployment Mode

- 2.2.6 Security

- 2.2.7 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Rising connected, electric, and autonomous vehicle adoption

- 3.2.1.3 Mandatory compliance with UN R155/R156 and ISO/SAE 21434

- 3.2.1.4 Increasing cyberattack complexity targeting vehicles

- 3.2.1.5 Growth of software-defined vehicles and OTA updates

- 3.2.1.6 Expansion of V2X and in-vehicle digital services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High implementation and integration costs

- 3.2.2.2 Complexity of AI-based cybersecurity systems

- 3.2.2.3 Shortage of skilled automotive cybersecurity talent

- 3.2.2.4 Legacy vehicle platform compatibility issues

- 3.2.3 Market opportunities

- 3.2.3.1 AI-driven predictive threat detection solutions

- 3.2.3.2 Edge AI for real-time, low-latency security

- 3.2.3.3 Biometric authentication for vehicle access and payments

- 3.2.3.4 Security-as-a-service and subscription-based models

- 3.2.3.5 Aftermarket cybersecurity for legacy vehicles

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 US- FMVSS and NHTSA guidelines

- 3.4.1.2 Canada - Motor vehicle safety regulations (MVSR)

- 3.4.2 Europe

- 3.4.2.1 Germany- EU General Safety Regulation (GSR)

- 3.4.2.2 UK- Road Vehicles (Approval) Regulations

- 3.4.2.3 France- EU AV and road safety frameworks

- 3.4.2.4 Italy- National Road Safety Plan (PNSS)

- 3.4.3 Asia Pacific

- 3.4.3.1 China- GB/T and GB standards

- 3.4.3.2 India- Motor Vehicles (Amendment) Act and AIS standards

- 3.4.3.3 Japan- Road Traffic Act and MLIT autonomous driving guidelines

- 3.4.3.4 Australia- Australian Design Rules (ADR)

- 3.4.4 LATAM

- 3.4.4.1 Mexico- NOM vehicle safety standards

- 3.4.4.2 Argentina- National traffic law 24.449

- 3.4.5 MEA

- 3.4.5.1 South Africa- National road traffic act (1996)

- 3.4.5.2 Saudi Arabia- Traffic law & vision 2030 transport initiatives

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 AI & machine learning evolution in automotive security

- 3.7.1.2 Deep learning algorithms for threat detection

- 3.7.1.3 Natural language processing for security intelligence

- 3.7.2 Emerging technologies

- 3.7.2.1 Computer vision applications in security surveillance

- 3.7.2.2 Context-aware computing & automated response

- 3.7.2.3 Quantum-resilient encryption development

- 3.7.1 Current technological trends

- 3.8 Patent analysis

- 3.8.1 AI-powered security patent landscape

- 3.8.2 Key patent holders & technology leaders

- 3.8.3 Emerging IP trends & filing patterns

- 3.8.4 Patent licensing & collaboration models

- 3.9 Pricing analysis

- 3.9.1 Solution pricing models (subscription, perpetual license, per-vehicle)

- 3.9.2 Hardware cost trends

- 3.9.3 Service pricing dynamics

- 3.9.4 Total cost of ownership analysis

- 3.10 Use cases & success stories

- 3.10.1 Fleet management security use cases

- 3.10.2 Autonomous vehicle protection scenarios

- 3.10.3 In-vehicle payment & commerce security

- 3.10.4 OTA update security implementation

- 3.10.5 V2X communication protection use cases

- 3.10.6 Connected infotainment security applications

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Investment & funding analysis

- 3.12.1 Venture capital investment trends

- 3.12.2 M&A activity & market consolidation

- 3.12.3 Strategic partnerships & collaborations

- 3.12.4 Government funding & grants

- 3.13 Future outlook and opportunities

- 3.13.1 Regulatory evolution & impact

- 3.13.2 Strategic opportunities

- 3.13.3 Future threat landscape

- 3.13.4 Investment opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 AI accelerators & processors

- 5.2.2 Hardware security modules (HSM)

- 5.2.3 Secure gateways & network devices

- 5.2.4 Storage & memory components

- 5.3 Software

- 5.3.1 AI-powered security platforms

- 5.3.2 Standalone security applications

- 5.3.3 Integrated software solutions

- 5.4 Services

- 5.4.1 Professional services

- 5.4.1.1 Consulting & advisory services

- 5.4.1.2 Deployment & integration services

- 5.4.1.3 Support & maintenance Services

- 5.4.2 Managed security services

- 5.4.2.1 Threat monitoring & detection

- 5.4.2.2 Incident response services

- 5.4.2.3 Security operations center (SOC) services

- 5.4.1 Professional services

Chapter 6 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 SUV

- 6.2.3 Sedan

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles (LCV)

- 6.3.2 Medium commercial vehicles (MCV)

- 6.3.3 Heavy commercial vehicles (HCV)

- 6.4 Electric vehicles (EVs)

Chapter 7 Market Estimates & Forecast, By Technology, 2022 - 2035 ($Bn)

- 7.1 Key trends

- 7.2 Machine learning

- 7.3 Natural language processing (NLP)

- 7.4 Computer vision

- 7.5 Context-aware computing

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Deployment Mode, 2022 - 2035 ($Bn)

- 8.1 Key trends

- 8.2 On premises

- 8.3 Cloud

Chapter 9 Market Estimates & Forecast, By Security, 2022 - 2035 ($Bn)

- 9.1 Key trends

- 9.2 Endpoint security

- 9.3 Application security

- 9.4 Wireless network security

- 9.5 Cloud security

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn)

- 10.1 Key trends

- 10.2 Advanced driver assistance system (ADAS) & safety systems

- 10.3 Infotainment system

- 10.4 Telematics system

- 10.5 Powertrain system

- 10.6 Body control & comfort system

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Netherlands

- 11.3.8 Sweden

- 11.3.9 Denmark

- 11.3.10 Poland

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Singapore

- 11.4.7 Thailand

- 11.4.8 Indonesia

- 11.4.9 Vietnam

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Colombia

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

- 11.6.4 Israel

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Aptiv

- 12.1.2 BlackBerry

- 12.1.3 Continental

- 12.1.4 Denso

- 12.1.5 Harman International Industries

- 12.1.6 Karamba Security

- 12.1.7 NVIDIA

- 12.1.8 Robert Bosch

- 12.1.9 Siemens

- 12.1.10 Upstream Security

- 12.2 Regional Players

- 12.2.1 Cybellum Technologies

- 12.2.2 ESCRYPT

- 12.2.3 GuardKnox Cyber Technologies

- 12.2.4 Infineon Technologies

- 12.2.5 Intertrust Technologies

- 12.2.6 NCC

- 12.2.7 NXP Semiconductors

- 12.2.8 Renesas Electronics

- 12.2.9 STMicroelectronics

- 12.2.10 Trillium Security

- 12.2.11 Vector Informatik

- 12.3 Emerging Technology Innovators

- 12.3.1 Aurora Labs

- 12.3.2 C2A Security

- 12.3.3 Cymotive Technologies

- 12.3.4 VicOneg bmhjb