PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936491

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936491

Industrial Emission Monitoring and Control System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

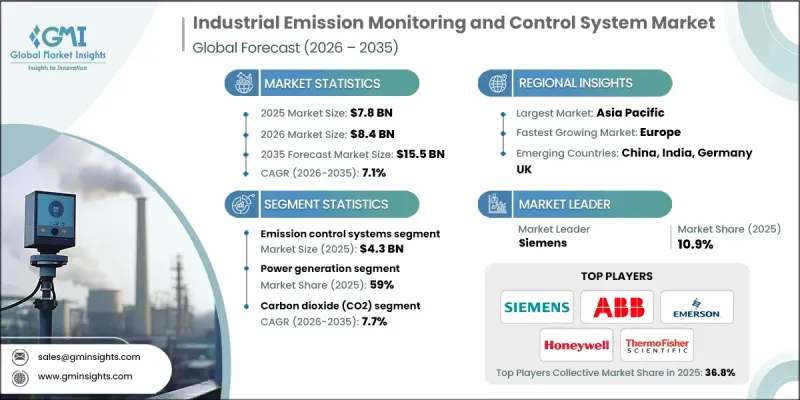

The Global Industrial Emission Monitoring and Control System Market was valued at USD 7.8 billion in 2025 and is estimated to grow at a CAGR of 7.1% to reach USD 15.5 billion by 2035.

Market expansion is driven by increasingly strict environmental regulations aimed at limiting industrial emissions and reducing environmental pollution. Governments across regions are enforcing compliance requirements that encourage industries to adopt advanced emission monitoring and control technologies. As a result, manufacturers are investing in sophisticated systems capable of delivering accurate, real-time emission data. Technological advancements, including the integration of artificial intelligence and connected monitoring platforms, are enhancing system performance and driving adoption. The energy and power sector remains one of the largest contributors to industrial emissions, making it a key demand generator for monitoring and control solutions. Ongoing transitions toward cleaner energy generation and the implementation of emission reduction technologies in power facilities are creating strong growth opportunities. While the market faces challenges such as high capital investment requirements and technical complexity in upgrading legacy systems, supportive government incentives and financial assistance programs are helping offset these barriers and encouraging broader adoption.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $7.8 Billion |

| Forecast Value | $15.5 Billion |

| CAGR | 7.1% |

The emission monitoring systems segment will grow at a CAGR of 7.3% during 2026 to 2035. The incorporation of connected sensors and advanced data analytics is improving continuous monitoring, real-time reporting, and compliance accuracy. Industries are placing greater emphasis on reducing greenhouse gas emissions and airborne pollutants, which is directly increasing demand for monitoring and control solutions. Regulatory authorities are strengthening environmental frameworks and promoting cleaner production practices, further accelerating the deployment of modern emission control technologies across industrial facilities.

The carbon dioxide segment is projected to grow at a CAGR of 7.7% from 2026 to 2035. Heightened awareness around climate change and global temperature rise has intensified the focus on carbon dioxide emission measurement and management. Governments worldwide are implementing carbon pricing mechanisms and emission accountability policies, compelling industries to track and control CO2 output more rigorously. This regulatory pressure is making CO2 monitoring a critical component of industrial emission management strategies.

United States Industrial Emission Monitoring and Control System Market accounted for 77% share and generated USD 1.8 billion in 2025. Market growth in the country is supported by stringent environmental regulations and enforcement frameworks established by federal authorities. Legislative mandates require industrial facilities to measure, report, and reduce emissions consistently. Additionally, rising corporate focus on sustainability initiatives and environmental responsibility is accelerating investment in emission monitoring solutions across multiple industries.

Key companies operating in the Global Industrial Emission Monitoring and Control System Market include Siemens, ABB, Emerson Electric, Honeywell International, Yokogawa Electric, Thermo Fisher Scientific, Endress+Hauser, Mitsubishi Heavy Industries, Horiba, Teledyne Technologies, AMETEK, Kongsberg, Kawasaki Heavy Industries, Durag Group, and Forbes Marshall. Companies in the Industrial Emission Monitoring and Control System Market are strengthening their market position through technology innovation, strategic partnerships, and geographic expansion. Leading players are investing heavily in research and development to enhance system accuracy, automation, and digital integration. Many are expanding their product portfolios to offer customized solutions tailored to specific industrial applications.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 System Type

- 2.2.3 Pollutant Type

- 2.2.4 End Use Industry

- 2.2.5 Distribution Channel

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By system type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By System Type, 2022 - 2035 ($Billion, Thousand Units)

- 5.1 Key trends

- 5.2 Emission monitoring systems

- 5.2.1 Continuous emission monitoring system (CEMS)

- 5.2.2 Predictive emission monitoring system (PEMS)

- 5.3 Emission control systems

- 5.3.1 Electrostatic precipitators (ESP)

- 5.3.2 Scrubbers (FGD systems)

- 5.3.3 Catalytic systems

- 5.3.4 Fabric filters/baghouses

- 5.3.5 Sorbent injection systems

- 5.3.6 Others (thermal oxidizers, cyclones etc.)

Chapter 6 Market Estimates & Forecast, By Pollutant Type, 2022 - 2035 ($Billion, Thousand Units)

- 6.1 Key trends

- 6.2 Nitrogen Oxides (NOx)

- 6.3 Sulfur Oxides (SOx/SO2)

- 6.4 Carbon Dioxide (CO2)

- 6.5 Methane

- 6.6 Particulate Matter

- 6.7 Others (THC, mercury etc.)

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2022 - 2035 ($Billion, Thousand Units)

- 7.1 Key trends

- 7.2 Power Generation

- 7.3 Oil & Gas

- 7.4 Chemical & Petrochemical

- 7.5 Metals & Mining

- 7.6 Pulp & Paper

- 7.7 Pharmaceuticals

- 7.8 Others (marine etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035 ($Billion, Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035 ($Billion, Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 AMETEK

- 10.3 Durag Group

- 10.4 Emerson Electric

- 10.5 Endress+Hauser

- 10.6 Forbes Marshall

- 10.7 Honeywell International

- 10.8 Horiba

- 10.9 Kawasaki Heavy Industries

- 10.10 Kongsberg

- 10.11 Mitsubishi Heavy Industries

- 10.12 Siemens

- 10.13 Teledyne Technologies

- 10.14 Thermo Fisher Scientific

- 10.15 Yokogawa Electric