PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936512

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936512

Electric Vehicle (EV) Battery Components Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

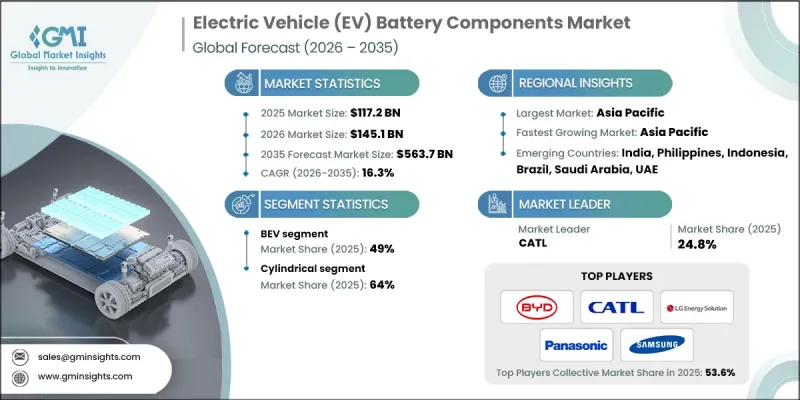

The Global Electric Vehicle Battery Components Market was valued at USD 117.2 billion in 2025 and is estimated to grow at a CAGR of 16.3% to reach USD 563.7 billion by 2035.

The rapid adoption of electric vehicles worldwide is transforming automotive powertrain design and reshaping supply chains. Components such as battery cells, modules, cathodes, anodes, battery management systems (BMS), and thermal management solutions are now central to determining vehicle range, performance, safety, and cost efficiency. As automakers shift from internal combustion engines to dedicated EV architectures, battery systems are increasingly treated as fully integrated platforms rather than individual parts, influencing both operational viability and lifecycle economics. The market is further boosted by large-scale investments and strategic collaborations among automakers, battery manufacturers, material suppliers, and semiconductor firms. Vertical integration strategies, including in-house battery assembly, localized cell production, and joint ventures for cathode and anode materials, are enabling OEMs to secure supplies, lower costs, and improve quality. Additionally, extensive component testing, lifecycle optimization, and adherence to global safety standards are enhancing product reliability, durability, and thermal safety.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $117.2 Billion |

| Forecast Value | $563.7 Billion |

| CAGR | 16.3% |

The battery electric vehicle (BEV) segment held 49% share in 2025 and is expected to grow at a CAGR of 17% through 2035. BEVs rely entirely on battery power, driving strong demand for high-capacity cells, modules, and associated systems to ensure long driving ranges, rapid charging, and consistent performance. Global policies and incentives supporting zero-emission vehicles further accelerate BEV adoption, positioning this segment as the primary growth driver for the market.

The cylindrical cells segment held 64% share in 2025, with projected growth at a CAGR of 15.7% from 2026 to 2035. These cells are favored for their proven performance, high energy density, superior thermal management, and long lifecycle. Their modular design and standardized sizes allow seamless integration into battery packs, simplifying assembly, maintenance, and recycling. Cylindrical cells also provide enhanced safety, reliable heat dissipation, and durability under high current loads, making them a preferred choice for both passenger and commercial EV applications.

China Electric Vehicle (EV) Battery Components Market reached a significant share in 2025. The country's rapid industrialization, strong domestic EV demand, and extensive supply chain integration support robust market expansion. China's dominant EV production base drives ongoing demand for battery cells, cathodes, anodes, separators, electrolytes, and casings. Control over upstream lithium refining, cathode manufacturing, and graphite anode production ensures cost efficiency, rapid scaling, and stable supply. Policy support through production-linked incentives and long-term industrial planning further accelerates technology adoption and capacity expansion across battery component segments.

Key players shaping the Global Electric Vehicle Battery Components Market include CATL, BYD, Panasonic, Blue Line Battery, Johnson Matthey, Mitsubishi Chemical, LG Energy Solution, Samsung SDI, Sumitomo Metal Mining, and Umicore. Leading companies in the Electric Vehicle Battery Components Market are adopting multiple strategies to strengthen their market presence and competitive position. These include forming strategic alliances with automakers and material suppliers to secure raw material access, investing in localized manufacturing to reduce costs and improve supply chain resilience, and expanding R&D efforts to develop next-generation high-capacity, fast-charging, and longer-lasting battery systems. Companies are also enhancing production scalability, integrating advanced thermal management and battery management technologies, and pursuing mergers or joint ventures to enter new geographic markets. Focused testing, lifecycle optimization, and adherence to global safety and environmental standards further improve product reliability, building trust among OEMs and fleet operators and solidifying long-term market foothold.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Battery Form

- 2.2.3 Propulsion

- 2.2.4 Vehicle

- 2.2.5 Battery Chemistry

- 2.2.6 Component

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global adoption of electric passenger and commercial vehicles

- 3.2.1.2 Increase in government incentives, subsidies, and EV infrastructure investments

- 3.2.1.3 Expansion of battery giga factories and localized manufacturing capacity

- 3.2.1.4 Growing electrification of logistics, public transport, and fleet vehicles

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and price volatility of critical battery raw materials

- 3.2.2.2 Limited large-scale battery recycling and end-of-life infrastructure

- 3.2.3 Market opportunities

- 3.2.3.1 Rise in adoption of next-generation battery chemistries and solid-state components

- 3.2.3.2 Increase in domestic manufacturing supported by EV and battery localization policies

- 3.2.3.3 Surge in demand for advanced battery management systems and power electronics

- 3.2.3.4 Growth in second life and recycling-based battery component applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 United States: NHTSA ADS Guidance & AV TEST Initiative.

- 3.4.2 Europe

- 3.4.2.1 EU Battery Regulation (Regulation (EU) 2023/1542)

- 3.4.2.2 Germany: Battery Act (Batteriegesetz - BattG)

- 3.4.2.3 United Kingdom: Batteries and Accumulators Regulations

- 3.4.2.4 France: Extended Producer Responsibility (EPR) for Batteries

- 3.4.3 Asia Pacific

- 3.4.3.1 China: New Energy Vehicle Power Battery Safety & Recycling Regulations

- 3.4.3.2 Japan: METI Lithium-Ion Battery Safety & Recycling Guidelines

- 3.4.3.3 South Korea: Act on Resource Circulation of Electrical & Electronic Equipment and Vehicles

- 3.4.3.4 Singapore: Environmental Protection and Management (Battery Waste) Regulations

- 3.4.4 Latin America

- 3.4.4.1 Brazil: National Solid Waste Policy (Battery Reverse Logistics Rules)

- 3.4.4.2 Mexico: Official Standard NOM-212-SEMARNAT (Battery Waste Management)

- 3.4.4.3 Chile: Extended Producer Responsibility Law (Law No. 20,920)

- 3.4.5 MEA

- 3.4.5.1 United Arab Emirates: Federal Integrated Waste Management Law (Battery Provisions)

- 3.4.5.2 Saudi Arabia: Environmental Law & SASO EV Battery Technical Regulations

- 3.4.5.3 South Africa: National Environmental Management - Waste Act (Battery Compliance)

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Sustainability and environmental impact analysis

- 3.9.1 Sustainable practices

- 3.9.2 Waste reduction strategies

- 3.9.3 Energy efficiency in production

- 3.9.4 Eco-friendly initiatives

- 3.9.5 Carbon footprint considerations

- 3.10 Future outlook & opportunities

- 3.11 OEM implementation framework

- 3.11.1 Vertical integration trends

- 3.11.2 Long-term offtake agreements & their impact on component pricing

- 3.11.3 Preferred supplier models vs open procurement

- 3.11.4 Co-development & joint venture models

- 3.12 Use Cases & application scenarios

- 3.13 Global capacity & utilization analysis

- 3.13.1 Installed vs announced component capacity

- 3.13.2 Regional utilization rates

- 3.13.3 Overcapacity & under-supply risk zones

- 3.13.4 Component bottleneck identification

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Battery Form, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Cylindrical

- 5.3 Pouch

- 5.4 Prismatic

Chapter 6 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 BEV

- 6.3 PHEV

- 6.4 HEV

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger Cars

- 7.2.1 Sedan

- 7.2.2 Hatchback

- 7.2.3 SUV

- 7.3 Commercial vehicle

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

- 7.4 Two- & Three-Wheelers

Chapter 8 Market Estimates & Forecast, By Battery Chemistry, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Lithium iron phosphate

- 8.3 Nickel cobalt aluminum

- 8.4 Nickel manganese cobalt

- 8.5 Lithium manganese oxide

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 Cell Components

- 9.2.1 Cathode

- 9.2.2 Anode

- 9.2.3 Electrolyte

- 9.2.4 Others

- 9.3 Pack Components

- 9.3.1 Battery Management System

- 9.3.2 Thermal Management System

- 9.3.3 Housing & Enclosure

- 9.3.4 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Belgium

- 10.3.8 Netherlands

- 10.3.9 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.4.8 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 BASF SE

- 11.1.2 BYD

- 11.1.3 Contemporary Amperex Technology Co. Limited (CATL)

- 11.1.4 Johnson

- 11.1.5 LG Energy Solution

- 11.1.6 Panasonic

- 11.1.7 Samsung

- 11.1.8 Umicore

- 11.1.9 Arkema

- 11.2 Regional Players

- 11.2.1 Asahi Kasei

- 11.2.2 BTR New Energy Materials

- 11.2.3 Celgard

- 11.2.4 EVE Energy

- 11.2.5 Ganfeng Lithium

- 11.2.6 Gotion High-Tech

- 11.2.7 Huayou Cobalt

- 11.2.8 JFE Chemical

- 11.2.9 Mitsubishi Chemical

- 11.2.10 SK Innovation

- 11.2.11 Sumitomo Metal Mining

- 11.2.12 Toray Industries

- 11.3 Emerging Players

- 11.3.1 Amprius Technologies

- 11.3.2 Anovion Technologies

- 11.3.3 Ascend Elements

- 11.3.4 FREYR Battery

- 11.3.5 QuantumScape

- 11.3.6 Redwood Materials