PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936513

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936513

Acoustic Barrier Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

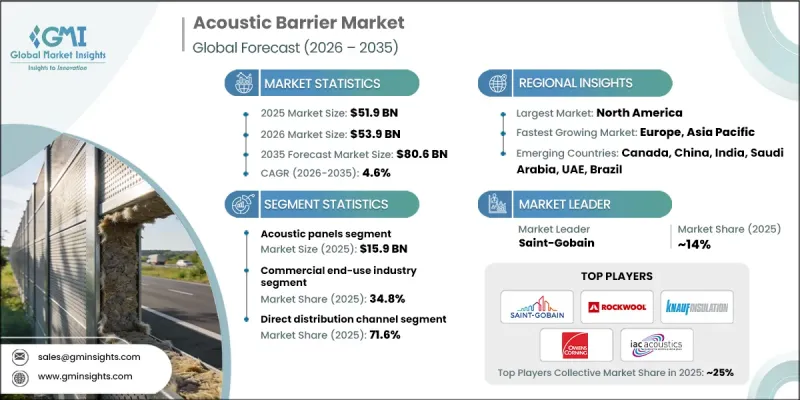

The Global Acoustic Barrier Market was valued at USD 51.9 billion in 2025 and is estimated to grow at a CAGR of 4.6% to reach USD 80.6 billion by 2035.

Market growth is driven by rapid urbanization, expanding transportation infrastructure, and rising awareness of the adverse health impacts of noise pollution. Governments and municipal authorities worldwide are enforcing stricter noise control regulations across highways, railways, airports, and industrial zones, significantly boosting demand for high-performance acoustic barriers. Additionally, the adoption of smart city initiatives and sustainable infrastructure projects is accelerating the deployment of advanced noise mitigation solutions. Manufacturers are increasingly focusing on durable, weather-resistant, and aesthetically integrated products that comply with environmental and safety standards, making acoustic barriers a critical component of modern urban and infrastructure development.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $51.9 Billion |

| Forecast Value | $80.6 Billion |

| CAGR | 4.6% |

The acoustic panels segment generated USD 15.9 billion in 2024. Their strong adoption is attributed to their versatility, modular design, and effectiveness in controlling reverberation and improving sound quality across commercial, institutional, and residential environments. Wall-mounted and ceiling-mounted acoustic panels are widely used in offices, hospitality venues, educational institutions, and entertainment facilities, where clear speech and occupant comfort are crucial. The growing trend toward open-plan buildings and wellness-oriented architectural designs continues to reinforce demand for advanced acoustic panel solutions that combine performance with visual appeal.

The direct distribution segment held 71.6% share in 2025 and is projected to grow at a CAGR of 4.6% from 2026 to 2035. Direct sales offer enhanced control over pricing, delivery schedules, and product specifications, which is especially critical for large-scale projects in transportation, commercial infrastructure, and industrial facilities. This approach enables quicker communication and more customized solutions, reducing reliance on intermediaries and minimizing delays. Furthermore, the increasing prevalence of turnkey projects and integrated service models promotes direct interaction between suppliers and clients, streamlining procurement and installation processes.

North America Acoustic Barrier Market generated USD 16.8 billion in 2024, supported by strict environmental noise regulations, large-scale infrastructure upgrades, and significant retrofit and replacement activities along aging transport corridors. The U.S. and Canada continue to invest heavily in highway modernization, urban transit systems, and industrial noise control solutions. Strong regulatory enforcement, coupled with high public awareness of noise-related health issues, has made acoustic barriers a standard requirement in infrastructure and construction projects across the region.

Key players operating in the Global Acoustic Barrier Market include Saint-Gobain, Rockwool International, Knauf Insulation, Owens Corning, IAC, Durisol, Echo Barrier, Gramm Barrier Systems, Nippon Steel Kobelco Metal Products, Saferoad Noise Protection, KOCH Finishing Systems, Kohlhauer, and JFE Metal Products. Companies in the acoustic barrier market are strengthening their market position by focusing on product innovation, material optimization, and integrated solution offerings. Leading players are investing in advanced materials such as composites, mineral wool, and transparent acrylics to enhance noise attenuation while meeting aesthetic and sustainability requirements. Strategic partnerships with infrastructure developers, government bodies, and EPC contractors are increasingly common to secure long-term projects. Firms are also expanding their portfolios beyond product supply to include acoustic consulting, noise mapping, customized design, and installation services, enabling end-to-end project execution.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Barrier type

- 2.2.3 Material

- 2.2.4 End use industry

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization & infrastructure expansion

- 3.2.1.2 Tightening environmental & noise regulations

- 3.2.1.3 Advances in materials & technology

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High upfront costs & CAPEX pressures

- 3.2.2.2 Installation & structural constraints

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By barrier type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Barrier Type, 2022 - 2035, (USD Billion) (Thousand Square Meters)

- 5.1 Key trends

- 5.2 Noise barrier walls

- 5.3 Acoustic panels

- 5.4 Wall-mounted

- 5.5 Ceiling-mounted

- 5.6 Free-standing

- 5.7 Acoustic enclosures

- 5.8 Acoustic fencing

- 5.9 Partition walls/demountable systems

Chapter 6 Market Estimates & Forecast, By Material, 2022 - 2035, (USD Billion) (Thousand Square Meters)

- 6.1 Key trends

- 6.2 Concrete-based barriers

- 6.3 Metal-based barriers

- 6.4 Transparent/acrylic-based barriers

- 6.5 Wood-based barriers

- 6.6 Mineral wool-based

- 6.6.1 Rock wool

- 6.6.2 Glass wool

- 6.7 Foam/polymer-based barriers

- 6.8 Composite/multi-material barrier

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2022 - 2035, (USD Billion) (Thousand Square Meters)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.3.1 Office

- 7.3.2 Hospitality

- 7.3.3 Retail

- 7.3.4 Entertainment & recreation

- 7.4 Industrial

- 7.5 Transportation infrastructure

- 7.6 Institutional

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Square Meters)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Square Meters)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Indonesia

- 9.4.7 Malaysia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Durisol

- 10.2 Echo Barrier

- 10.3 Gramm Barrier Systems

- 10.4 IAC

- 10.5 JFE Metal Products

- 10.6 K. Schutte GmbH

- 10.7 Knauf Insulation

- 10.8 KOCH Finishing Systems

- 10.9 Kohlhauer

- 10.10 Nippon Steel Kobelco Metal Products

- 10.11 Owens Corning

- 10.12 Rockwool

- 10.13 Saferoad Noise Protection

- 10.14 Saint-Gobain

- 10.15 Weldon