PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936515

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936515

Automotive Drive Shaft Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

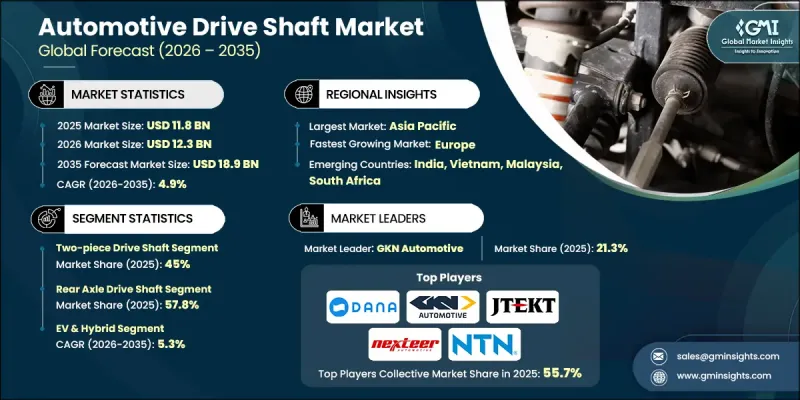

The Global Automotive Drive Shaft Market was valued at USD 11.8 billion in 2025 and is estimated to grow at a CAGR of 4.9% to reach USD 18.9 billion by 2035.

Market growth is tied to rising global vehicle production across passenger and commercial categories. As vehicle output increases, demand for essential drivetrain components continues to rise, positioning drive shafts as a critical element in modern automotive architecture. These components play a vital role in power transmission, making them indispensable to vehicle driveline and transmission systems. Expanding electrification across the automotive industry further supports market momentum, as electric and hybrid platforms require drive shafts engineered to manage distinct torque profiles and compact powertrain layouts. Continued growth in both conventional and electrified vehicle manufacturing reinforces long-term demand. Automakers are also responding to regulatory pressure and efficiency targets by prioritizing weight reduction, which is accelerating innovation across drivetrain components. In parallel, the aftermarket segment contributes significantly to market expansion as aging vehicles require replacement parts, sustaining consistent demand for both traditional and advanced drive shaft solutions.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $11.8 Billion |

| Forecast Value | $18.9 Billion |

| CAGR | 4.9% |

Manufacturers are increasingly shifting toward lightweight construction by adopting alternative materials that improve efficiency and vehicle dynamics. Reduced component weight enhances fuel economy and performance while supporting compliance with emissions standards. Adoption of these advanced materials is particularly strong in regions with stringent efficiency requirements. The aftermarket continues to benefit from vehicle longevity, driving steady replacement demand across diverse material types.

The two-piece drive shafts segment held 45% share in 2025 and generated USD 5.3 billion. This configuration is widely adopted in vehicles requiring extended driveline lengths, particularly in higher-demand utility and commercial segments. Modular construction supports easier installation, simplified handling, and more efficient maintenance, contributing to its widespread acceptance across global markets.

The rear axle drive shafts segment accounted for 57.8% share in 2025 and is projected to reach USD 10.3 billion by 2035. Strong adoption of rear-wheel and all-wheel drive architectures across multiple vehicle categories continues to support demand. Rear axle configurations offer structural advantages and reduced engineering complexity, making them a preferred choice in larger vehicles, particularly in regions with strong demand for utility-focused transportation.

U.S. Automotive Drive Shaft Market reached USD 1.28 billion in 2025. Domestic manufacturers continue to adopt advanced materials and refined production techniques to enhance strength-to-weight ratios and overall efficiency. Regulatory pressure related to fuel efficiency and emissions reduction remains a key driver influencing component design and material selection.

Major companies operating in the Global Automotive Drive Shaft Market include GKN Automotive, Dana, American Axle & Manufacturing, NTN, Nexteer Automotive, Neapco, JTEKT, Hyundai WIA, Wanxiang Qianchao, and IFA. To strengthen their foothold, companies in the automotive drive shaft industry focus on material innovation, production efficiency, and strategic partnerships with vehicle manufacturers. Investment in lightweight engineering enables compliance with efficiency standards while improving performance. Portfolio diversification across vehicle types and drivetrain architectures allows suppliers to serve both conventional and electrified platforms. Expansion of aftermarket offerings supports recurring revenue streams. Manufacturers also prioritize automation and precision manufacturing to enhance quality and reduce costs.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Shaft

- 2.2.3 Position

- 2.2.4 Design Structure

- 2.2.5 Material

- 2.2.6 Vehicle

- 2.2.7 Propulsion

- 2.2.8 Sales Channel

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing global vehicle production & sales

- 3.2.1.2 E-axle integration in battery electric vehicles (BEVs)

- 3.2.1.3 Lightweight material adoption for fuel efficiency

- 3.2.1.4 Shift toward rear-wheel & all-wheel-drive (AWD) SUVs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Market saturation & intense price competition

- 3.2.2.2 Declining internal combustion engine (ICE) passenger car sales

- 3.2.3 Market opportunities

- 3.2.3.1 Electric & hybrid vehicle drive shaft customization

- 3.2.3.2 Carbon fiber composite technology commercialization

- 3.2.3.3 Aftermarket growth in emerging economies

- 3.2.3.4 White-space markets in Africa & Latin America

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 National Highway Traffic Safety Administration (NHTSA)

- 3.4.1.2 EPA (Environmental Protection Agency)

- 3.4.1.3 Society of Automotive Engineers (SAE International)

- 3.4.1.4 Transport Canada

- 3.4.1.5 Occupational Safety and Health Administration (OSHA)

- 3.4.2 Europe

- 3.4.2.1 European Commission (EC)

- 3.4.2.2 European Automobile Manufacturers’ Association (ACEA)

- 3.4.2.3 European Committee for Standardization (CEN)

- 3.4.3 Asia Pacific

- 3.4.3.1 Ministry of Land, Infrastructure, Transport and Tourism (MLIT), Japan

- 3.4.3.2 Ministry of Industry and Information Technology (MIIT), China

- 3.4.3.3 Automotive Research Association of India (ARAI)

- 3.4.4 Latin America

- 3.4.4.1 National Institute of Metrology, Quality and Technology (INMETRO)

- 3.4.4.2 Secretariat of Economy (SE), Mexico

- 3.4.4.3 National Traffic Safety Agency (ANTSV), Argentina

- 3.4.5 Middle East & Africa

- 3.4.5.1 GCC Standardization Organization (GSO)

- 3.4.5.2 South African Bureau of Standards (SABS)

- 3.4.5.3 Saudi Standards, Metrology and Quality Organization (SASO)

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Sustainability and environmental impact

- 3.11.1 Environmental impact assessment

- 3.11.2 Social impact & community benefits

- 3.11.3 Governance & corporate responsibility

- 3.11.4 Sustainable finance & investment trends

- 3.12 Product lifecycle analysis

- 3.12.1 Drive shaft lifecycle stages

- 3.12.2 Lifecycle by material

- 3.12.3 Failure modes & lifecycle limiting factors

- 3.12.4 Predictive maintenance & lifecycle extension

- 3.12.5 End-of-life disposal & recycling

- 3.13 Electric & Hybrid Vehicle Impact Analysis

- 3.13.1 EV Drivetrain Architecture & Drive Shaft Implications

- 3.13.2 EV-Specific Drive Shaft Requirements

- 3.13.3 Hybrid Vehicle Drive Shaft Complexity

- 3.13.4 Competitive Landscape Transformation

- 3.14 Case studies

- 3.15 OEM drivetrain architecture mapping

- 3.16 System-level driveline component interaction

- 3.17 NVH Performance & Vehicle Dynamics Benchmarking

- 3.18 Aftermarket Failure Modes & Replacement Economics

- 3.19 Future outlook & opportunities

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Shaft, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Single-Piece Drive Shaft

- 5.3 Two-Piece Drive Shaft

- 5.4 Slip-in-Tube Drive Shaft

Chapter 6 Market Estimates & Forecast, By Position, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Front Axle Drive Shaft

- 6.3 Rear Axle Drive Shaft

Chapter 7 Market Estimates & Forecast, By Design Structure, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Hollow Drive Shaft

- 7.3 Rigid/Solid Drive Shaft

Chapter 8 Market Estimates & Forecast, By Material, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Steel

- 8.3 Aluminum

- 8.4 Carbon Fiber

Chapter 9 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 Passenger cars

- 9.2.1 SUV

- 9.2.2 Sedan

- 9.2.3 Hatchback

- 9.3 Commercial vehicles

- 9.3.1 LCV

- 9.3.2 MCV

- 9.3.3 HCV

- 9.4 Two wheelers

Chapter 10 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 Internal Combustion Engine (ICE)

- 10.3 EV & Hybrid

- 10.3.1 Battery Electric Vehicle (BEV)

- 10.3.2 Hybrid Electric Vehicle (HEV)

- 10.3.3 Plug-in Hybrid Electric Vehicle (PHEV)

Chapter 11 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 11.1 Key trends

- 11.2 Original Equipment Manufacturer (OEM)

- 11.3 Aftermarket

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Czech Republic

- 12.3.8 Belgium

- 12.3.9 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.4.6 Singapore

- 12.4.7 Malaysia

- 12.4.8 Indonesia

- 12.4.9 Vietnam

- 12.4.10 Thailand

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 Colombia

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Global players

- 13.1.1 GKN Automotive

- 13.1.2 Dana

- 13.1.3 American Axle & Manufacturing (AAM)

- 13.1.4 NTN

- 13.1.5 Nexteer

- 13.1.6 JTEKT

- 13.1.7 Hyundai WIA

- 13.1.8 IFA

- 13.1.9 Neapco

- 13.1.10 Schaeffler

- 13.2 Regional players

- 13.2.1 Wanxiang Qianchao

- 13.2.2 Xuchang Yuandong Driveshaft

- 13.2.3 TrakMotive Europe

- 13.2.4 EDS - ALL DRIVESHAFT

- 13.2.5 GuangZhou JunChi AutoParts

- 13.2.6 Drexler Automotive

- 13.2.7 Dorman Products

- 13.2.8 Quigley

- 13.3 Emerging players

- 13.3.1 GSP Automotive

- 13.3.2 The Timken

- 13.3.3 Comer Industries

- 13.3.4 GNA Drivelines

- 13.3.5 Schaeffler

- 13.3.6 Elbe

- 13.3.7 Amalga Composites