PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939051

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939051

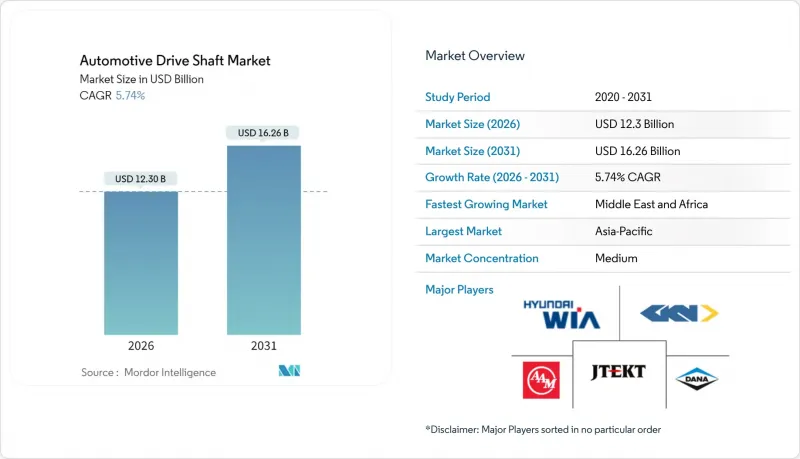

Automotive Drive Shaft - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Automotive drive shaft market size in 2026 is estimated at USD 12.3 billion, growing from 2025 value of USD 11.63 billion with 2031 projections showing USD 16.26 billion, growing at 5.74% CAGR over 2026-2031.

This growth trajectory reflects the market's adaptation to electrification demands while maintaining robust performance in traditional powertrains. The transition from multi-piece conventional shafts to high-precision lightweight alternatives creates both disruption and opportunity, as OEMs balance cost pressures with performance requirements across diverse vehicle architectures.

Global Automotive Drive Shaft Market Trends and Insights

E-axle Integration Reshapes Shaft Architecture

E-axle integration fundamentally alters drive shaft requirements by eliminating traditional multi-piece configurations while creating demand for high-precision lightweight propeller shafts in rear-wheel-drive electric architectures. Tesla's Model S Plaid and BMW iX demonstrate how integrated motor-gearbox units reduce component count yet require specialized carbon-fiber propeller shafts for torque vectoring applications. This architectural shift explains why BEV segments grow at 14.25% CAGR despite potentially reducing per-vehicle shaft content. Schaeffler's April 2025 production launch of ball screw drives for Chinese EV manufacturers illustrates how suppliers adapt precision manufacturing capabilities from traditional driveline applications to electric powertrains. The transition creates opportunities for suppliers with advanced materials expertise while challenging traditional steel-focused manufacturers.

Carbon-Fiber Adoption Accelerates Beyond Premium Segments

Carbon-fiber composite shaft adoption extends beyond luxury applications into performance-oriented mainstream vehicles, driven by weight reduction mandates and NVH improvement requirements. Ford's latest F-150 variants and BMW's 3-Series incorporate carbon-fiber propeller shafts to achieve fuel economy targets while maintaining durability under high-torque conditions. The material's 60% weight reduction compared to steel enables longer shaft lengths without critical speed limitations, particularly valuable in AWD configurations where packaging constraints intensify. Manufacturing scale improvements reduce carbon-fiber shaft costs by approximately 15-20% annually, making adoption economically viable for volume applications beyond the traditional premium segment focus. This trend accelerates as OEMs prioritize lightweighting strategies to offset battery weight penalties in hybrid and electric powertrains.

Raw Material Price Volatility Pressures Margins

Carbon fiber and specialty steel price volatility creates margin pressure across the drive shaft supply chain, with carbon fiber prices fluctuating 25-30% quarterly based on aerospace demand cycles and energy costs. The concentration of carbon fiber production among few global suppliers (Toray, SGL Carbon, Hexcel) creates supply bottlenecks when demand surges from aerospace recovery and renewable energy applications. Specialty steel grades used in high-performance applications face similar volatility, with chromium-molybdenum alloy prices increasing 18% in 2024 due to mining disruptions and geopolitical tensions affecting raw material supply. This volatility forces suppliers to implement dynamic pricing mechanisms and hedge strategies that complicate long-term OEM contracts, potentially slowing adoption of advanced materials in cost-sensitive applications.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives Drive Localization

- AWD Proliferation Drives Inter-Axle Demand

- Supply Chain Concentration Creates Vulnerability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hollow shafts command 56.63% market share in 2025, reflecting their optimal balance of weight reduction and manufacturing cost efficiency compared to solid alternatives. The design's advantages include 40-50% weight reduction versus solid shafts while maintaining equivalent torque capacity through optimized wall thickness engineering. Composite/CFRP shafts accelerate at 12.62% CAGR through 2031, driven by premium vehicle adoption and performance applications where weight savings justify higher material costs. Two-piece/slip-in tube configurations serve specific packaging requirements in compact vehicle architectures, particularly in front-wheel-drive applications where space constraints limit single-piece shaft installation.

Solid shaft applications persist in heavy-duty commercial vehicles and off-road applications where durability requirements outweigh weight considerations. The segment's stability reflects commercial vehicle manufacturers' conservative approach, prioritizing proven reliability over advanced materials. Manufacturing innovations in hollow shaft production, including hydroforming and advanced welding techniques, continue to expand the design's applicability across vehicle segments while maintaining cost competitiveness against solid alternatives.

Conventional steel maintains 67.32% market share in 2025, reflecting its cost-effectiveness and established manufacturing infrastructure across global supply chains. However, carbon-fiber/CFRP materials surge at 14.33% CAGR through 2031, indicating a fundamental shift toward lightweight solutions that extends beyond premium applications. High-strength alloy steel serves intermediate applications where weight reduction requirements exceed conventional steel capabilities but cost constraints limit carbon-fiber adoption. Aluminum applications focus on specific use cases where corrosion resistance and moderate weight reduction justify the material premium over steel alternatives.

The material transition reflects broader automotive lightweighting mandates driven by fuel economy regulations and electric vehicle range optimization. Carbon-fiber manufacturing scale improvements, including automated fiber placement and resin transfer molding, reduce production costs while improving quality consistency. This technological advancement enables carbon-fiber adoption in volume applications previously dominated by steel, particularly in propeller shaft applications where length and critical speed requirements favor lightweight materials.

The Automotive Drive Shaft Market Report is Segmented by Design Type (Hollow Shaft, Solid Shaft, Two-piece/Slip-in Tube, and More), Material (Conventional Steel, and More), Position Type (Rear Axle Shafts, and More), Vehicle Type (Passenger Cars, and More), Powertrain/Propulsion (ICE, Hybrid, BEV), Sales Channel (OEM, Aftermarket), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominates with 45.72% market share in 2025, driven by China's massive vehicle production scale and ASEAN's expanding commercial vehicle manufacturing capabilities. The region's growth stems from infrastructure development programs that boost commercial vehicle demand, particularly in Indonesia, Thailand, and Vietnam where industrial corridor development creates sustained freight transportation requirements. China's February 2025 commercial vehicle production of 318,000 units, representing 36.6% year-over-year growth, demonstrates the scale of demand driving regional shaft requirements. Regional suppliers benefit from proximity to major OEM production facilities and established supply chain relationships that reduce logistics costs and lead times.

North America and Europe represent mature markets with established automotive manufacturing bases that drive steady demand for drive shaft components across diverse vehicle segments. North American growth focuses on SUV and pickup truck segments where AWD proliferation creates demand for inter-axle propeller shafts, while European markets emphasize lightweight materials adoption driven by stringent emissions regulations. The regions' focus on premium applications and advanced materials creates opportunities for suppliers with carbon-fiber expertise and precision manufacturing capabilities. Government incentives in both regions support local manufacturing development, with the U.S. Section 48C program and European Union's Green Deal industrial policy encouraging domestic component production.

Middle-East and Africa emerges as the fastest-growing region at 8.77% CAGR through 2031, driven by infrastructure development programs and increasing vehicle ownership rates across the region. South Africa's automotive manufacturing expansion and UAE's logistics hub development create demand for commercial vehicle components, while oil-rich nations economic diversification programs support automotive assembly operations. The region's growth reflects broader industrialization trends that create sustained demand for transportation infrastructure and commercial vehicle fleets. However, the market is uneven across countries, with differing policy support and manufacturing capacity shaping growth trajectories.

- GKN PLC (Melrose Industries PLC)

- Dana Incorporated

- JTEKT Corporation

- Hyundai Wia Corporation

- Nexteer Automotive Group Ltd.

- American Axle and Manufacturing Holdings Inc.

- NTN Corporation

- Showa Corporation

- IFA Rotorion Holding GmbH

- ZF Friedrichshafen AG

- Meritor Inc.

- Neapco Holdings LLC

- GSP Automotive Group

- Wanxiang Qianchao Co. Ltd.

- Hitachi Astemo Ltd.

- ElringKlinger AG (Composite Shaft Division)

- Poclain Powertrain

- Jilin Jinghua Automotive Parts

- Univance Corporation

- Yujiang Vicray Industrial Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-axle integration in BEVs reduces need for multi-piece shafts but drives demand for high-precision lightweight prop-shafts

- 4.2.2 Rapid adoption of carbon-fiber composite shafts in performance and premium vehicles

- 4.2.3 Increasing government incentives for local lightweight-material manufacturing

- 4.2.4 Shift toward rear-wheel-based AWD for SUVs in North America and Europe

- 4.2.5 Booming CV production in ASEAN and Africa industrial corridors

- 4.2.6 Over-the-air driveline analytics unlocking predictive-maintenance retrofits

- 4.3 Market Restraints

- 4.3.1 Raw-material (carbon fiber, specialty steel) price volatility

- 4.3.2 Supply-chain concentration of precision tube-drawing in East Asia

- 4.3.3 Declining ICE passenger-car sales in China and EU

- 4.3.4 Warranty-liability risks from composite shaft delamination

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD))

- 5.1 By Design Type

- 5.1.1 Hollow Shaft

- 5.1.2 Solid Shaft

- 5.1.3 Two-piece/Slip-in Tube

- 5.1.4 Composite/Carbon-Fiber Shaft

- 5.2 By Material

- 5.2.1 Conventional Steel

- 5.2.2 High-Strength Alloy Steel

- 5.2.3 Aluminum

- 5.2.4 Carbon-Fiber/CFRP

- 5.3 By Position Type

- 5.3.1 Rear Axle Shafts

- 5.3.2 Front Axle Shafts

- 5.3.3 Inter-axle/Propeller Shafts for AWD

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commercial Vehicles

- 5.4.3 Medium and Heavy Commercial Vehicles

- 5.5 By Powertrain / Propulsion

- 5.5.1 Internal Combustion Engine (ICE)

- 5.5.2 Hybrid (HEV and PHEV)

- 5.5.3 Battery Electric Vehicle (BEV)

- 5.6 By Sales Channel

- 5.6.1 OEM

- 5.6.2 Aftermarket

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Rest of North America

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 India

- 5.7.4.4 South Korea

- 5.7.4.5 Rest of Asia-Pacific

- 5.7.5 Middle-East and Africa

- 5.7.5.1 United Arab Emirates

- 5.7.5.2 Saudi Arabia

- 5.7.5.3 Egypt

- 5.7.5.4 South Africa

- 5.7.5.5 Rest of Middle-East and Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 GKN PLC (Melrose Industries PLC)

- 6.4.2 Dana Incorporated

- 6.4.3 JTEKT Corporation

- 6.4.4 Hyundai Wia Corporation

- 6.4.5 Nexteer Automotive Group Ltd.

- 6.4.6 American Axle and Manufacturing Holdings Inc.

- 6.4.7 NTN Corporation

- 6.4.8 Showa Corporation

- 6.4.9 IFA Rotorion Holding GmbH

- 6.4.10 ZF Friedrichshafen AG

- 6.4.11 Meritor Inc.

- 6.4.12 Neapco Holdings LLC

- 6.4.13 GSP Automotive Group

- 6.4.14 Wanxiang Qianchao Co. Ltd.

- 6.4.15 Hitachi Astemo Ltd.

- 6.4.16 ElringKlinger AG (Composite Shaft Division)

- 6.4.17 Poclain Powertrain

- 6.4.18 Jilin Jinghua Automotive Parts

- 6.4.19 Univance Corporation

- 6.4.20 Yujiang Vicray Industrial Co.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment