PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936524

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936524

EMEA Aquaculture Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

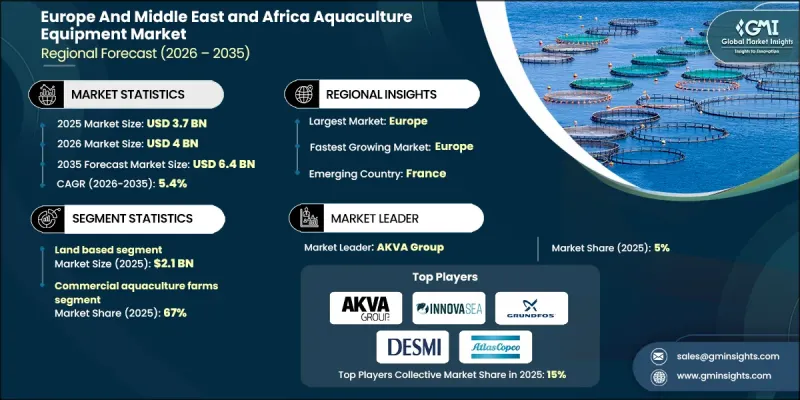

Europe And Middle East, and Africa Aquaculture Equipment Market was valued at USD 3.7 billion in 2025 and is estimated to grow at a CAGR of 5.4% to reach USD 6.4 billion by 2035.

The regional market shows gradual but consistent progress driven by rising food demand, pressure on natural resources, and a stronger focus on responsible production practices. In Europe, aquaculture operates within a highly developed food ecosystem where the priority lies in operational precision, reliability, and animal welfare rather than rapid capacity expansion. Equipment providers in this region align closely with producers to deliver solutions that support efficiency, regulatory compliance, and long-term sustainability. The overall approach favors incremental improvement, stable output, and reduced operational losses, encouraging innovation that is practical, cost-aware, and aligned with real farm conditions rather than experimental development. In the Middle East and Africa, aquaculture equipment demand follows a distinct trajectory shaped by food security goals and reduced dependence on imports. Many countries in these regions view aquaculture as a strategic sector, leading to increased demand for equipment that is resilient, easy to operate, and adaptable to diverse environmental conditions. Systems that perform reliably under variable climates and limited infrastructure receive stronger attention, particularly in areas where technical resources are still evolving.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.7 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 5.4% |

The land-based aquaculture equipment segment generated USD 2.1 billion in 2025, making it the leading system type in the market. This dominance is linked to the higher level of operational control these systems provide. Onshore facilities allow farmers to closely manage water conditions, feeding schedules, and stock health while reducing exposure to unpredictable environmental factors. These setups also align well with regulatory frameworks, especially in regions with restricted coastal access. From a financial perspective, land-based operations offer greater predictability, year-round production, and improved risk management, which strengthens confidence among operators and investors.

The commercial aquaculture farms segment accounted for 67% share in 2025. Their leadership is tied to their central role in large-scale seafood production and revenue generation. These farms operate continuously and require consistent investment in equipment to support daily activities, including operational efficiency and production stability. Because even marginal improvements can directly influence profitability and output quality, commercial operators remain the primary focus for equipment suppliers when developing new solutions.

Germany Aquaculture Equipment Market held a 19% share, generating USD 0.5 billion in 2025. The broader European market reflects a structured and regulation-driven environment where producers emphasize consistency, efficiency, and environmental responsibility. Equipment adoption is influenced by strict sustainability standards, pushing demand for systems that minimize waste, enhance animal welfare, and optimize energy usage. Limited availability of farming locations further increases the need for durable, compliant, and long-lasting equipment solutions across the region.

Key companies active in the Europe And Middle East, and Africa Aquaculture Equipment Market include Xylem Inc., Grundfos Holding A/S, AKVA Group, Pentair AES, Atlas Copco AB, Innovasea, DESMI, Ingersoll Rand, SPX Flow, Azcue Pumps, Flowrox, Speck Pumps, Landia Inc., KAESER Compressors, and Sullair. Companies operating in the Europe And Middle East and Africa Aquaculture Equipment Market focus on strengthening their market position through product reliability, regional partnerships, and technology adaptation. Many players prioritize designing equipment that meets strict environmental regulations while maintaining operational efficiency. Strategic collaborations with fish farms help suppliers tailor systems to local conditions and regulatory needs. Firms also invest in durability and energy-efficient technologies to address long-term cost concerns for operators. Geographic expansion, localized manufacturing, and after-sales service networks are used to improve customer retention.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Equipment type

- 2.2.2 Application

- 2.2.3 End use

- 2.2.4 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for farmed seafood

- 3.2.1.2 Focus on controlled and sustainable farming

- 3.2.1.3 Modernization of aquaculture operations

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial setup and upgrade costs

- 3.2.2.2 Operational complexity and skill gaps

- 3.2.3 Opportunities

- 3.2.3.1 Expansion of commercial aquaculture projects

- 3.2.3.2 Growing adoption in emerging regions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and Disruptions

- 3.5 Future market trends

- 3.6 Risk and mitigation Analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By equipment type

- 3.9 Regulatory landscape

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2022-2035 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Water circulation & transfer equipment (pumps)

- 5.2.1 Centrifugal pumps

- 5.2.2 Submersible pumps

- 5.2.3 Specialized pumps

- 5.2.4 Positive displacement pumps

- 5.3 Aeration & oxygenation equipment

- 5.3.1 Air compressors

- 5.3.1.1 Oil-free compressors

- 5.3.1.2 Oil-lubricated compressors

- 5.3.2 Air blowers

- 5.3.3 Oxygen generation systems

- 5.3.4 Aeration accessories

- 5.3.1 Air compressors

- 5.4 Water treatment & conditioning equipment

- 5.4.1 Mixing equipment

- 5.4.1.1 Submersible mixers

- 5.4.1.2 Static mixers

- 5.4.1.3 Venturi mixers

- 5.4.2 Biological treatment

- 5.4.3 Physical treatment

- 5.4.4 Chemical/advanced treatment

- 5.4.1 Mixing equipment

- 5.5 Feeding & nutrition systems

- 5.6 Fish handling & harvesting equipment

- 5.7 Monitoring & control systems

- 5.8 Structural & containment systems

- 5.9 Other specialized equipment

Chapter 6 Market Estimates & Forecast, By Application, 2022-2035 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Land-based

- 6.3 Sea-based

Chapter 7 Market Estimates & Forecast, By End Use, 2022-2035 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Commercial aquaculture farms

- 7.3 Hatcheries and nurseries

- 7.4 Ornamental fish and aquarium trad

- 7.5 Research and educational institutions

- 7.6 Others (Government & Conservation)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2022-2035 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indiect sales

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Europe

- 9.2.1 UK

- 9.2.2 Germany

- 9.2.3 France

- 9.2.4 Italy

- 9.2.5 Spain

- 9.2.6 Russia

- 9.2.7 Netherlands

- 9.3 Middle East and Africa

- 9.3.1 Saudi Arabia

- 9.3.2 UAE

- 9.3.3 South Africa

Chapter 10 Company Profiles

- 10.1 Grundfos Holding A/S

- 10.2 Pentair AES

- 10.3 DESMI

- 10.4 Xylem Inc.

- 10.5 Speck Pumps

- 10.6 Azcue Pumps

- 10.7 Atlas Copco AB

- 10.8 Ingersoll Rand

- 10.9 KAESER Compressors

- 10.10 Sullair

- 10.11 Landia Inc.

- 10.12 SPX Flow

- 10.13 Flowrox

- 10.14 AKVA Group

- 10.15 Innovasea