PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936532

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936532

Rare Disease Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

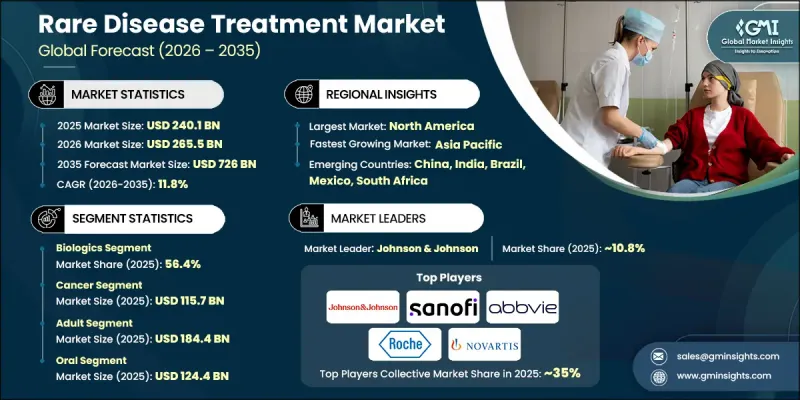

The Global Rare Disease Treatment Market was valued at USD 240.1 billion in 2025 and is estimated to grow at a CAGR of 11.8% to reach USD 726 billion by 2035.

The market focuses on the development and commercialization of therapies designed to address conditions affecting limited patient populations but characterized by substantial unmet clinical needs. Rare disease treatments span a broad range of advanced therapeutic modalities developed under specialized regulatory pathways, supported by favorable policy incentives and reimbursement structures. Continued progress in precision medicine, along with regulatory support programs that encourage innovation, continues to accelerate market expansion. The industry is increasingly centered on disease-modifying and curative approaches that target underlying biological mechanisms rather than symptom management alone. Innovations in molecular science and therapeutic engineering are transforming treatment outcomes and long-term disease control. The convergence of scientific advancements, patient-focused development strategies, and supportive regulatory ecosystems continues to strengthen global demand and investment across pharmaceutical and healthcare markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $240.1 Billion |

| Forecast Value | $726 Billion |

| CAGR | 11.8% |

A notable transformation within the market is the shift toward molecularly targeted and genetically informed therapies. Advanced therapeutic approaches are gaining traction as they offer durable clinical benefits and the potential to alter disease progression. Personalized treatment development has become increasingly prevalent, supported by advancements in genomic research and diagnostic precision. These tailored therapies enhance treatment effectiveness while reducing the risk of adverse reactions, reinforcing the transition toward individualized care models across rare disease management.

The biologics segment held 56.4% share in 2025 and is projected to grow at a CAGR of 11.7% during 2026-2035. These therapies play a central role in addressing complex biological conditions due to their specificity and strong therapeutic performance. Their ability to deliver targeted intervention with improved safety profiles has driven widespread adoption. Continued innovation in biologic development, including customization based on patient-level data, further supports sustained segment growth and aligns with the broader shift toward precision-driven healthcare.

The adult patient population generated reached USD 184.4 billion in 2025 and is expected to grow at a CAGR of 11.7% throughout 2035. Adults represent the largest treatment group globally due to disease progression patterns and diagnosis timelines. While the pediatric segment remains smaller in comparison, it continues to experience accelerated growth, supported by expanded diagnostic capabilities and earlier disease identification. The evolving treatment landscape ensures continued investment across both population segments.

North America Rare Disease Treatment Market accounted for 41.1% share in 2025, maintaining its leadership position due to advanced healthcare systems, strong regulatory incentives, and rapid adoption of innovative therapies. The region benefits from extensive research infrastructure, early integration of precision medicine, and substantial investment in biotechnology development. Supportive reimbursement structures and active patient advocacy further contribute to sustained demand and market maturity across the region.

Key companies operating in the Global Rare Disease Treatment Market include Novartis, Pfizer, Sanofi, Vertex Pharmaceutical, Takeda Pharmaceutical, Bristol-Myers Squibb, AstraZeneca, Merck & Co., AbbVie, Bayer, Novo Nordisk, GlaxoSmithKline, Eli Lilly and Company, Johnson & Johnson, Amgen, Alexion Pharmaceuticals, Baxter International, and F. Hoffmann La Roche. These organizations maintain strong positions through innovation-driven pipelines and long-term investment strategies. To reinforce their foothold, companies in the rare disease treatment sector are prioritizing sustained investment in research and development focused on high-value, disease-modifying therapies. Strategic collaborations, licensing agreements, and acquisitions are widely used to expand therapeutic pipelines and accelerate commercialization timelines. Firms are also leveraging precision medicine platforms to develop targeted treatments that address specific patient subgroups.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research approach

- 1.3 Quality commitments

- 1.3.1 GMI AI policy and data integrity commitment

- 1.3.1.1 Source consistency protocol

- 1.3.1 GMI AI policy and data integrity commitment

- 1.4 Research trail and confidence scoring

- 1.4.1 Research trail components

- 1.4.2 Scoring components

- 1.5 Data collection

- 1.5.1 Partial list of primary sources

- 1.6 Data mining sources

- 1.6.1 Paid sources

- 1.6.1.1 Sources, by region

- 1.6.1 Paid sources

- 1.7 Base estimates and calculations

- 1.7.1 Revenue share analysis

- 1.7.2 Base year calculation

- 1.8 Forecast model

- 1.9 Research transparency addendum

- 1.9.1 Source attribution framework

- 1.9.2 Quality assurance metrics

- 1.9.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug type trends

- 2.2.3 Therapeutic area trends

- 2.2.4 Patient trends

- 2.2.5 Route of administration trends

- 2.2.6 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of rare diseases

- 3.2.1.2 Advancements in precision medicine and biotechnology

- 3.2.1.3 Supportive regulatory frameworks and incentives

- 3.2.1.4 Growing awareness and early diagnosis rates

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and limited affordability

- 3.2.2.2 Small patient populations and clinical trial complexity

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets with improving healthcare infrastructure

- 3.2.3.2 Collaborations and digital health integration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.4.1 Current technological trends

- 3.4.2 Emerging technologies

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Biologics

- 5.3 Non-biologics

Chapter 6 Market Estimates and Forecast, By Therapeutic Area, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Cancer

- 6.3 Blood-related disorders

- 6.4 Central nervous system

- 6.5 Respiratory disorders

- 6.6 Musculoskeletal disorders

- 6.7 Cardiovascular disorders

- 6.8 Other therapeutic areas

Chapter 7 Market Estimates and Forecast, By Patient, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Adult

- 7.3 Pediatric

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Oral

- 8.3 Injectable

- 8.4 Other routes of administration

Chapter 9 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals and clinics

- 9.3 Homecare settings

- 9.4 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AbbVie

- 11.2 Alexion Pharmaceuticals

- 11.3 Amgen

- 11.4 AstraZeneca

- 11.5 Baxter International

- 11.6 Bayer

- 11.7 Bristol-Myers Squibb

- 11.8 Eli Lilly and Company

- 11.9 F. Hoffmann La Roche

- 11.10 GlaxoSmithKline

- 11.11 Johnson & Johnson

- 11.12 Merck & Co.

- 11.13 Novartis

- 11.14 Novo Nordisk

- 11.15 Pfizer

- 11.16 Sanofi

- 11.17 Takeda Pharmaceutical

- 11.18 Vertex Pharmaceutical