PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936578

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936578

Interventional Radiology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

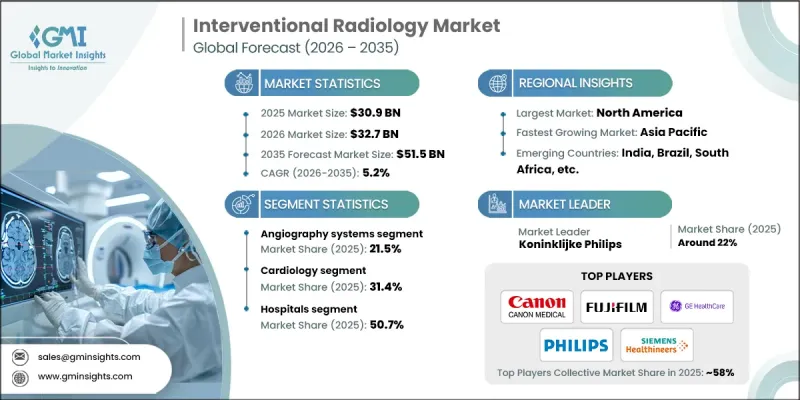

The Global Interventional Radiology Market was valued at USD 30.9 billion in 2025 and is estimated to grow at a CAGR of 5.2% to reach USD 51.5 billion by 2035.

Market expansion is driven by several key factors, including the increasing prevalence of chronic diseases, an aging population, rapid advancements in imaging technologies, and growing demand for minimally invasive procedures. The adoption of interventional radiology in oncology, the integration of advanced 3D and 4D imaging systems, and the rising use of image-guided therapies are fueling the demand for IR solutions. Continuous improvements in imaging hardware and software are unlocking new clinical applications, while modern angiographic systems offer enhanced spatial and temporal resolution. Additional technologies, such as fused imaging and 3D procedural roadmaps, enable precise planning and real-time navigation during procedures, increasing procedural success rates and reducing complications. These innovations, combined with the availability of portable imaging systems, are expanding IR accessibility in intensive care units, emergency departments, and resource-limited settings, further driving the market's growth globally.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $30.9 Billion |

| Forecast Value | $51.5 Billion |

| CAGR | 5.2% |

The hospitals segment held a 50.7% share in 2025, as hospitals provide the necessary infrastructure, multidisciplinary teams, and capital investment to support complex interventional procedures. Large academic medical centers and high-volume community hospitals perform many advanced IR procedures, particularly those requiring sophisticated imaging, inpatient support, and specialized expertise. Hospitals remain the preferred choice for complex interventions due to their ability to integrate advanced technologies and provide critical care support during procedures.

The clinics segment was valued at USD 7.8 billion in 2025, contributing to market growth by expanding outpatient access to image-guided, minimally invasive interventions. Specialized IR clinics are improving patient throughput, offering focused expertise, advanced imaging systems, and streamlined evaluation processes. This not only enhances patient convenience but also alleviates hospital burdens, enabling healthcare systems to deliver care more efficiently while maintaining high-quality outcomes.

North America Interventional Radiology Market held 36% share in 2025. The region's leadership stems from advanced healthcare infrastructure, high procedure volumes, early adoption of cutting-edge technologies, robust reimbursement frameworks, and concentration of top medical device manufacturers. North America also benefits from high per-capita healthcare spending, comprehensive insurance coverage through public and private systems, and a mature regulatory environment that supports innovation while ensuring patient safety. These factors make the region a prime market for interventional radiology solutions.

Key players in the Global Interventional Radiology Market include Agfa-Gevaert Group, Canon Medical Systems, Carestream Health Inc., Cook, Esaote SPA, Fujifilm Corporation, GE Healthcare, Hologic, Inc., Koninklijke Philips, Mindray, Olympus Corporation, Samsung Healthcare, Shimadzu Corporation, Siemens Healthineers, and Teleflex. Companies in the interventional radiology market are strengthening their foothold by investing in R&D for advanced imaging technologies, 3D/4D navigation systems, and AI-assisted procedural planning. Strategic partnerships with hospitals, clinics, and health systems enhance market reach and clinical integration. Firms are also expanding service networks and offering training programs to improve adoption and maximize equipment utilization. Focused innovation in portable and minimally invasive systems allows companies to target underserved markets. Additionally, adopting value-based solutions, flexible financing models, and cloud-enabled imaging platforms helps firms improve patient outcomes while reinforcing their competitive positioning in key regions worldwide.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Application trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic disease worldwide

- 3.2.1.2 Technological advancements in medical imaging

- 3.2.1.3 Increasing demand for minimally invasive procedures

- 3.2.1.4 Growing elderly population base

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with product

- 3.2.2.2 Complex regulatory scenario

- 3.2.3 Opportunities

- 3.2.3.1 AI- and robotics-enabled image-guided interventions

- 3.2.3.2 Increasing investments in hybrid operating rooms

- 3.2.3.3 Development of low-radiation and radiation-free imaging technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Value chain analysis

- 3.7 Reimbursement scenario

- 3.8 In-patient to outpatient shift landscape

- 3.9 Pricing analysis

- 3.10 Policy landscape

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

- 3.13 Gap analysis

- 3.14 Future market trends

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Angiography systems

- 5.3 Ultrasound imaging systems

- 5.4 CT scanners

- 5.5 MRI systems

- 5.6 Fluoroscopy systems

- 5.7 Biopsy devices

- 5.8 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiology

- 6.3 Oncology

- 6.4 Gynecology

- 6.5 Obstetrics

- 6.6 Urology

- 6.7 Gastroenterology

- 6.8 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Clinics

- 7.4 Ambulatory surgical centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Agfa-Gevaert Group

- 9.2 Canon Medical Systems

- 9.3 Carestream Health Inc.

- 9.4 Cook

- 9.5 Esaote SPA

- 9.6 Fujifilm Corporation

- 9.7 GE Healthcare

- 9.8 Hologic, Inc.

- 9.9 Koninklijke Philips

- 9.10 Mindray

- 9.11 Olympus Corporation

- 9.12 Samsung Healthcare

- 9.13 Shimadzu Corporation

- 9.14 Siemens Healthineers

- 9.15 Teleflex