PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936582

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936582

Assured PNT (Positioning, Navigation, and Timing) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

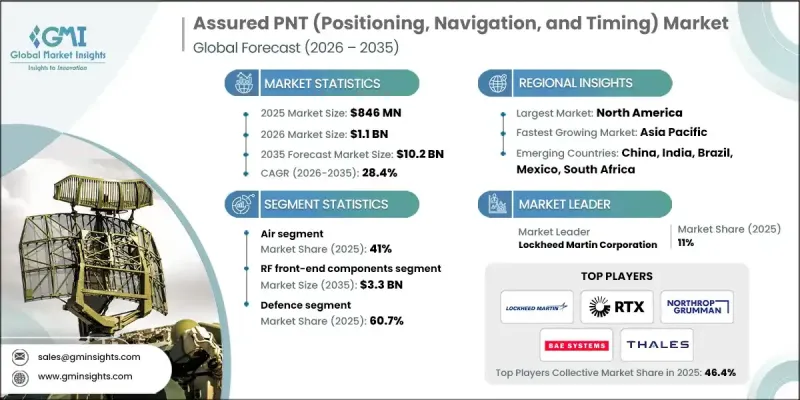

The Global Assured PNT (Positioning, Navigation, and Timing) Market was valued at USD 846 million in 2025 and is estimated to grow at a CAGR of 28.4% to reach USD 10.2 billion by 2035.

The market is gaining momentum due to the critical need for resilient timing and positioning solutions across industries that rely heavily on precision, including telecommunications, defense, energy, and finance. Traditional GPS-based systems face vulnerabilities such as jamming, spoofing, and signal interruptions, making the adoption of Assured PNT solutions essential. These systems integrate multiple methods and redundant technologies to ensure continuous operation even if one source fails. The industry is moving toward more secure, integrated, and multi-source solutions, combining GEO, MEO, and LEO GNSS constellations, ground-based augmentation, and zero-trust security frameworks. Rising reliance on GPS and GNSS for smart cities, autonomous vehicles, and critical infrastructure is driving the evolution of the assured PNT market.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $846 Million |

| Forecast Value | $10.2 Billion |

| CAGR | 28.4% |

The air segment held a 41% share in 2025, as aviation increasingly depends on assured PNT to maintain flight safety, enable autonomous operations, and manage air traffic efficiently. Advanced avionics, sensor fusion, and navigation systems ensure accurate positioning even during GPS outages or in congested airspace.

The defense segment accounted for 60.7% share in 2025. Assured PNT is critical for mission-focused operations in GPS-denied or jammed environments. Military applications span ground, air, and maritime platforms, focusing on electronic warfare resilience, secure navigation, and tactical coordination.

Europe Assured PNT (Positioning, Navigation, and Timing) Market was valued at USD 216.7 million in 2025. Regional growth is driven by GNSS resilience programs, multi-constellation integration, land-based augmentation systems, and public-private partnerships in defense, transportation, and critical infrastructure sectors.

Key players in the Global Assured PNT (Positioning, Navigation, and Timing) Market include Advanced Navigation, Aevex Aerospace, BAE Systems plc, Bliley Technologies, Curtiss-Wright, General Dynamics, Hemisphere GNSS, Hexagon AB, Honeywell International, Israel Aerospace Industries, KVH Industries, Leidos, Leonardo, Lockheed Martin, and Northrop Grumman. Companies in the Assured PNT (Positioning, Navigation, and Timing) Market are focusing on strengthening their presence through continuous innovation and product development, particularly in multi-source and resilient navigation technologies. Strategic collaborations and partnerships allow firms to expand market reach and integrate complementary solutions. Investments in cybersecurity and zero-trust models enhance product reliability and regulatory compliance.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Component trends

- 2.2.2 Platform trends

- 2.2.3 End use trends

- 2.2.4 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in demand for reliable information in applications such as emergency services, military, and aerospace

- 3.2.1.2 Expansion of defense and security applications requiring reliable navigation

- 3.2.1.3 Growing vulnerabilities of GPS highlighting the need for assured PNT Systems

- 3.2.1.4 Rising adoption of multi-source and hybrid PNT technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and training cost

- 3.2.2.2 Lack of proper regulations and standard

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of assured PNT with autonomous vehicles and drones for enhanced navigation

- 3.2.3.2 Growth in maritime and aviation sectors requiring resilient navigation solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Emerging business models

- 3.9 Compliance requirements

- 3.10 Defense budget analysis

- 3.11 Global defense spending trends

- 3.12 Regional defense budget allocation

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Key defense modernization programs

- 3.14 Budget forecast (2025-2034)

- 3.14.1 Impact on industry growth

- 3.14.2 Defense budgets by country

- 3.14.3 Defense budget allocation by segment

- 3.14.3.1 Personnel

- 3.14.3.2 Operations and maintenance

- 3.14.3.3 Procurement

- 3.14.3.4 Research, development, test and evaluation

- 3.14.3.5 Infrastructure and construction

- 3.14.3.6 Technology and innovation

- 3.15 Supply chain resilience

- 3.16 Geopolitical analysis

- 3.17 Workforce analysis

- 3.18 Digital transformation

- 3.19 Mergers, acquisitions, and strategic partnerships landscape

- 3.20 Risk assessment and management

- 3.21 Major contract awards (2022-2025)

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Components, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Timing components

- 5.2.1 Atomic clocks

- 5.2.2 Frequency standards / oscillators

- 5.3 Rf front-end components

- 5.3.1 Antennas

- 5.3.2 Power amplifiers

- 5.3.3 Transponders

- 5.4 Signal Processing Components

- 5.4.1 Receivers (GNSS, multi-constellation, authenticated)

- 5.4.2 Anti-jam / anti-spoof modules

- 5.5 Inertial & environmental sensors

- 5.5.1 Accelerometers

- 5.5.2 Gyroscopes

- 5.5.3 Magnetometers

- 5.6 Supporting & integration components

- 5.6.1 Control electronics

- 5.6.2 Software-defined PNT modules

- 5.6.3 Interfaces & enclosures

Chapter 6 Market Estimates and Forecast, By Platform, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Air

- 6.2.1 Military aircraft

- 6.2.1.1 Fighter aircraft

- 6.2.1.2 Special mission aircraft

- 6.2.2 Military helicopters

- 6.2.3 Unmanned systems

- 6.2.1 Military aircraft

- 6.3 Land

- 6.3.1 Combat vehicles

- 6.3.1.1 Main battle tanks

- 6.3.1.2 Armored personnel carriers

- 6.3.1.3 Armored amphibious vehicles

- 6.3.1.4 Others

- 6.3.2 Unmanned ground vehicles

- 6.3.1 Combat vehicles

- 6.4 Others

- 6.4.1 Naval

- 6.4.2 Destroyers

- 6.4.3 Frigates

- 6.4.4 Corvettes

- 6.4.5 Submarines

Chapter 7 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Defense

- 7.3 Homeland security

Chapter 8 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Global Key Players

- 9.1.1 BAE Systems plc

- 9.1.2 Lockheed Martin

- 9.1.3 Northrop Grumman

- 9.1.4 Raytheon Technologies

- 9.2 Regional Key Players

- 9.2.1 North America

- 9.2.1.1 General Dynamics

- 9.2.1.2 Honeywell International

- 9.2.1.3 Leidos

- 9.2.2 Europe

- 9.2.2.1 Leonardo

- 9.2.2.2 Thales Group

- 9.2.2.3 Hexagon AB

- 9.2.3 APAC

- 9.2.3.1 Israel Aerospace Industries

- 9.2.3.2 Collins Aerospace (RTX)

- 9.2.3.3 KVH Industries

- 9.2.1 North America

- 9.3 Niche Players / Disruptors

- 9.3.1 Advanced Navigation

- 9.3.2 Aevex Aerospace

- 9.3.3 Bliley Technologies

- 9.3.4 Curtiss-Wright

- 9.3.5 Hemisphere GNSS

- 9.3.6 SBG Systems

- 9.3.7 Septentrio N.V.