PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936586

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936586

Europe Car Leasing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

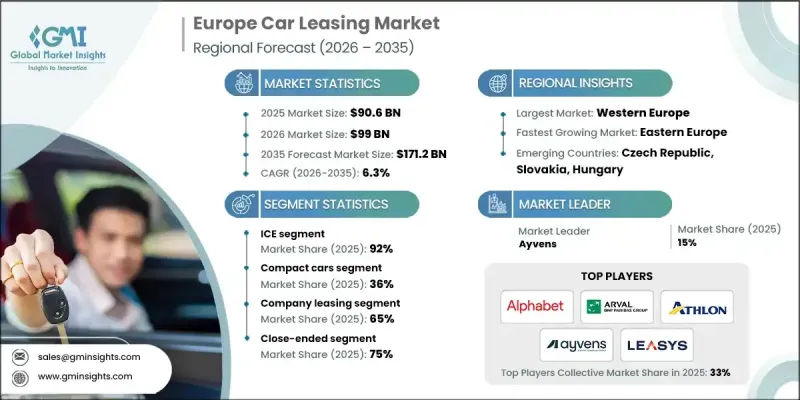

Europe Car Leasing Market was valued at USD 90.6 billion in 2025 and is estimated to grow at a CAGR of 6.3% to reach USD 171.2 billion by 2035.

Favorable taxation policies related to company vehicles, VAT deductibility, and the widespread accounting treatment of operating leases strongly encourage leasing over vehicle ownership. Corporate fleets account for a substantial share of new vehicle registrations across major European economies, supporting structurally high leasing penetration in Western and Northern Europe. Leasing provides cost transparency, balance sheet efficiency, and seamless fleet renewal, which appeals to businesses focused on operational control. Environmental regulations and the rapid expansion of low-emission zones across the European Union further accelerate the use of leasing to deploy electric vehicles. Leasing reduces exposure to battery aging, residual value uncertainty, and rapid technology shifts. Bundled offerings that include incentives, charging access, and servicing enhance leasing appeal. Europe benefits from a mature full-service leasing ecosystem that integrates insurance, maintenance, telematics, and fleet administration, enabling leasing to function as a comprehensive mobility model rather than a simple financing option.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $90.6 Billion |

| Forecast Value | $171.2 Billion |

| CAGR | 6.3% |

The internal combustion engine vehicles segment accounted for 92% share in 2025 and is expected to grow at a CAGR of 5.7% from 2026 to 2035. Their dominance reflects lower upfront costs, predictable operating expenses, established service networks, and stable resale values, which remain attractive to budget-focused small businesses and large fleet operators.

The compact vehicles segment held a 36% share in 2025 and is forecast to grow at a CAGR of 7.7% through 2035. Dense urban populations and constrained city infrastructure favor smaller vehicles due to ease of maneuvering, parking efficiency, and compliance with city traffic standards. Both business and private lessees increasingly select compact models to maximize mobility efficiency in congested metropolitan areas across Western and Southern Europe.

Germany Car Leasing Market held a 27% share, generating USD 18 billion in 2025. A deeply established company car culture supports strong leasing adoption, with vehicles commonly used as employee benefits and operational assets. Favorable tax structures, standardized fleet programs, and high vehicle replacement rates sustain consistently high leasing penetration. Germany also hosts some of the most influential OEM-backed leasing organizations in the region.

Key companies active in the Europe Car Leasing Market include Arval, Alphabet, Ayvens, Athlon, Leasys, Sixt Leasing, Europcar Mobility, Hertz Lease, Free2Move, and Business Lease. Companies operating in the Europe car leasing market strengthen their position by expanding full-service offerings and investing in digital fleet management platforms. Providers focus on long-term corporate contracts, cross-border leasing solutions, and flexible mobility packages to serve multinational clients. Strategic partnerships with vehicle manufacturers help secure competitive pricing and access to low-emission vehicles. Firms also emphasize electric vehicle leasing solutions that bundle charging, maintenance, and insurance to reduce customer complexity. Data-driven telematics, predictive maintenance, and sustainability reporting tools further enhance value for fleet operators, while localized services and scalable platforms support market expansion across diverse European regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research approach

- 1.2 Quality Commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research Trail & Confidence Scoring

- 1.3.1 Research Trail Components

- 1.3.2 Scoring Components

- 1.4 Data Collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.7.1 Quantified market impact analysis

- 1.7.1.1 Mathematical impact of growth parameters on forecast

- 1.7.1 Quantified market impact analysis

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Propulsion

- 2.2.4 End use

- 2.2.5 Leasing

- 2.2.6 Service providers

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Strong corporate fleet leasing adoption

- 3.2.1.3 Electrification and emission compliance

- 3.2.1.4 Growth of full-service leasing models

- 3.2.1.5 Digitalization of leasing platforms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Residual value risk volatility

- 3.2.2.2 Regulatory complexity across countries

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of EV leasing penetration

- 3.2.3.2 SME and gig-economy fleet growth

- 3.2.3.3 Subscription and flexible leasing models

- 3.2.3.4 Eastern Europe market expansion

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. National Highway Traffic Safety Administration (NHTSA) Regulations

- 3.4.1.2 Environmental Protection Agency (EPA) Emission Standards

- 3.4.1.3 California Air Resources Board (CARB) Standards

- 3.4.2 Europe

- 3.4.2.1 European Union General Safety Regulation (EU GSR)

- 3.4.2.2 EU Directive on End-of-Life Vehicles (ELV)

- 3.4.2.3 European Commission Safety Standards for Passenger Vehicles

- 3.4.2.4 European Union Type Approval Process

- 3.4.3 Asia Pacific

- 3.4.3.1 China National Standards for Vehicle Safety

- 3.4.3.2 India Bureau of Indian Standards (BIS)

- 3.4.3.3 Japan Ministry of Land, Infrastructure, Transport and Tourism (MLIT) Regulations

- 3.4.3.4 ASEAN Automotive Safety Standards

- 3.4.4 Latin America

- 3.4.4.1 Brazil National Traffic Department (DENATRAN) Standards

- 3.4.4.2 Argentina National Road Safety Agency (ANSV) Regulations

- 3.4.4.3 Mexico Secretariat of Communications and Transport (SCT) Regulations

- 3.4.4.4 MERCOSUR Harmonization of Vehicle Safety Standards

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE Federal Vehicle Safety Law

- 3.4.5.2 Saudi Arabian Standards Organization (SASO) Vehicle Safety Regulations

- 3.4.5.3 South African Bureau of Standards (SABS) AUTOMOTIVE REGULATIONS

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly Initiatives

- 3.11.5 Carbon footprint considerations

- 3.12 Leasing Business Model Framework

- 3.12.1 Fixed vs variable lease pricing structures

- 3.12.2 Revenue streams: lease rentals, residual value, add-on services

- 3.12.3 Full-service leasing vs financial leasing economics

- 3.12.4 OEM-backed captive vs independent lessor models

- 3.12.5 Margin differences across customer segments (corporate vs private)

- 3.13 Residual Value Management & Risk Framework

- 3.14 Cost Economics of Car Leasing

- 3.15 Pricing & Subscription Model Analysis

- 3.16 Customer Procurement & Decision Criteria

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Western

- 4.2.2 Eastern

- 4.2.3 Northern

- 4.2.4 Southern

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn, Units)

- 5.1 Key trends

- 5.2 City cars

- 5.3 Superminis

- 5.4 Compact cars

- 5.5 Mid-size cars

- 5.6 Executive cars

- 5.7 Luxury cars

Chapter 6 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Mn, Units)

- 6.1 Key trends

- 6.2 ICE

- 6.3 EV

Chapter 7 Market Estimates & Forecast, By End Use, 2022 - 2035 ($Mn, Units)

- 7.1 Key trends

- 7.2 Private leasing

- 7.3 Company leasing

Chapter 8 Market Estimates & Forecast, By Leasing, 2022 - 2035 ($Mn, Units)

- 8.1 Key trends

- 8.2 Open ended

- 8.3 Close ended

Chapter 9 Market Estimates & Forecast, By Service Providers, 2022 - 2035 ($Mn, Units)

- 9.1 Key trends

- 9.2 Automotive manufacturers and dealerships

- 9.3 NBFC’s

- 9.4 Independent leasing companies

- 9.5 Online leasing platforms

- 9.6 Credit unions and cooperative leasing programs

- 9.7 Automotive rental companies

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn, Units)

- 10.1 Key trends

- 10.2 Western Europe

- 10.2.1 Germany

- 10.2.2 France

- 10.2.3 Netherlands

- 10.2.4 Belgium

- 10.2.5 Switzerland

- 10.2.6 Austria

- 10.2.7 Luxembourg

- 10.2.8 Portugal

- 10.3 Eastern Europe

- 10.3.1 Poland

- 10.3.2 Czech Republic

- 10.3.3 Slovakia

- 10.3.4 Romania

- 10.3.5 Slovenia

- 10.3.6 Bulgaria

- 10.3.7 Hungary

- 10.3.8 Croatia

- 10.4 Northern Europe

- 10.4.1 UK

- 10.4.2 Denmark

- 10.4.3 Sweden

- 10.4.4 Norway

- 10.4.5 Finland

- 10.5 Southern Europe

- 10.5.1 Italy

- 10.5.2 Spain

- 10.5.3 Greece

- 10.5.4 Bosnia and Herzegovina

- 10.5.5 Albania

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Alphabet (BMW)

- 11.1.2 Arval BNP Paribas

- 11.1.3 Ayvens

- 11.1.4 LeasePlan

- 11.1.5 Toyota Financial Services

- 11.1.6 Volkswagen Financial Services

- 11.1.7 Volvo Car

- 11.2 Regional Players

- 11.2.1 Athlon

- 11.2.2 Europcar Mobility

- 11.2.3. Free2 Move

- 11.2.4 Leasys

- 11.2.5 Mobilize Lease&Co

- 11.2.6 Porsche Mobility

- 11.2.7 PSA Finance

- 11.2.8 Sixt Leasing (Allane)

- 11.3 Emerging Players

- 11.3.1 Business Lease

- 11.3.2 Hertz Lease

- 11.3.3 Hitachi Capital Vehicle (MHC Mobility)

- 11.3.4 Nordea Finance

- 11.3.5 Raiffeisen Leasing

- 11.3.6 UniCredit