PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936588

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936588

Thrombosis Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

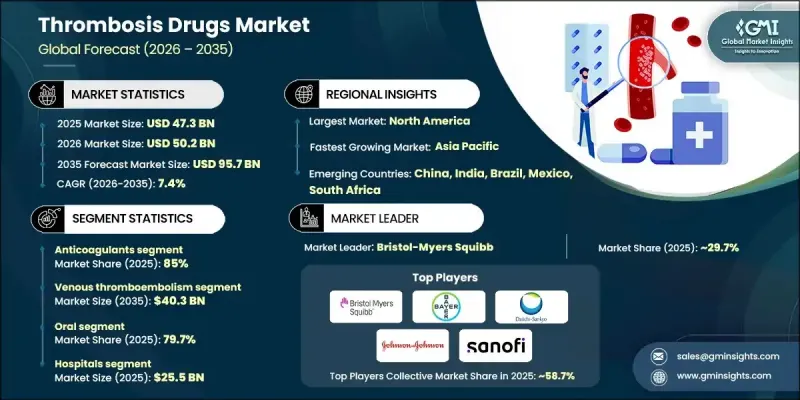

The Global Thrombosis Drugs Market was valued at USD 47.3 billion in 2025 and is estimated to grow at a CAGR of 7.4% to reach USD 95.7 billion by 2035.

The growth is driven by the rising prevalence of cardiovascular disorders, including myocardial infarction, pulmonary embolism, and ischemic stroke, which necessitate rapid restoration of blood flow, making thrombosis treatment critical in emergency care. Thrombosis drugs are designed to prevent and treat clot formation in blood vessels, including anticoagulants that inhibit clotting factors, antiplatelet agents that block platelet aggregation, and thrombolytics that dissolve existing clots. The growing adoption of direct oral anticoagulants, which offer convenience and improved safety profiles, has further accelerated market expansion. Increased surgical procedures, rising incidences of cancer-associated thrombosis, and prolonged anticoagulation therapy, alongside growing clinical focus on thrombotic complications, collectively fuel demand. Novel oral anticoagulants (NOACs) emerge as a preferred therapy, particularly for non-valvular atrial fibrillation, due to their proven efficacy in preventing ischemic stroke.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $47.3 Billion |

| Forecast Value | $95.7 Billion |

| CAGR | 7.4% |

The anticoagulants segment held an 85% share, generating USD 40.2 billion in 2025. This segment includes direct oral anticoagulants, heparin, vitamin K antagonists, and injectable direct thrombin inhibitors. Its dominance is attributed to widespread use in both prophylactic and therapeutic settings, including atrial fibrillation, stroke prevention, venous thromboembolism management, and post-surgical thromboprophylaxis. Strong clinical guidelines, physician familiarity, and growing use of direct oral anticoagulants valued for predictable efficacy, convenient dosing, and minimal monitoring have further solidified this segment's leadership.

The venous thromboembolism segment is expected to reach USD 40.3 billion by 2035. It encompasses deep vein thrombosis and pulmonary embolism, with growth driven by aging populations, increasing rates of obesity and cancer, longer hospital stays, and higher volumes of surgical procedures. Greater awareness and implementation of thromboprophylaxis guidelines in both hospital and outpatient settings are contributing to rising diagnosis and treatment rates globally.

North America Thrombosis Drugs Market held a 59.5% share in 2025. The region benefits from a well-established healthcare infrastructure, including advanced hospitals, specialized cardiac centers, and access to both oral and parenteral anticoagulants. High prevalence of cardiovascular diseases, atrial fibrillation, and venous thromboembolism, especially in older populations, drives strong demand for thrombosis therapies. Early adoption of NOACs, supportive reimbursement frameworks, and widespread knowledge of thromboprophylaxis protocols among healthcare professionals further reinforce the region's leadership.

Leading players in the Global Thrombosis Drugs Market include AstraZeneca, Sanofi, Dr. Reddy's Laboratories, Johnson & Johnson, Pfizer, Novartis, Bayer, Boehringer Ingelheim, Microbix Biosystems, Karma Pharmatech, Daiichi Sankyo, Bristol-Myers Squibb, Aspen Pharmacare, Chiesi Farmaceutici, Teva Pharmaceuticals, and Lupin. Key strategies adopted by companies in the Thrombosis Drugs Market to strengthen their market position include heavy investments in research and development to enhance drug efficacy, safety, and patient adherence. Firms are entering strategic collaborations and licensing agreements with hospitals, research institutions, and biotech companies to expand their product portfolios and clinical reach. Expanding into emerging markets and improving supply chain distribution networks ensures wider therapy accessibility.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research approach

- 1.3 Quality commitments

- 1.3.1 GMI AI policy and data integrity commitment

- 1.3.2 Source consistency protocol

- 1.4 Research trail and confidence scoring

- 1.4.1 Research trail components

- 1.4.2 Scoring components

- 1.5 Data collection

- 1.5.1 Partial list of primary sources

- 1.6 Data mining sources

- 1.6.1 Paid sources

- 1.6.2 Sources, by region

- 1.7 Base estimates and calculations

- 1.7.1 Revenue share analysis

- 1.7.2 Base year calculation

- 1.8 Forecast model

- 1.9 Research transparency addendum

- 1.9.1 Source attribution framework

- 1.9.2 Quality assurance metrics

- 1.9.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Drug class trends

- 2.2.3 Disease type trends

- 2.2.4 Route of administration trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of cardiovascular and cerebrovascular events

- 3.2.1.2 Growing adoption of novel oral anticoagulants (NOACs)

- 3.2.1.3 Rising number of surgical procedures

- 3.2.1.4 Advancements in thrombolytic drug formulations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of adverse reactions and side effects

- 3.2.2.2 Stringent regulatory approval

- 3.2.3 Market opportunities

- 3.2.3.1 Growing shift towards preventive cardiovascular care

- 3.2.3.2 Developing next-generation upstream coagulation inhibitors

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Reimbursement scenario

- 3.7 Pipeline analysis

- 3.8 Pricing analysis

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Drug Class, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Anticoagulants

- 5.2.1 Direct oral anticoagulants

- 5.2.2 Heparin

- 5.2.3 Vitamin K antagonists

- 5.2.4 Injectable DTIs

- 5.3 Antiplatelet drugs

- 5.3.1 P2Y12 platelet inhibitor

- 5.3.2 Aspirin

- 5.3.3 Glycoprotein IIb/IIIa inhibitors

- 5.4 Thrombolytic drugs

Chapter 6 Market Estimates and Forecast, By Disease Type, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Venous thromboembolism

- 6.2.1 Deep vein thrombosis

- 6.2.2 Pulmonary embolism

- 6.3 Arterial thrombosis

- 6.4 Atrial fibrillation

- 6.5 Cerebrovascular disorders

- 6.6 Other disease types

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Parenteral

- 7.4 Topical

Chapter 8 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aspen Pharmacare

- 10.2 AstraZeneca

- 10.3 Bayer

- 10.4 Boehringer Ingelheim

- 10.5 Bristol-Myers Squibb

- 10.6 Chiesi Farmaceutici

- 10.7 Daiichi Sankyo

- 10.8 Dr. Reddy’s Laboratories

- 10.9 Johnson & Johnson

- 10.10 Karma Pharmatech

- 10.11 Lupin

- 10.12 Microbix Biosystems

- 10.13 Novartis

- 10.14 Pfizer

- 10.15 Sanofi

- 10.16 Teva Pharmaceuticals