PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936591

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936591

Automotive Transmission Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

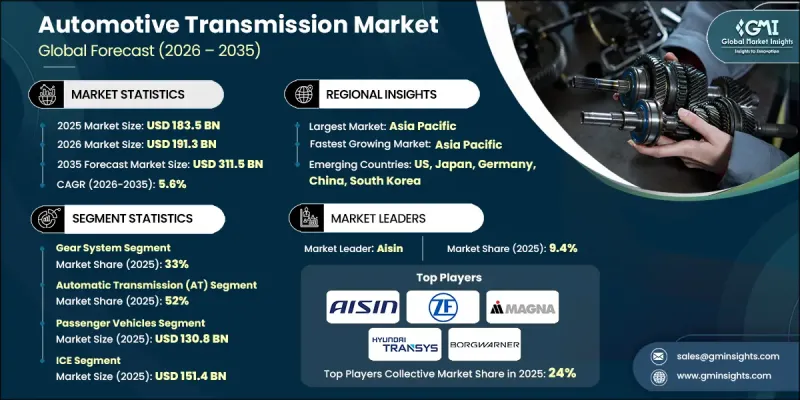

The Global Automotive Transmission Market was valued at USD 183.5 billion in 2025 and is estimated to grow at a CAGR of 5.6% to reach USD 311.5 billion by 2035.

Market growth is shaped by increasingly stringent global efficiency and emission regulations, which are pushing automakers to adopt advanced transmission technologies that enhance fuel economy without compromising driving comfort. Regulatory frameworks across major automotive regions are encouraging higher gear counts, intelligent shift logic, and compatibility with hybrid powertrains, firmly anchoring OEM development strategies and long-term supplier investments. At the same time, changing consumer preferences are accelerating the transition away from manual transmissions, as drivers increasingly favor smooth, convenient, and refined driving experiences, especially in congested urban environments. Automatic, dual-clutch, and continuously variable transmissions are gaining traction across both mass-market and premium vehicles. While battery electric vehicles typically rely on simplified drivetrains, their rising volumes are generating strong demand for reduction gearsets, differentials, and integrated electric drive modules. This shift is increasing the importance of software integration, thermal control, and noise optimization, raising system value even as mechanical complexity evolves.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $183.5 Billion |

| Forecast Value | $311.5 Billion |

| CAGR | 5.6% |

The gear system segment held 33% share in 2025 and is expected to grow at a CAGR of 5.5% through 2035. Gear systems remain fundamental across all transmission architectures, supporting torque conversion, power distribution, and efficiency optimization in both conventional and electrified vehicles. Continuous improvements in gear design, precision manufacturing, and noise reduction are reinforcing their central role in modern drivetrains.

The automatic transmissions accounted for 52% share in 2025 and are forecast to grow at a CAGR of 6% from 2026 to 2035. Advanced control units now leverage adaptive logic to optimize shift timing based on driving behavior and operating conditions, delivering smoother performance and improved fuel efficiency. These benefits continue to drive widespread replacement of manual gearboxes across vehicle segments.

China Automotive Transmission Market reached USD 35.1 billion in 2025. As the world's largest vehicle manufacturing hub, the country continues to see strong demand for automatic, CVT, and dual-clutch systems, alongside rapid growth in electrified powertrains that rely on advanced reduction and integrated drive technologies.

Key players in the Global Automotive Transmission Market include ZF Friedrichshafen, Aisin, BorgWarner, Magna International, Allison Transmission, Schaeffler, JATCO, Eaton, GKN Automotive, and Hyundai Transys. Companies operating in the automotive transmission market are strengthening their competitive position by investing in next-generation transmission platforms that support electrification, hybridization, and improved efficiency. Strategic collaborations with automakers enable early integration of advanced systems into new vehicle architectures. Firms are prioritizing software-driven optimization, modular transmission designs, and lightweight materials to enhance performance and reduce costs. Expanding production capacity in high-growth regions, improving vertical integration, and focusing on reliability and durability are also key priorities. Additionally, manufacturers are advancing e-axle solutions and intelligent control technologies to align with long-term electrification trends and evolving regulatory requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research approach

- 1.2 Quality Commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research Trail & Confidence Scoring

- 1.3.1 Research Trail Components

- 1.3.2 Scoring Components

- 1.4 Data Collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022-2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Transmission

- 2.2.3 Component

- 2.2.4 Vehicle

- 2.2.5 Propulsion

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 System & platform providers

- 3.1.1.2 Hardware suppliers

- 3.1.1.3 Powertrain & software integration partners

- 3.1.1.4 Niche specialists

- 3.1.1.5 End use

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Factors impacting the supply chain

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent emission & fuel economy regulations

- 3.2.1.2 Rising demand for comfort & performance

- 3.2.1.3 Increasing demand in battery electric vehicles (BEVs)

- 3.2.1.4 Rising vehicle ownership across emerging markets

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Technological complexity & cost pressure

- 3.2.2.2 Ev transition cannibalizing traditional transmissions

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of electrified and hybrid transmission systems

- 3.2.3.2 Growth in commercial and off-highway electrification

- 3.2.3.3 Software-defined and modular transmission platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 CAFE Standards

- 3.4.1.2 EPA Greenhouse Gas (GHG) Emission Standards

- 3.4.1.3 USMCA Automotive Rules of Origin

- 3.4.1.4 CARB Advanced Clean Cars & Advanced Clean Trucks Regulations

- 3.4.2 Europe

- 3.4.2.1 EU CO2 Emission Performance Standards

- 3.4.2.2 Euro 7 Emission Regulations

- 3.4.2.3 Fit for 55 Package

- 3.4.2.4 REACH & End-of-Life Vehicle (ELV) Directives

- 3.4.3 Asia Pacific

- 3.4.3.1 China VI Emission Standards

- 3.4.3.2 NEV (New Energy Vehicle) Mandate - China

- 3.4.3.3 BS-VI Emission Norms (India)

- 3.4.3.4 Japan Top Runner Fuel Economy Program

- 3.4.4 Latin America

- 3.4.4.1 PROCONVE (Brazil Emission Standards)

- 3.4.4.2 Argentina Vehicle Emission Regulations

- 3.4.4.3 Mexico NOM Emission Standards

- 3.4.5 Middle East & Africa

- 3.4.5.1 GCC Fuel Economy and Emission Regulations

- 3.4.5.2 South Africa Automotive Production and Development Programme (APDP)

- 3.4.5.3 National EV & Industrial Localization Policies

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Pricing analysis

- 3.8.1 By product

- 3.8.2 By region

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Transmission system pricing benchmarks

- 3.14 Total Cost of Ownership (TCO) comparison

- 3.15 Manufacturing & capacity analysis

- 3.16 Customer & OEM buying behavior

- 3.17 Software economics & strategy

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Transmission, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Manual transmission (MT)

- 5.3 Automatic transmission (AT)

- 5.4 Continuously variable transmission (CVT)

- 5.5 Dual-clutch transmission (DCT)

- 5.6 Automated manual transmission (AMT)

Chapter 6 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gear systems

- 6.3 Clutch assemblies

- 6.4 Torque converters

- 6.5 Mechatronics & control units (TCU)

- 6.6 Axle & differential systems

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV / Crossover

- 7.3 Commercial vehicles

- 7.3.1 Light commercial vehicles (LCV)

- 7.3.2 Medium commercial vehicles (MCV)

- 7.3.3 Heavy commercial vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Internal combustion engine (ICE)

- 8.3 Electric Vehicles

- 8.3.1 Hybrid electric vehicles (HEV)

- 8.3.2 Plug-in hybrid electric vehicles (PHEV)

- 8.3.3 Battery electric vehicles (BEV)

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Benelux

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.4.8 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Chile

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global leaders

- 11.1.1 ZF Friedrichshafen

- 11.1.2 Aisin

- 11.1.3 Magna International

- 11.1.4 BorgWarner

- 11.1.5 Schaeffler

- 11.1.6 Hyundai Transys

- 11.1.7 JATCO

- 11.1.8 Allison Transmission

- 11.1.9 Eaton

- 11.1.10 GKN Automotive

- 11.2 Regional players

- 11.2.1 Punch Powertrain

- 11.2.2 Dana

- 11.2.3 AVL List

- 11.2.4 Ricardo

- 11.2.5 Nidec

- 11.2.6 GETRAG

- 11.2.7 Yutong Group Powertrain Division

- 11.2.8 SAIC Transmission Systems

- 11.2.9 AVTEC

- 11.2.10 FEV

- 11.3 Emerging players

- 11.3.1 Inovance Automotive

- 11.3.2 Zhejiang Wanliyang Transmission

- 11.3.3 Hofer Powertrain

- 11.3.4 Xtrac

- 11.3.5 Blue Nexus