PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934608

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934608

Automotive Automatic Transmission - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

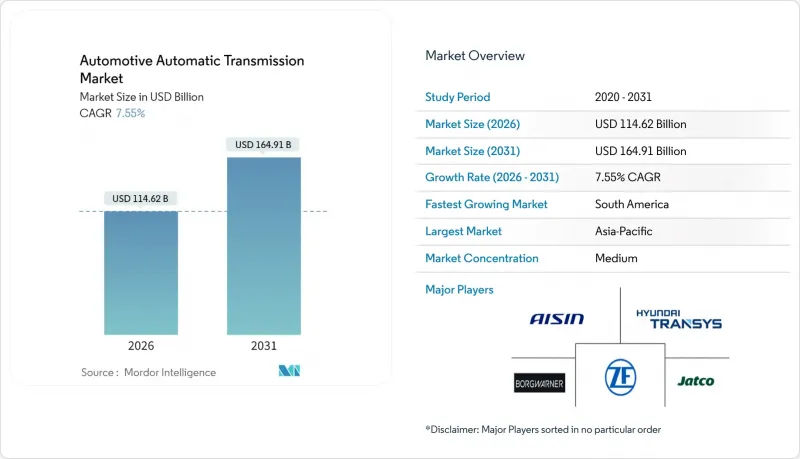

The Automotive Automatic Transmission market is expected to grow from USD 106.57 billion in 2025 to USD 114.62 billion in 2026 and is forecast to reach USD 164.91 billion by 2031 at 7.55% CAGR over 2026-2031.

Tightening greenhouse-gas rules, rapid electrification, and consumer demand for seamless driving continue to recalibrate technology investment priorities across the automotive transmission market. Regulatory milestones-most notably the Environmental Protection Agency's 50% fleet-average CO2 reduction target for model years 2027-2032-are steering original-equipment manufacturers toward higher-efficiency automatic, continuously variable, and dual-clutch systems. Electrified drivelines amplify this shift: dedicated hybrid transmissions, multi-speed e-axles, and software-defined control modules are now central to model-year refresh cycles. Competitive advantage hinges on integrating AI-enabled shift strategies and over-the-air update architectures, which lower compliance costs, unlock service revenue, and cushion warranty risk in the automotive transmission market.

Global Automotive Automatic Transmission Market Trends and Insights

Tight global CO2 regs

The Environmental Protection Agency now targets an 85 g/mile fleet average for light-duty vehicles by 2032, a mandate that elevates transmission efficiency to compliance linchpin status. Corporate Average Fuel Economy increments of 2% per year for cars and light trucks amplify the urgency, while heavy-duty pickups face a steeper 10% annual climb Predictive AI shift strategies have already cut fuel use by 10.42% in simulation trials. OEMs now treat transmission upgrades as a quicker, lower-cost path to reducing tailpipe emissions where charging infrastructure is immature, positioning the automotive transmission market as a key compliance lever

Urban Congestion Shift

Stop-and-go traffic in megacities such as Mumbai and Jakarta bolsters demand for automated gearboxes, despite price premiums hovering near USD 6,109 over manual variants in India. Government localization schemes under Make-in-India and ASEAN hybrid tax breaks are narrowing that pricing gap. Younger, tech-savvy buyers now associate automatics with lower fatigue and better real-world mileage, accelerating penetration in the automotive transmission market.

High cost & complexity

Automatic gearboxes command notable price premiums that retain 61% of India's buyers in manual segments. Multi-speed 8- and 10-speed designs add electronic valve bodies and complex hydraulics, narrowing the pool of service-ready workshops and heightening total cost of ownership. Localization efforts by suppliers such as Aisin ease import duties but cannot fully erase material cost differentials, restraining adoption in the automotive transmission market

Other drivers and restraints analyzed in the detailed report include:

- Hybrid/xEV e-transmissions

- OTA-ready TCMs

- Semiconductor Shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automatic units captured 45.60% of the automotive transmission market share in 2025. Performance-oriented dual-clutch variants, now advancing at 3.63% CAGR, appeal to both premium sedans and emerging-market compacts, reinforcing segment resilience. AI-driven shift logic, gear-jump capability, and lock-up torque converters underpin these gains amid mounting fuel-economy regulations.

E-mobility poses design pivots rather than existential threats. Multi-speed boxes for electric commercial trucks, such as Eaton's 4-speed, show that efficiency gains justify added mass when payload or gradeability is critical. The automotive transmission market size for automatic platforms will therefore persist as OEMs combine mechanical refinement with software updates that unlock post-sale upgrades.

Gasoline powertrains held 60.95% revenue in 2025, yet hybrids are surging with a 12.62% CAGR, the highest within the automotive transmission market. Regulators in Thailand and Indonesia cut excise and VAT rates for qualified hybrids, propelling OEMs to bundle dedicated hybrid transmissions into regional line-ups.

Battery-electric vehicles rely mainly on single-speed reducers, but research suggests multi-speed e-drives could extend highway range. Meanwhile, diesel remains entrenched in heavy-duty fleets where torque demands require robust gearsets. The automotive transmission market size for hybrid systems will keep expanding as charging infrastructure matures unevenly across countries.

The Automotive Automatic Transmission Market Report is Segmented by Transmission Type (Automatic Transmission (AT)/Torque Converter, Automatic Manual (AMT), and More), Fuel Type (Gasoline, Diesel, and More), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Component (Torque Converter, Planetary Gear-Set, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific remains the largest contributor to the automotive transmission market, buoyed by China's scale and India's localisation push under the Make-in-India program. ZF targets raising its regional sales share to 30% by 2031, supported by over 50 plants and technical centres in China .

South America posts the fastest growth at 12.76% CAGR through 2031. Argentina's tax reform slashed mid-range vehicle prices by up to 20%, improving affordability and spurring automatic uptake. Colombia's eight assembly plants and Brazil's established supply base underscore the region's widening manufacturing footprint, even as currency volatility and political risk temper capital-spending decisions.

North America and Europe display stable volumes but high technology churn. EPA greenhouse-gas targets and UNECE R155 cybersecurity rules elevate demand for next-generation control modules and software-friendly hardware, keeping the automotive transmission market focused on premium upgrades. The Middle East and Africa offer long-run upside linked to urbanisation and fleet modernisation, though low current motorisation levels delay near-term scale.

- Aisin Seiki Co., Ltd.

- ZF Friedrichshafen AG

- JATCO Ltd.

- Hyundai Transys

- Allison Transmission Holdings

- BorgWarner Inc.

- Magna International Inc.

- Continental AG

- Schaeffler AG

- Eaton Corporation plc

- Valeo SA

- Punch Powertrain NV

- Tremec

- Shaanxi Fast Auto Drive

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tightening Global CO2 / CAFE Regulations Spur OEM Demand For High-Efficiency AT, CVT and DCT

- 4.2.2 Urban Congestion Drives Consumer Shift To Automatics in Emerging Economies

- 4.2.3 Hybrid and XEV Proliferation Necessitates Dedicated E-Transmissions (ECTV, DHT)

- 4.2.4 OTA-Upgradeable TCMS Open New Software-Service Revenue Streams

- 4.2.5 Asia-Pacific Production-Linked Incentives for Advanced AT Manufacturing

- 4.2.6 AI-Optimized Shift Scheduling Boosts Fuel Economy and Extends Powertrain Life

- 4.3 Market Restraints

- 4.3.1 High Unit Cost and Repair Complexity Versus Manual Transmissions

- 4.3.2 Semiconductor Shortages Disrupting TCM and Mechatronics Supply Chain

- 4.3.3 Rising Cybersecurity-Compliance Costs for Transmission ECUs (UNECE WP.29)

- 4.3.4 Warranty Issues (E.G., GM 8-Speed Shudder) Dent Consumer Confidence

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD), and Volume (Units))

- 5.1 By Transmission Type

- 5.1.1 Automatic (AT)/Torque-Converter

- 5.1.2 Automated Manual (AMT)

- 5.1.3 Continuously Variable (CVT)

- 5.1.4 Dual-Clutch (DCT)

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Hybrid-Electric

- 5.2.4 Battery-Electric (single-speed e-drive)

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.4 By Component

- 5.4.1 Torque Converter

- 5.4.2 Planetary Gear-set

- 5.4.3 Hydraulic and Mechatronic Controls

- 5.4.4 Transmission Fluid

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Russia

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Aisin Seiki Co., Ltd.

- 6.4.2 ZF Friedrichshafen AG

- 6.4.3 JATCO Ltd.

- 6.4.4 Hyundai Transys

- 6.4.5 Allison Transmission Holdings

- 6.4.6 BorgWarner Inc.

- 6.4.7 Magna International Inc.

- 6.4.8 Continental AG

- 6.4.9 Schaeffler AG

- 6.4.10 Eaton Corporation plc

- 6.4.11 Valeo SA

- 6.4.12 Punch Powertrain NV

- 6.4.13 Tremec

- 6.4.14 Shaanxi Fast Auto Drive

7 Market Opportunities and Future Outlook