PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936593

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936593

Dental Tourism Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

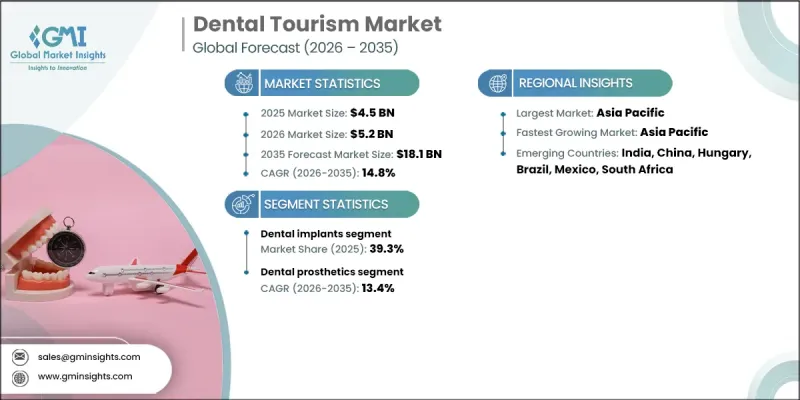

The Global Dental Tourism Market was valued at USD 4.5 billion in 2025 and is estimated to grow at a CAGR of 14.8% to reach USD 18.1 billion by 2035.

Strong market growth is driven by rising dental treatment costs in developed economies, increasing access to high-quality dental services abroad, and growing demand for cosmetic and advanced dental procedures. Dental tourism involves patients traveling domestically or internationally to receive dental care that offers cost advantages, reduced waiting periods, or access to advanced treatment options. The market benefits from improved global connectivity, favorable travel policies, and the development of structured healthcare tourism frameworks that simplify patient coordination and care continuity. The integration of digital consultations and virtual treatment planning has transformed patient engagement by enabling early assessment and transparent cost evaluation before travel. This digital shift improves decision confidence and streamlines planning. Additionally, providers are increasingly aligning dental services with broader wellness-focused travel experiences, which enhances the overall appeal of dental tourism and supports sustained market momentum beyond 2025.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4.5 Billion |

| Forecast Value | $18.1 Billion |

| CAGR | 14.8% |

The dental implants segment held a 39.3% share in 2025, supported by the rising incidence of tooth loss and growing preference for durable restorative solutions. Continued advancements in implant technology and consistently high treatment success rates are reinforcing segment growth. The high cost of implant procedures in developed regions makes overseas treatment an attractive alternative, as patients benefit from bundled offerings that reduce overall expenses while maintaining clinical quality. This cost efficiency remains a key driver of demand within the implants segment.

The dental clinics segment held a 72.6% share in 2025 and is expected to reach USD 13.8 billion by 2035. Clinics remain the preferred care setting due to their ability to deliver specialized treatments at competitive prices. Rising patient inflows from high-cost regions are increasing utilization rates and revenue potential, positioning clinics as the primary service providers within the dental tourism ecosystem.

U.S. Dental Tourism Market reached USD 578.1 million in 2025. Market expansion is influenced by high domestic dental costs and significant out-of-pocket expenses, which encourage outbound travel for treatment. Cost disparities continue to shape patient decision-making, making dental tourism a financially attractive alternative.

Key companies operating in the Global Dental Tourism Market include Apollo Hospitals, ACIBADEM Healthcare Group, Fortis Healthcare, Raffles Medical Group, Manipal Hospitals, Max Healthcare, Bumrungrad International Hospital, KPJ Healthcare Berhad, Mount Elizabeth Medical Centre, Fulop Clinic, DentAkademi, Kreativ Dental Clinic, Thonglor Dental Hospital, Vera Smile, and Cancun Dental Specialists. Companies in the dental tourism market are strengthening their competitive position through service integration, digital engagement, and international partnerships. Leading providers are investing in virtual consultation platforms, multilingual patient support, and coordinated care models to improve accessibility and trust. Strategic alliances with travel facilitators and insurers help streamline patient journeys. Many operators are expanding treatment portfolios and enhancing accreditation standards to reinforce quality perception. Geographic expansion, targeted marketing, and bundled pricing strategies further enable companies to attract international patients and build long-term market presence.

Table of Contents

Chapter 1 Research Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.7.1 Quantified market impact analysis

- 1.7.1.1 Mathematical impact of growth parameters on forecast

- 1.7.1 Quantified market impact analysis

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Service trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of dental diseases

- 3.2.1.2 Rising number of uninsured or underinsured patients

- 3.2.1.3 Advancements in dental treatment technologies

- 3.2.1.4 Growing awareness of dental tourism options

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with dental tourism

- 3.2.2.2 Lack of standardized global dental care regulations

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of tele-dentistry and virtual consultations

- 3.2.3.2 Growth in personalized and cosmetic dental treatments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Medical coverage scenario

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Customer insights

- 3.11 Investment landscape

- 3.12 Gap analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive positioning matrix

- 4.4 Competitive analysis of major market players

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Service, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Dental implants

- 5.3 Orthodontics

- 5.4 Dental cosmetics

- 5.5 Dental prosthetics

- 5.6 Other services

Chapter 6 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Dental clinics

- 6.3 Hospitals

- 6.4 Other end users

Chapter 7 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Belgium

- 7.3.6 Poland

- 7.3.7 Hungary

- 7.3.8 Czech Republic

- 7.3.9 Turkey

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 ACIBADEM Healthcare Group

- 8.2 Apollo Hospitals

- 8.3 Bumrungrad International Hospital

- 8.4 Cancun Dental Specialists

- 8.5 DentAkademi

- 8.6 Fortis Healthcare

- 8.7 Fulop Clinic

- 8.8 KPJ Healthcare Berhad

- 8.9 Kreativ Dental Clinic

- 8.10 Manipal Hospitals

- 8.11 Max Healthcare

- 8.12 Mount Elizabeth Medical Centre

- 8.13 Raffles Medical Group

- 8.14 Thonglor Dental Hospital (TDH)

- 8.15 Vera Smile