PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936595

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936595

Military Microgrid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

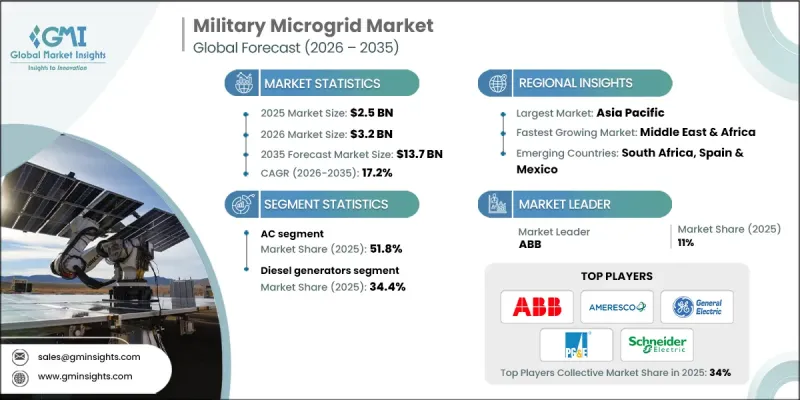

The Global Military Microgrid Market was valued at USD 2.5 billion in 2025 and is estimated to grow at a CAGR of 17.2% to reach USD 13.7 billion by 2035.

Growth is driven by the increasing need for uninterrupted and secure power to support mission-critical defense operations in environments exposed to grid instability, cyber risks, and physical threats. Military installations increasingly require energy systems that can operate independently, particularly in remote or high-risk locations where traditional fuel logistics are costly and unreliable. Microgrids address these challenges by delivering localized, resilient power while reducing dependence on centralized grids. Their ability to integrate diverse energy sources and maintain operational continuity under extreme conditions has made them a core component of modern defense infrastructure. A military microgrid functions as a self-sufficient energy network capable of operating autonomously or in coordination with the main grid. By combining renewable energy, energy storage, and conventional generation, these systems enhance energy security, reduce fuel consumption, and improve readiness. Rising adoption of advanced control platforms, real-time energy management, and AI-driven optimization tools is further improving scalability, performance, and efficiency, accelerating global market penetration.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.5 Billion |

| Forecast Value | $13.7 Billion |

| CAGR | 17.2% |

The direct current segment is expected to grow at a CAGR of 17% through 2035, supported by its high efficiency and strong compatibility with renewable generation and energy storage systems deployed at military facilities. DC-based architectures reduce energy conversion losses and provide stable power delivery for sensitive defense equipment. Their ability to support sustainability objectives while lowering reliance on fuel-based generation makes them particularly suitable for installations operating in remote or contested environments.

The natural gas segment is forecast to grow at a CAGR of 16.5% by 2035, driven by favorable emissions profiles, cost advantages, and reliable fuel availability. Natural gas-based generation supports continuous power delivery while integrating effectively with renewable energy sources, enabling defense facilities to lower carbon intensity without compromising operational reliability. This transition aligns with broader sustainability goals while enhancing energy efficiency across military installations.

United States Military Microgrid Market held 81.6% share in 2025 and is projected to generate USD 670 million by 2035. Market expansion is fueled by a strong focus on energy resilience to protect defense operations from disruptions caused by grid failures, cyber incidents, or environmental events. Continued institutional backing and long-term infrastructure investment are reinforcing adoption, as military facilities prioritize autonomous energy systems that ensure mission continuity and infrastructure security without reliance on external grids.

Key companies operating in the Global Military Microgrid Market include Siemens, Schneider Electric, ABB, General Electric, Eaton Corporation, Ameresco, Lockheed Martin, Black & Veatch, Burns & McDonnell, PowerSecure, S&C Electric Company, AES Corporation, PG&E, and Critical Loop. Companies active in the military microgrid market are strengthening their market position through technology integration, long-term contracting, and solution customization. Leading players are investing in advanced control systems, AI-enabled energy management platforms, and modular microgrid architectures to improve flexibility and reliability. Strategic collaboration with defense agencies and infrastructure developers enables tailored system design aligned with mission requirements. Firms are also expanding service capabilities across installation, maintenance, and lifecycle management to secure recurring revenue. Emphasis on cybersecurity, system redundancy, and resilience engineering is enhancing value propositions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.1.1 Quantified market impact analysis

- 1.3.2 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.3.1 Key trends for market estimates

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.2 Business trends

- 2.3 Connectivity trends

- 2.4 Grid type trends

- 2.5 Power source trends

- 2.6 Storage device trends

- 2.7 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Cost structure analysis

- 3.6 Price trend analysis (USD/MW)

- 3.6.1 By grid type

- 3.6.2 By region

- 3.7 Porter's analysis

- 3.7.1 Bargaining power of suppliers

- 3.7.2 Bargaining power of buyers

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.8 PESTEL analysis

- 3.8.1 Political factors

- 3.8.2 Economic factors

- 3.8.3 Social factors

- 3.8.4 Technological factors

- 3.8.5 Legal factors

- 3.8.6 Environmental factors

- 3.9 Emerging opportunities & trends

- 3.9.1 Digitalization & IoT integration

- 3.9.2 Emerging market penetration

- 3.10 Investment analysis and future outlook

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Grid Type, 2022 - 2035 (USD Billion & MW)

- 5.1 Key trends

- 5.2 AC microgrid

- 5.3 DC microgrid

- 5.4 Hybrid

Chapter 6 Market Size and Forecast, By Connectivity, 2022 - 2035 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Grid connected

- 6.3 Off grid

Chapter 7 Market Size and Forecast, By Power Source, 2022 - 2035 (USD Billion & MW)

- 7.1 Key trends

- 7.2 Diesel generators

- 7.3 Natural gas

- 7.4 Solar PV

- 7.5 CHP

- 7.6 Others

Chapter 8 Market Size and Forecast, By Storage Device, 2022 - 2035 (USD Billion & MW)

- 8.1 Key trends

- 8.2 Lithium-ion

- 8.3 Lead acid

- 8.4 Flow battery

- 8.5 Flywheels

- 8.6 Others

Chapter 9 Market Size and Forecast, By Region, 2022 - 2035 (USD Billion & MW)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Russia

- 9.3.5 Spain

- 9.3.6 Italy

- 9.3.7 Denmark

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 South Korea

- 9.4.4 India

- 9.4.5 Australia

- 9.5 Middle East and Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 South Africa

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 AES Corporation

- 10.3 Ameresco

- 10.4 Black & Veatch

- 10.5 Burns & McDonnell

- 10.6 Critical Loop

- 10.7 Eaton Corporation

- 10.8 General Electric

- 10.9 Lockheed Martin

- 10.10 PG&E

- 10.11 PowerSecure

- 10.12 S&C Electric Company

- 10.13 Schneider Electric

- 10.14 Siemens