PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936599

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936599

Liver Cancer Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

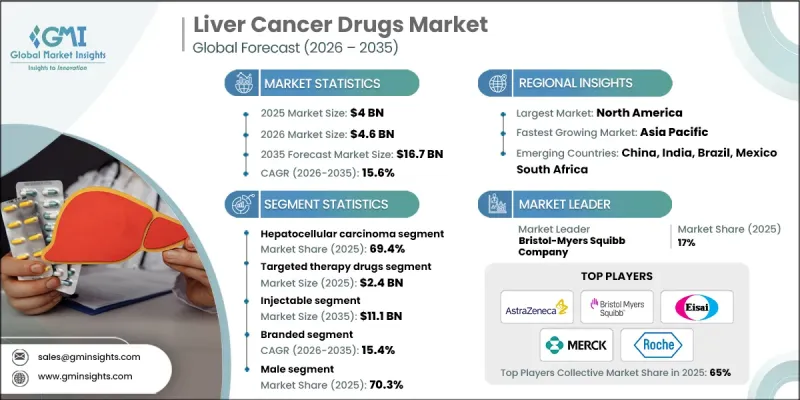

The Global Liver Cancer Drugs Market was valued at USD 4 billion in 2025 and is estimated to grow at a CAGR of 15.6% to reach USD 16.7 billion by 2035.

Market growth is driven by the rising incidence of primary liver cancers worldwide and the persistently high mortality rates associated with delayed diagnosis and limited curative treatment options. Liver cancer remains one of the most fatal oncology indications, creating an urgent need for effective drug-based therapies that can extend survival and slow disease progression. The liver cancer drugs market encompasses the research, production, and commercialization of pharmaceutical treatments used to manage liver malignancies, including therapies designed to improve outcomes and quality of life. Drug innovation is increasingly focused on targeted agents, immunotherapies, biologics, and chemotherapy-based regimens. Because many patients are diagnosed at advanced stages, systemic therapies play a critical role in disease management. Strong oncology research pipelines, supportive regulatory frameworks, and expanding reimbursement coverage continue to encourage innovation and accelerate patient access. As precision medicine and combination treatment strategies gain traction, pharmaceutical investment in liver cancer therapeutics is intensifying, positioning the market for sustained long-term expansion.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $4 Billion |

| Forecast Value | $16.7 Billion |

| CAGR | 15.6% |

The hepatocellular carcinoma segment accounted for 69.4% share in 2025 and is expected to grow at a CAGR of 15.5% throughout 2035. This dominance reflects the high global burden of this cancer type and continued advancements in treatment approaches, including combination therapies and immune-based drugs. Ongoing prevalence of underlying liver conditions continues to support strong demand for effective therapeutic options.

The injectable segment generated USD 2.7 billion in 2025 and is projected to grow to USD 11.1 billion by 2035. Injectable formulations are widely used in advanced treatment settings due to their suitability for immunotherapies and biologics, which require controlled administration and clinical supervision. Their established role in first line and combination regimens further supports segment leadership.

North America Liver Cancer Drugs Market held 41.1% share in 2025. Regional dominance is supported by strong regulatory pathways, advanced diagnostic infrastructure, early adoption of innovative therapies, and a well-developed clinical research ecosystem. Favorable reimbursement policies and increasing focus on early detection and treatment optimization continue to drive demand.

Key companies operating in the Global Liver Cancer Drugs Market include Merck & Co., F. Hoffmann-La Roche, AstraZeneca, Bayer, Bristol-Myers Squibb Company, Regeneron Pharmaceuticals, Johnson & Johnson, Eisai, Exelixis, Sanofi, Amgen, AbbVie, Taiho Pharmaceutical, Servier Pharmaceuticals, and Glenmark Pharmaceuticals. Companies in the liver cancer drugs market are strengthening their competitive position through aggressive research and development initiatives focused on novel drug targets and combination therapies. Many players are expanding immuno-oncology portfolios and investing in precision medicine to improve treatment response rates. Strategic collaborations with research institutions and biotechnology firms are accelerating clinical development timelines. Companies are also prioritizing regulatory approvals across multiple regions to expand market access. Lifecycle management strategies, including label expansions and next-generation formulations, are being used to extend product value.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research approach

- 1.3 Quality commitments

- 1.3.1 GMI AI policy and data integrity commitment

- 1.3.1.1 Source consistency protocol

- 1.3.1 GMI AI policy and data integrity commitment

- 1.4 Research trail and confidence scoring

- 1.4.1 Research trail components

- 1.4.2 Scoring components

- 1.5 Data collection

- 1.5.1 Partial list of primary sources

- 1.6 Data mining sources

- 1.6.1 Paid sources

- 1.6.1.1 Sources, by region

- 1.6.1 Paid sources

- 1.7 Base estimates and calculations

- 1.7.1 Revenue share analysis

- 1.7.2 Base year calculation

- 1.8 Forecast model

- 1.9 Research transparency addendum

- 1.9.1 Source attribution framework

- 1.9.2 Quality assurance metrics

- 1.9.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Drug class trends

- 2.2.4 Route of administration trends

- 2.2.5 Medication type trends

- 2.2.6 Gender trends

- 2.2.7 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global incidence of liver cancer

- 3.2.1.2 Shift toward targeted and immuno-oncology therapies

- 3.2.1.3 Expanding geriatric population

- 3.2.1.4 Rising healthcare expenditure and oncology focus

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs and reimbursement constraints

- 3.2.2.2 Late diagnosis limiting treatment eligibility

- 3.2.3 Market opportunities

- 3.2.3.1 Next-generation combination and personalized therapies

- 3.2.3.2 Growth potential in emerging, high-burden regions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Liver cancer statistics, by region

- 3.6 Future market trends

- 3.7 Pipeline analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2022 - 2035 ($ Mn)

- 5.1 Key trends

- 5.2 Hepatocellular carcinoma

- 5.3 Cholangiocarcinoma

- 5.4 Hepatoblastoma

- 5.5 Liver metastasis

- 5.6 Other types

Chapter 6 Market Estimates and Forecast, By Drug Class, 2022 - 2035 ($ Mn)

- 6.1 Key trends

- 6.2 Chemotherapeutic agents

- 6.3 Targeted therapy drugs

- 6.4 Immunotherapy drugs

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2022 - 2035 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

Chapter 8 Market Estimates and Forecast, By Medication Type, 2022 - 2035 ($ Mn)

- 8.1 Key trends

- 8.2 Generic

- 8.3 Branded

Chapter 9 Market Estimates and Forecast, By Gender, 2022 - 2035 ($ Mn)

- 9.1 Key trends

- 9.2 Male

- 9.3 Female

Chapter 10 Market Estimates and Forecast, By End Use, 2022 - 2035 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals

- 10.3 Specialty cancer centers

- 10.4 Research and academic centers

Chapter 11 Market Estimates and Forecast, By Region, 2022 - 2035 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AbbVie

- 12.2 Amgen

- 12.3 AstraZeneca

- 12.4 Bayer

- 12.5 Bristol-Myers Squibb Company

- 12.6 Eisai

- 12.7 Exelixis

- 12.8 F. Hoffmann-La Roche

- 12.9 Glenmark Pharmaceuticals

- 12.10 Johnson & Johnson

- 12.11 Merck & Co.

- 12.12 Regeneron Pharmaceuticals

- 12.13 Sanofi

- 12.14 Servier Pharmaceuticals

- 12.15 Taiho Pharmaceutical