PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936607

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936607

Automotive Premium Tires Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

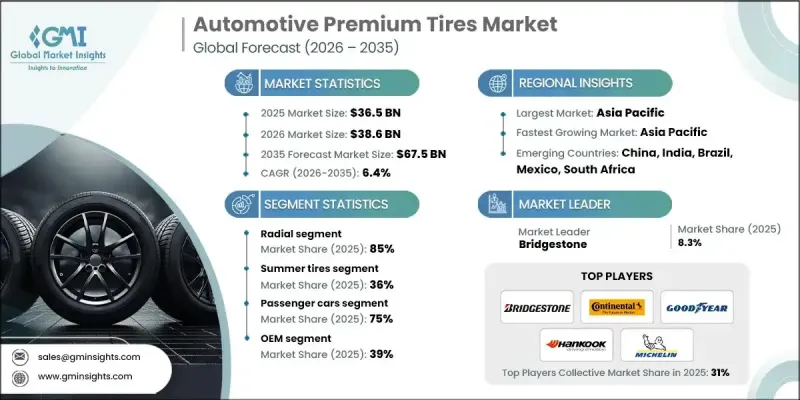

The Global Automotive Premium Tires Market was valued at USD 36.5 billion in 2025 and is estimated to grow at a CAGR of 6.4% to reach USD 67.5 billion by 2035.

Growth is strongly supported by rising sales of high-end passenger vehicles and utility vehicles, along with increasing OEM demand for tires that deliver superior grip, high-speed stability, and refined ride quality. Automakers now position premium tires as an integral part of overall vehicle performance, which sustains baseline demand and supports long-term, higher-value supply agreements. Consumers show heightened awareness of braking efficiency, traction on wet surfaces, reduced road noise, and stability at elevated speeds. Premium tires address these expectations through advanced tread patterns and engineered rubber blends, encouraging customers to upgrade from factory-fitted tires and accept higher replacement costs. This behavior strengthens both OEM and replacement demand and reinforces premium tires as a value-driven segment rather than a discretionary purchase. In North America and Europe, an aging vehicle fleet supports a consistent cycle of replacement tire demand. Owners of premium vehicles increasingly choose replacement tires that match or exceed original specifications, which drives aftermarket revenue growth and stabilizes demand for high-performance tire solutions across mature automotive markets.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $36.5 Billion |

| Forecast Value | $67.5 Billion |

| CAGR | 6.4% |

The radial tires segment held an 85% share in 2025 and is forecasted to grow at a CAGR of 6.9% from 2026 to 2035, supported by advantages in handling precision, durability, and reduced rolling resistance. OEMs continue to standardize radial tires across luxury and performance-focused models, particularly as efficiency and ride quality become critical design priorities.

The summer tire segment held a 36% share in 2025 and is expected to grow at a CAGR of 5.1% through 2035. These tires are engineered for warm-weather conditions and prioritize traction, steering response, and stability at higher speeds, delivering a refined driving experience that aligns with premium vehicle positioning.

US Automotive Premium Tires Market reached USD 8.18 billion in 2025. As the domestic market shifts toward electric vehicles and larger vehicle formats, demand is rising for premium tires that offer low rolling resistance, enhanced load capacity, and effective noise control. Buyers increasingly value tread life, energy efficiency, and all-condition performance, prompting manufacturers to expand specialized premium tire offerings across OEM and replacement channels.

Key companies operating in the Global Automotive Premium Tires Market include Michelin, Bridgestone, Goodyear Tire & Rubber Company, Continental, Pirelli, Hankook Tire & Technology, Yokohama Rubber Company, Sumitomo Rubber Industries (Dunlop), Apollo Tyres, and Cooper Tire & Rubber Company. Companies in the automotive premium tires market focus on product innovation, OEM collaboration, and portfolio diversification to strengthen their competitive position. Manufacturers invest heavily in advanced materials and compound technologies to improve durability, efficiency, and ride comfort. Strategic partnerships with automakers help secure long-term supply contracts and early inclusion in new vehicle platforms. Firms also expand premium replacement tire ranges to capture higher-margin aftermarket demand. Geographic expansion and localized production reduce supply chain risk and enhance responsiveness to regional demand trends.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.3 GMI AI policy & data integrity commitment

- 1.4 Research trail & confidence scoring

- 1.4.1 Research trail components

- 1.4.2 Scoring components

- 1.5 Data collection

- 1.5.1 Partial list of primary sources

- 1.6 Data mining sources

- 1.6.1 Paid sources

- 1.7 Base estimates and calculations

- 1.7.1 Base year calculation

- 1.8 Forecast model

- 1.9 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Tire

- 2.2.3 Tire construction

- 2.2.4 Rim size

- 2.2.5 Vehicle

- 2.2.6 Technology

- 2.2.7 Sales channel

- 2.3 TAM analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising luxury & performance vehicle demand

- 3.2.1.2 Focus on safety, comfort & handling

- 3.2.1.3 Growing vehicle parc in developed markets

- 3.2.1.4 OEM premium positioning

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High price sensitivity limiting adoption in cost-conscious markets

- 3.2.2.2 Volatility in raw material prices impacting margins

- 3.2.3 Market opportunities

- 3.2.3.1 Expanding premium vehicle sales in emerging economies

- 3.2.3.2 EV-specific tire demand

- 3.2.3.3 Aftermarket customization demand

- 3.2.3.4 Smart & sustainable tires

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S. Department of Transportation (DOT) Standards

- 3.4.1.2 Occupational Safety and Health Administration (OSHA) Guidelines

- 3.4.1.3 U.S. Environmental Protection Agency (EPA)

- 3.4.2 Europe

- 3.4.2.1 EN ISO Tire Standards

- 3.4.2.2 European Union Customs and Safety Regulations

- 3.4.2.3 BS EN / CEN Standards

- 3.4.2.4 National Standards (UNE, DIN, etc.)

- 3.4.3 Asia Pacific

- 3.4.3.1 China GB (Guobiao) Standards

- 3.4.3.2 Japan JIS Requirements

- 3.4.3.3 Korea KS Certification

- 3.4.3.4 Indian BIS Standards

- 3.4.3.5 Thai Industrial Standards Institute (TISI)

- 3.4.4 Latin America

- 3.4.4.1 INMETRO (National Institute of Metrology)

- 3.4.4.2 INTI certification (Instituto Nacional de Tecnologia Industrial)

- 3.4.4.3 NOM standards (Norma Oficial Mexicana)

- 3.4.5 Middle East & Africa

- 3.4.5.1 ESMA / Emirates Conformity Assessment Scheme (ECAS)

- 3.4.5.2 GCC technical regulations

- 3.4.5.3 SABS certification

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Pricing analysis

- 3.8.1 Pricing by product

- 3.8.2 Pricing by region

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 EV-Specific Tire Economics & Design Trade-offs

- 3.13.1 Rolling resistance vs durability trade-offs

- 3.13.2 Acoustic foam cost premium

- 3.13.3 Impact on ASP and margins

- 3.13.4 EV vs ICE replacement economics

- 3.14 Raw Material Risk & Cost Sensitivity Analysis

- 3.15 Channel-Level Margin & Pricing Analysis

- 3.16 Consumer Behavior & Premium Adoption Analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Tire, 2022 - 2035 ($Mn, Units)

- 5.1 Key trends

- 5.2 Summer tires

- 5.3 Winter tires

- 5.4 All-season tires

- 5.5 All terrain tires

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Tire Construction, 2022 - 2035 ($Mn, Units)

- 6.1 Key trends

- 6.2 Radial

- 6.3 Bias

Chapter 7 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn, Units)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicle

- 7.3.1 LCV (Light commercial vehicle)

- 7.3.2 MCV (Medium commercial vehicle)

- 7.3.3 HCV (Heavy commercial vehicle)

Chapter 8 Market Estimates & Forecast, By Rim Size, 2022 - 2035 ($Mn, Units)

- 8.1 Key trends

- 8.2 Below 15 inches

- 8.3 15-20 inches

- 8.4 Above 20 inches

Chapter 9 Market Estimates & Forecast, By Technology, 2022 - 2035 ($Mn, Units)

- 9.1 Key trends

- 9.2 Run-flat technology

- 9.3 Self-sealing tires

- 9.4 Eco-friendly tires

- 9.5 Noise reduction technology

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Mn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Nordics

- 11.3.7 Russia

- 11.3.8 Poland

- 11.3.9 Romania

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Vietnam

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Global companies

- 12.1.1 Apollo Tyres

- 12.1.2 Bridgestone

- 12.1.3 Continental

- 12.1.4 Cooper Tire & Rubber Company

- 12.1.5 Goodyear Tire & Rubber Company

- 12.1.6 Hankook Tire & Technology

- 12.1.7 Kumho Tire

- 12.1.8 Michelin

- 12.1.9 Pirelli

- 12.1.10 Sumitomo Rubber Industries

- 12.1.11 Toyo Tire

- 12.1.12 Yokohama Rubber Company

- 12.2 Regional players

- 12.2.1 CEAT

- 12.2.2 Giti Tire

- 12.2.3 JK Tyre & Industries

- 12.2.4 Linglong Tire

- 12.2.5 Maxxis International

- 12.2.6 MRF Tyres

- 12.2.7 Nexen Tire

- 12.2.8 Nokian Tyres

- 12.2.9 Sailun

- 12.3 Emerging players

- 12.3.1 Double Coin

- 12.3.2 Laufenn

- 12.3.3 Petlas

- 12.3.4 Radar Tires

- 12.3.5 Triangle Tyre

- 12.3.6 ZC Rubber