PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936661

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936661

Automotive Airbag Inflator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

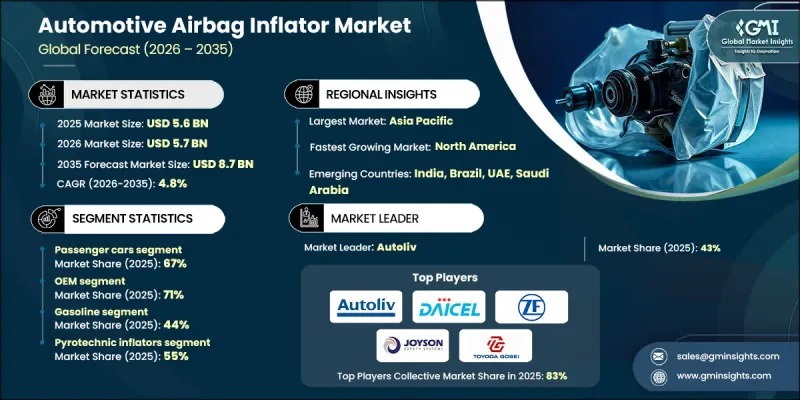

The Global Automotive Airbag Inflator Market was valued at USD 5.6 billion in 2025 and is estimated to grow at a CAGR of 4.8% to reach USD 8.7 billion by 2035.

The rising production of motor vehicles worldwide is a significant driver of this growth. As manufacturers ramp up output to meet surging demand, each new vehicle requires multiple airbag inflators, which elevates installation rates and strengthens long-term supply agreements. This higher production volume also improves economies of scale and accelerates the adoption of advanced inflator technologies across different vehicle segments. Consumers are increasingly prioritizing passive safety systems and crash protection when purchasing vehicles, leading automakers to integrate high-performance multi-airbag systems even in mid-tier models. The integration of smart, connected vehicle systems, including predictive sensors and intelligent crash-response mechanisms, requires inflators that deploy quickly and efficiently. By aligning occupant protection with advanced driver-assistance systems (ADAS), next-generation inflators are seeing higher demand, creating substantial opportunities for suppliers in the market.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $5.6 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 4.8% |

The passenger vehicles segment accounted for 67% share in 2025 and is expected to grow at a CAGR of 4.7% between 2026 and 2035. Regulatory mandates requiring airbags in all passenger vehicles, including entry-level models, are a key factor driving growth. Laws enforcing multiple airbag systems, frontal, side, and curtain, directly increase the number of inflators per vehicle. As compliance deadlines approach across various regions, manufacturers are accelerating the installation of airbag systems, ensuring steady, regulation-driven growth for suppliers.

The original equipment manufacturers (OEMs) segment held a 71% share in 2025 and is projected to grow at a CAGR of 4.5% from 2026 to 2035. OEMs' strict adherence to evolving safety regulations helps them avoid recalls, penalties, and reputational damage. High-quality, innovative inflators allow OEMs to maintain consistency in crash protection standards across multiple vehicle platforms. This focus on compliance and safety drives long-term contracts with inflator suppliers, providing stable demand and continuous technological advancements.

China Automotive Airbag Inflator Market held 40% share, generating USD 845.3 million in 2025. Being the world's largest automotive manufacturing hub, China produces millions of passenger vehicles annually, resulting in high demand for inflators across all vehicle segments. Ongoing capacity expansions by local and joint-venture OEMs support strong inflator consumption and encourage sustained growth for suppliers.

Key players operating in the Global Automotive Airbag Inflator Market include ARC Automotive, Autoliv, Joyson Safety Systems, Toyoda Gosei, Daicel, Ashimori Industry, Hyundai Mobis, ITW Automotive, Nippon Kayaku, and ZF. Companies in the automotive airbag inflator market are focusing on several strategies to strengthen their market presence and competitive position. They are investing heavily in research and development to create next-generation, high-performance inflators that meet evolving safety standards. Long-term supply agreements with OEMs are being secured to ensure stable demand and foster collaboration for technological innovation. Strategic mergers, acquisitions, and partnerships are also employed to expand global footprints and leverage complementary capabilities. Additionally, manufacturers are diversifying their product portfolios to cater to passenger vehicles, commercial vehicles, and connected vehicle platforms.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research approach

- 1.2 Quality Commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research Trail & Confidence Scoring

- 1.3.1 Research Trail Components

- 1.3.2 Scoring Components

- 1.4 Data Collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.7.1 Quantified market impact analysis

- 1.7.1.1 Mathematical impact of growth parameters on forecast

- 1.7.1 Quantified market impact analysis

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Inflator

- 2.2.4 Airbag

- 2.2.5 Propulsion

- 2.2.6 Sales channel

- 2.2.7 Deployment mode

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global vehicle production

- 3.2.1.2 Stringent safety regulations

- 3.2.1.3 Growth of multi-airbag architectures

- 3.2.1.4 Inflator technology advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Recall and liability risks

- 3.2.2.2 Raw material cost volatility

- 3.2.3 Market opportunities

- 3.2.3.1 EV & autonomous vehicle growth

- 3.2.3.2 Emerging market safety adoption

- 3.2.3.3 Aftermarket & recall replacements

- 3.2.3.4 Sustainable inflator materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 US National Highway Traffic Safety Administration (NHTSA) Regulations

- 3.4.1.2 Environmental Protection Agency (EPA) Emission Standards

- 3.4.1.3 California Air Resources Board (CARB) Standards

- 3.4.2 Europe

- 3.4.2.1 European Union General Safety Regulation (EU GSR)

- 3.4.2.2 EU Directive on End-of-Life Vehicles (ELV)

- 3.4.2.3 European Commission Safety Standards for Passenger Vehicles

- 3.4.2.4 European Union Type Approval Process

- 3.4.3 Asia Pacific

- 3.4.3.1 China National Standards for Vehicle Safety

- 3.4.3.2 India Bureau of Indian Standards (BIS) Airbag Regulations

- 3.4.3.3 Japan Ministry of Land, Infrastructure, Transport and Tourism (MLIT) Regulations

- 3.4.3.4 ASEAN Road Safety Standards

- 3.4.4 Latin America

- 3.4.4.1 Brazil National Traffic Department (DENATRAN) Standards

- 3.4.4.2 Argentina National Road Safety Agency (ANSV) Regulations

- 3.4.4.3 Mexico Secretariat of Communications and Transport (SCT) Regulations

- 3.4.4.4 MERCOSUR Harmonization of Vehicle Safety Standards

- 3.4.5 Middle East & Africa

- 3.4.5.1 UAE Federal Vehicle Safety Law

- 3.4.5.2 Saudi Arabian Standards Organization (SASO) Vehicle Safety Regulations

- 3.4.5.3 South African Bureau of Standards (SABS) Automotive Regulations

- 3.4.1 North America

- 3.5 Major market trends and disruptions

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By product

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Cost breakdown analysis

- 3.12.1 Airbag Inflator Component Costs

- 3.12.2 R&D and Innovation Costs

- 3.12.3 Manufacturing and Assembly Costs

- 3.12.4 Logistics and Distribution Costs

- 3.13 Patent analysis

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly Initiatives

- 3.14.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Mn, Units)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUV

- 5.2.4 Others

- 5.3 Commercial vehicle

- 5.3.1 Light commercial vehicle (LCV)

- 5.3.2 Medium commercial vehicle (MCV)

- 5.3.3 Heavy commercial vehicle (HCV)

Chapter 6 Market Estimates & Forecast, By Inflator, 2022 - 2035 ($Mn, Units)

- 6.1 Key trends

- 6.2 Pyrotechnic inflators

- 6.3 Stored gas inflators

- 6.4 Hybrid inflators

Chapter 7 Market Estimates & Forecast, By Airbag, 2022 - 2035 ($Mn, Units)

- 7.1 Key trends

- 7.2 Frontal

- 7.3 Side

- 7.4 Curtain

- 7.5 Knee

- 7.6 Pedestrian

Chapter 8 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Mn, Units)

- 8.1 Key trends

- 8.2 Gasoline

- 8.3 Diesel

- 8.4 BEV

- 8.5 PHEV

- 8.6 HEV

- 8.7 FCEV

- 8.8 CNG/LPG

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Deployment Mode, 2022 - 2035 ($Mn, Units)

- 10.1 Key trends

- 10.2 Single-stage

- 10.3 Multi-stage

Chapter 11 Market Estimates & Forecast, By Region, 2022 - 2035 ($Mn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Argentina

- 11.5.3 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Global Players

- 12.1.1 Autoliv

- 12.1.2 Bosch

- 12.1.3 Continental

- 12.1.4 Daicel

- 12.1.5 Delphi

- 12.1.6 Denso

- 12.1.7 Hyundai Mobis

- 12.1.8 Joyson Safety Systems

- 12.1.9 ZF

- 12.2 Regional Players

- 12.2.1 ARC Automotive

- 12.2.2 Ashimori Industry

- 12.2.3 ITW Automotive

- 12.2.4 Kolon Industries

- 12.2.5 Nippon Kayaku

- 12.2.6 Seiren

- 12.2.7 Toyoda Gosei

- 12.3 Emerging Players

- 12.3.1 Jinheng Automotive Safety Technology

- 12.3.2 Nihon Plast

- 12.3.3 Swicofil

- 12.3.4 Tenaris