PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936667

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936667

Gas Meters Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

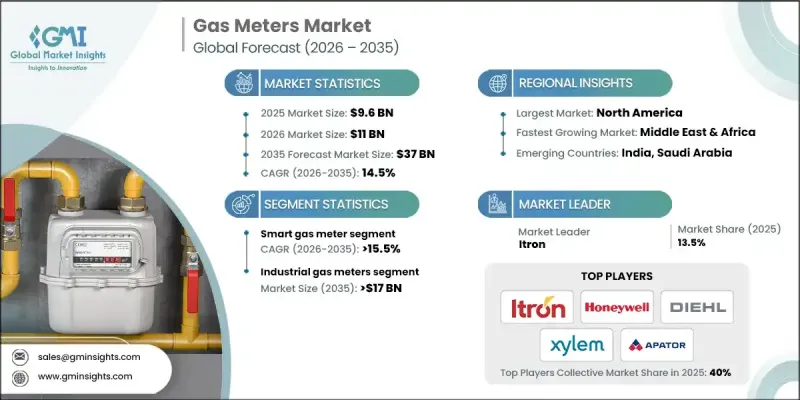

The Global Gas Meters Market was valued at USD 9.6 billion in 2025 and is estimated to grow at a CAGR of 14.5% to reach USD 37 billion by 2035.

Rising investments focused on energy security are driving demand as utilities increasingly require precise, granular data to manage a tighter global gas supply. The integration of multi-utility digital platforms is reshaping the market, enabling cross-service visibility, process automation, and enhanced customer engagement. Digital metering infrastructure is increasingly adopted to provide detailed usage data and streamline operations, supported by regulatory enforcement and ambitious rollout targets. Second-generation advanced metering infrastructures are introducing enhanced functions, including cybersecurity, granular interval data, and remote monitoring, while promoting device interoperability and shaping industry standards. The growing focus on accurate, networked data is encouraging utilities to modernize existing systems and invest in smart metering solutions that deliver operational efficiency and energy management insights.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $9.6 Billion |

| Forecast Value | $37 Billion |

| CAGR | 14.5% |

The smart gas meters segment is expected to grow at 15.5% CAGR through 2035. These devices integrate microcontrollers, precision sensors, and communication modules, enabling automated, two-way data transfer between meters and utility systems. Smart meters support multiple data collection methods, including fixed networks, cellular connectivity, and drive-by readings, reducing manual interventions and providing near real-time consumption visibility for both utilities and end-users. Their deployment strengthens operational efficiency and facilitates energy conservation initiatives while ensuring compliance with evolving regulatory requirements.

The industrial gas meters segment accounted for 46.7% share in 2025 and is projected to reach USD 17 billion by 2035. These meters are designed to accommodate high-volume industrial applications, including manufacturing, chemical production, refining, power generation, and food processing. Advanced technologies such as turbine meters provide precise measurement across a wide range of flow rates, often handling 500 to over 10,000 cubic meters per hour, ensuring reliability and performance in critical industrial environments.

U.S. Gas Meters Market was valued at USD 2.4 billion in 2025, fueled by ongoing modernization, replacement cycles, and widespread utility digitalization. Increasing regulatory pressure to monitor emissions and enhance network safety, coupled with government-led environmental guidelines, is driving the adoption of advanced metering solutions. The demand for accurate leak detection and compliance-focused measurement devices continues to accelerate market expansion across the country.

Key players active in the Global Gas Meters Market include Itron, Emerson Electrics, ABB, Xylem, Badger Meter, Pietro Fiorentini, Schneider Electric, Diehl Stiftung, Suntront, Elster Group, Romet, AKG Acoustics, Edmi Limited, RMG, Siemens, Raychem RPG, ZENNER, Apator SA, Honeywell International, and Aclara. Companies in the gas meters market are strengthening their position through continuous technological innovation, product diversification, and strategic partnerships. Manufacturers are investing in smart meter development with advanced communication capabilities, cybersecurity features, and real-time analytics. Expanding service networks and providing comprehensive maintenance solutions improve customer retention. Companies are also focusing on integrating meters with broader energy management platforms and multi-utility digital ecosystems to enhance operational intelligence. Geographic expansion into emerging markets, coupled with flexible deployment options for industrial and residential applications, supports a long-term market foothold.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Market estimates & forecast parameters

- 1.3 Forecast

- 1.3.1 Key trends for market estimates

- 1.3.2 Quantified market impact analysis

- 1.3.2.1 Mathematical impact of growth parameters on forecast

- 1.3.3 Scenario analysis framework

- 1.4 Primary research and validation

- 1.4.1 Some of the primary sources (but not limited to)

- 1.5 Data mining sources

- 1.5.1 Paid Sources

- 1.5.2 Sources, by region

- 1.6 Research trail & scoring components

- 1.6.1 Research trail components

- 1.6.2 Scoring components

- 1.7 Research transparency addendum

- 1.7.1 Source attribution framework

- 1.7.2 Quality assurance metrics

- 1.7.3 Our commitment to trust

- 1.8 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022 - 2035

- 2.1.1 Business trends

- 2.1.2 Technology trends

- 2.1.3 Product trends

- 2.1.4 End use trends

- 2.1.5 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material availability & sourcing analysis

- 3.1.2 Manufacturing capacity assessment

- 3.1.3 Supply chain resilience & risk factors

- 3.1.4 Distribution network analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

- 3.6.1 Political factors

- 3.6.2 Economic factors

- 3.6.3 Social factors

- 3.6.4 Technological factors

- 3.6.5 Legal factors

- 3.6.6 Environmental factors

- 3.7 Cost structure analysis of gas meters

- 3.8 Emerging opportunities & trends

- 3.9 Investment analysis & future prospects

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2025

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.4.1 Key partnerships & collaborations

- 4.4.2 Major M&A activities

- 4.4.3 Product innovations & launches

- 4.4.4 Market expansion strategies

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2022 - 2035 (USD Million)

- 5.1 Key trends

- 5.2 Smart

- 5.3 Conventional

Chapter 6 Market Size and Forecast, By Product, 2022 - 2035 (USD Million)

- 6.1 Key trends

- 6.2 Diaphragm meters

- 6.3 Rotary meters

- 6.4 Turbine meters

- 6.5 Ultrasonic meters

- 6.6 Coriolis meters

Chapter 7 Market Size and Forecast, By End Use, 2022 - 2035 (USD Million)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Size and Forecast, By Region, 2022 - 2035 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Mexico

- 8.6.3 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Aclara

- 9.3 AKG Acoustics

- 9.4 Apator SA

- 9.5 Badger Meter

- 9.6 Diehl Stiftung

- 9.7 Edmi Limited

- 9.8 Elster Group

- 9.9 Emerson Electrics

- 9.10 Honeywell International

- 9.11 Itron

- 9.12 Pietro Fiorentini

- 9.13 Schneider Electric

- 9.14 Siemens

- 9.15 Suntront

- 9.16 Raychem RPG

- 9.17 RMG

- 9.18 Romet

- 9.19 Xylem

- 9.20 ZENNER