PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936679

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1936679

Construction Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

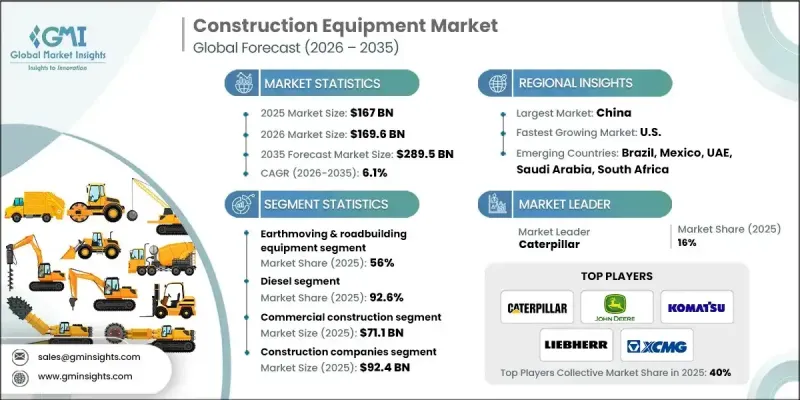

The Global Construction Equipment Market was valued at USD 167 billion in 2025 and is estimated to grow at a CAGR of 6.1% to reach USD 289.5 billion by 2035.

Market expansion is fueled by the critical role of infrastructure and construction in driving economic development, alongside significant government investments in large-scale public infrastructure projects. Rapid urbanization, increasing industrialization, and rising demand for improved transportation networks are creating strong demand for advanced construction machinery. Technological innovations, including smart construction solutions and digital integration, are transforming operations, enabling improved productivity, precision, and safety. The rising adoption of automation, telematics, and AI-assisted equipment, coupled with strategic partnerships among equipment manufacturers and technology providers, is accelerating the digital shift across the sector. Additionally, growing rental services for construction machinery are making high-end equipment more accessible, enhancing market penetration in emerging economies. Overall, the market is witnessing robust growth driven by increasing construction activity, technological evolution, and government-backed initiatives.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $289.5 Billion |

| Forecast Value | $289.5 Billion |

| CAGR | 6.1% |

The earthmoving and road-building equipment segment held 56% share in 2025 and is expected to grow at a CAGR of 5.5% through 2035. Equipment such as excavators, backhoes, loaders, and compactors is experiencing high demand due to large-scale infrastructure projects and road network expansions. Governments' focus on improving connectivity and accessibility in urban and remote regions is creating sustained demand for high-quality machinery. The segment's growth is further supported by ongoing public works programs, which require specialized equipment for precise earthmoving and construction operations. This segment's dominance underscores the central role of road-building and infrastructure development in driving the construction equipment market.

The diesel-powered equipment segment held a 92.6% share in 2025 and is forecasted to grow at a CAGR of 5.6% from 2026 to 2035. Manufacturers are incorporating advanced technologies in diesel engines to improve fuel efficiency, reduce emissions, and enhance overall machine performance. Integration of telematics, combining GPS tracking, onboard diagnostics, and remote monitoring, is allowing real-time performance analysis and predictive maintenance. Rental companies and contractors are increasingly adopting telematics-enabled equipment for fleet management, optimizing operational efficiency and reducing downtime. Cloud-based solutions allow operators to monitor machinery, track usage, and plan maintenance schedules, reinforcing the appeal of diesel-powered machines in both large-scale projects and rental operations.

China Construction Equipment Market held 50% share in 2025, generating USD 38.7 billion in 2025. The region's growth is driven by rapid urbanization, industrial expansion, and the rising adoption of construction equipment rental models to offset labor cost increases. Chinese manufacturers and rental providers are emphasizing technologically advanced machinery with enhanced automation, fuel efficiency, and telematics integration to attract contractors and large-scale infrastructure developers. The combination of rising infrastructure investments and cost-effective rental solutions is strengthening market demand and driving the adoption of high-performance construction equipment throughout the region.

Key players operating in the Global Construction Equipment Market include Caterpillar, CNH Industrial, Deere & Co., Doosan, Hitachi Construction Machinery, Komatsu, Liebherr, Sany, Terex, Volvo, and XCMG. Companies in the construction equipment market are adopting multiple strategies to consolidate their presence and expand market share. These include investing heavily in R&D to develop smart, energy-efficient, and telematics-enabled machinery. Firms are entering strategic partnerships with technology providers to integrate AI, IoT, and automation into their products. Expanding service networks and rental solutions enhance accessibility, particularly in emerging markets. Companies are also pursuing mergers and acquisitions to strengthen their global footprint, optimize supply chains, and gain access to new customer bases.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality Commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.2.1.1 Source consistency protocol

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research Trail & Confidence Scoring

- 1.3.1 Research Trail Components

- 1.3.2 Scoring Components

- 1.4 Data Collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.5.1.1 Sources, by region

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.7.1 Quantified market impact analysis

- 1.7.1.1 Mathematical impact of growth parameters on forecast

- 1.7.1 Quantified market impact analysis

- 1.8 Research transparency addendum

- 1.8.1 Source attribution framework

- 1.8.2 Quality assurance metrics

- 1.8.3 Our commitment to trust

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Propulsion

- 2.2.4 Application

- 2.2.5 End use

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization and infrastructure development

- 3.2.1.2 Rising government investments in smart cities & public works

- 3.2.1.3 Technological advancements

- 3.2.1.4 Shift toward electric and hybrid construction equipment

- 3.2.1.5 Rental and leasing boom

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital and maintenance costs

- 3.2.2.2 Volatility in raw material prices

- 3.2.2.3 Shortage of skilled operators

- 3.2.2.4 Regulatory and emission compliance requirements

- 3.2.2.5 Intense competition from rental and used equipment

- 3.2.3 Market opportunities

- 3.2.3.1 Electric & Hybrid Equipment Adoption Acceleration

- 3.2.3.2 Autonomous Construction Operations & AI Integration

- 3.2.3.3 Precision Construction Technology & GPS Guidance

- 3.2.3.4 Equipment-as-a-Service (EaaS) Business Models

- 3.2.3.5 Retrofit & Upgrade Market for Legacy Equipment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 Environmental Protection Agency (EPA)

- 3.4.1.2 Canadian Standards Association, CSA C225-00

- 3.4.2 Europe

- 3.4.2.1 Committee for European Construction Equipment (CECE)

- 3.4.2.2 Construction Equipment Standards and Regulations Committee (CESRC)

- 3.4.2.3 Construction Products Regulation (EU 2011/305) (CPR)

- 3.4.3 Asia Pacific

- 3.4.3.1 ICEMA - Indian Construction Equipment Manufacturers’ Association

- 3.4.3.2 China Construction Machinery Association (CCMA)

- 3.4.3.3 The International Council on Clean Transportation

- 3.4.4 Latin America

- 3.4.4.1 Chilean Construction Chamber (CChC)

- 3.4.4.2 International Council on Clean Transportation (ICCT)

- 3.4.4.3 Brazilian Regulatory Standards (NR)

- 3.4.5 MEA

- 3.4.5.1 ASTM international standards

- 3.4.5.2 Presidential Legislative Decree 7/11

- 3.4.5.3 Driven machinery regulations

- 3.4.1 North America

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Patent analysis

- 3.8 Technology and innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By product

- 3.10 Cost breakdown analysis

- 3.10.1 Raw material costs

- 3.10.2 Powertrain & propulsion system costs

- 3.10.3 Hydraulic & mechanical system costs

- 3.10.4 Electrical & electronic component costs

- 3.10.5 Manufacturing & assembly costs

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Import and export

- 3.11.3 Major import countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Customer & demand-side intelligence

- 3.13.1 Purchase vs rental decision drivers

- 3.13.2 Total cost of ownership (TCO) considerations

- 3.13.3 Brand loyalty vs price sensitivity

- 3.13.4 Replacement cycle & fleet renewal trends

- 3.14 Demand-supply gap & capacity utilization analysis

- 3.14.1 Capacity utilization rates (OEM vs regional players)

- 3.14.2 Demand-supply mismatch hotspots

- 3.14.3 Short-term vs long-term capacity outlook

- 3.15 Aftermarket & Lifecycle Revenue Analysis

- 3.15.1 Parts & service revenue share

- 3.15.2 Maintenance contracts & service bundling

- 3.15.3 Digital service monetization

- 3.15.4 Impact on OEM margins

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2022 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Earthmoving & roadbuilding equipment

- 5.2.1 Backhoe

- 5.2.2 Excavator

- 5.2.3 Loader

- 5.2.4 Compaction equipment

- 5.2.5 Others

- 5.3 Material handling and cranes

- 5.3.1 Storage and handling equipment

- 5.3.2 Engineered systems

- 5.3.3 Industrial trucks

- 5.3.4 Bulk material handling equipment

- 5.4 Concrete equipment

- 5.4.1 Concrete pumps

- 5.4.2 Crusher

- 5.4.3 Transit mixers

- 5.4.4 Asphalt pavers

- 5.4.5 Batching plants

Chapter 6 Market Estimates & Forecast, By Propulsion, 2022 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 CNG/LNG

- 6.4 Electric

Chapter 7 Market Estimates & Forecast, By Application, 2022 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Residential construction

- 7.3 Commercial construction

- 7.4 Industrial construction

- 7.5 Mining & quarrying

Chapter 8 Market Estimates & Forecast, By End Use, 2022 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Construction companies

- 8.3 Mining operators

- 8.4 Rental companies

- 8.5 Government & municipalities

- 8.6 Industrial users

Chapter 9 Market Estimates & Forecast, By Region, 2022-2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Denmark

- 9.3.8 Finland

- 9.3.9 Norway

- 9.3.10 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Singapore

- 9.4.7 Thailand

- 9.4.8 Indonesia

- 9.4.9 Vietnam

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 Caterpillar

- 10.1.2 Komatsu

- 10.1.3 John Deere

- 10.1.4 Volvo

- 10.1.5 Liebherr

- 10.1.6 Hitachi

- 10.1.7 JCB

- 10.1.8 Sany

- 10.2 Regional Champions

- 10.2.1 Case

- 10.2.2 New Holland

- 10.2.3 Doosan

- 10.2.4 Hyundai

- 10.2.5 XCMG

- 10.2.6 Zoomlion

- 10.2.7 Terex

- 10.2.8 Manitou

- 10.2.9 Wacker Neuson

- 10.3 Emerging Players & Service Providers

- 10.3.1 United Rentals

- 10.3.2 Ashtead / Sunbelt Rentals

- 10.3.3 H&E Equipment Services

- 10.3.4 Home Depot Tool Rental

- 10.3.5 Built Robotics

- 10.3.6 SafeAI

- 10.3.7 Trimble

- 10.3.8 Topcon