PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934895

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934895

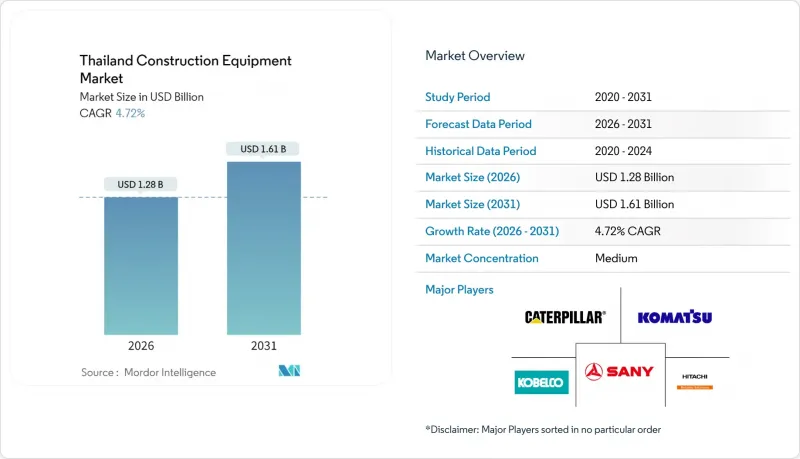

Thailand Construction Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Thailand construction equipment market was valued at USD 1.22 billion in 2025 and estimated to grow from USD 1.28 billion in 2026 to reach USD 1.61 billion by 2031, at a CAGR of 4.72% during the forecast period (2026-2031).

The growth trajectory reflects the nation's role as an infrastructure hub for mainland Southeast Asia, the megaproject pipeline of the Eastern Economic Corridor (EEC), and continued state commitment to multi-modal transport links. Demand also benefits from Thailand's rapid emergence as an electric-vehicle manufacturing base, which keeps factory construction momentum high. Equipment suppliers are capitalizing on the rebound in tourism-led hospitality developments, the renewable-energy build-out, and the shift toward equipment-as-a-service models that address tight contractor margins. Competitive intensity rises as global OEMs defend share against cost-aggressive Chinese entrants, while local rental operators broaden value-added services to counter skilled-operator shortages.

Thailand Construction Equipment Market Trends and Insights

Surge in Megaprojects Under Eastern Economic Corridor (EEC)

Phase-2 EEC developments span 77 projects and introduce simultaneous port, rail, and highway workstreams concentrating equipment demand over 2025-2027. Data-center builds within the corridor require precision foundation equipment capable of strict thermal and seismic tolerances, while advanced-manufacturing zones drive orders for high-capacity cranes and material-handling solutions. The integrated logistics approach compresses project timelines, lifting utilization peaks above historic norms. Environmental compliance clauses in EEC tenders accelerate fleet renewal toward low-emission models, nudging contractors to replace aging internal-combustion units with newer Tier-4 and Stage V machines.

Renewable-Energy Build-Out Lifting Demand for Cranes and Earth-Moving Gear

Large-scale solar farms and battery-energy-storage projects in Northeastern Thailand need low-ground-pressure dozers, pile drivers for tracker foundations, and heavy-lift cranes for containerized BESS modules. Compressed construction schedules tied to incentive windows strain existing fleets, pushing daily rental rates upward during peak months. Grid-connection works add demand for specialized tensioners and pullers used in high-voltage line stringing.

Skilled-Operator Shortages Pushing Renters Over Buyers

Policy shifts affecting cross-border labor reduced the available foreign construction workforce, raising labor costs and limiting experienced operators for heavy machinery. Rental companies respond by bundling certified operators with equipment, offering training programs, and adopting semi-autonomous excavators that cut the learning curve. Contractors migrate to rental to avoid fixed payroll costs and ensure operator availability aligned with project cycles.

Other drivers and restraints analyzed in the detailed report include:

- Public-Private Partnerships Accelerating Infrastructure Roll-Outs

- Rapid Adoption of Machine-Control and BIM-Integrated Equipment

- Tight Credit Conditions for SMEs Slowing Fleet Renewal Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Thailand construction equipment market size for excavators stood at 45.12% of total revenue in 2025. Demand spans earthworks for megaproject highways, trenching for utility corridors, and foundation digging for data centers. Rental fleets keep high utilization because excavators suit both small and large civil packages. Loaders and backhoe units record the quickest rise at a 5.19% CAGR, favored for renewable-energy site prep and industrial estate grading. Crane purchases surge for wind-turbine erection and high-rise glazing, while telescopic handlers satisfy warehouse builds tied to e-commerce growth. Motor graders remain stable on provincial road programs. Specialist dredgers and amphibious excavators underpin port expansions, illustrating how project complexity diversifies unit mix within the Thailand construction equipment market.

Versatility explains excavators' dominance: attachments such as rock-breakers, augers, and tilt buckets extend task scope without extra chassis investment. Dealers deepen value by offering quick-coupler kits and predictive-maintenance packages that minimize downtime. Conversely, crane suppliers differentiate through high-lift capacity and narrow-footprint models tailored to congested urban sites. The machinery-type landscape therefore reflects both multi-purpose workhorses and high-spec niche products, each carving share as infrastructure designs evolve.

Internal-combustion engines supplied 94.08% of 2025 units, but their share slips as battery-electric machines log an 10.84% CAGR to 2031. Urban emission curbs and site-noise ordinances encourage contractors to trial electric mini-excavators, loaders, and scissors lifts. Hybrid models bridge the infrastructure gap by pairing smaller engines with electrified drive trains, cutting fuel use without reliance on fixed chargers. Despite upfront premiums, total-cost-of-ownership models show breakeven within three years on two-shift operations, helping justify fleet pilots among leading contractors in Bangkok.

Challenges persist: rural sites lack power supply, spare-parts channels for battery systems are nascent, and import duties inflate sticker prices. OEMs respond by localizing battery-pack assembly and bundling charging-equipment leases within purchase deals. As EEC ports and industrial estates expand grid capacity, electric adoption is expected to accelerate further, lifting the Thailand construction equipment market toward cleaner propulsion over the decade.

The Thailand Construction Equipment Report is Segmented by Machinery Type (Cranes, Telescopic Handlers, and More), Propulsion (Internal Combustion Engine and More), Power Output (Below 100 HP and More), End-User (Infrastructure, Residential and Commercial Construction, and More), Application (Earth-Moving, Material Handling, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Caterpillar Inc.

- Komatsu Ltd.

- Hitachi Construction Machinery Co. Ltd.

- Kobelco Construction Machinery Co. Ltd.

- SANY Group

- XCMG Group

- Zoomlion Heavy Industry Science & Technology Co. Ltd.

- Hyundai Construction Equipment Co. Ltd.

- Liebherr Group

- CNH Industrial N.V.

- JC Bamford Excavators Ltd (JCB)

- Volvo Construction Equipment

- Doosan Bobcat

- Wirtgen Group (John Deere)

- Yanmar Holdings Co. Ltd.

- Takeuchi Mfg. Co. Ltd.

- Kubota Corporation

- Sumitomo Construction Machinery Co. Ltd.

- Terex Corporation

- Manitowoc Company Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge In Megaprojects Under Eastern Economic Corridor (EEC)

- 4.2.2 Public-Private Partnerships Accelerating Infrastructure Roll-Outs

- 4.2.3 Tourism-Led Rebound in Commercial and Hospitality Construction

- 4.2.4 Renewable-Energy Build-Out (Solar Farms, BESS) Lifting Demand for Cranes and Earth-Moving Gear

- 4.2.5 Localization of EV Supply-Chain Plants Requiring Green-Field Factory Construction

- 4.2.6 Rapid Adoption of Machine-Control & BIM-Integrated Equipment to Cut Project Over-Runs

- 4.3 Market Restraints

- 4.3.1 Construction-Input Inflation Squeezing Contractor CAPEX

- 4.3.2 Skilled-Operator Shortages Pushing Renters Over Buyers

- 4.3.3 High Import Duties and Sparse Charging Infra Delaying Electric Heavy Machinery Uptake

- 4.3.4 Tight Credit Conditions for SMEs Slowing Fleet Renewal Cycles

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD), Volume (Units))

- 5.1 By Machinery Type

- 5.1.1 Cranes

- 5.1.2 Telescopic Handlers

- 5.1.3 Excavators

- 5.1.4 Loaders & Backhoe

- 5.1.5 Motor Graders

- 5.1.6 Other Machinery Types

- 5.2 By Propulsion

- 5.2.1 Internal Combustion Engine

- 5.2.2 Electric & Hybrid

- 5.3 By Power Output

- 5.3.1 Below 100 HP

- 5.3.2 101 - 200 HP

- 5.3.3 Above 200 HP

- 5.4 By End-user

- 5.4.1 Infrastructure

- 5.4.2 Residential and Commercial Construction

- 5.4.3 Mining and Industrial

- 5.4.4 Agriculture

- 5.4.5 Energy and Utilities

- 5.5 By Application

- 5.5.1 Earth-moving

- 5.5.2 Material Handling

- 5.5.3 Road Construction

- 5.5.4 Lifting & Hoisting

- 5.6 By Region

- 5.6.1 Bangkok Metropolitan Area

- 5.6.2 Central Thailand

- 5.6.3 Northern Thailand

- 5.6.4 Northeastern Thailand

- 5.6.5 Southern Thailand

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.4.1 Caterpillar Inc.

- 6.4.2 Komatsu Ltd.

- 6.4.3 Hitachi Construction Machinery Co. Ltd.

- 6.4.4 Kobelco Construction Machinery Co. Ltd.

- 6.4.5 SANY Group

- 6.4.6 XCMG Group

- 6.4.7 Zoomlion Heavy Industry Science & Technology Co. Ltd.

- 6.4.8 Hyundai Construction Equipment Co. Ltd.

- 6.4.9 Liebherr Group

- 6.4.10 CNH Industrial N.V.

- 6.4.11 JC Bamford Excavators Ltd (JCB)

- 6.4.12 Volvo Construction Equipment

- 6.4.13 Doosan Bobcat

- 6.4.14 Wirtgen Group (John Deere)

- 6.4.15 Yanmar Holdings Co. Ltd.

- 6.4.16 Takeuchi Mfg. Co. Ltd.

- 6.4.17 Kubota Corporation

- 6.4.18 Sumitomo Construction Machinery Co. Ltd.

- 6.4.19 Terex Corporation

- 6.4.20 Manitowoc Company Inc.

7 Market Opportunities & Future Outlook