PUBLISHER: Industry Experts | PRODUCT CODE: 1783025

PUBLISHER: Industry Experts | PRODUCT CODE: 1783025

Global Artificial Intelligence (AI) Platform Market - Technologies, Deployment Types, Company Types and Industry Sectors

Global Artificial Intelligence (AI) Platforms Market Trends and Outlook

| Key Metrics | |

|---|---|

| Historical Period: | 2021-2024 |

| Base Year: | 2024 |

| Forecast Period: | 2024-2030 |

| Units: | Value market in US$ |

| Companies Mentioned: | 30+ |

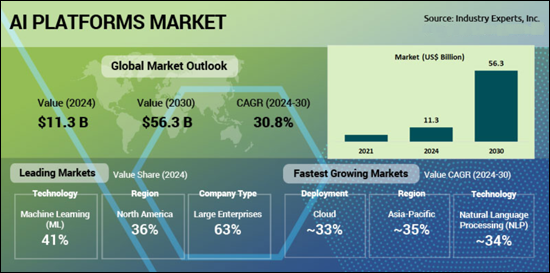

The global AI Platforms market is valued at US$11.3 billion in 2024 and is projected to reach US$56.3 billion by 2030, growing at a CAGR of 30.8%. The market's rapid expansion is driven by growing enterprise needs for automation, efficiency, and cost reduction. With over 80% of companies embedding AI into core strategies, platforms that can process vast datasets, originating from IoT devices, social media, and other digital sources, are in high demand. Breakthroughs in machine learning, deep learning, and neural networks, like Google's use of artificial neural networks for route optimization, are enhancing platform intelligence. Hyperscalers such as Microsoft Azure, AWS Bedrock, and Google Vertex AI are minimizing adoption barriers by offering scalable, ready-to-deploy AI services. This is enabling smaller organizations to embrace AI without significant upfront investments. Furthermore, the AI-as-a-Service (AIaaS) model has emerged as a cost-effective path for businesses to integrate AI capabilities, with tech giants like AWS, Microsoft, and Google dominating this space.

INFOGRAPHICS

AI Platforms Regional Market Analysis

North America is projected to hold the largest share of the global AI Platforms market in 2024, accounting for approximately 36.2% of total revenue. The region's dominance stems from the presence of global AI leaders such as Microsoft Azure, AWS, Google Cloud, and IBM Watson, all headquartered in the United States. Widespread enterprise adoption, particularly across finance, healthcare, and retail, is supported by robust cloud infrastructure, a strong AI talent pool, and significant R&D and venture capital investments, including a US$20 billion federal AI push and nearly US$18 billion in private AI funding in 2024. A relatively flexible regulatory environment compared to Europe further accelerates AI deployment. Asia-Pacific, however, is poised to experience the fastest growth, registering a CAGR of 34.6% between 2024 and 2030. Government-backed initiatives such as China's New Generation AI Development Plan, India's #AIforAll, and Japan's AI funding programs are catalyzing AI platform adoption across the region. With high digital penetration, rapid cloud adoption, and a thriving AI startup ecosystem in China and India, the region is leveraging both global and local cloud-based AI services. Affordable AIaaS offerings and increasing SME adoption are further propelling growth, with AI use among businesses expected to rise sharply in the coming years.

AI Platforms Market Analysis by Technology

Machine Learning (ML) dominates the global AI Platforms market by technology, accounting for an estimated 41.2% share in 2024, driven by its versatility across industries such as finance, healthcare, retail, and manufacturing. ML's ability to process both structured and unstructured data, along with support from frameworks like TensorFlow and PyTorch and cloud services like AWS SageMaker and Google Cloud AI, has made it the foundation of AI platforms. It plays a central role in powering automation, predictive analytics, and decision-making, while also serving as the backbone for other AI fields like computer vision and NLP. Meanwhile, Natural Language Processing (NLP) is expected to post the fastest CAGR of 33.8% during 2024-2030, fueled by rising demand for conversational AI, customer engagement, and real-time language interaction. Advances in transformer-based models like GPT, BERT, and Llama have enhanced NLP capabilities in text generation and multilingual understanding, while cloud-based APIs and low-code tools have expanded accessibility. Emerging use cases in legal, healthcare, and education, combined with growing adoption in multimodal AI systems, are further reinforcing NLP's position as the fastest-growing technology in the AI Platforms market.

AI Platforms Market Analysis by Deployment Type

Cloud deployment is the dominant and fastest-growing segment in the AI Platforms market, projected to hold a 63% share in 2024 and register a CAGR of 33% between 2024 and 2030. The cloud's flexibility in providing on-demand computational power, including access to GPUs and TPUs, enables dynamic scaling of AI workloads without large upfront investments. AI-as-a-Service (AIaaS) offerings from AWS, Azure, and Google Cloud simplify adoption by offering pre-built models, machine learning frameworks, and APIs, making advanced AI tools accessible even to organizations with limited in-house expertise. The cloud also reduces capital expenditure by eliminating the need for on-premise infrastructure while offering centralized storage, real-time data access, and collaboration capabilities across global teams. Cloud platforms facilitate rapid AI prototyping and deployment, shorten time-to-market, and support innovations in generative AI and IoT. With approximately 70% of enterprises already leveraging public cloud services, industries such as healthcare, finance, and retail are using cloud-based AI for predictive analytics, chatbots, and personalized experiences, reinforcing the cloud's pivotal role in shaping the future of AI platforms.

AI Platforms Market Analysis by Company Type

Large enterprises are expected to lead the global AI Platforms market in 2024 with a dominant share of 63.3%, driven by their capacity to invest in advanced infrastructure, specialized talent, and customized AI solutions. These organizations use AI platforms for a wide range of complex applications such as fraud detection, predictive maintenance, and supply chain optimization across their global operations. Their established IT ecosystems and access to vast datasets enhance the effectiveness of AI deployments, while integration with leading cloud providers like AWS, Azure, and Google Cloud is typically seamless. Moreover, large enterprises benefit from dedicated data science teams that tailor AI tools to specific business needs, including regulatory compliance in industries like finance and healthcare. In contrast, small and medium-sized enterprises (SMEs) are expected to witness the fastest growth between 2024 and 2030, with a projected CAGR of 34.8%. This surge is fueled by affordable, cloud-based, subscription models from platforms like Google Cloud AI and AWS SageMaker, along with the growing availability of low-code/no-code tools such as H2O.ai and DataRobot. These enable rapid AI adoption without deep technical expertise, helping SMEs automate functions like customer support, marketing, and resource optimization. AI-powered CRM tools from providers like Salesforce Einstein, Zoho, and HubSpot are also accelerating adoption among SMEs, reinforcing their growing importance in the AI platform ecosystem.

AI Platforms Market Analysis by Industry Sector

BFSI (Banking, Financial Services, and Insurance) represents the largest industry sector in the global AI Platforms market, contributing an estimated 18.6% share in 2024. The sector's data-rich environment, including customer profiles, transaction records, and insurance claims, makes it highly suitable for AI-driven analytics, fraud detection, and risk assessment. AI platforms are widely used for real-time identification of fraudulent activity, automation of loan and claims processing, and enhancing customer service through chatbots and robo-advisors. Leading institutions like JPMorgan Chase and Allstate are leveraging AI to deliver personalized offerings and streamline operations. On the other hand, Healthcare is expected to be the fastest-growing sector, registering a CAGR of 36.3% between 2024 and 2030. AI is transforming this field through innovations in diagnostics, drug discovery, personalized treatment, and patient monitoring. The rapid increase in healthcare data, such as electronic health records, wearable device data, and genomic information, is driving adoption of AI platforms for predictive analytics and clinical decision-making. Government initiatives, startup investments, and cloud-based tools like Azure Health AI and AWS HealthLake are lowering adoption barriers for providers of all sizes. Additionally, new use cases including AI-assisted surgeries, telemedicine, and mental health monitoring are accelerating the use of AI across the healthcare ecosystem.

AI Platforms Market Report Scope

This global report on AI Platforms analyzes the global and regional markets based on Technology, Deployment Type, Company Type and Industry Sector for the period 2021-2030 with forecasts from 2024 to 2023 in terms of value in US$. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of how and where the market is progressing.

AI Platforms Market by Geographic Region

- North America (The United States, Canada and Mexico)

- Europe (Germany, the United Kingdom, France, Italy, the Netherlands, Spain, Russia, Switzerland and Rest of Europe)

- Asia-Pacific (China, Japan, India, Australia, Singapore, South Korea and Rest of Asia-Pacific)

- South America (Brazil, Argentina, Colombia, Chile, Peru and Rest of South America)

- Middle East & Africa (The United Arab Emirates, South Africa, Egypt, Saudi Arabia, Morocco, Kuwait, Qatar and Rest of Middle East & Africa)

AI Platforms Market by Technology

- Machine Learning (ML)

- Natural Language Processing (NLP)

- Deep Learning

- Computer Vision

- Robotic Process Automation (RPA)

AI Platforms Market by Deployment Type

- Cloud

- On-Premise

AI Platforms Market by Company Type

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

AI Platforms Market by Industry Sector

- BFSI (Banking, Financial Services, Insurance)

- IT & Telecom

- Manufacturing

- Government

- Healthcare

- Retail & Ecommerce

- Energy & Utilities

- Transportation

- Education

- Others

Major Market Players:

|

|

TABLE OF CONTENTS

PART A: GLOBAL MARKET PERSPECTIVE

1. EXECUTIVE SUMMARY

- 1.1. A Roundup on Artificial Intelligence Platforms

- 1.1.1. Market Segmentation for AI Platforms

- 1.1.1.1. Technologies

- 1.1.1.2. Deployment Types

- 1.1.1.3. Company Types

- 1.1.1.4. Industry Sectors

- 1.1.1. Market Segmentation for AI Platforms

2. INDUSTRY LANDSCAPE

- 2.1. Artificial Intelligent (AI) Platform Market Outlook

- 2.2. Comprehensive AI Platform Industry Analysis - Growth Drivers and Inhibitors

- 2.2.1. Growth Drivers

- 2.2.1.1. Technological Catalysts

- 2.2.1.2. Economic Momentum & Policy Catalysts

- 2.2.1.3. Competitive Innovation and Specialization

- 2.2.1.4. Demand-Side Pull & Expanding Use Cases

- 2.2.1.5. Strategic Outlook & Market Trajectory

- 2.2.2. Growth Inhibitors

- 2.2.2.1. Technological Bottlenecks

- 2.2.2.2. Cost Pressures and Investment Hurdles

- 2.2.2.3. Regulatory Complexity and Data Governance

- 2.2.2.4. Vendor Lock-In and Ecosystem Fragmentation

- 2.2.2.5. Adoption Resistance and Skills Gap

- 2.2.1. Growth Drivers

- 2.3. Risk Landscape and Entry Barriers in the AI Platform Industry

- 2.3.1. Technological Hurdles

- 2.3.2. Capital and Talent Constraints

- 2.3.3. Competitive and Market Saturation Risks

- 2.3.4. Supply Chain and Infrastructure Vulnerabilities

- 2.3.5. Regulatory and Legal Pressure

- 2.3.6. User Adoption and Change-Management Issues

- 2.4. Market Entry/Exit Strategies for AI Platform Industry

- 2.4.1. Market Entry

- 2.4.1.1. Alliance-First Approach

- 2.4.1.2. Build-from-Scratch Deployment

- 2.4.1.3. Acquire-to-Scale Path

- 2.4.1.4. License-and-Embed Route

- 2.4.1.5. Shared-Equity Framework

- 2.4.1.6. Partner-Led Distribution Channel

- 2.4.2. Exit Strategies

- 2.4.2.1. Acquire-to-Integrate Path

- 2.4.2.2. Public-Listing Road

- 2.4.2.3. Partial Asset Transfer

- 2.4.2.4. Retrench-or-Reroute Option

- 2.4.1. Market Entry

- 2.5. Startup Headwinds in the AI Platform Market

- 2.5.1. Data Scarcity and Bias Barriers

- 2.5.2. Misaligned Sales and Distribution Tactics

- 2.5.3. Capital Crunch and Cost Constraints

- 2.5.4. Skilled Workforce Deficit

- 2.5.5. Complex Regulatory Compliance Roadblocks

- 2.5.6. Proof-of-Value and Transparency Challenges

- 2.5.7. Cross Border Growth Obstacles

- 2.5.8. Standing Out Amid Platform Saturation

- 2.5.9. Scaling Strains and Fit Friction

- 2.5.10. Customer Conversion and Education Barriers

- 2.6. Strategic AI Platform Industry Analysis

- 2.6.1. SWOT Analysis

- 2.6.1.1. Strengths

- 2.6.1.2. Weaknesses

- 2.6.1.3. Opportunities

- 2.6.1.4. Threats

- 2.6.2. Porter's Five Forces Analysis

- 2.6.3. PESTLE Analysis

- 2.6.1. SWOT Analysis

3. COMPETITIVE LANDSCAPE

- 3.1. Market Positioning of Key Companies

- 3.1.1. Microsoft Azure AI

- 3.1.2. Amazon Web Services (AWS)

- 3.1.3. Google Cloud AI

- 3.1.4. OpenAI

- 3.1.5. IBM Watsonx

- 3.2. Market Share Analysis of Artificial Intelligent (AI) Platform

- 3.3. Emerging Opportunities in the AI Platform Market

- 3.3.1. Broadening Market Horizons

- 3.3.2. Untapped Niches with Outsized Potential

- 3.3.3. Technology Catalysts Driving the Next Wave

- 3.3.4. Adoption Trajectory Through 2030

- 3.4. Key Market Players

- 3.4.1. Adobe Inc.

- 3.4.2. Amazon Web Services, Inc.

- 3.4.3. Baidu Inc.

- 3.4.4. C3.ai Inc

- 3.4.5. Clarifai

- 3.4.6. Dell Technologies Inc.

- 3.4.7. Databricks Inc.

- 3.4.8. DataRobot Inc.

- 3.4.9. Exlservice Holdings Inc.

- 3.4.10. Google LLC

- 3.4.11. H2O.ai

- 3.4.12. Hewlett Packard Enterprise Co.

- 3.4.13. International Business Machines Corp. (IBM)

- 3.4.14. Infogain

- 3.4.15. Infosys Ltd.

- 3.4.16. Intel Corporation

- 3.4.17. Meta Platforms Inc.

- 3.4.18. Microsoft Corporation

- 3.4.19. Mixpanel

- 3.4.20. New Relic Inc.

- 3.4.21. NVIDIA Corporation

- 3.4.22. OpenAI

- 3.4.23. Optimizely

- 3.4.24. Oracle Corporation

- 3.4.25. Palantir Technologies Inc.

- 3.4.26. Qualcomm Technologies, Inc.

- 3.4.27. Salesforce, Inc.

- 3.4.28. ServiceNow Inc.

- 3.4.29. SAS Institute Inc.

- 3.4.30. SoundHound AI

- 3.4.31. Symphony AI

- 3.4.32. Wipro Ltd.

4. KEY BUSINESS & PRODUCT TRENDS

- 4.1. June 2025

- 4.1.1. C3 AI and HII Collaborate to Boost Shipyard Efficiency with Enterprise AI

- 4.1.2. Mixpanel Announces Expansion of its Digital Analytics Platform

- 4.1.3. xAI Now offers Grok Models through Oracle Cloud Infrastructure (OCI)

- 4.1.4. Oracle and NVIDIA Expand Collaboration for AI Innovation

- 4.1.5. Databricks Announces Strategic Partnership with Google Cloud

- 4.1.6. Superblocks and Databricks Deepen Collaboration to Deploy Data and AI Apps Securely

- 4.2. May 2025

- 4.2.1. Microsoft and Yotta Forge Partnership to Enhance AI infrastructure in India

- 4.2.2. Meta and Red Hat Collaborate to Fuel the Evolution of Generative AI for Enterprise

- 4.2.3. Clarifai Joins Vultr Cloud Alliance to Deliver Scalable, Secure Full-Stack AI Solutions

- 4.2.4. Accenture Announces Collaboration with Dell Technologies and NVIDIA

- 4.2.5. Dell Introduces Novel Next Generation Enterprise AI Solutions with NVIDIA

- 4.2.6. H2O.ai Granted with FedRAMP-R "In Process" designation

- 4.2.7. Databricks Introduces Data Intelligence for Marketing

- 4.2.8. Seekr Announces Multi-year Agreement with OCI

- 4.2.9. Optimizely Announces Improvements to Optimizely Opal

- 4.2.10. ServiceNow Introduces Reimagined ServiceNow AI Platform

- 4.2.11. IBM Announces technology Partnership with Oracle

- 4.3. April 2025

- 4.3.1. OpenAI Unveils OpenAI o3 and o4-mini

- 4.3.2. Google Announces Updates to its Vertex AI Platform

- 4.3.3. Danone Adopts Databricks to Power 'OneSource 2.0' and Accelerate Data-to-Decision with AI

- 4.3.4. C3 AI and Arcfield Collaborate to Enhance Service for Defense and Intelligence Agencies

- 4.4. March 2025

- 4.4.1. Infogain Announces Launch of Ignis

- 4.4.2. NVIDIA Empowers Storage Providers with AI Data Platform for AI Inference Workloads

- 4.4.3. Databricks and Palantir Forge Strategic Product Partnership

- 4.5. February 2025

- 4.5.1. OpenAI Launches Research Preview of GPT-4.5

- 4.5.2. New Relic Introduces New AI Capabilities to its Intelligent Observability Platform

- 4.5.3. EXL Unveils EXLerate.AI(TM) Platform

- 4.6. December 2024

- 4.6.1. Comet Announces Strategic Partnership with AWS

- 4.6.2. AWS Introduces New Generation of AWS

- 4.7. November 2024

- 4.7.1. Microsoft Unveils Azure AI Foundry

- 4.7.2. SAS Unveils SAS-R Viya-R Workbench

- 4.8. October 2024

- 4.8.1. New Relic Unveils Novel Intelligent Observability Platform

- 4.9. September 2024

- 4.9.1. HPE Announces Availability of HPE Private Cloud AI and New Solution Accelerators

- 4.10. August 2024

- 4.10.1. Wipro Announces Extended Collaboration with Dell

- 4.11. July 2024

- 4.11.1. Oracle Announces Availability of Palantir's Foundry and AIP on OCI

- 4.12. June 2024

- 4.12.1. Wipro Forges Strategic Collaboration with HPE

- 4.12.2. OpenAI to Extend Microsoft Azure AI Platform through OCI

- 4.12.3. Wipro Announces Launch of Lab45 AI Platform

- 4.13. March 2024

- 4.13.1. Cloudera Expands NVIDIA Partnership to Power AI Capabilities with NIM Microservices

- 4.14. February 2024

- 4.14.1. Wipro Unveils Wipro Enterprise Artificial Intelligence (AI)-Ready Platform

- 4.15. November 2023

- 4.15.1. Databricks Inc. Launches Data Intelligence Platform

- 4.16. June 2023

- 4.16.1. Adobe Announces Launch of New Sensei GenAI Services New Sensei GenAI Services

5. GLOBAL MARKET OVERVIEW

- 5.1. Global AI Platform Market Overview by Technology

- 5.1.1. AI Platform Technology Market Overview by Global Region

- 5.1.1.1. Machine Learning (ML)

- 5.1.1.2. Natural Language Processing (NLP)

- 5.1.1.3. Deep Learning

- 5.1.1.4. Computer Vision

- 5.1.1.5. Robotic Process Automation (RPA)

- 5.1.1. AI Platform Technology Market Overview by Global Region

- 5.2. Global AI Platform Market Overview by Deployment Type

- 5.2.1. AI Platform Deployment Market Overview by Global Region

- 5.2.1.1. Cloud

- 5.2.1.2. On-Premise

- 5.2.1. AI Platform Deployment Market Overview by Global Region

- 5.3. Global AI Platform Market Overview by Company Type

- 5.3.1. AI Platform Company Type Market Overview by Global Region

- 5.3.1.1. Large Enterprises

- 5.3.1.2. Small & Medium-sized Enterprises (SMEs)

- 5.3.1. AI Platform Company Type Market Overview by Global Region

- 5.4. Global AI Platform Market Overview by Industry Sector

- 5.4.1. AI Platform Industry Sector Market Overview by Global Region

- 5.4.1.1. BFSI

- 5.4.1.2. IT & Telecom

- 5.4.1.3. Manufacturing

- 5.4.1.4. Government

- 5.4.1.5. Healthcare

- 5.4.1.6. Retail & Ecommerce

- 5.4.1.7. Energy & Utilities

- 5.4.1.8. Transportation

- 5.4.1.9. Education

- 5.4.1.10. Other Sectors

- 5.4.1. AI Platform Industry Sector Market Overview by Global Region

PART B: REGIONAL MARKET PERSPECTIVE

REGIONAL MARKET OVERVIEW

6. NORTH AMERICA

- 6.1. North American Artificial Intelligence (AI) Platform Market Overview by Geographic Region

- 6.2. North American Artificial Intelligence (AI) Platform Market Overview by Technology

- 6.3. North American Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 6.4. North American Artificial Intelligence (AI) Platform Market Overview by Company Type

- 6.5. North American Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 6.6. Country-wise Analysis of North American Artificial Intelligent Platform Market

- 6.6.1. THE UNITED STATES

- 6.6.1.1. United States Artificial Intelligence (AI) Platform Market Overview by Technology

- 6.6.1.2. United States Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 6.6.1.3. United States Artificial Intelligence (AI) Platform Market Overview by Company Type

- 6.6.1.4. United States Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 6.6.2. CANADA

- 6.6.2.1. Canadian Artificial Intelligence (AI) Platform Market Overview by Technology

- 6.6.2.2. Canadian Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 6.6.2.3. Canadian Artificial Intelligence (AI) Platform Market Overview by Company Type

- 6.6.2.4. Canadian Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 6.6.3. MEXICO

- 6.6.3.1. Mexican Artificial Intelligence (AI) Platform Market Overview by Technology

- 6.6.3.2. Mexican Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 6.6.3.3. Mexican Artificial Intelligence (AI) Platform Market Overview by Company Type

- 6.6.3.4. Mexican Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 6.6.1. THE UNITED STATES

7. EUROPE

- 7.1. European Artificial Intelligence (AI) Platform Market Overview by Geographic Region

- 7.2. European Artificial Intelligence (AI) Platform Market Overview by Technology

- 7.3. European Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 7.4. European Artificial Intelligence (AI) Platform Market Overview by Company Type

- 7.5. European Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 7.6. Country-wise Analysis of European Artificial Intelligent Platform Market

- 7.6.1. GERMANY

- 7.6.1.1. German Artificial Intelligence (AI) Platform Market Overview by Technology

- 7.6.1.2. German Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 7.6.1.3. German Artificial Intelligence (AI) Platform Market Overview by Company Type

- 7.6.1.4. German Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 7.6.2. THE UNITED KINGDOM

- 7.6.2.1. United Kingdom Artificial Intelligence (AI) Platform Market Overview by Technology

- 7.6.2.2. United Kingdom Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 7.6.2.3. United Kingdom Artificial Intelligence (AI) Platform Market Overview by Company Type

- 7.6.2.4. United Kingdom Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 7.6.3. FRANCE

- 7.6.3.1. French Artificial Intelligence (AI) Platform Market Overview by Technology

- 7.6.3.2. French Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 7.6.3.3. French Artificial Intelligence (AI) Platform Market Overview by Company Type

- 7.6.3.4. French Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 7.6.4. ITALY

- 7.6.4.1. Italian Artificial Intelligence (AI) Platform Market Overview by Technology

- 7.6.4.2. Italian Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 7.6.4.3. Italian Artificial Intelligence (AI) Platform Market Overview by Company Type

- 7.6.4.4. Italian Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 7.6.5. THE NETHERLANDS

- 7.6.5.1. Dutch Artificial Intelligence (AI) Platform Market Overview by Technology

- 7.6.5.2. Dutch Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 7.6.5.3. Dutch Artificial Intelligence (AI) Platform Market Overview by Company Type

- 7.6.5.4. Dutch Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 7.6.6. SPAIN

- 7.6.6.1. Spanish Artificial Intelligence (AI) Platform Market Overview by Technology

- 7.6.6.2. Spanish Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 7.6.6.3. Spanish Artificial Intelligence (AI) Platform Market Overview by Company Type

- 7.6.6.4. Spanish Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 7.6.7. RUSSIA

- 7.6.7.1. Russian Artificial Intelligence (AI) Platform Market Overview by Technology

- 7.6.7.2. Russian Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 7.6.7.3. Russian Artificial Intelligence (AI) Platform Market Overview by Company Type

- 7.6.7.4. Russian Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 7.6.8. SWITZERLAND

- 7.6.8.1. Swiss Artificial Intelligence (AI) Platform Market Overview by Technology

- 7.6.8.2. Swiss Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 7.6.8.3. Swiss Artificial Intelligence (AI) Platform Market Overview by Company Type

- 7.6.8.4. Swiss Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 7.6.9. REST OF EUROPE

- 7.6.9.1. Rest of Europe Artificial Intelligence (AI) Platform Market Overview by Technology

- 7.6.9.2. Rest of Europe Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 7.6.9.3. Rest of Europe Artificial Intelligence (AI) Platform Market Overview by Company Type

- 7.6.9.4. Rest of Europe Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 7.6.1. GERMANY

8. ASIA-PACIFIC

- 8.1. Asia-Pacific Artificial Intelligence (AI) Platform Market Overview by Geographic Region

- 8.2. Asia-Pacific Artificial Intelligence (AI) Platform Market Overview by Technology

- 8.3. Asia-Pacific Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 8.4. Asia-Pacific Artificial Intelligence (AI) Platform Market Overview by Company Type

- 8.5. Asia-Pacific Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 8.6. Country-wise Analysis of Asia-Pacific Artificial Intelligent Platform Market

- 8.6.1. CHINA

- 8.6.1.1. Chinese Artificial Intelligence (AI) Platform Market Overview by Technology

- 8.6.1.2. Chinese Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 8.6.1.3. Chinese Artificial Intelligence (AI) Platform Market Overview by Company Type

- 8.6.1.4. Chinese Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 8.6.2. JAPAN

- 8.6.2.1. Japanese Artificial Intelligence (AI) Platform Market Overview by Technology

- 8.6.2.2. Japanese Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 8.6.2.3. Japanese Artificial Intelligence (AI) Platform Market Overview by Company Type

- 8.6.2.4. Japanese Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 8.6.3. INDIA

- 8.6.3.1. Indian Artificial Intelligence (AI) Platform Market Overview by Technology

- 8.6.3.2. Indian Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 8.6.3.3. Indian Artificial Intelligence (AI) Platform Market Overview by Company Type

- 8.6.3.4. Indian Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 8.6.4. AUSTRALIA

- 8.6.4.1. Australia Artificial Intelligence (AI) Platform Market Overview by Technology

- 8.6.4.2. Australia Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 8.6.4.3. Australia Artificial Intelligence (AI) Platform Market Overview by Company Type

- 8.6.4.4. Australia Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 8.6.5. SINGAPORE

- 8.6.5.1. Singaporean Artificial Intelligence (AI) Platform Market Overview by Technology

- 8.6.5.2. Singaporean Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 8.6.5.3. Singaporean Artificial Intelligence (AI) Platform Market Overview by Company Type

- 8.6.5.4. Singaporean Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 8.6.6. SOUTH KOREA

- 8.6.6.1. South Korean Artificial Intelligence (AI) Platform Market Overview by Technology

- 8.6.6.2. South Korean Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 8.6.6.3. South Korean Artificial Intelligence (AI) Platform Market Overview by Company Type

- 8.6.6.4. South Korean Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 8.6.7. REST OF ASIA-PACIFIC

- 8.6.7.1. Rest of Asia-Pacific Artificial Intelligence (AI) Platform Market Overview by Technology

- 8.6.7.2. Rest of Asia-Pacific Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 8.6.7.3. Rest of Asia-Pacific Artificial Intelligence (AI) Platform Market Overview by Company Type

- 8.6.7.4. Rest of Asia-Pacific Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 8.6.1. CHINA

9. SOUTH AMERICA

- 9.1. South American Artificial Intelligence (AI) Platform Market Overview by Geographic Region

- 9.2. South American Artificial Intelligence (AI) Platform Market Overview by Technology

- 9.3. South American Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 9.4. South American Artificial Intelligence (AI) Platform Market Overview by Company Type

- 9.5. South American Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 9.6. Country-wise Analysis of South American Artificial Intelligent Platform Market

- 9.6.1. BRAZIL

- 9.6.1.1. Brazilian Artificial Intelligence (AI) Platform Market Overview by Technology

- 9.6.1.2. Brazilian Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 9.6.1.3. Brazilian Artificial Intelligence (AI) Platform Market Overview by Company Type

- 9.6.1.4. Brazilian Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 9.6.2. Argentina

- 9.6.2.1. Argentine Artificial Intelligence (AI) Platform Market Overview by Technology

- 9.6.2.2. Argentine Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 9.6.2.3. Argentine Artificial Intelligence (AI) Platform Market Overview by Company Type

- 9.6.2.4. Argentine Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 9.6.3. COLOMBIA

- 9.6.3.1. Colombian Artificial Intelligence (AI) Platform Market Overview by Technology

- 9.6.3.2. Colombian Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 9.6.3.3. Colombian Artificial Intelligence (AI) Platform Market Overview by Company Type

- 9.6.3.4. Colombian Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 9.6.4. CHILE

- 9.6.4.1. Chilean Artificial Intelligence (AI) Platform Market Overview by Technology

- 9.6.4.2. Chilean Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 9.6.4.3. Chilean Artificial Intelligence (AI) Platform Market Overview by Company Type

- 9.6.4.4. Chilean Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 9.6.5. PERU

- 9.6.5.1. Peruvian Artificial Intelligence (AI) Platform Market Overview by Technology

- 9.6.5.2. Peruvian Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 9.6.5.3. Peruvian Artificial Intelligence (AI) Platform Market Overview by Company Type

- 9.6.5.4. Peruvian Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 9.6.6. REST OF SOUTH AMERICA

- 9.6.6.1. Rest of South America Artificial Intelligence (AI) Platform Market Overview by Technology

- 9.6.6.2. Rest of South America Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 9.6.6.3. Rest of South America Artificial Intelligence (AI) Platform Market Overview by Company Type

- 9.6.6.4. Rest of South America Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 9.6.1. BRAZIL

10. MIDDLE EAST & AFRICA

- 10.1. Middle East & Africa Artificial Intelligence (AI) Platform Market Overview by Geographic Region

- 10.2. Middle East & Africa Artificial Intelligence (AI) Platform Market Overview by Technology

- 10.3. Middle East & Africa Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 10.4. Middle East & Africa Artificial Intelligence (AI) Platform Market Overview by Company Type

- 10.5. Middle East & Africa Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 10.6. Country-wise Analysis of Middle & Africa Artificial Intelligent Platform Market

- 10.6.1. THE UNITED ARAB EMIRATES

- 10.6.1.1. United Arab Emirates Artificial Intelligence (AI) Platform Market Overview by Technology

- 10.6.1.2. United Arab Emirates Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 10.6.1.3. United Arab Emirates Artificial Intelligence (AI) Platform Market Overview by Company Type

- 10.6.1.4. United Arab Emirates Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 10.6.2. SOUTH AFRICA

- 10.6.2.1. South African Artificial Intelligence (AI) Platform Market Overview by Technology

- 10.6.2.2. South African Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 10.6.2.3. South African Artificial Intelligence (AI) Platform Market Overview by Company Type

- 10.6.2.4. South African Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 10.6.3. EGYPT

- 10.6.3.1. Egyptian Artificial Intelligence (AI) Platform Market Overview by Technology

- 10.6.3.2. Egyptian Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 10.6.3.3. Egyptian Artificial Intelligence (AI) Platform Market Overview by Company Type

- 10.6.3.4. Egyptian Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 10.6.4. SAUDI ARABIA

- 10.6.4.1. Saudi Arabian Artificial Intelligence (AI) Platform Market Overview by Technology

- 10.6.4.2. Saudi Arabian Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 10.6.4.3. Saudi Arabian Artificial Intelligence (AI) Platform Market Overview by Company Type

- 10.6.4.4. Saudi Arabian Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 10.6.5. MOROCCO

- 10.6.5.1. Moroccan Artificial Intelligence (AI) Platform Market Overview by Technology

- 10.6.5.2. Moroccan Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 10.6.5.3. Moroccan Artificial Intelligence (AI) Platform Market Overview by Company Type

- 10.6.5.4. Moroccan Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 10.6.6. KUWAIT

- 10.6.6.1. Kuwait Artificial Intelligence (AI) Platform Market Overview by Technology

- 10.6.6.2. Kuwait Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 10.6.6.3. Kuwait Artificial Intelligence (AI) Platform Market Overview by Company Type

- 10.6.6.4. Kuwait Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 10.6.7. QATAR

- 10.6.7.1. Qatar Artificial Intelligence (AI) Platform Market Overview by Technology

- 10.6.7.2. Qatar Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 10.6.7.3. Qatar Artificial Intelligence (AI) Platform Market Overview by Company Type

- 10.6.7.4. Qatar Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 10.6.8. REST OF MIDDLE EAST & AFRICA

- 10.6.8.1. Rest of Middle East & Africa Artificial Intelligence (AI) Platform Market Overview by Technology

- 10.6.8.2. Rest of Middle East & Africa Artificial Intelligence (AI) Platform Market Overview by Deployment Type

- 10.6.8.3. Rest of Middle East & Africa Artificial Intelligence (AI) Platform Market Overview by Company Type

- 10.6.8.4. Rest of Middle East & Africa Artificial Intelligence (AI) Platform Market Overview by Industry Sector

- 10.6.1. THE UNITED ARAB EMIRATES

PART C: GUIDE TO THE INDUSTRY

- 1. NORTH AMERICA

- 2. EUROPE

- 3. ASIA-PACIFIC

PART D: ANNEXURE

- 1. RESEARCH METHODOLOGY

- 2. FEEDBACK

Charts & Graphs

PART A: GLOBAL MARKET PERSPECTIVE

- Chart 1: Global AI Platform Market (2024 & 2030) by Geographic Region

- Chart 2: Global AI Platform Market (2024 & 2030) by Technology

- Chart 3: Global AI Platform Market (2024 & 2030) by Deployment Type

- Chart 4: Global AI Platform Market (2024 & 2030) by Company Type

- Chart 5: Global AI Platform Market (2024 & 2030) by Industry Sector

- Chart 6: Global Artificial Intelligence (AI) Platform Market Share (2024) by Company

GLOBAL MARKET OVERVIEW

- Chart 7: Global AI Platform Market Analysis (2021-2030) in US$ Million

- Chart 8: Global AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 9: Glance at 2021, 2024 and 2030 Global AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 10: Global AI Platform-Machine Learning (ML) Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 11: Glance at 2021, 2024 and 2030 Global AI Platform-Machine Learning (ML) Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 12: Global AI Platform-Natural Language Processing (NLP) Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 13: Glance at 2021, 2024 and 2030 Global AI Platform-Natural Language Processing (NLP) Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 14: Global AI Platform-Deep Learning Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 15: Glance at 2021, 2024 and 2030 Global AI Platform-Deep Learning Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 16: Global AI Platform-Computer Vision Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 17: Glance at 2021, 2024 and 2030 Global AI Platform-Computer Vision Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 18: Global AI Platform-Robotic Process Automation (RPA) Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 19: Glance at 2021, 2024 and 2030 Global AI Platform-Robotic Process Automation (RPA) Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 20: Global AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 21: Glance at 2021, 2024 and 2030 Global AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 22: Global Cloud AI Platform Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 23: Glance at 2021, 2024 and 2030 Global Cloud AI Platform Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 24: Global On-Premise AI Platform Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 25: Glance at 2021, 2024 and 2030 Global On-Premise AI Platform Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 26: Global AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 27: Glance at 2021, 2024 and 2030 Global AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 28: Global AI Platform in Large Enterprises Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 29: Glance at 2021, 2024 and 2030 Global AI Platform in Large Enterprises Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 30: Global AI Platform in Small & Medium-sized Enterprises (SMEs) Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 31: Glance at 2021, 2024 and 2030 Global AI Platform in Small & Medium-sized Enterprises (SMEs) Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 32: Global AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 33: Glance at 2021, 2024 and 2030 Global AI Platform Market Share (%) by Industry Sector - BFSI, IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

- Chart 34: Global AI Platform Market Analysis (2021-2030) in BFSI Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 35: Glance at 2021, 2024 and 2030 Global AI Platform Market Share (%) in BFSI Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 36: Global AI Platform Market Analysis (2021-2030) in IT & Telecom Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 37: Glance at 2021, 2024 and 2030 Global AI Platform in IT & Telecom Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 38: Global AI Platform Market Analysis (2021-2030) in Manufacturing Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 39: Glance at 2021, 2024 and 2030 Global AI Platform Market Share (%) in Manufacturing Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 40: Global AI Platform Market Analysis (2021-2030) in Government Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 41: Glance at 2021, 2024 and 2030 Global AI Platform Market Share (%) in Government Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 42: Global AI Platform Market Analysis (2021-2030) in Healthcare Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 43: Glance at 2021, 2024 and 2030 Global AI Platform Market Share (%) in Healthcare Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 44: Global AI Platform Market Analysis (2021-2030) in Retail & Ecommerce Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 45: Glance at 2021, 2024 and 2030 Global AI Platform Market Share (%) in Retail & Ecommerce Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 46: Global AI Platform Market Analysis (2021-2030) in Energy & Utilities Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 47: Glance at 2021, 2024 and 2030 Global AI Platform Market Share (%) in Energy & Utilities Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 48: Global AI Platform Market Analysis (2021-2030) in Transportation Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 49: Glance at 2021, 2024 and 2030 Global AI Platform Market Share (%) in Transportation Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 50: Global AI Platform Market Analysis (2021-2030) in Education Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 51: Glance at 2021, 2024 and 2030 Global AI Platform Market Share (%) in Education Sector by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

- Chart 52: Global AI Platform in Market Analysis (2021-2030) in Other Sectors by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 53: Glance at 2021, 2024 and 2030 Global AI Platform Market Share (%) in Other Sectors by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

PART B: REGIONAL MARKET PERSPECTIVE

- Chart 54: Global AI Platform Market Analysis (2021-2030) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa in US$ Million

- Chart 55: Glance at 2021, 2024 and 2030 Global AI Platform Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific, South America and Middle East & Africa

REGIONAL MARKET OVERVIEW

NORTH AMERICA

- Chart 56: North American AI Platform Market Analysis (2021-2030) in US$ Million

- Chart 57: North American AI Platform Market Analysis (2021-2030) by Geographic Region - United States, Canada and Mexico in US$ Million

- Chart 58: Glance at 2021, 2024 and 2030 North American AI Platform Market Share (%) by Geographic Region - United States, Canada and Mexico

- Chart 59: North American AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 60: Glance at 2021, 2024 and 2030 North American AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 61: North American AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 62: Glance at 2021, 2024 and 2030 North American AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 63: North American AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 64: Glance at 2021, 2024 and 2030 North American AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 65: North American AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 66: Glance at 2021, 2024 and 2030 North American AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

THE UNITED STATES

- Chart 67: United States AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 68: Glance at 2021, 2024 and 2030 United States AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 69: United States AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 70: Glance at 2021, 2024 and 2030 United States AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 71: United States AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 72: Glance at 2021, 2024 and 2030 United States AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 73: United States AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 74: Glance at 2021, 2024 and 2030 United States AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

CANADA

- Chart 75: Canadian AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 76: Glance at 2021, 2024 and 2030 Canadian AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 77: Canadian AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 78: Glance at 2021, 2024 and 2030 Canadian AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 79: Canadian AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 80: Glance at 2021, 2024 and 2030 Canadian AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 81: Canadian AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 82: Glance at 2021, 2024 and 2030 Canadian AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

MEXICO

- Chart 83: Mexican AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 84: Glance at 2021, 2024 and 2030 Mexican AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 85: Mexican AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 86: Glance at 2021, 2024 and 2030 Mexican AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 87: Mexican AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 88: Glance at 2021, 2024 and 2030 Mexican AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 89: Mexican AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 90: Glance at 2021, 2024 and 2030 Mexican AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

EUROPE

- Chart 91: European AI Platform Market Analysis (2021-2030) in US$ Million

- Chart 92: European AI Platform Market Analysis (2021-2030) by Geographic Region - Germany, United Kingdom, France, Italy, Netherlands, Spain, Russia, Switzerland and Rest of Europe in US$ Million

- Chart 93: Glance at 2021, 2024 and 2030 European AI Platform Market Share (%) by Geographic Region - Germany, United Kingdom, France, Italy, Netherlands, Spain, Russia, Switzerland and Rest of Europe

- Chart 94: European AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 95: Glance at 2021, 2024 and 2030 European AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 96: European AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 97: Glance at 2021, 2024 and 2030 European AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 98: European AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 99: Glance at 2021, 2024 and 2030 European AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 100: European AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 101: Glance at 2021, 2024 and 2030 European AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

GERMANY

- Chart 102: German AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 103: Glance at 2021, 2024 and 2030 German AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 104: German AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 105: Glance at 2021, 2024 and 2030 German AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 106: German AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 107: Glance at 2021, 2024 and 2030 German AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 108: German AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 109: Glance at 2021, 2024 and 2030 German AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

THE UNITED KINGDOM

- Chart 110: United Kingdom AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 111: Glance at 2021, 2024 and 2030 United Kingdom AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 112: United Kingdom AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 113: Glance at 2021, 2024 and 2030 United Kingdom AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 114: United Kingdom AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 115: Glance at 2021, 2024 and 2030 United Kingdom AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 116: United Kingdom AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 117: Glance at 2021, 2024 and 2030 United Kingdom AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

FRANCE

- Chart 118: French AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 119: Glance at 2021, 2024 and 2030 French AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 120: French AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 121: Glance at 2021, 2024 and 2030 French AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 122: French AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 123: Glance at 2021, 2024 and 2030 French AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 124: French AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 125: Glance at 2021, 2024 and 2030 French AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

ITALY

- Chart 126: Italian AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 127: Glance at 2021, 2024 and 2030 Italian AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 128: Italian AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 129: Glance at 2021, 2024 and 2030 Italian AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 130: Italian AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 131: Glance at 2021, 2024 and 2030 Italian AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 132: Italian AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 133: Glance at 2021, 2024 and 2030 Italian AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

THE NETHERLANDS

- Chart 134: Dutch AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 135: Glance at 2021, 2024 and 2030 Dutch AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 136: Dutch AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 137: Glance at 2021, 2024 and 2030 Dutch AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 138: Dutch AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 139: Glance at 2021, 2024 and 2030 Dutch AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 140: Dutch AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 141: Glance at 2021, 2024 and 2030 Dutch AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

SPAIN

- Chart 142: Spanish AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 143: Glance at 2021, 2024 and 2030 Spanish AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 144: Spanish AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 145: Glance at 2021, 2024 and 2030 Spanish AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 146: Spanish AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 147: Glance at 2021, 2024 and 2030 Spanish AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 148: Spanish AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 149: Glance at 2021, 2024 and 2030 Spanish AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

RUSSIA

- Chart 150: Russian AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 151: Glance at 2021, 2024 and 2030 Russian AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 152: Russian AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 153: Glance at 2021, 2024 and 2030 Russian AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 154: Russian AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 155: Glance at 2021, 2024 and 2030 Russian AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 156: Russian AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 157: Glance at 2021, 2024 and 2030 Russian AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

SWITZERLAND

- Chart 158: Swiss AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 159: Glance at 2021, 2024 and 2030 Swiss AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 160: Swiss AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 161: Glance at 2021, 2024 and 2030 Swiss AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 162: Swiss AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 163: Glance at 2021, 2024 and 2030 Swiss AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 164: Swiss AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 165: Glance at 2021, 2024 and 2030 Swiss AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

REST OF EUROPE

- Chart 166: Rest of Europe AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 167: Glance at 2021, 2024 and 2030 Rest of Europe AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 168: Rest of Europe AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 169: Glance at 2021, 2024 and 2030 Rest of Europe AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 170: Rest of Europe AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 171: Glance at 2021, 2024 and 2030 Rest of Europe AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 172: Rest of Europe AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 173: Glance at 2021, 2024 and 2030 Rest of Europe AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

ASIA-PACIFIC

- Chart 174: Asia-Pacific AI Platform Market Analysis (2021-2030) in US$ Million

- Chart 175: Asia-Pacific AI Platform Market Analysis (2021-2030) by Geographic Region - China, Japan, India, Australia, Singapore, South Korea and Rest of Asia-Pacific in US$ Million

- Chart 176: Glance at 2021, 2024 and 2030 Asia-Pacific AI Platform Market Share (%) by Geographic Region - China, Japan, India, Australia, Singapore, South Korea and Rest of Asia-Pacific

- Chart 177: Asia-Pacific AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 178: Glance at 2021, 2024 and 2030 Asia-Pacific AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 179: Asia-Pacific AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 180: Glance at 2021, 2024 and 2030 Asia-Pacific AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 181: Asia-Pacific AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 182: Glance at 2021, 2024 and 2030 Asia-Pacific AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 183: Asia-Pacific AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 184: Glance at 2021, 2024 and 2030 Asia-Pacific AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

CHINA

- Chart 185: Chinese AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 186: Glance at 2021, 2024 and 2030 Chinese AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 187: Chinese AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 188: Glance at 2021, 2024 and 2030 Chinese AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 189: Chinese AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 190: Glance at 2021, 2024 and 2030 Chinese AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 191: Chinese AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 192: Glance at 2021, 2024 and 2030 Chinese AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

JAPAN

- Chart 193: Japanese AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 194: Glance at 2021, 2024 and 2030 Japanese AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 195: Japanese AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 196: Glance at 2021, 2024 and 2030 Japanese AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 197: Japanese AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 198: Glance at 2021, 2024 and 2030 Japanese AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 199: Japanese AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 200: Glance at 2021, 2024 and 2030 Japanese AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

INDIA

- Chart 201: Indian AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 202: Glance at 2021, 2024 and 2030 Indian AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 203: Indian AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 204: Glance at 2021, 2024 and 2030 Indian AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 205: Indian AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 206: Glance at 2021, 2024 and 2030 Indian AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)

- Chart 207: Indian AI Platform Market Analysis (2021-2030) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others in US$ Million

- Chart 208: Glance at 2021, 2024 and 2030 Indian AI Platform Market Share (%) by Industry Sector - BFSI (Banking, Financial Services, Insurance), IT & Telecom, Manufacturing, Government, Healthcare, Retail & Ecommerce, Energy & Utilities, Transportation, Education and Others

AUSTRALIA

- Chart 209: Australia AI Platform Market Analysis (2021-2030) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA) in US$ Million

- Chart 210: Glance at 2021, 2024 and 2030 Australia AI Platform Market Share (%) by Technology - Machine Learning (ML), Natural Language Processing (NLP), Deep Learning, Computer Vision and Robotic Process Automation (RPA)

- Chart 211: Australia AI Platform Market Analysis (2021-2030) by Deployment Type - Cloud and On-Premise in US$ Million

- Chart 212: Glance at 2021, 2024 and 2030 Australia AI Platform Market Share (%) by Deployment Type - Cloud and On-Premise

- Chart 213: Australia AI Platform Market Analysis (2021-2030) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs) in US$ Million

- Chart 214: Glance at 2021, 2024 and 2030 Australia AI Platform Market Share (%) by Company Type - Large Enterprises and Small & Medium-sized Enterprises (SMEs)