PUBLISHER: Industry Experts | PRODUCT CODE: 1856786

PUBLISHER: Industry Experts | PRODUCT CODE: 1856786

Global Haptics Market - Technologies and Applications

Global Haptics Market Trends and Outlook

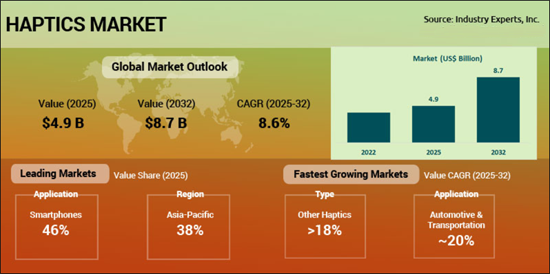

The global haptics market is poised for significant growth, expanding from US$4.9 billion in 2025 to nearly US$8.7 billion by 2032, at a CAGR of 8.6%. Growth is underpinned by rising adoption of advanced haptic feedback technologies in smartphones, gaming, automotive, wearables, healthcare, and the metaverse. While smartphones remain the largest market, demand is shifting towards automotive applications and immersive digital experiences, reflecting the industry's transition beyond traditional mobile use cases.

INFOGRAPHICS

The market is driven by several factors, including the proliferation of touch-based interfaces, growing consumer demand for immersive experiences, advancements in actuator technology (LRAs, piezoelectric, VCAs), and integration of haptics with AR/VR devices. Automotive and transportation emerge as the fastest-growing domain, while Asia-Pacific leads geographically, supported by its dominant electronics manufacturing ecosystem. As industries embrace metaverse wearables, healthcare simulations, robotics, and accessibility solutions, haptics is increasingly positioned as a core enabler of next-generation human-machine interfaces.

Key companies shaping the haptics industry include AAC Technologies, Immersion Corporation, TDK Corporation, Texas Instruments, Microchip Technology, Johnson Electric, Alps Alpine, Ultraleap, and bHaptics. Together, they drive innovation across actuators, software, and applications, with over 40 major company profiles covered and more than 100 industry participants listed.

Haptics Regional Market Analysis

The global haptics market is set for strong growth through 2032, supported by increasing use in smartphones, gaming, automotive, and healthcare applications. Asia-Pacific represents the largest regional market with 38.1% of the global share in 2025, underpinned by its extensive electronics manufacturing base and strong consumer appetite for advanced digital devices. North America is the next major market, leveraging its mature gaming ecosystem, early adoption of VR/AR technologies, and growing deployment in automotive and healthcare sectors. Europe also holds a significant position, benefiting from automotive innovation and medical research. In terms of growth momentum, Asia-Pacific stands out as the fastest-growing region, reflecting rapid adoption of next-generation haptic technologies across consumer and industrial domains. Europe is the second fastest-expanding market, supported by ongoing advances in vehicle infotainment, immersive interfaces, and healthcare applications. North America continues to progress steadily, while the Rest of the World experiences comparatively modest uptake.

Haptics Market Analysis by Type

The haptics market by type continues to be dominated by tactile haptics, which accounts for over 70% share due to its ubiquity in smartphones, tablets, wearables, and consumer electronics. Kinesthetic haptics forms the second-largest category, supported by rising use in gaming consoles, immersive VR/AR environments, and robotics. Vibrotactile haptics, though well established, is gradually losing relative share as more advanced actuator types and applications come to the forefront. From a growth perspective, Other Haptics (including contactless and thermal haptics) is the fastest-growing category, advancing at a CAGR of 18.4%. These innovations are gaining ground in healthcare, automotive, and extended reality applications, offering more natural, immersive, and high-definition touch experiences. Kinesthetic haptics is also set for rapid growth as VR-based entertainment, teleoperation, and medical training expand globally.

Haptics Market Analysis by Actuator Type

Linear Resonant Actuators (LRAs) form the largest segment with share of 45% in 2025, reflecting their dominance in smartphones, wearables, and premium consumer electronics owing to energy efficiency and faster response times. ERM motors remain substantial, but their relative share is gradually declining as the market shifts toward advanced solutions. In terms of momentum, Other Actuators, including electroactive polymers, shape memory alloys, and microfluidics, lead growth with a CAGR of 18.1%, reaching US$420 million by 2032. These innovations are increasingly applied in wearables, medical devices, and VR/AR systems. Piezoelectric actuators are the second fastest-growing, supported by adoption in automotive touch panels, laptops, and high-definition tactile systems.

Haptics Market Analysis by Application

Smartphones continue to be the largest segment, valued at US$2.24 billion in 2025 and representing about 46% of the total. This dominance is attributed to the near-universal use of haptic actuators in mobile devices for alerts, keyboard feedback, and multimedia experiences. Gaming & entertainment stands as the second largest, benefiting from the demand for immersive gameplay through advanced controllers, consoles, and VR peripherals. Looking at growth momentum, automotive & transportation emerges as the fastest-growing segment, advancing at a CAGR of 20% to exceed US$1.8 billion by 2032. This acceleration is fueled by the adoption of haptic-enabled infotainment systems, solid-state controls, ADAS integration, and driver-assist features. Metaverse applications (VR, AR, XR) follow, underpinned by innovation in haptic gloves, suits, and mid-air haptics for immersive digital interactions.

Haptics Market Report Scope

This global report on Haptics market analyzes the global and regional markets based on Type, Actuator Type, and Application for the period 2022-2032 with forecasts from 2025 to 2032 in terms of value in US$. In addition to providing profiles of major companies operating in this space, the latest corporate and industrial developments have been covered to offer a clear panorama of how and where the market is progressing.

| Key Metrics | |

|---|---|

| Analysis Period: | 2022-2032 |

| Base Year: | 2025 |

| Forecast Period: | 2025-2032 |

| Units: | Value market in US$ |

| Companies Mentioned: | 40+ |

Haptics Market by Geographic Region

- North America (The United States, Canada and Mexico)

- Europe (France, Germany, Italy, Spain, the United Kingdom and Rest of Europe)

- Asia-Pacific (China, Japan, South Korea and Rest of Asia-Pacific)

- Rest of World

Haptics Market by Type

- Vibrotactile Haptics

- Tactile Haptics

- Kinesthetic Haptics

- Other Haptics (including contactless haptics, thermal haptics etc.)

Haptics Market by Actuator Type

- Eccentric Rotating Mass (ERM) Motors

- Linear Resonant Actuators (LRA)

- Voice Coil Actuators (VCAs) also referred to as Voice Coil Motors (VCMs)

- Piezoelectric Actuators (PA) (ceramic, composite, and polymer-based)

- Other Actuators (including other tactile, kinesthetic, forced impact, microfluidic systems, and other emerging)

Haptics Market by Application

- Smartphones

- Gaming & Entertainment

- Other Consumer Electronics (includes laptops, notebooks & tablets)

- Metaverse (includes VR, AR and XR)

- Wearables (including smart devices)

- Automotive & Transportation

- Other Applications (robotics, healthcare, military and other emerging)

Major Market Players:

|

|

TABLE OF CONTENTS

PART A: GLOBAL MARKET PERSPECTIVE

1. INTRODUCTION

- 1.1. Global Haptics Market by Type - Snapshot and Forecast

- 1.2. Global Haptics Market by Actuator Type - Snapshot and Forecast

- 1.3. Global Haptics Market by Application - Snapshot and Forecast

- 1.4. Global Haptics Market by Geographic Region - Snapshot and Forecast

- 1.5. Product Outline

- 1.5.1. Haptics Technology Overview

- 1.5.2. Working Principle of Haptic Systems

- 1.5.3. Core Components of Haptic Systems

- 1.5.3.1. Input and Sensing Layer

- 1.5.3.2. Controller or Processor

- 1.5.3.3. Driver Circuitry

- 1.5.3.4. Actuators

- 1.5.3.5. Haptic Software and Rendering Engine

- 1.5.4. Haptics Types

- 1.5.4.1. Vibrotactile Haptics

- 1.5.4.2. Tactile Haptics

- 1.5.4.3. Kinesthetic Haptics

- 1.5.4.4. Other Haptics Types

- 1.5.5. Actuators Used in Haptic Technology

- 1.5.5.1. Eccentric Rotating Mass (ERM) Motors

- 1.5.5.2. Linear Resonant Actuators (LRA)

- 1.5.5.3. Voice Coil Actuators (VCA) / Voice Coil Motors (VCM)

- 1.5.5.4. Piezoelectric Actuators (PA)

- 1.5.5.5. Other Actuators

- 1.5.6. Haptics Applications

- 1.5.6.1. Smartphones

- 1.5.6.2. Gaming & Entertainment

- 1.5.6.3. Other Consumer Electronics

- 1.5.6.4. Metaverse (VR, AR, and XR)

- 1.5.6.5. Wearables (Including Smart Devices)

- 1.5.6.6. Automotive & Transportation

- 1.5.6.6.1. Aerospace and Aviation

- 1.5.6.7. Other Applications

- 1.5.6.7.1. Robotics and Teleoperation

- 1.5.6.7.2. Healthcare and Medical Simulation

- 1.5.6.7.3. Military and Defense

- 1.5.6.7.4. Education and Training

- 1.5.6.7.5. Industrial, Assistive, and Accessibility Technologies

2. KEY MARKET TRENDS

- 2.1. Adaptive Haptics: The Integration of AI for Enhanced Feedback

- 2.2. High-Definition Haptics: The New Frontier in Sensory Immersion

- 2.3. The Rise of Mid-Air and Wearable Haptics

- 2.4. Recent Technology-Focused Developments and Trends in Haptics

- 2.4.1. Automotive & In-Vehicle Haptics: Solid-State Interfaces, Piezo Surge, and Cabin-Wide Feedback

- 2.4.2. Gaming, XR & Immersive Entertainment: From Gloves and Cushions to Cinema-Scale Motion

- 2.4.3. Medical, Healthcare & Assistive Haptics: Precision, Inclusion, and Accessibility

- 2.4.4. Actuators, Drivers & Development Ecosystems: Building Blocks of the Haptic Revolution

- 2.4.5. Consumer Electronics & Smart Devices: Tactility as a Design Language

- 2.4.6. Ecosystem, IP & Industrial Collaborations: Licensing, Partnerships, and Resets

3. KEY MARKET PLAYERS

- 3.1. 3D Systems (United States)

- 3.2. AAC Technologies (China)

- 3.3. Aito Bv (Netherlands)

- 3.4. Alps Alpine (Japan)

- 3.5. bHaptics Inc. (South Korea)

- 3.6. Boreas Technologies (Canada)

- 3.7. Cirrus Logic Inc. (United States)

- 3.8. D-BOX technology (Canada)

- 3.9. Dot Incorporation (South Korea)

- 3.10. Force Dimension (Switzerland)

- 3.11. Fundamental XR (United Kingdom)

- 3.12. General Vibration Corporation (United States)

- 3.13. GREWUS GmbH (Germany)

- 3.14. Haption S.A. (France)

- 3.15. HaptX (United States)

- 3.16. IMAGIS Co., Ltd. (South Korea)

- 3.17. Immersion Corporation (United States)

- 3.18. Johnson Electric Holdings Limited (China)

- 3.19. Kyocera (Japan)

- 3.20. Microchip Technology Inc. (United States)

- 3.21. Minebea Mitsumi Inc. (Japan)

- 3.22. Moog Inc. (United States)

- 3.23. Nidec Corporation (Japan)

- 3.24. Oxford Metrics (United Kingdom)

- 3.25. Precision Microdrives (United Kingdom)

- 3.26. PSYONIC (United States)

- 3.27. PUI Audio (United States)

- 3.28. Razer Inc. (United States)

- 3.29. Renesas Electronics Corporation (Japan)

- 3.30. Semiconductor Components Industries, LLC (Onsemi) (United States)

- 3.31. Siesmic (United States)

- 3.32. SMK Corporation (Japan)

- 3.33. Synaptics Incorporated (United States)

- 3.34. Tanvas (United States)

- 3.35. TDK Corporation (Japan)

- 3.36. Texas Instruments Inc. (United States)

- 3.37. TITAN Haptics Inc. (Canada)

- 3.38. Ultraleap Limited (United Kingdom)

- 3.39. Vibra Nova (France)

- 3.40. Yageo Corporation (Taiwan)

- 3.40.1. Novasentis, Inc.

4. KEY BUSINESS & PRODUCT TRENDS

- 4.1. September 2025

- 4.1.1. TITAN Haptics Announces Launch of Carlton Development Kit in China

- 4.2. July 2025

- 4.2.1. Fundamental VR Rebrands as Fundamental XR

- 4.3. June 2025

- 4.3.1. D-BOX Technologies and HOYTS Announce Extension of their Partnership

- 4.4. May 2025

- 4.4.1. Dot Inc. Unveils Dot Vista at Microsoft Build 2025

- 4.4.2. D-BOX and Cinemark Announce Extension of their Collaboration

- 4.5. April 2025

- 4.5.1. Kyocera Corporation Applies its HAPTIVITY-R Technology to Sigma BF

- 4.5.2. Boreas' Haptic Module to be Integrated into NIO ET9

- 4.5.3. GREWUS and Redtree Solutions Unveil Strategic Partnership

- 4.6. March 2025

- 4.6.1. MinebeaMitsumi Inc. Announces Signing of MOU with Kailas Robotics

- 4.6.2. Ultraleap Sells Parts and Haptics IP

- 4.7. February 2025

- 4.7.1. Microchip Unveils New Additions to maXTouch-R M1 Generation Family

- 4.8. January 2025

- 4.8.1. AAC Unveils new Haptic Automotive Solution

- 4.8.2. Kyocera Partners up With TactoTek for Innovation and also Joins Funding Round

- 4.9. December 2024

- 4.9.1. Alps Alpine Announces Launch of U-Type Haptic Reactor

- 4.9.2. OnePlus Partners with AAC and Fuzzy Hug to Innovated Art and Haptic Technology

- 4.10. November 2024

- 4.10.1. PSYONIC and the Limbs for Life Foundation Unveil Ability Fund

- 4.10.2. HaptX Extends Partnership with AIS Global

- 4.10.3. bHaptics Unveils new Innovations

- 4.11. September 2024

- 4.11.1. Razer Unveils New Innovation at RazerCon 2024

- 4.11.2. Razer Announces Launch of Razer Kraken V4 Pro

- 4.12. June 2024

- 4.12.1. Innovobot Labs Forges Strategic Partnership with GREWUS

- 4.12.2. HaptX Unveils new Innovation HaptX Gloves G1

- 4.13. May 2024

- 4.13.1. Dot Announces Collaboration with Kiosk Group

- 4.14. March 2024

- 4.14.1. Immersion Extends License Agreement with Nintendo

- 4.15. April 2024

- 4.15.1. Orbis and FundamentalVR Launch VR Solution for Surgical Training

- 4.16. February 2024

- 4.16.1. Immersion Signs Licensing Agreement with Meta

- 4.16.2. AAC Announces Acquisition of Acoustics Solutions

- 4.17. December 2023

- 4.17.1. AAC and Ultrasense Collaborate for Innovative Touch Experience Solutions

- 4.18. November 2023

- 4.18.1. D-BOX Announces Strategic Partnership with Playseat-R

- 4.18.2. Boreas Announces Series B Funding

- 4.19. September 2023

- 4.19.1. HaptX Signs MOU with CNS

- 4.19.2. TDK Unveils Development Starter Kit

5. GLOBAL MARKET OVERVIEW

- 5.1. Global Haptics Market Overview by Haptics Type

- 5.1.1. Global Haptics Type Market Overview by Geographic Region

- 5.1.1.1. Vibrotactile Haptics

- 5.1.1.2. Tactile Haptics

- 5.1.1.3. Kinesthetic Haptics

- 5.1.1.4. Other Haptics

- 5.1.1. Global Haptics Type Market Overview by Geographic Region

- 5.2. Global Haptics Market Overview by Actuator Type

- 5.2.1. Global Haptics Actuator Type Market Overview by Geographic Region

- 5.2.1.1. Eccentric Rotating Mass (ERM) Motors

- 5.2.1.2. Linear Resonant Actuators (LRA)

- 5.2.1.3. Voice Coil Actuators (VCAs)

- 5.2.1.4. Piezoelectric Actuators (PA)

- 5.2.1.5. Other Actuators

- 5.2.1. Global Haptics Actuator Type Market Overview by Geographic Region

- 5.3. Global Haptics Market Overview by Application

- 5.3.1. Global Haptics Application Market Overview by Geographic Region

- 5.3.1.1. Smartphones

- 5.3.1.2. Other Consumer Electronics

- 5.3.1.3. Gaming & Entertainment

- 5.3.1.4. Metaverse

- 5.3.1.5. Wearables

- 5.3.1.6. Automotive & Transportation

- 5.3.1.7. Other Applications

- 5.3.1. Global Haptics Application Market Overview by Geographic Region

PART B: REGIONAL MARKET PERSPECTIVE

- Global Haptics Market Overview by Geographic Region

REGIONAL MARKET OVERVIEW

6. NORTH AMERICA

- 6.1. North American Haptics Market Overview by Geographic Region

- 6.2. North American Haptics Market Overview by Haptics Type

- 6.3. North American Haptics Market Overview by Actuator Type

- 6.4. North American Haptics Market Overview by Application

- 6.5. Country-wise Analysis of North American Haptics Market

- 6.5.1. THE UNITED STATES

- 6.5.1.1. United States Haptics Market Overview by Haptics Type

- 6.5.1.2. United States Haptics Market Overview by Actuator Type

- 6.5.1.3. United States Haptics Market Overview by Application

- 6.5.2. CANADA

- 6.5.2.1. Canadian Haptics Market Overview by Haptics Type

- 6.5.2.2. Canadian Haptics Market Overview by Actuator Type

- 6.5.2.3. Canadian Haptics Market Overview by Application

- 6.5.3. MEXICO

- 6.5.3.1. Mexican Haptics Market Overview by Haptics Type

- 6.5.3.2. Mexican Haptics Market Overview by Actuator Type

- 6.5.3.3. Mexican Haptics Market Overview by Application

- 6.5.1. THE UNITED STATES

7. EUROPE

- 7.1. European Haptics Market Overview by Geographic Region

- 7.2. European Haptics Market Overview by Haptics Type

- 7.3. European Haptics Market Overview by Actuator Type

- 7.4. European Haptics Market Overview by Application

- 7.5. Country-wise Analysis of European Haptics Market

- 7.5.1. FRANCE

- 7.5.1.1. French Haptics Market Overview by Haptics Type

- 7.5.1.2. French Haptics Market Overview by Actuator Type

- 7.5.1.3. French Haptics Market Overview by Application

- 7.5.2. GERMANY

- 7.5.2.1. German Haptics Market Overview by Haptics Type

- 7.5.2.2. German Haptics Market Overview by Actuator Type

- 7.5.2.3. German Haptics Market Overview by Application

- 7.5.3. ITALY

- 7.5.3.1. Italian Haptics Market Overview by Haptics Type

- 7.5.3.2. Italian Haptics Market Overview by Actuator Type

- 7.5.3.3. Italian Haptics Market Overview by Application

- 7.5.4. SPAIN

- 7.5.4.1. Spanish Haptics Market Overview by Haptics Type

- 7.5.4.2. Spanish Haptics Market Overview by Actuator Type

- 7.5.4.3. Spanish Haptics Market Overview by Application

- 7.5.5. THE UNITED KINGDOM

- 7.5.5.1. United Kingdom Haptics Market Overview by Haptics Type

- 7.5.5.2. United Kingdom Haptics Market Overview by Actuator Type

- 7.5.5.3. United Kingdom Haptics Market Overview by Application

- 7.5.6. REST OF EUROPE

- 7.5.6.1. Rest of Europe Haptics Market Overview by Haptics Type

- 7.5.6.2. Rest of Europe Haptics Market Overview by Actuator Type

- 7.5.6.3. Rest of Europe Haptics Market Overview by Application

- 7.5.1. FRANCE

8. ASIA-PACIFIC

- 8.1. Asia-Pacific Haptics Market Overview by Geographic Region

- 8.2. Asia-Pacific Haptics Market Overview by Haptics Type

- 8.3. Asia-Pacific Haptics Market Overview by Actuator Type

- 8.4. Asia-Pacific Haptics Market Overview by Application

- 8.5. Country-wise Analysis of Asia-Pacific Haptics Market

- 8.5.1. CHINA

- 8.5.1.1. Chinese Haptics Market Overview by Haptics Type

- 8.5.1.2. Chinese Haptics Market Overview by Actuator Type

- 8.5.1.3. Chinese Haptics Market Overview by Application

- 8.5.2. JAPAN

- 8.5.2.1. Japanese Haptics Market Overview by Haptics Type

- 8.5.2.2. Japanese Haptics Market Overview by Actuator Type

- 8.5.2.3. Japanese Haptics Market Overview by Application

- 8.5.3. SOUTH KOREA

- 8.5.3.1. South Korean Haptics Market Overview by Haptics Type

- 8.5.3.2. South Korean Haptics Market Overview by Actuator Type

- 8.5.3.3. South Korean Haptics Market Overview by Application

- 8.5.4. REST OF ASIA-PACIFIC

- 8.5.4.1. Rest of Asia-Pacific Haptics Market Overview by Haptics Type

- 8.5.4.2. Rest of Asia-Pacific Haptics Market Overview by Actuator Type

- 8.5.4.3. Rest of Asia-Pacific Haptics Market Overview by Application

- 8.5.1. CHINA

9. REST OF WORLD

- 9.1. Rest of World Haptics Market Overview by Haptics Type

- 9.2. Rest of World Haptics Market Overview by Actuator Type

- 9.3. Rest of World Haptics Market Overview by Application

PART C: GUIDE TO THE INDUSTRY

- 1. NORTH AMERICA

- 2. EUROPE

- 3. ASIA-PACIFIC

PART D: ANNEXURE

- 1. RESEARCH METHODOLOGY

- 2. FEEDBACK

Charts & Graphs

PART A: GLOBAL MARKET PERSPECTIVE

- Chart 1: Global Haptics Market (2022-2032) in US$ Million

- Chart 2: Global Haptics Market (2022-2032) by Haptics Type in US$ Million

- Chart 3: Global Haptics Market (2022-2032) by Actuator Type in US$ Million

- Chart 4: Global Haptics Market (2022-2032) by Application in US$ Million

- Chart 5: Global Haptics Market (2022-2032) by Geographic Region in US$ Million

GLOBAL MARKET OVERVIEW

- Chart 6: Global Haptics Market Analysis (2022-2032) in US$ Million

- Chart 7: Global Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 8: Glance at 2022, 2025 and 2032 Global Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 9: Global Vibrotactile Haptics Market Analysis (2022-2032) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 10: Glance at 2022, 2025 and 2032 Global Vibrotactile Haptics Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 11: Global Tactile Haptics Market Analysis (2022-2032) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 12: Glance at 2022, 2025 and 2032 Global Tactile Haptics Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 13: Global Kinesthetic Haptics Market Analysis (2022-2032) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 14: Glance at 2022, 2025 and 2032 Global Kinesthetic Haptics Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 15: Global Other Haptics Market Analysis (2022-2032) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 16: Glance at 2022, 2025 and 2032 Global Other Haptics Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 17: Global Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 18: Glance at 2022, 2025 and 2032 Global Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 19: Global Eccentric Rotating Mass (ERM) Motors Based Haptics Market Analysis (2022-2032) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 20: Glance at 2022, 2025 and 2032 Global Eccentric Rotating Mass (ERM) Motors Based Haptics Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 21: Global Linear Resonant Actuators (LRA) Based Haptics Market Analysis (2022-2032) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 22: Glance at 2022, 2025 and 2032 Global Linear Resonant Actuators (LRA) Based Haptics Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 23: Global Voice Coil Actuators (VCAs) Based Haptics Market Analysis (2022-2032) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 24: Glance at 2022, 2025 and 2032 Global Voice Coil Actuators (VCAs) Based Haptics Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 25: Global Piezoelectric Actuators (PA) Based Haptics Market Analysis (2022-2032) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 26: Glance at 2022, 2025 and 2032 Global Piezoelectric Actuators (PA) Based Haptics Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 27: Global Other Actuators Based Haptics Market Analysis (2022-2032) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 28: Glance at 2022, 2025 and 2032 Global Other Actuators Based Haptics Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 29: Global Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 30: Glance at 2022, 2025 and 2032 Global Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

- Chart 31: Global Haptics Market Analysis (2022-2032) in Smartphones by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 32: Glance at 2022, 2025 and 2032 Global Haptics Market Share (%) in Smartphones by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 33: Global Haptics Market Analysis (2022-2032) in Other Consumer Electronics by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 34: Glance at 2022, 2025 and 2032 Global Haptics Market Share (%) in Other Consumer Electronics by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 35: Global Haptics Market Analysis (2022-2032) in Gaming & Entertainment by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 36: Glance at 2022, 2025 and 2032 Global Haptics Market Share (%) in Gaming & Entertainment by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 37: Global Haptics Market Analysis (2022-2032) in Metaverse by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 38: Glance at 2022, 2025 and 2032 Global Haptics Market Share (%) in Metaverse by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 39: Global Haptics Market Analysis (2022-2032) in Wearables by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 40: Glance at 2022, 2025 and 2032 Global Haptics Market Share (%) in Wearables by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 41: Global Haptics Market Analysis (2022-2032) in Automotive & Transportation by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 42: Glance at 2022, 2025 and 2032 Global Haptics Market Share (%) in Automotive & Transportation by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

- Chart 43: Global Haptics Market Analysis (2022-2032) in Other Applications by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 44: Glance at 2022, 2025 and 2032 Global Haptics Market Share (%) in Other Applications by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

PART B: REGIONAL MARKET PERSPECTIVE

- Chart 45: Global Haptics Market Analysis (2022-2032) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World in US$ Million

- Chart 46: Glance at 2022, 2025 and 2032 Global Haptics Market Share (%) by Geographic Region - North America, Europe, Asia-Pacific and Rest of World

REGIONAL MARKET OVERVIEW

NORTH AMERICA

- Chart 47: North American Haptics Market Analysis (2022-2032) by Geographic Region - United States, Canada and Mexico in US$ Million

- Chart 48: Glance at 2022, 2025 and 2032 North American Haptics Market Share (%) by Geographic Region - United States, Canada and Mexico

- Chart 49: North American Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 50: Glance at 2022, 2025 and 2032 North American Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 51: North American Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 52: Glance at 2022, 2025 and 2032 North American Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 53: North American Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 54: Glance at 2022, 2025 and 2032 North American Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

THE UNITED STATES

- Chart 55: United States Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 56: Glance at 2022, 2025 and 2032 United States Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 57: United States Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 58: Glance at 2022, 2025 and 2032 United States Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 59: United States Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 60: Glance at 2022, 2025 and 2032 United States Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

CANADA

- Chart 61: Canadian Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 62: Glance at 2022, 2025 and 2032 Canadian Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 63: Canadian Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 64: Glance at 2022, 2025 and 2032 Canadian Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 65: Canadian Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 66: Glance at 2022, 2025 and 2032 Canadian Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

MEXICO

- Chart 67: Mexican Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 68: Glance at 2022, 2025 and 2032 Mexican Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 69: Mexican Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 70: Glance at 2022, 2025 and 2032 Mexican Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 71: Mexican Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 72: Glance at 2022, 2025 and 2032 Mexican Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

EUROPE

- Chart 73: European Haptics Market Analysis (2022-2032) by Geographic Region - France, Germany, Italy, Spain, United Kingdom and Rest of Europe in US$ Million

- Chart 74: Glance at 2022, 2025 and 2032 European Haptics Market Share (%) by Geographic Region - France, Germany, Italy, Spain, United Kingdom and Rest of Europe

- Chart 75: European Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 76: Glance at 2022, 2025 and 2032 European Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 77: European Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 78: Glance at 2022, 2025 and 2032 European Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 79: European Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 80: Glance at 2022, 2025 and 2032 European Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

FRANCE

- Chart 81: French Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 82: Glance at 2022, 2025 and 2032 French Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 83: French Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 84: Glance at 2022, 2025 and 2032 French Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 85: French Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 86: Glance at 2022, 2025 and 2032 French Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

GERMANY

- Chart 87: German Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 88: Glance at 2022, 2025 and 2032 German Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 89: German Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 90: Glance at 2022, 2025 and 2032 German Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 91: German Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 92: Glance at 2022, 2025 and 2032 German Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

ITALY

- Chart 93: Italian Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 94: Glance at 2022, 2025 and 2032 Italian Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 95: Italian Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 96: Glance at 2022, 2025 and 2032 Italian Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 97: Italian Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 98: Glance at 2022, 2025 and 2032 Italian Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

SPAIN

- Chart 99: Spanish Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 100: Glance at 2022, 2025 and 2032 Spanish Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 101: Spanish Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 102: Glance at 2022, 2025 and 2032 Spanish Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 103: Spanish Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 104: Glance at 2022, 2025 and 2032 Spanish Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

THE UNITED KINGDOM

- Chart 105: United Kingdom Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 106: Glance at 2022, 2025 and 2032 United Kingdom Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 107: United Kingdom Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 108: Glance at 2022, 2025 and 2032 United Kingdom Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 109: United Kingdom Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 110: Glance at 2022, 2025 and 2032 United Kingdom Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

REST OF EUROPE

- Chart 111: Rest of Europe Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 112: Glance at 2022, 2025 and 2032 Rest of Europe Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 113: Rest of Europe Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 114: Glance at 2022, 2025 and 2032 Rest of Europe Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 115: Rest of Europe Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 116: Glance at 2022, 2025 and 2032 Rest of Europe Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

ASIA-PACIFIC

- Chart 117: Asia-Pacific Haptics Market Analysis (2022-2032) by Geographic Region - China, Japan, South Korea and Rest of Asia-Pacific in US$ Million

- Chart 118: Glance at 2022, 2025 and 2032 Asia-Pacific Haptics Market Share (%) by Geographic Region - China, Japan, South Korea and Rest of Asia-Pacific

- Chart 119: Asia-Pacific Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 120: Glance at 2022, 2025 and 2032 Asia-Pacific Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 121: Asia-Pacific Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 122: Glance at 2022, 2025 and 2032 Asia-Pacific Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 123: Asia-Pacific Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 124: Glance at 2022, 2025 and 2032 Asia-Pacific Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

CHINA

- Chart 125: Chinese Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 126: Glance at 2022, 2025 and 2032 Chinese Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 127: Chinese Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 128: Glance at 2022, 2025 and 2032 Chinese Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 129: Chinese Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 130: Glance at 2022, 2025 and 2032 Chinese Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

JAPAN

- Chart 131: Japanese Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 132: Glance at 2022, 2025 and 2032 Japanese Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 133: Japanese Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 134: Glance at 2022, 2025 and 2032 Japanese Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 135: Japanese Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 136: Glance at 2022, 2025 and 2032 Japanese Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

SOUTH KOREA

- Chart 137: South Korean Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 138: Glance at 2022, 2025 and 2032 South Korean Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 139: South Korean Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 140: Glance at 2022, 2025 and 2032 South Korean Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 141: South Korean Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 142: Glance at 2022, 2025 and 2032 South Korean Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

REST OF ASIA-PACIFIC

- Chart 143: Rest of Asia-Pacific Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 144: Glance at 2022, 2025 and 2032 Rest of Asia-Pacific Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 145: Rest of Asia-Pacific Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 146: Glance at 2022, 2025 and 2032 Rest of Asia-Pacific Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 147: Rest of Asia-Pacific Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 148: Glance at 2022, 2025 and 2032 Rest of Asia-Pacific Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications

REST OF WORLD

- Chart 149: Rest of World Haptics Market Analysis (2022-2032) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics in US$ Million

- Chart 150: Glance at 2022, 2025 and 2032 Rest of World Haptics Market Share (%) by Haptics Type - Vibrotactile Haptics, Tactile Haptics, Kinesthetic Haptics and Other Haptics

- Chart 151: Rest of World Haptics Market Analysis (2022-2032) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators in US$ Million

- Chart 152: Glance at 2022, 2025 and 2032 Rest of World Haptics Market Share (%) by Actuator Type - Eccentric Rotating Mass (ERM) Motors, Linear Resonant Actuators (LRA), Voice Coil Actuators (VCAs), Piezoelectric Actuators (PA) and Other Actuators

- Chart 153: Rest of World Haptics Market Analysis (2022-2032) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications in US$ Million

- Chart 154: Glance at 2022, 2025 and 2032 Rest of World Haptics Market Share (%) by Application - Smartphones, Other Consumer Electronics, Gaming & Entertainment, Metaverse, Wearables, Automotive & Transportation and Other Applications