PUBLISHER: IoT Analytics GmbH | PRODUCT CODE: 1891233

PUBLISHER: IoT Analytics GmbH | PRODUCT CODE: 1891233

Software-defined Vehicles Adoption Report 2026

A report detailing the adoption of software-defined vehicles, incl. deep-dive on the software stack, specific OEM and supplier adoption strategies, and key trends and challenges.

Sample preview

The automotive industry is transitioning from hardware-centric engineering to a software-first approach, fundamentally altering vehicle architecture, development processes, and the driver experience. This shift to Software-Defined Vehicles (SDVs) enables continuous feature updates, centralized computing, and new monetization models through subscription-based services. However, it also introduces complexities in organizational structure, cybersecurity risks, and the integration of multi-system software stacks.

The "Software-Defined Vehicle (SDV) Adoption Report 2026" provides a comprehensive analysis of the SDV landscape, detailing the adoption strategies of major OEMs and Tier-1 suppliers. It examines the market through multiple technical and strategic lenses: the evolution of electrical/electronic (E/E) architectures, the composition of the 8-layer software stack, the role of Artificial Intelligence (AI) in development, and the regulatory frameworks governing vehicle security.

The findings in this report rely on a survey of 86 automotive executives from OEMs and suppliers, conducted in early 2025, alongside 20+ in-depth expert interviews. The research also incorporates insights from major industry events such as AutoShanghai 2025 and IAA Mobility 2025.

Sample preview

Report at a glance

- 140-page report: Detailing the adoption trends, technologies, and strategies defining the SDV market.

- Market prioritization data: Analysis indicates that 45% of OEMs classify SDVs as their top strategic priority, surpassing autonomous driving and electrification.

- Financial insights: Data details that leading OEMs allocate 21% of their SDV expenditure to software, with a nearly equal portion dedicated to electrical/electronic architectures.

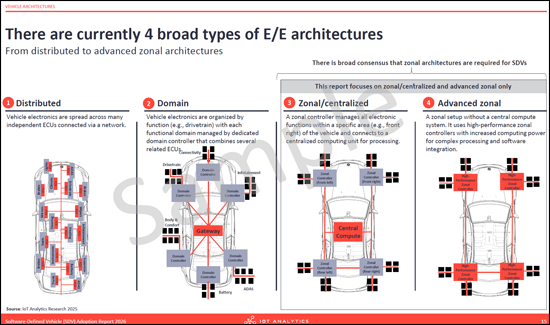

- Deep dive into Zonal Architectures: Examines the migration status, with a vast majority of OEMs currently adopting zonal E/E architectures to reduce wiring complexity and centralize compute power.

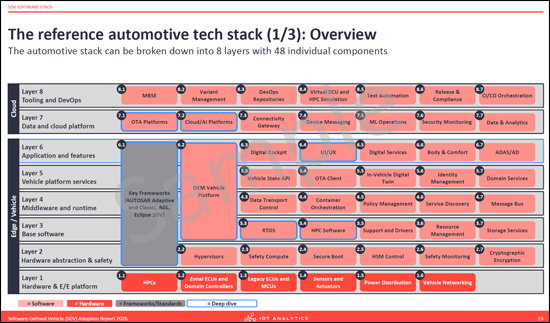

- Software stack breakdown: A structural analysis of the SDV software stack, identifying 8 layers and 48 components, from hardware abstraction to cloud platforms.

- Vendor and OEM landscape: Profiles strategies from key players including Tesla, BMW, Mercedes-Benz, Nio, Nissan, AWS, Microsoft, and NXP.

Sample preview

Key areas of analysis

- Introduction to SDVs: Defines the SDV as a vehicle built with a software-first approach across four dimensions: vehicle architecture, cloud integration, software-driven engineering, and lifecycle management. It outlines the shift from distributed ECUs to centralized computing.

- Vehicle architectures: Details the transition from domain-based to zonal E/E architectures. The section analyzes the benefits of zonal designs, such as weight reduction and simplified wiring, while addressing barriers like skill gaps and high upfront costs.

- The SDV software stack: Dissects the reference automotive tech stack into 8 layers, including the hardware & E/E platform, middleware, and application layers. It evaluates key frameworks such as AUTOSAR Adaptive and Eclipse SDV, and deep-dives into vehicle platforms like MB.OS and Tesla OS.

- Role and adoption of AI: Analyzes the value of AI across the V-model development process. Data indicates that the overwhelming majority of OEMs see the greatest value for AI in software development and validation. The section also covers Generative AI applications in code generation and requirements engineering.

- Security and regulations: Examines the expanded attack surface of SDVs, identifying five primary attack vectors including ECU exploitation and OTA vulnerabilities. It outlines compliance requirements with standards such as ISO 21434 and UN R155/R156.

- OEM and supplier adoption strategies: Contrasts the approaches of tech-native players like Tesla and Nio against traditional incumbents. It highlights that European OEMs prioritize SDVs significantly more aggressively than their APAC counterparts.

- Trends and challenges: Identifies macro trends such as the adoption of cloud-native development pipelines and the modularization of software stacks. It also addresses challenges like consumer pushback on subscription models and the shortage of software engineering talent.

A data-driven foundation for key business functions

- Strategy & corporate development: Align strategic roadmaps with the shift toward zonal architectures, which a vast majority of competitors are adopting, and assess investment priorities where 45% of OEMs classify SDVs as their top strategic goal.

- Product management: Inform feature roadmaps by analyzing the adoption of specific SDV capabilities; for instance, a significant majority of new vehicles sold in 2024 possessed Software-Over-The-Air (SOTA) capabilities.

- R&D & engineering leadership: Direct resource allocation based on industry priorities, noting that software accounts for the leading share of SDV budgets. Evaluate the utility of AI, as a clear majority of peers expect it to be critical for ADAS simulation.

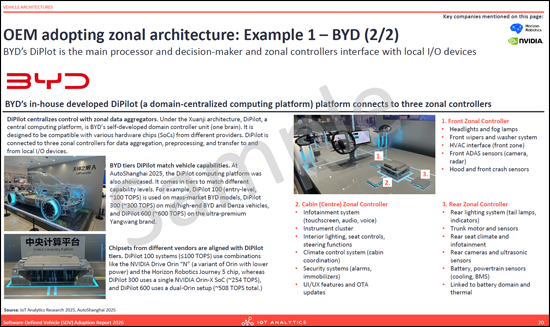

- Market intelligence: Assess the competitive landscape by reviewing the platform strategies of major players like BMW, Stellantis, Nissan, and BYD, and understanding the friction points between OEMs and suppliers regarding "white-box" code sharing.

Key concepts defined

- Software-Defined Vehicle (SDV): An automobile engineered with a software-first approach, where core functions (control, connectivity, user experience) and development processes are primarily defined by software rather than hardware.

- Zonal Architecture: An E/E architecture that groups Electronic Control Units (ECUs) by their physical location (zones) within the vehicle rather than by function, connecting them to central computing units to simplify wiring and processing.

- Vehicle Platform: An end-to-end software ecosystem (e.g., MB.OS, VW.OS) that manages hardware, enables real-time control, supports OTA updates, and provides a development environment for applications.

- Over-the-Air (OTA): The capability to download and install software and firmware updates remotely, managing the lifecycle of vehicle software without physical dealership visits.

- High-Performance Computing (HPC): Centralized computing units within the vehicle that process complex, data-intensive workloads such as AI, ADAS, and cross-domain functions.

Questions answered:

- What is a software-defined vehicle (definition), and which stakeholders treat SDV as a strategic priority?

- Which components of the automotive technology stack are foundational to SDV development and operations?

- What types of zonal architecture are emerging, and what are its benefits and adoption challenges?

- How valuable is AI expected to be across SDV lifecycle?

- What are SDV cybersecurity risks and mitigation approaches?

- What are the SDV adoption strategies of OEMs and suppliers?

- What are the key trends and challenges in SDV adoption?

Companies mentioned:

A selection of companies mentioned in the report.

|

|

|

Table of Contents

1. Executive summary

- The insights in this report are based on 4 main research sources

- Executive summary (4 parts)

- Analyst opinion: 4 things that stood out in our research

2. Introduction

- Introduction: Chapter overview and key takeaways

- The traditional automotive industry is experiencing pressure on 3 fronts

- As a result, OEMs are investing in 3 key product strategies

- IoT Analytics' 2025 survey shows SDV is the top strategic priority

- European OEMs and suppliers are at the forefront of SDV revolution

- Definition of an SDV

- How manufacturers and industry associations define SDV

- There are 4 main dimensions of an SDV

- Each of the 4 dimensions plays a separate role across the automotive development V-model

- Why are SDVs so important? Key quotes

- Evolution of SDVs

- OEMs invest into SDVs each year with most spending on software and E/E architectures

- Case in point: Mercedes-Benz's software-defined future (3 parts)

- Expert market consensus: Tech-native OEMs are clearly ahead with SDVs

3. Vehicle architectures

- Vehicle architectures: Chapter overview and key takeaways

- SDV requirements change future E/E architectures

- There are currently broad types of E/E architectures

- Zonal architecture adoption (5 parts)

- OEM adopting zonal architecture: Example 1 - BYD (2 parts)

- OEM adopting zonal architecture: Example 2 - Tesla

- OEM adopting zonal architecture: Example 3 - Rivian

- Supplier adopting zonal architecture: Example - NXP (2 parts)

- Key benefits of zonal architecture

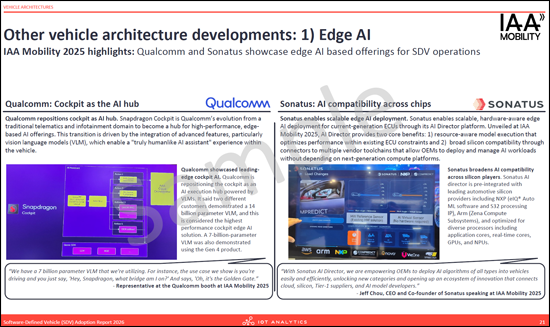

- Other vehicle architecture developments: 1 - Edge AI

- Other vehicle architecture developments: 2 - Hardware virtualization

4. The SDV software stack

- SDV Software stack: Chapter overview and key takeaways

- The reference automotive tech stack (3 parts)

- Deep dive 1: Key frameworks (2 parts)

- Deep dive 2: OEM Vehicle Platform (7 parts)

- Deep dive 3: RTOS (2 parts)

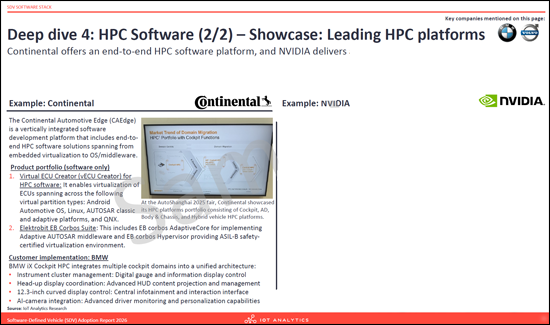

- Deep dive 4: HPC software (2 parts)

- Deep dive 5: OTA platforms (2 parts)

- Deep dive 6: Cloud platforms (6 parts)

- Deep dive 7: UI/UX (2 parts)

- Deep dive 8: Applications and features - What SDV enables

5. Role and adoption of AI

- Role and adoption of AI: Chapter overview and key takeaways

- AI's value creation potential in vehicle development

- Deep-dive: Role of AI in zonal architecture development

- The role of AI for vehicle design and vehicle applications

- Role of AI when building specific vehicle systems

- Key vehicle functions that make use of AI

- The role of generative AI

6. Role of security and regulations

- Role of security and regulations: Chapter overview and key takeaways

- Cybersecurity risks in SDVs (2 parts)

- The role of cybersecurity in the SDV V-Model

- Overall cybersecurity maturity

- Responsibility for key cybersecurity topics

- Automotive cybersecurity vendor showcase 1: Upstream

- Automotive cybersecurity vendor showcase 2: Critical Software

- Regulations (2 parts)

- OEM and supplier adoption strategies: Chapter overview and key takeaways

- OEM SDV adoption (10 parts)

- Supplier SDV adoption (4 parts)

7. Trends and challenges

- Trends and challenges: Chapter overview and key takeaways

- Trend 1 (3 parts)

- Trend 2

- Trend 3

- Trend 4

- Challenge 1 (2 parts)

- Challenge 2 (2 parts)

- Challenge 3 (3 parts)

- Other insights: Highlights from the EW25 SDV panel discussion

8. Methodology

- The insights in this report are based on 4 main research sources

- Complete list of survey questions (2 parts)

- Complete list of interview questions

- Respondent sampling overview (3 parts)

9. About IoT Analytics

- About IoT Analytics

- Other publications by IoT Analytics

- Information and contact