PUBLISHER: IoT Analytics GmbH | PRODUCT CODE: 1931739

PUBLISHER: IoT Analytics GmbH | PRODUCT CODE: 1931739

State of Enterprise IoT 2026: Connected Operations in the AI Era

A comprehensive 124-page report on the current state of enterprise Internet of Things with a focus on edge and industrial AI, including market update, forecasts, latest trends, and more.

Overview of the State of Enterprise IoT 2026 report

The State of Enterprise IoT 2026: Connected operations in the AI era report is a current enterprise IoT market assessment and comprehensive summary of recent market actions, including a number of detailed insights generated by the IoT Analytics team in Q3 and Q4 2025. These insights are based on our continued coverage of leading conferences, fairs and exhibits as well as webinars. IoT Analytics conducts more than 500 individual interviews and discussions per year. This report also includes individual research results derived from different reports and models. The report shows the results of our updated enterprise IoT market model and highlights from other recent reports.

The main purpose of this document is to broaden our readers' knowledge of enterprise IoT and inform them about current trends shaping the market and short- and medium-term developments. All the discussed insights center around IoT-related topics but, in many instances, expand beyond IoT. The report presents a discussion of many current market developments, including the latest market environment and forecasts, regional and vertical focus areas, technology stack (cybersecurity, analytics/AI, platform/cloud, general software, connectivity, and hardware), and a discussion of investment and merger and acquisition (M&A) activities. Insights are substantiated with relevant examples and evidence.

The report includes

- Executive summary (Analyst opinion on the autonomous operations era, summary of key findings)

- Global macroeconomic environment (Key indicators 2019-2025, 6 key themes to watch including tariffs and demographics)

- General IoT business sentiment (Impact of macro themes, industrial automation market view, and deep dive on challenges)

- Updated IoT market (IoT device connections forecast to 2035, enterprise IoT spending forecast by technology/segment/region, and vendor market shares)

- Industrial IoT trends & developments (GenAI and agentic AI adoption, vendor updates from Siemens/Microsoft/AWS, and upcoming startups like Gridware)

- IoT connectivity trends & developments (Adoption of LTE Cat-1 bis/5G RedCap, satellite integration, eSIM/iSIM growth, and vendor updates from Vodafone/China Mobile)

- IoT hardware trends & developments (Edge AI in MCUs, US semiconductor investment, RISC-V momentum, and vendor updates from Qualcomm/Infineon)

- Other IoT-related trends (Impact of sustainability and cybersecurity regulations (CRA, ESPR) on IoT, and analysis of data center infrastructure spending)

- IoT workforce developments (Job opening trends for industrial IoT vendors, rise in AI roles, and recent tech layoffs)

- Investments and M&A activity (Global IoT funding trends, new industrial AI unicorns, and deep dive on Qualcomm's edge AI acquisitions)

Table of Contents

1. Executive summary

- Analyst opinion: Enterprise IoT in the era of AI

- Executive summary (4 parts)

- Reminder: This report takes a broad definition of enterprise IoT

- Key findings from selected IoT Analytics reports

2. Global macroeconomic environment

- The macro view: Key indicators

- The macro view: Key themes to watch

- How macro themes affect industrial enterprise technology markets

- IoT sentiment remains elevated, despite fewer mentions in corporate earnings calls

- Key signals in the enterprise IoT market right now

3. General IoT business sentiment

- Industrial automation market view

- Deep dive: Key challenges for IoT device makers (3 parts)

- Number of connected IoT devices

- Number of intelligent edge AI IoT devices

- Number of connected enterprise IoT devices

- Global IoT enterprise market forecast

4. Updated IoT market

- Global IoT enterprise market forecast by technology

- Enterprise IoT tech stack: Definitions

- Global IoT enterprise market forecast by segment

- Global IoT enterprise market forecast by region

- Leading enterprise IoT vendors: Market share 2024

- Recent IIoT trends & developments

- IIoT Trend 1

- IoT Trend 2

- IIoT Trend 3 (2 parts)

- IIoT Trend 4

- IoT analysis 1: IoT platforms evolution in past 10 years (2 parts)

- IIoT analysis 2: The largest industrial AI vendors

- IIoT analysis 3: Agentic AI vs. AI agents vs. agents

5. Industrial IoT

- IIoT vendor update 1: Siemens (3 parts)

- IIoT vendor update 2: Advantech (2 parts)

- IIoT vendor update 3: ABB

- IIoT vendor update 4: Yokogawa (2 parts)

- IIoT vendor update 4: AWS (2 parts)

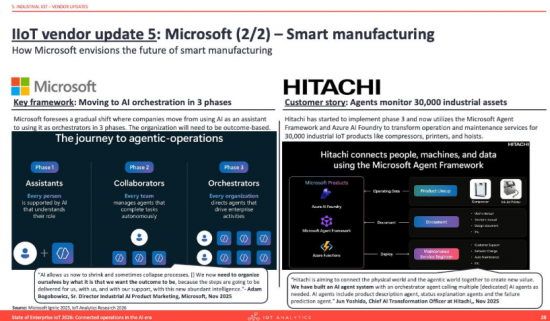

- IIoT vendor update 5: Microsoft (2 parts)

- Upcoming IIoT company 1: Gridware

- Upcoming IIoT company 2: Helsing

- Upcoming IIoT company 3: Nanoprecise

- Recent IIoT product launch news (4 parts)

6. IoT connectivity

- Recent IoT connectivity trends & developments

- IoT connectivity trend 1

- IoT connectivity trend 2

- IoT connectivity trend 3

- IoT connectivity trend 4

- IoT connectivity analysis 1: Comparing satellite IoT vs other IoT wireless technologies

- IoT connectivity vendor update 1: Vodafone

- IoT connectivity vendor update 2: China Mobile (2 parts)

- Upcoming IoT connectivity company 1: Hubble Network

- Upcoming IoT connectivity company 2: Morse Micro

- Upcoming IoT connectivity company 3: One Layer

- Recent IoT connectivity product launch news

7. IoT hardware

- Recent IoT hardware trends & developments

- IoT hardware trend 1

- IoT hardware trend 2

- IoT hardware trend 3

- IoT hardware analysis 1: The rise of artificial intelligence (3 parts)

- IoT hardware vendor update 1: Qualcomm

- IoT hardware vendor update 2: Infineon

- Upcoming IoT hardware company 1: Openlight

- Upcoming IoT hardware company 2: Axelera AI

- Upcoming IoT hardware company 3: Ambiq Micro

- Recent IoT hardware product launch news

8. Other IoT

- Recent other IoT-related trends & developments

- Other IoT-related trend 1

- Other IoT-related trend 2

- Analysis 1: Regulations that will impact enterprises

- Analysis 2: Data center spending distribution across infrastructure

- Other vendor update: Palantir

9. IoT workforce developments

- Job openings by selected leading industrial IoT vendors

- Job opening index in selected categories (US only)

- AI job openings as share of all job openings (US only)

- The tech job market: Selected recent layoffs

10. Investments and M&A activity

- Global funding of IoT companies

- Industrial IoT/AI unicorns produced in 2025

- Recent IoT-related acquisitions

- Deep dive: Qualcomm's recent acquisitions are building an edge AI development platform

11. About IoT Analytics