PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1777129

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1777129

Copper Tubes Market by Type (Type K, Type L, Type M, Other Types), Form (Straight Tubes, Coils, Capillary Tubes, Other Forms), Application (HVACR, Plumbing, Industrial, Automotive, Medical, Other Applications), Region - Global Forecast to 2030

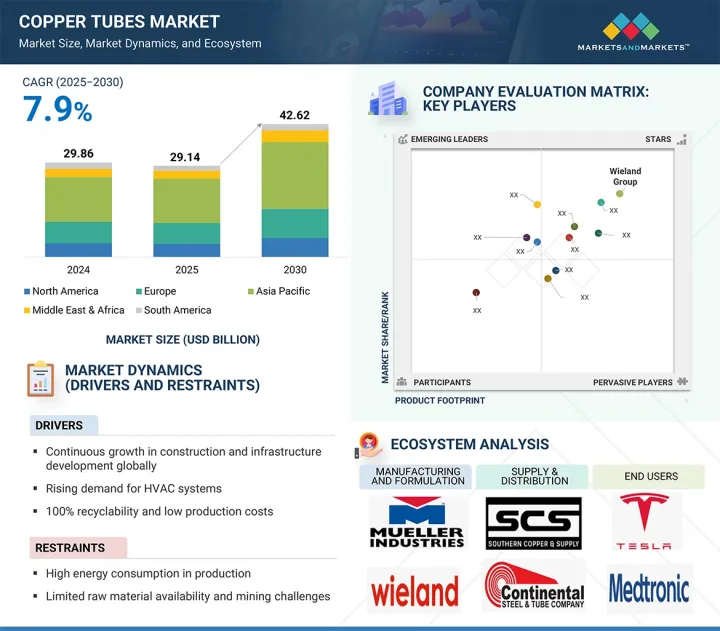

The copper tubes market is projected to grow from USD 29.14 billion in 2025 to USD 42.62 billion by 2030, at a CAGR of 7.9%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/USD Billion) and Volume (Kiloton) |

| Segments | Type, Form, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

The copper tubes market is experiencing significant growth driven by increased demand for energy-efficient HVACR solutions, the expansion of healthcare infrastructure, and a heightened emphasis on sustainable building practices. Copper is emerging as the preferred material for medical, plumbing, and industrial applications due to its inherent strength, excellent thermal conductivity, and recyclability. The development of smart cities, the retrofitting of existing infrastructure, and the rising adoption of electric vehicles-necessitating advanced thermal management systems-present substantial opportunities for market expansion. Additionally, domestic production is supported by favorable government policies, while green building certifications further catalyze market growth. As industries increasingly prioritize operational efficiency and sustainability, copper tubes are positioning themselves as a viable and future-proof alternative, meeting both current demands and long-term objectives.

"Type K to be fastest-growing segment of copper tubes market during forecast period"

Type K copper tubes represent the fastest-growing segment in the copper tubing market, driven by several key factors. Their superior strength and thicker walls provide exceptional pressure-handling capabilities, making them highly versatile for various applications. Major application areas for Type K tubes include medical gas tubing, underground plumbing systems, and fluid transport networks, all of which contribute to increasing demand across these sectors. Furthermore, this trend aligns with the growing global emphasis on sustainable, corrosion-resistant, and durable tubing solutions with an extended service life. Consequently, Type K copper tubes are poised for continued growth in the market.

"HVACR to be fastest-growing application segment of copper tubes market during forecast period"

In recent years, there has been a marked trend towards improving indoor air quality and enhancing energy efficiency, prompting various governments to initiate efforts aimed at reducing carbon footprints. This shift underscores the increasing demand for energy-efficient HVACR systems, which significantly depend on copper tubes for their operation. Concurrently, urbanization and industrialization have further fueled the demand for HVACR systems, thereby driving the necessity for copper tubes. Copper tubes are highly preferred in these HVACR systems due to their exceptional thermal conductivity and corrosion resistance, which collectively extend the operational lifespan of these systems. As the focus on sustainable and efficient solutions intensifies, the role of copper in HVACR applications becomes even more critical.

"Asia Pacific to be fastest-growing regional market for copper tubes during forecast period"

The Asia Pacific region is emerging as the fastest-growing market for copper tubes, driven by continuous urbanization and industrial development observed over the past decade. Governments across the region are increasingly prioritizing sustainability alongside industrialization, particularly in key applications for copper tubes, such as plumbing, medical, automotive, industrial, and HVACR sectors. Significantly, government-sponsored initiatives aimed at upgrading housing, water infrastructure, and sanitation facilities-especially in rural and semi-urban areas-are further bolstering the demand for copper tubes. Additionally, Asia Pacific is a leading manufacturing hub for HVACR systems, electronics, and automotive components, which will increase the demand for copper tubing. The region serves as a vital economic engine for production, benefitting from an abundant supply of raw materials, cost-effective labor, and a growing number of indigenous manufacturers specializing in copper tubes-all contributing to sustained market growth.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

- By Company Type: Tier 1 - 60%, Tier 2 - 25%, and Tier 3 - 15%

- By Designation: Manger-Level - 30%, Director Level - 20%, and Others - 50%

- By Region: North America - 20%, Europe -30%, Asia Pacific - 30%, Middle East & Africa - 10%, and South America-10%

The key players in this market are Mueller Industries (US), Wieland Group (Germany), Hailiang Group (China), KME Group SpA (Italy), LUVATA (Finland), Cerro Flow Products LLC (US), KOBE STEEL, LTD. (Japan), Cambridge-Lee Industries LLC (US), Shanghai Metal Corporation (China), Quindao Hongtai Copper Tube Co., Ltd. (China).

Research Coverage

This report segments the market for the copper tubes based on type, form, application, and region. It provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and partnerships associated with the market for the copper tubes market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the copper tubes market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights into the following points:

- Analysis of key drivers: Continuous Growth in Construction and Infrastructure Development Globally, Rising Demand for HVAC Systems and Copper's 100% recyclability drives the global market by reducing production cost, ensuring supply stability and meeting sustainability demands

- Market Penetration: Comprehensive information on the copper tubes offered by top players in the global copper tubes market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the copper tubes market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for the copper tubes across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global copper tubes market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the copper tubes market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS & EXCLUSIONS

- 1.3.2 COPPER TUBES MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary data sources

- 2.1.2.3 Key primary participants

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE APPROACH

- 2.2.2 DEMAND-SIDE APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COPPER TUBES MARKET

- 4.2 COPPER TUBES MARKET, BY TYPE

- 4.3 COPPER TUBES MARKET, BY FORM

- 4.4 COPPER TUBES MARKET, BY APPLICATION

- 4.5 COPPER TUBES MARKET, BY THICKNESS

- 4.6 COPPER TUBES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing construction and infrastructure development globally

- 5.2.1.2 Rising demand for HVAC systems

- 5.2.1.3 100% recyclability reduces production costs, ensures supply stability, and meets sustainability demands

- 5.2.2 RESTRAINTS

- 5.2.2.1 Highly energy-intensive production process

- 5.2.2.2 Limited raw material availability and mining challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth in demand for renewable energy and electric vehicles

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing competition from aluminum and cross-linked polyethylene

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI ON COPPER TUBES MARKET

- 5.3.1 INTRODUCTION

- 5.3.2 OPTIMIZATION OF MANUFACTURING

- 5.3.3 PREDICTIVE MAINTENANCE

- 5.3.4 MARKET FORECASTING AND COMPETITIVE INTELLIGENCE

- 5.3.5 SUPPLY CHAIN OPTIMIZATION

- 5.3.6 CUSTOMER EXPERIENCE AND TECHNICAL SUPPORT

- 5.3.7 SUSTAINABILITY AND CARBON FOOTPRINT ANALYSIS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR COPPER TUBES MANUFACTURERS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL SOURCING

- 6.3.1.1 Copper ore extraction

- 6.3.1.2 Processing

- 6.3.2 MANUFACTURE OF COPPER TUBES

- 6.3.2.1 Casting and smelting

- 6.3.2.2 Extrusion and drawing

- 6.3.2.3 Annealing

- 6.3.2.4 Cutting and shaping

- 6.3.2.5 Surface treatment

- 6.3.3 DISTRIBUTORS

- 6.3.4 END USERS

- 6.3.1 RAW MATERIAL SOURCING

- 6.4 IMPACT OF 2025 US TARIFFS ON COPPER TUBES MARKET

- 6.4.1 INTRODUCTION

- 6.4.2 KEY TARIFF RATES

- 6.4.3 PRICE IMPACT ANALYSIS

- 6.4.4 IMPACT ON COUNTRY/REGION

- 6.4.4.1 US

- 6.4.4.2 Europe

- 6.4.4.3 Asia Pacific

- 6.4.5 IMPACT ON APPLICATIONS

- 6.5 INVESTMENT AND FUNDING SCENARIO

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 6.6.2 AVERAGE SELLING PRICE TREND, BY TYPE, 2021-2024

- 6.6.3 AVERAGE SELLING PRICE TREND, BY THICKNESS, 2021-2024

- 6.6.4 AVERAGE SELLING PRICE TREND, BY FORM, 2021-2024

- 6.6.5 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2021-2024

- 6.6.6 AVERAGE SELLING PRICE OF TOP THREE COPPER TUBE TYPES, BY KEY PLAYERS, 2024

- 6.7 ECOSYSTEM ANALYSIS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.3 ADJACENT TECHNOLOGIES

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.9.2 GRANTED PATENTS, 2015-2024

- 6.9.2.1 Publication trends for last ten years

- 6.9.3 INSIGHTS

- 6.9.4 LEGAL STATUS

- 6.9.5 JURISDICTION ANALYSIS

- 6.9.6 TOP APPLICANTS

- 6.9.7 KEY PATENTS FOR COPPER TUBES

- 6.10 TRADE ANALYSIS

- 6.10.1 IMPORT SCENARIO (HS CODE 741110)

- 6.10.2 EXPORT SCENARIO (HS CODE 741110)

- 6.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 TARIFF AND REGULATIONS RELATED TO COPPER TUBES

- 6.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.3 REGULATIONS RELATED TO COPPER TUBES MARKET

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 THREAT OF NEW ENTRANTS

- 6.13.2 THREAT OF SUBSTITUTES

- 6.13.3 BARGAINING POWER OF SUPPLIERS

- 6.13.4 BARGAINING POWER OF BUYERS

- 6.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

- 6.15 MACROECONOMIC INDICATORS

- 6.15.1 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES

- 6.16 CASE STUDY ANALYSIS

- 6.16.1 SUMITOMO'S ENHANCED THERMAL CONDUCTIVITY COPPER TUBES FOR HVAC SYSTEMS

- 6.16.2 KME GROUP'S SUSTAINABLE COPPER TUBE PRODUCTION WITH ECO-FRIENDLY PRACTICES

- 6.16.3 HINDALCO INDUSTRIES' HIGH-PRECISION COPPER TUBES FOR HVAC&R IN INDIA

7 COPPER TUBES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 HVACR

- 7.2.1 RISING DEMAND FOR ENERGY-EFFICIENT AND CORROSION-RESISTANT MATERIALS TO DRIVE MARKET

- 7.3 PLUMBING

- 7.3.1 EXPANDING CONSTRUCTION AND INFRASTRUCTURE DEVELOPMENT TO BOOST GROWTH

- 7.4 INDUSTRIAL

- 7.4.1 RISING DEMAND FOR RELIABLE HEAT TRANSFER SOLUTIONS UNDER EXTREME PRESSURE AND CORROSIVE ENVIRONMENTS TO PROPEL MARKET

- 7.5 MEDICAL

- 7.5.1 GROWING EMPHASIS ON CONTAMINATION-FREE GAS DELIVERY AND THERMAL PRECISION TO FUEL MARKET

- 7.6 AUTOMOTIVE

- 7.6.1 INCREASING NEED FOR DURABLE AND HEAT-EFFICIENT MATERIALS IN HIGH-PERFORMANCE VEHICLES TO SUPPORT GROWTH

- 7.7 OTHER APPLICATIONS

- 7.7.1 MARINE

- 7.7.2 ELECTRICAL & ELECTRONICS

- 7.7.3 SOLAR ENERGY SYSTEMS

8 COPPER TUBES MARKET, BY FORM

- 8.1 INTRODUCTION

- 8.2 STRAIGHT TUBES

- 8.2.1 STRENGTH, RELIABILITY, AND VERSATILITY TO DRIVE MARKET

- 8.3 COILS

- 8.3.1 FLEXIBILITY TO DRIVE ADOPTION

- 8.4 CAPILLARY TUBES

- 8.4.1 COMPACT AND EFFICIENT PERFORMANCE IN REFRIGERATION UNITS TO SUPPORT MARKET GROWTH

- 8.5 OTHER FORMS

- 8.5.1 INNER GROOVED TUBES

- 8.5.2 FINNED TUBES

- 8.5.3 FLATTENED TUBES

9 COPPER TUBES MARKET, BY THICKNESS

- 9.1 INTRODUCTION

- 9.2 STANDARD GAGE

- 9.2.1 EXCELLENT THERMAL CONDUCTIVITY AND CORROSION RESISTANCE TO DRIVE DEMAND FOR RESIDENTIAL, COMMERCIAL, AND INDUSTRIAL APPLICATIONS

- 9.3 EXTRA-HEAVY GAGE

- 9.3.1 INCREASED DURABILITY TO FUEL SUITABILITY FOR HEAVY-DUTY APPLICATIONS

- 9.4 THIN-WALL GAGE

- 9.4.1 COST-EFFECTIVENESS AND EASE OF INSTALLATION IN TIGHT SPACES FOR LOW PRESSURE APPLICATIONS TO BOOST MARKET

- 9.5 OTHER THICKNESSES

- 9.5.1 COPPER CLAD TUBES

- 9.5.2 MICRO TUBES

10 COPPER TUBES MARKET, BY TYPE

- 10.1 INTRODUCTION

- 10.2 TYPE K

- 10.2.1 THICKEST WALL AND DURABILITY TO DRIVE DEMAND FOR UNDERGROUND WATER SUPPLY AND HIGH-PRESSURE APPLICATIONS

- 10.3 TYPE M

- 10.3.1 UTILITY IN LOW-PRESSURE INDOOR WATER DISTRIBUTION TO BOOST MARKET

- 10.4 TYPE L

- 10.4.1 BALANCE OF STRENGTH AND WORKABILITY TO FUEL DEMAND IN RESIDENTIAL WATER PIPING AND HVAC SYSTEMS

- 10.5 OTHER TYPES

- 10.5.1 DMV (DRAIN, WASTE, AND VENT) TUBES

- 10.5.2 ACR (AIR CONDITIONING AND REFRIGERATION) TUBES

- 10.5.3 MEDICAL GAS TUBING

11 COPPER TUBES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Significant investments in power grid expansion and green building projects to propel market

- 11.2.2 JAPAN

- 11.2.2.1 Aging infrastructure and energy-efficient retrofitting to drive adoption in residential and commercial buildings

- 11.2.3 INDIA

- 11.2.3.1 Rapid urbanization and government-led smart city initiatives to boost demand for HVAC and plumbing systems

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Rising electric vehicle production and expansion of battery cooling systems to fuel demand

- 11.2.5 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Government focus on improving aging infrastructure, water, and HVAC systems to drive market

- 11.3.2 CANADA

- 11.3.2.1 Green building initiatives and renewable energy goals to support market growth

- 11.3.3 MEXICO

- 11.3.3.1 Growth in automotive production to propel market

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Expanding electric vehicle production and battery cooling infrastructure to drive demand

- 11.4.2 ITALY

- 11.4.2.1 Rising construction and plumbing activities fueled by infrastructure projects to boost market

- 11.4.3 FRANCE

- 11.4.3.1 Large-scale investments in healthcare infrastructure to drive market

- 11.4.4 UK

- 11.4.4.1 Major investments in 5G and digital infrastructure to propel market

- 11.4.5 SPAIN

- 11.4.5.1 Focus on renewable energy to drive demand

- 11.4.6 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 UAE

- 11.5.1.1.1 Smart city initiatives and high-rise building developments to fuel demand

- 11.5.1.2 Saudi Arabia

- 11.5.1.2.1 Massive infrastructure projects and increased HVACR installations to boost market

- 11.5.1.3 Rest of GCC countries

- 11.5.1.1 UAE

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Expanding healthcare infrastructure and medical gas systems to boost demand

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 ARGENTINA

- 11.6.1.1 Growing demand for energy-efficient cooling systems amid rising temperatures to fuel market

- 11.6.2 BRAZIL

- 11.6.2.1 Rising urbanization and large-scale residential construction projects to boost demand

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 ARGENTINA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN (JANUARY 2020-JUNE 2025)

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.3.1 MARKET SHARE OF KEY PLAYERS, 2024

- 12.4 REVENUE ANALYSIS, 2020-2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Type footprint

- 12.6.5.4 Application footprint

- 12.6.5.5 Form footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs, 2024

- 12.7.5.2 Competitive benchmarking of key startups/SMEs, 2024

- 12.7.6 VALUATION AND FINANCIAL METRICS OF KEY COPPER TUBES VENDORS

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 PRODUCT LAUNCHES

- 12.8.2 DEALS

- 12.8.3 EXPANSIONS

- 12.8.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 MUELLER INDUSTRIES

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 WIELAND GROUP

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 HAILIANG GROUP

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Others

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 KME GROUP SPA

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses and competitive threats

- 13.1.5 LUVATA

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Others

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 CERRO FLOW PRODUCTS LLC

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Others

- 13.1.6.4 MnM view

- 13.1.6.4.1 Right to win

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses and competitive threats

- 13.1.7 KOBE STEEL, LTD.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 MnM view

- 13.1.7.3.1 Right to win

- 13.1.7.3.2 Strategic choices

- 13.1.7.3.3 Weaknesses and competitive threats

- 13.1.8 CAMBRIDGE-LEE INDUSTRIES LLC

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 MnM view

- 13.1.8.3.1 Right to win

- 13.1.8.3.2 Strategic choices

- 13.1.8.3.3 Weaknesses and competitive threats

- 13.1.9 SHANGHAI METAL CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.9.3.1 Right to win

- 13.1.9.3.2 Strategic choices

- 13.1.9.3.3 Weaknesses and competitive threats

- 13.1.10 QINGDAO HONGTAI COPPER CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.3.2 Expansions

- 13.1.10.4 MnM view

- 13.1.10.4.1 Right to win

- 13.1.10.4.2 Strategic choices

- 13.1.10.4.3 Weaknesses and competitive threats

- 13.1.1 MUELLER INDUSTRIES

- 13.2 OTHER PLAYERS

- 13.2.1 MM KEMBLA: COMPANY OVERVIEW

- 13.2.2 UNIFLOW COPPER TUBES

- 13.2.3 GOLDEN DRAGON PRECISE COPPER TUBE GROUP INC.

- 13.2.4 INTERSTATE METAL, INC.

- 13.2.5 MEHTA TUBES LIMITED

- 13.2.6 BRASSCO TUBE INDUSTRIES

- 13.2.7 NIPPONTUBE

- 13.2.8 NINGBO JINTIAN COPPER (GROUP) CO., LTD.

- 13.2.9 CUPORI

- 13.2.10 MAKSAL TUBES (PTY) LTD.

- 13.2.11 METTUBE

- 13.2.12 LYON COPPER ALLOYS

- 13.2.13 CUBEX TUBINGS LIMITED

- 13.2.14 SEAH FS CO., LTD.

- 13.2.15 TUBE TECH COPPER & ALLOYS PVT. LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD/KG)

- TABLE 2 AVERAGE SELLING PRICE, BY TYPE, 2021-2024 (USD/KG)

- TABLE 3 AVERAGE SELLING PRICE, BY THICKNESS, 2021-2024 (USD/KG)

- TABLE 4 AVERAGE SELLING PRICE, BY FORM, 2021-2024 (USD/KG)

- TABLE 5 AVERAGE SELLING PRICE, BY APPLICATION, 2021-2024 (USD/KG)

- TABLE 6 AVERAGE SELLING PRICES OF COPPER TUBE TYPES, BY KEY PLAYERS (USD/KG)

- TABLE 7 COPPER TUBES MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 8 COPPER TUBES MARKET: KEY TECHNOLOGIES

- TABLE 9 COPPER TUBES MARKET: COMPLEMENTARY TECHNOLOGIES

- TABLE 10 COPPER TUBES MARKET: ADJACENT TECHNOLOGIES

- TABLE 11 TOTAL NUMBER OF PATENTS

- TABLE 12 MAJOR PATENT OWNERS FOR COPPER TUBES

- TABLE 13 COPPER TUBES MARKET: MAJOR PATENTS

- TABLE 14 COPPER TUBES MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 TARIFFS RELATED TO COPPER TUBES, BY COUNTRY, 2025

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 COPPER TUBES MARKET: REGULATIONS/STANDARDS

- TABLE 22 IMPACT OF PORTERS FIVE FORCES ON COPPER TUBES MARKET

- TABLE 23 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 25 GDP TRENDS AND FORECAST, BY KEY COUNTRY, 2021-2030 (USD MILLION)

- TABLE 26 COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 27 COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 28 COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 29 COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 30 COPPER TUBES MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 31 COPPER TUBES MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 32 COPPER TUBES MARKET, BY FORM, 2021-2024 (KILOTON)

- TABLE 33 COPPER TUBES MARKET, BY FORM, 2025-2030 (KILOTON)

- TABLE 34 COPPER TUBES MARKET, BY THICKNESS, 2021-2024 (USD MILLION)

- TABLE 35 COPPER TUBES MARKET, BY THICKNESS, 2025-2030 (USD MILLION)

- TABLE 36 COPPER TUBES MARKET, BY THICKNESS, 2021-2024 (KILOTON)

- TABLE 37 COPPER TUBES MARKET, BY THICKNESS, 2025-2030 (KILOTON)

- TABLE 38 COPPER TUBES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 39 COPPER TUBES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 40 COPPER TUBES MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 41 COPPER TUBES MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 42 COPPER TUBES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 COPPER TUBES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 COPPER TUBES MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 45 COPPER TUBES MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 46 ASIA PACIFIC: COPPER TUBES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 47 ASIA PACIFIC: COPPER TUBES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 48 ASIA PACIFIC: COPPER TUBES MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 49 ASIA PACIFIC: COPPER TUBES MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 50 ASIA PACIFIC: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 51 ASIA PACIFIC: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 52 ASIA PACIFIC: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 53 ASIA PACIFIC: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 54 ASIA PACIFIC: COPPER TUBES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 55 ASIA PACIFIC: COPPER TUBES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 56 ASIA PACIFIC: COPPER TUBES MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 57 ASIA PACIFIC: COPPER TUBES MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 58 ASIA PACIFIC: COPPER TUBES MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 59 ASIA PACIFIC: COPPER TUBES MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 60 ASIA PACIFIC: COPPER TUBES MARKET, BY FORM, 2021-2024 (KILOTON)

- TABLE 61 ASIA PACIFIC: COPPER TUBES MARKET, BY FORM, 2025-2030 (KILOTON)

- TABLE 62 CHINA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 63 CHINA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 64 CHINA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 65 CHINA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 66 JAPAN: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 67 JAPAN: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 68 JAPAN: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 69 JAPAN: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 70 INDIA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 71 INDIA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 72 INDIA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 73 INDIA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 74 SOUTH KOREA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 75 SOUTH KOREA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 76 SOUTH KOREA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 77 SOUTH KOREA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 78 REST OF ASIA PACIFIC: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 79 REST OF ASIA PACIFIC: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 80 REST OF ASIA PACIFIC: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 81 REST OF ASIA PACIFIC: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 82 NORTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 85 NORTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 86 NORTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 89 NORTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 90 NORTH AMERICA: COPPER TUBES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: COPPER TUBES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: COPPER TUBES MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 93 NORTH AMERICA: COPPER TUBES MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 94 NORTH AMERICA: COPPER TUBES MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: COPPER TUBES MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: COPPER TUBES MARKET, BY FORM, 2021-2024 (KILOTON)

- TABLE 97 NORTH AMERICA: COPPER TUBES MARKET, BY FORM, 2025-2030 (KILOTON)

- TABLE 98 US: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 99 US: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 100 US: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 101 US: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 102 CANADA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 103 CANADA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 104 CANADA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 105 CANADA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 106 MEXICO: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 107 MEXICO: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 108 MEXICO: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 109 MEXICO: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 110 EUROPE: COPPER TUBES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 111 EUROPE: COPPER TUBES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 112 EUROPE: COPPER TUBES MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 113 EUROPE: COPPER TUBES MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 114 EUROPE: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 115 EUROPE: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 116 EUROPE: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 117 EUROPE: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 118 EUROPE: COPPER TUBES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 119 EUROPE: COPPER TUBES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 120 EUROPE: COPPER TUBES MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 121 EUROPE: COPPER TUBES MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 122 EUROPE: COPPER TUBES MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 123 EUROPE: COPPER TUBES MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 124 EUROPE: COPPER TUBES MARKET, BY FORM, 2021-2024 (KILOTON)

- TABLE 125 EUROPE: COPPER TUBES MARKET, BY FORM, 2025-2030 (KILOTON)

- TABLE 126 GERMANY: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 127 GERMANY: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 128 GERMANY: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 129 GERMANY: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 130 ITALY: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 131 ITALY: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 132 ITALY: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 133 ITALY: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 134 FRANCE: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 135 FRANCE: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 136 FRANCE: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 137 FRANCE: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 138 UK: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 139 UK: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 UK: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 141 UK: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 142 SPAIN: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 143 SPAIN: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 SPAIN: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 145 SPAIN: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 146 REST OF EUROPE: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 147 REST OF EUROPE: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 148 REST OF EUROPE: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 149 REST OF EUROPE: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 150 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 153 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 154 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 157 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 158 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 161 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 162 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY FORM, 2021-2024 (KILOTON)

- TABLE 165 MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY FORM, 2025-2030 (KILOTON)

- TABLE 166 UAE: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 167 UAE: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 168 UAE: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 169 UAE: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 170 SAUDI ARABIA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 171 SAUDI ARABIA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 172 SAUDI ARABIA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 173 SAUDI ARABIA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 174 REST OF GCC COUNTRIES: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 175 REST OF GCC COUNTRIES: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 176 REST OF GCC COUNTRIES: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 177 REST OF GCC COUNTRIES: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 178 SOUTH AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 179 SOUTH AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 180 SOUTH AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 181 SOUTH AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 186 SOUTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 187 SOUTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 188 SOUTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 189 SOUTH AMERICA: COPPER TUBES MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 190 SOUTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 191 SOUTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 192 SOUTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 193 SOUTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 194 SOUTH AMERICA: COPPER TUBES MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 195 SOUTH AMERICA: COPPER TUBES MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 196 SOUTH AMERICA: COPPER TUBES MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 197 SOUTH AMERICA: COPPER TUBES MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 198 SOUTH AMERICA: COPPER TUBES MARKET, BY FORM, 2021-2024 (USD MILLION)

- TABLE 199 SOUTH AMERICA: COPPER TUBES MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 200 SOUTH AMERICA: COPPER TUBES MARKET, BY FORM, 2021-2024 (KILOTON)

- TABLE 201 SOUTH AMERICA: COPPER TUBES MARKET, BY FORM, 2025-2030 (KILOTON)

- TABLE 202 ARGENTINA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 203 ARGENTINA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 204 ARGENTINA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 205 ARGENTINA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 206 BRAZIL: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 207 BRAZIL: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 208 BRAZIL: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 209 BRAZIL: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 210 REST OF SOUTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 211 REST OF SOUTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 212 REST OF SOUTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 213 REST OF SOUTH AMERICA: COPPER TUBES MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 214 OVERVIEW OF STRATEGIES ADOPTED BY KEY COPPER TUBES MANUFACTURERS

- TABLE 215 COPPER TUBES MARKET: DEGREE OF COMPETITION

- TABLE 216 COPPER TUBES MARKET: REGION FOOTPRINT

- TABLE 217 COPPER TUBES MARKET: TYPE FOOTPRINT

- TABLE 218 COPPER TUBES MARKET: APPLICATION FOOTPRINT

- TABLE 219 COPPER TUBES MARKET: FORM FOOTPRINT

- TABLE 220 COPPER TUBES MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 221 COPPER TUBES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 222 COPPER TUBES MARKET: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 223 COPPER TUBES MARKET: DEALS, JANUARY 2020-JUNE 2025

- TABLE 224 COPPER TUBES MARKET: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 225 COPPER TUBES MARKET: OTHERS, JANUARY 2020-JUNE 2025

- TABLE 226 MUELLER INDUSTRIES: COMPANY OVERVIEW

- TABLE 227 MUELLER INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 MUELLER INDUSTRIES: DEALS, JANUARY 2020-JUNE 2025

- TABLE 229 WIELAND GROUP: COMPANY OVERVIEW

- TABLE 230 WIELAND GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 WIELAND GROUP: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 232 WIELAND GROUP: DEALS, JANUARY 2020-JUNE 2025

- TABLE 233 WIELAND GROUP: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 234 HAILIANG GROUP: COMPANY OVERVIEW

- TABLE 235 HAILIANG GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 HAILIANG GROUP: OTHERS, JANUARY 2020-JUNE 2025

- TABLE 237 KME GROUP SPA: COMPANY OVERVIEW

- TABLE 238 KME GROUP SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 LUVATA: COMPANY OVERVIEW

- TABLE 240 LUVATA: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 241 LUVATA: DEALS, JANUARY 2020-JUNE 2025

- TABLE 242 LUVATA: OTHERS, JANUARY 2020-JUNE 2025

- TABLE 243 CERRO FLOW PRODUCTS LLC: COMPANY OVERVIEW

- TABLE 244 CERRO FLOW PRODUCTS LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 CERRO FLOW PRODUCTS LLC: OTHERS, JANUARY 2020-JUNE 2025

- TABLE 246 KOBE STEEL, LTD.: COMPANY OVERVIEW

- TABLE 247 KOBE STEEL, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 CAMBRIDGE-LEE INDUSTRIES LLC: COMPANY OVERVIEW

- TABLE 249 CAMBRIDGE-LEE INDUSTRIES LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 SHANGHAI METAL CORPORATION: COMPANY OVERVIEW

- TABLE 251 SHANGHAI METAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 QINGDAO HONGTAI COPPER CO., LTD.: COMPANY OVERVIEW

- TABLE 253 QINGDAO HONGTAI COPPER CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 254 QINGDAO HONGTAI COPPER CO., LTD.: DEALS, JANUARY 2020-JUNE 2025

- TABLE 255 QINGDAO HONGTAI COPPER CO., LTD.: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 256 MM KEMBLA: COMPANY OVERVIEW

- TABLE 257 UNIFLOW COPPER TUBES: COMPANY OVERVIEW

- TABLE 258 GOLDEN DRAGON PRECISE COPPER TUBE GROUP INC.: COMPANY OVERVIEW

- TABLE 259 INTERSTATE METAL, INC.: COMPANY OVERVIEW

- TABLE 260 MEHTA TUBES LIMITED: COMPANY OVERVIEW

- TABLE 261 BRASSCO TUBE INDUSTRIES: COMPANY OVERVIEW

- TABLE 262 NIPPONTUBE: COMPANY OVERVIEW

- TABLE 263 NINGBO JINTIAN COPPER (GROUP) CO., LTD.: COMPANY OVERVIEW

- TABLE 264 CUPORI: COMPANY OVERVIEW

- TABLE 265 MAKSAL TUBES (PTY) LTD.: COMPANY OVERVIEW

- TABLE 266 METTUBE: COMPANY OVERVIEW

- TABLE 267 LYON COPPER ALLOYS: COMPANY OVERVIEW

- TABLE 268 CUBEX TUBINGS LIMITED: COMPANY OVERVIEW

- TABLE 269 SEAH FS CO., LTD.: COMPANY OVERVIEW

- TABLE 270 TUBE TECH COPPER & ALLOYS PVT. LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 COPPER TUBES MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 COPPER TUBES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 COPPER TUBES MARKET: DATA TRIANGULATION

- FIGURE 8 TYPE K SEGMENT TO LEAD MARKET BETWEEN 2025 AND 2030

- FIGURE 9 STRAIGHT TUBES SEGMENT TO LEAD MARKET BETWEEN 2025 AND 2030

- FIGURE 10 HVACR APPLICATION SEGMENT TO LEAD MARKET BETWEEN 2025 AND 2030

- FIGURE 11 STANDARD GAGE THICKNESS SEGMENT TO LEAD MARKET BETWEEN 2025 AND 2030

- FIGURE 12 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 RISING DEMAND FROM HVACR, PLUMBING, AND INDUSTRIAL SECTORS TO DRIVE MARKET

- FIGURE 14 TYPE K TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 15 STRAIGHT TUBES TO BE FASTEST-GROWING FORM SEGMENT DURING FORECAST PERIOD

- FIGURE 16 HVACR TO BE FASTEST-GROWING APPLICATION SEGMENT DURING FORECAST PERIOD

- FIGURE 17 THIN-WALL GAGE TO BE FASTEST-GROWING THICKNESS SEGMENT DURING FORECAST PERIOD

- FIGURE 18 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN COPPER TUBES MARKET

- FIGURE 20 USE OF GENERATIVE AI IN COPPER TUBES MARKET

- FIGURE 21 REVENUE SHIFT IN COPPER TUBES MARKET

- FIGURE 22 COPPER TUBES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 COPPER TUBES MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 24 COPPER TUBES MARKET: AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- FIGURE 25 AVERAGE SELLING PRICE TREND FOR TOP THREE TYPES, BY KEY PLAYERS, 2024

- FIGURE 26 COPPER TUBES MARKET ECOSYSTEM

- FIGURE 27 PATENTS GRANTED IN LAST TEN YEARS, 2015-2024

- FIGURE 28 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 29 REGIONAL ANALYSIS OF COPPER TUBE-RELATED PATENTS GRANTED, 2024

- FIGURE 30 TOP 10 PATENT APPLICANTS IN LAST TEN YEARS

- FIGURE 31 IMPORT DATA RELATED TO HS CODE 741110-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 32 EXPORT DATA RELATED TO HS CODE 741110-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 33 PORTER'S FIVE FORCES ANALYSIS: COPPER TUBES MARKET

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 36 HVACR SEGMENT TO LEAD COPPER TUBES MARKET DURING FORECAST PERIOD

- FIGURE 37 STRAIGHT TUBES SEGMENT TO LEAD COPPER TUBES MARKET DURING FORECAST PERIOD

- FIGURE 38 STANDARD GAGE THICKNESS SEGMENT TO DOMINATE COPPER TUBES MARKET DURING FORECAST PERIOD

- FIGURE 39 TYPE K SEGMENT TO LEAD COPPER TUBES MARKET DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC: COPPER TUBES MARKET SNAPSHOT

- FIGURE 42 NORTH AMERICA: COPPER TUBES MARKET SNAPSHOT

- FIGURE 43 EUROPE: COPPER TUBES MARKET SNAPSHOT

- FIGURE 44 COPPER TUBES MARKET: SHARE OF KEY PLAYERS, 2024

- FIGURE 45 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 46 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY SEGMENT

- FIGURE 47 COPPER TUBES MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 48 COPPER TUBES MARKET: COMPANY FOOTPRINT

- FIGURE 49 COPPER TUBES MARKET: COMPANY EVALUATION MATRIX STARTUPS/SMES, 2024

- FIGURE 50 EV/EBITDA OF KEY VENDORS

- FIGURE 51 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN

- FIGURE 52 MUELLER INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 53 KOBE STEEL, LTD.: COMPANY SNAPSHOT