PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1777130

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1777130

EV Connector Market by System (Sealed, Unsealed), Application (ADAS & Safety, Battery Management, Body Control & Interiors), Propulsion (BEV, PHEV, FCEV), Voltage, Connection, Component, and Region - Global Forecast to 2032

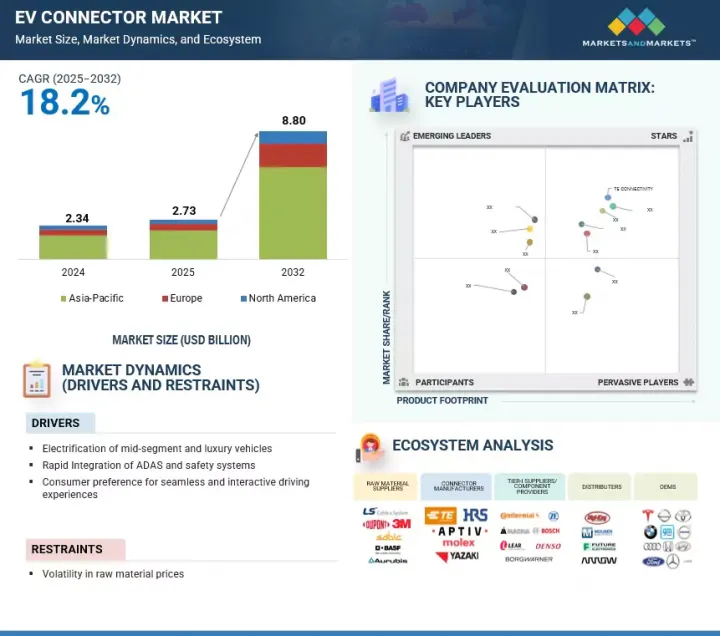

The EV connector market is projected to reach USD 8.80 billion by 2032, from USD 2.73 billion in 2025, with a CAGR of 18.2%. As electric and software-defined vehicles evolve, the adoption of advanced EV connectors is rising.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Segments | System, Propulsion, Connection, Application, Voltage, Component, and Region |

| Regions covered | Asia Pacific, Europe, and North America |

Modern EVs employ high-voltage, multi-signal connectors that combine power, signal, and data lines in a compact interface, improving efficiency and reducing weight. With the shift toward zonal electrical architectures, vehicles require miniaturized and high-density connectors to manage complex signal transmission within limited space. High-speed data connectors such as automotive Ethernet and coaxial types are becoming essential to support real-time data flow for ADAS and over-the-air updates. These connectors are designed to maintain reliable performance while resisting electromagnetic interference. In high-power systems like inverters, liquid-cooled connectors are emerging to control heat in tight spaces. Smart connectors with built-in sensors are also being introduced to monitor temperature, current, and wear conditions.

"High voltage is expected to be the fastest-growing segment by voltage during the forecast period."

High-voltage connectors are essential for EVs, enabling efficient and reliable power transfer across multiple high-energy systems. They play a central role in propulsion, thermal management, and electronic subsystems, ensuring seamless integration of complex architectures. Their application extends beyond core drivetrain functions to advanced systems such as ADAS, BMS, and lighting. In BMS, high-voltage connectors link battery modules, voltage and temperature sensors, and control units, ensuring safe monitoring, balancing, and control of high-voltage battery packs, which typically operate at 400V or above. They must maintain signal accuracy and power stability under high current loads and temperature changes. In engine management systems, these connectors transfer power from the battery to the motor while allowing precise control of motor functions such as speed, torque, and regenerative braking. They are designed to meet automotive-grade standards like IP6K9K sealing, high vibration resistance, and thermal durability. As EV systems move toward higher voltages and more compact designs, high-voltage connectors are improving in conductivity, thermal performance, and integration, making them vital for efficient and reliable EV operations. Ongoing advancements in high-voltage connector technologies, such as miniaturized connectors, EMI shielding, and lightweight materials, are further focused on improving safety, reliability, and efficiency.

"FCEV is expected to be the fastest-growing segment by propulsion during the forecast period."

FCEVs are accelerating demand for advanced connectors due to their high voltage and high current powertrain systems and the integration of fuel cell stacks, batteries, and electric drivetrains. The harsh operating environment, marked by temperature extremes, vibration, and hydrogen exposure, necessitates sealed and chemically resistant connector solutions. Additionally, the complexity of onboard safety, sensing, and thermal management systems drives the need for compact, high-density, and EMI-shielded signal connectors. These connectors must meet high standards for sealing, reliability, and chemical resistance due to hydrogen use and safety requirements. Typically, in FCEVs, connectors are used in fuel cell stacks, high-voltage batteries, traction motors, inverters, DC-DC converters, and thermal systems like coolant heaters. These high-voltage connectors must support stable operation in high-temperature and chemically active environments. FCEVs generally operate with high-voltage electrical systems. Low-voltage connectors are used in fuel cell control units, hydrogen tank systems, leak detection sensors, and cabin systems. EV connectors with exceptional insulation and safety features safely distribute and transmit power from the fuel cell to the electric motor, auxiliary systems, and battery.

"Europe is expected to be the second fastest market during the forecast period."

Europe hosts leading Tier-I suppliers in the EV connector market, including Rosenberger Group (Germany), TE Connectivity (Ireland), and Leoni (Germany), among others. In addition to domestic connector manufacturers, EV connector producers from around the world also operate in Europe. Japan Aviation Electronics Industry, Ltd. (Japan), Amphenol Corporation (US), and Hirose Electric Co., Ltd. (Japan) have manufacturing facilities and sales offices in the region. Their significant presence is expected to contribute to the expansion of the European EV connector market during the forecast period. Furthermore, several countries in Europe are promoting EVs through significant incentives. The demand for electric vehicles has also surged due to the region's focus on zero- or low-emission vehicles. For example, the UK has announced plans to phase out petrol and diesel vehicles by 2030 and to encourage EV adoption.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 30%, Tier I - 55%, and Others - 15%,

- By Designation: CXOs - 15%, Managers - 15%, and Executives - 70%

- By Region: North America - 30%, Europe - 20%, and Asia Pacific - 50%

The EV connector market is dominated by established players such as TE Connectivity (Ireland), Aptiv (Ireland), Yazaki Corporation (Japan), Molex (US), and Hirose Electric Co., Ltd. (Japan). These companies actively manufacture and develop new and advanced connectors. They have set up R&D facilities and offer best-in-class products to their customers.

Research Coverage:

The market study covers the EV connector market by system (sealed and unsealed), connection (wire-to-wire, wire-to-board, board-to-board, and other connection types), propulsion (BEV, PHEV, FCEV, and HEV), application (ADAS & safety systems, body control & interiors, infotainment systems, engine management & powertrain, battery management systems, vehicle lighting, and other applications), voltage (low voltage, medium voltage, high voltage), component (terminal, housing, lock, and other components), and region (north America, Europe, and Asia Pacific). It also covers the competitive landscape and company profiles of the major players in the EV connector market.

Key Benefits of Purchasing this Report

The study offers a detailed competitive analysis of the key players in the market, including their company profiles, important insights into product and business offerings, recent developments, and main market strategies. The report will assist market leaders and new entrants with estimates of revenue figures for the overall EV connector market and its subsegments. It helps stakeholders understand the competitive landscape and gain additional insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report provides information on key market drivers, restraints, challenges, and opportunities, helping stakeholders keep track of market dynamics.

The report provides insights on the following points:

- Analysis of key drivers (OEMs' emphasis on electrification of mid-segment and luxury vehicles, Rapid integration of ADAS and safety systems, Consumer preference for seamless and interactive driving experience), restraints (Volatility in Raw Material Prices), opportunities (Scaling of autonomous driving technologies, Shift toward advanced electrical/electronic (E/E) architecture), and challenges (Material degradation due to mechanical wear and thermal stresses, Transition from conventional connector systems to modular platform designs) influencing the growth of the EV connector market

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product launches in the EV connector market

- Market Development: Comprehensive information about lucrative markets - the report analyses the EV connector market across various regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the EV connector market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like TE Connectivity (Ireland), Aptiv (Ireland), Yazaki Corporation (Japan), Molex (US), and Hirose Electric Co., Ltd. (Japan) in the EV connector market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary participants

- 2.1.2.2 Primary interviewees from demand and supply sides

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Major objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EV CONNECTOR MARKET

- 4.2 EV CONNECTOR MARKET, BY REGION

- 4.3 EV CONNECTOR MARKET, BY APPLICATION

- 4.4 EV CONNECTOR MARKET, BY CONNECTION

- 4.5 EV CONNECTOR MARKET, BY PROPULSION

- 4.6 EV CONNECTOR MARKET, BY VOLTAGE

- 4.7 EV CONNECTOR MARKET, BY SYSTEM

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 OEMs' emphasis on electrification of mid-segment and luxury vehicles

- 5.2.1.2 Rapid integration of ADAS and safety systems

- 5.2.1.3 Consumer preference for seamless and interactive driving experience

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatility in raw material prices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Scaling of autonomous driving technologies

- 5.2.3.2 Shift toward advanced electrical/electronic (E/E) architecture

- 5.2.4 CHALLENGES

- 5.2.4.1 Material degradation due to mechanical wear and thermal stresses

- 5.2.4.2 Transition from conventional connector systems to modular platform designs

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.3.2 AVERAGE SELLING PRICE OF EV CONNECTORS OFFERED BY KEY PLAYERS

- 5.4 TRADE ANALYSIS

- 5.4.1 IMPORT SCENARIO (HS CODE 853670)

- 5.4.2 EXPORT SCENARIO (HS CODE 853670)

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIERS

- 5.5.2 EV CONNECTOR MANUFACTURERS

- 5.5.3 EV CONNECTOR DISTRIBUTORS

- 5.5.4 TIER I/COMPONENT PROVIDERS

- 5.5.5 AUTOMOTIVE OEMS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 High-frequency and high-speed connectors

- 5.7.1.2 Miniaturized connectors

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Power delivery and management

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Thermal management systems

- 5.7.3.2 Advanced materials

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 KEY REGULATIONS

- 5.9.2.1 QC/T1067-2017

- 5.9.2.2 USCAR-2

- 5.9.2.3 GMW3191-2012

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 AUTOMOTIVE MINIATURIZATION SOLUTIONS BY MOLEX

- 5.10.2 CONNECTED, AUTONOMOUS, AND ELECTRIC WIRE HARNESSES BY SUMITOMO ELECTRIC GROUP

- 5.10.3 SPEEDFLOAT MA01 SERIES BY JAE

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 IMPACT OF AI

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 STRATEGIC POSITIONING OF CHINESE EXPORTERS AND FOREIGN ENTRANTS IN CHINA'S EV CONNECTOR ECOSYSTEM

- 5.16.1 CHINESE CONNECTOR EXPORTERS

- 5.16.2 FOREIGN CONNECTOR FIRMS IN CHINA

- 5.17 EVOLUTION OF EV CONNECTORS IN AUTONOMOUS VEHICLES

- 5.17.1 SIGNIFICANCE OF EV CONNECTORS IN AUTONOMOUS VEHICLE ARCHITECTURE

- 5.17.2 REQUIREMENTS OF EV CONNECTORS IN AUTONOMOUS VEHICLES

- 5.17.3 STRATEGIC ALIGNMENT BY EV CONNECTOR MANUFACTURERS

6 EV CONNECTOR MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 ADAS & SAFETY SYSTEMS

- 6.2.1 RAPID INTEGRATION OF AUTONOMOUS AND SEMI-AUTONOMOUS FUNCTIONS

- 6.3 BODY CONTROL & INTERIORS

- 6.3.1 RISE OF ADVANCED AND AUTONOMOUS ELECTRIC VEHICLES

- 6.4 INFOTAINMENT SYSTEMS

- 6.4.1 SURGE IN DEMAND FOR CONSOLIDATED IN-VEHICLE ENTERTAINMENT SYSTEMS

- 6.5 ENGINE MANAGEMENT & POWERTRAIN

- 6.5.1 INCREASED COMPLEXITY OF PLUG-IN HYBRID ELECTRIC VEHICLES

- 6.6 BATTERY MANAGEMENT SYSTEMS

- 6.6.1 TREND OF GREEN ENERGY IN AUTOMOTIVE INDUSTRY

- 6.7 VEHICLE LIGHTING

- 6.7.1 LARGE-SCALE ADOPTION OF DYNAMIC AND CUSTOMIZABLE LIGHTING IN ELECTRIC VEHICLES

- 6.8 OTHER APPLICATIONS

- 6.9 PRIMARY INSIGHTS

7 EV CONNECTOR MARKET, BY SYSTEM

- 7.1 INTRODUCTION

- 7.2 SEALED

- 7.2.1 ONGOING LAUNCHES OF APPLICATION-FOCUSED PRODUCTS

- 7.3 UNSEALED

- 7.3.1 EXTENSIVE USE IN IN-CABIN APPLICATIONS

- 7.4 PRIMARY INSIGHTS

8 EV CONNECTOR MARKET, BY VOLTAGE

- 8.1 INTRODUCTION

- 8.2 LOW VOLTAGE

- 8.2.1 INCREASED PREFERENCE DUE TO COMPACT SIZE AND COST SAVINGS

- 8.3 MEDIUM VOLTAGE

- 8.3.1 SHIFT TOWARD ELECTRIC AND HYBRID VEHICLES

- 8.4 HIGH VOLTAGE

- 8.4.1 LARGE-SCALE INTEGRATION OF ADVANCED ONBOARD ELECTRONICS

- 8.5 PRIMARY INSIGHTS

9 EV CONNECTOR MARKET, BY CONNECTION

- 9.1 INTRODUCTION

- 9.2 WIRE-TO-WIRE

- 9.2.1 INTEGRATION WITH POWER ELECTRONICS AND LIGHTING SYSTEMS

- 9.3 WIRE-TO-BOARD

- 9.3.1 DEPLOYMENT IN ELECTRONIC CONTROL UNITS AND INFOTAINMENT SYSTEMS

- 9.4 BOARD-TO-BOARD

- 9.4.1 FACILITATES MODULAR DESIGN, MINIMAL SIGNAL LOSS, AND HIGH-SPEED DATA TRANSMISSION

- 9.5 OTHER CONNECTION TYPES

- 9.6 PRIMARY INSIGHTS

10 EV CONNECTOR MARKET, BY PROPULSION

- 10.1 INTRODUCTION

- 10.2 BEV

- 10.2.1 IMPLEMENTATION OF STRICT EMISSION REGULATIONS

- 10.3 PHEV

- 10.3.1 HEIGHTENED DEMAND FOR HIGH-VOLTAGE APPLICATIONS

- 10.4 FCEV

- 10.4.1 COMPLEXITY OF ONBOARD SAFETY, SENSING, AND THERMAL MANAGEMENT SYSTEMS

- 10.5 HEV

- 10.6 PRIMARY INSIGHTS

11 EV CONNECTOR MARKET, BY COMPONENT

- 11.1 INTRODUCTION

- 11.2 TERMINAL

- 11.3 HOUSING

- 11.4 LOCK

- 11.5 OTHER COMPONENTS

12 EV CONNECTOR MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 MACROECONOMIC OUTLOOK

- 12.2.2 CHINA

- 12.2.2.1 Rise in domestic EV production and sales to drive market

- 12.2.3 INDIA

- 12.2.3.1 Localization of EV connectors to drive market

- 12.2.4 JAPAN

- 12.2.4.1 Strong OEM base and advanced electrification strategies to drive market

- 12.2.5 SOUTH KOREA

- 12.2.5.1 Growing incorporation of smart cockpit features in local EV models to drive market

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK

- 12.3.2 NETHERLANDS

- 12.3.2.1 Continuous innovations in connector technologies to drive market

- 12.3.3 GERMANY

- 12.3.3.1 Leadership in premium EV manufacturing and large-scale electronics integration to drive market

- 12.3.4 FRANCE

- 12.3.4.1 Collaborations between OEMs and EV connector manufacturers to drive market

- 12.3.5 NORWAY

- 12.3.5.1 Integration of smart-diagnostic-ready connectors in EVs to drive market

- 12.3.6 AUSTRIA

- 12.3.6.1 Focus on development and prototyping of advanced EV connectors to drive market

- 12.3.7 UK

- 12.3.7.1 Significant presence of local EV connector manufacturers to drive market

- 12.3.8 SPAIN

- 12.3.8.1 Strong EV production capacity to drive market

- 12.3.9 SWEDEN

- 12.3.9.1 National objective of fossil-free transportation to drive market

- 12.3.10 SWITZERLAND

- 12.3.10.1 Elevated demand for miniaturized and climate-resistant connectors to drive market

- 12.3.11 DENMARK

- 12.4 NORTH AMERICA

- 12.4.1 MACROECONOMIC OUTLOOK

- 12.4.2 US

- 12.4.2.1 Integration of ADAS, V2X, and platform-specific high-voltage architectures to drive market

- 12.4.3 CANADA

- 12.4.3.1 Regulatory push for full electrification to drive market

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.3.1 TE CONNECTIVITY

- 13.3.2 APTIV

- 13.3.3 YAZAKI CORPORATION

- 13.3.4 MOLEX

- 13.3.5 HIROSE ELECTRIC CO., LTD.

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 System footprint

- 13.7.5.4 Connection footprint

- 13.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING

- 13.8.5.1 List of start-ups/SMEs

- 13.8.5.2 Competitive benchmarking of start-ups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHERS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 TE CONNECTIVITY

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches/developments

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.3.4 Others

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 APTIV

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansions

- 14.1.2.3.3 Others

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 YAZAKI CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.3.2 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 MOLEX

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches/developments

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 HIROSE ELECTRIC CO., LTD.

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches/developments

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 SUMITOMO ELECTRIC INDUSTRIES, LTD.

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.3.2 Expansions

- 14.1.6.3.3 Others

- 14.1.7 JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches/developments

- 14.1.7.3.2 Expansions

- 14.1.7.3.3 Others

- 14.1.8 AMPHENOL CORPORATION

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.9 ROSENBERGER GROUP

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.9.3.2 Expansions

- 14.1.10 KYOCERA CORPORATION

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches/developments

- 14.1.10.3.2 Deals

- 14.1.10.3.3 Others

- 14.1.11 FURUKAWA ELECTRIC CO., LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.3.2 Expansions

- 14.1.12 LUXSHARE PRECISION INDUSTRY CO., LTD.

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Deals

- 14.1.12.3.2 Expansions

- 14.1.12.3.3 Others

- 14.1.1 TE CONNECTIVITY

- 14.2 OTHER PLAYERS

- 14.2.1 JST MFG. CO., LTD.

- 14.2.2 LITTELFUSE, INC.

- 14.2.3 SHENGLAN TECHNOLOGY CO., LTD.

- 14.2.4 KINSUN INDUSTRIES INC.

- 14.2.5 TXGA LLC

- 14.2.6 THB GROUP

- 14.2.7 LUMBERG HOLDINGS, INC.

- 14.2.8 LEONI AG

- 14.2.9 SAMTEC

- 14.2.10 FUJIKURA LTD.

- 14.2.11 ITT INC.

- 14.2.12 WURTH ELEKTRONIK EISOS GMBH & CO. KG

- 14.2.13 HUBER+SUHNER

15 RECOMMENDATIONS BY MARKETSANDMARKETS

- 15.1 ASIA PACIFIC TO BE LUCRATIVE MARKET FOR EV CONNECTORS

- 15.2 EMPHASIS ON STRENGTHENING EV CONNECTOR PORTFOLIO FOR ADAS AND SAFETY SYSTEMS

- 15.3 HIGH IP-RATED SEALED SOLUTIONS, SMART DIAGNOSTICS, AND MODULAR DESIGNS TO BE KEY FOCUS AREAS

- 15.4 CONCLUSION

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS

List of Tables

- TABLE 1 MARKET DEFINITION, BY APPLICATION

- TABLE 2 MARKET DEFINITION, BY CONNECTION

- TABLE 3 MARKET DEFINITION, BY PROPULSION

- TABLE 4 MARKET DEFINITION, BY SYSTEM

- TABLE 5 MARKET DEFINITION, BY VOLTAGE

- TABLE 6 MARKET DEFINITION, BY COMPONENT

- TABLE 7 CURRENCY EXCHANGE RATES, 2019-2024

- TABLE 8 PROMINENT MID-SEGMENT AND LUXURY EV MODELS, 2024

- TABLE 9 ADAS-EQUIPPED ELECTRIC VEHICLES

- TABLE 10 IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 11 AVERAGE SELLING PRICE TREND OF EV CONNECTORS IN ASIA PACIFIC, 2022-2024 (USD)

- TABLE 12 AVERAGE SELLING PRICE TREND OF EV CONNECTORS IN EUROPE, 2022-2024 (USD)

- TABLE 13 AVERAGE SELLING PRICE TREND OF EV CONNECTORS IN NORTH AMERICA, 2022-2024 (USD)

- TABLE 14 AVERAGE SELLING PRICE OF EV CONNECTORS OFFERED BY KEY PLAYERS, 2024

- TABLE 15 IMPORT DATA FOR HS CODE 853670-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 16 EXPORT DATA FOR HS CODE 853670-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 17 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 18 THERMAL MANAGEMENT SYSTEMS

- TABLE 19 ADVANCED MATERIALS

- TABLE 20 PATENT ANALYSIS

- TABLE 21 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 QC/T-1067 TEMPERATURE CLASSIFICATION

- TABLE 25 QC/T-1067 VIBRATION CLASSIFICATION

- TABLE 26 QC/T-1067 SEALING CLASSIFICATION

- TABLE 27 USCAR-2 TEMPERATURE CLASSIFICATION

- TABLE 28 USCAR-2 VIBRATION CLASSIFICATION

- TABLE 29 USCAR-2 SEALING CLASSIFICATION

- TABLE 30 GMW-3191 TEMPERATURE CLASSIFICATION

- TABLE 31 GMW-3191 VIBRATION CLASSIFICATION

- TABLE 32 GMW-3191 SEALING CLASSIFICATION

- TABLE 33 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 34 LIST OF FUNDINGS, 2023-2024

- TABLE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE COMPONENTS (%)

- TABLE 36 KEY BUYING CRITERIA FOR TOP THREE COMPONENTS

- TABLE 37 EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 38 EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 39 EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 40 EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 41 ADAS & SAFETY SYSTEMS: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 42 ADAS & SAFETY SYSTEMS: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 43 ADAS & SAFETY SYSTEMS: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 ADAS & SAFETY SYSTEMS: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 45 BODY CONTROL & INTERIORS: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 46 BODY CONTROL & INTERIORS: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 47 BODY CONTROL & INTERIORS: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 BODY CONTROL & INTERIORS: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 49 INFOTAINMENT SYSTEMS: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 50 INFOTAINMENT SYSTEMS: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 51 INFOTAINMENT SYSTEMS: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 INFOTAINMENT SYSTEMS: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 53 ENGINE MANAGEMENT & POWERTRAIN: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 54 ENGINE MANAGEMENT & POWERTRAIN: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 55 ENGINE MANAGEMENT & POWERTRAIN: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 ENGINE MANAGEMENT & POWERTRAIN: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 57 BATTERY MANAGEMENT SYSTEMS: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 58 BATTERY MANAGEMENT SYSTEMS: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 59 BATTERY MANAGEMENT SYSTEMS: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 BATTERY MANAGEMENT SYSTEMS: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 61 VEHICLE LIGHTING: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 62 VEHICLE LIGHTING: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 63 VEHICLE LIGHTING: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 VEHICLE LIGHTING: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 65 OTHER APPLICATIONS: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 66 OTHER APPLICATIONS: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 67 OTHER APPLICATIONS: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 OTHER APPLICATIONS: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 69 EV CONNECTOR MARKET, BY SYSTEM, 2021-2024 (MILLION UNITS)

- TABLE 70 EV CONNECTOR MARKET, BY SYSTEM, 2025-2032 (MILLION UNITS)

- TABLE 71 EV CONNECTOR MARKET, BY SYSTEM, 2021-2024 (USD MILLION)

- TABLE 72 EV CONNECTOR MARKET, BY SYSTEM, 2025-2032 (USD MILLION)

- TABLE 73 SEALED: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 74 SEALED: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 75 SEALED: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 SEALED: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 77 UNSEALED: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 78 UNSEALED: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 79 UNSEALED: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 UNSEALED: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 81 EV CONNECTOR MARKET, BY VOLTAGE, 2021-2024 (MILLION UNITS)

- TABLE 82 EV CONNECTOR MARKET, BY VOLTAGE, 2025-2032 (MILLION UNITS)

- TABLE 83 EV CONNECTOR MARKET, BY VOLTAGE, 2021-2024 (USD MILLION)

- TABLE 84 EV CONNECTOR MARKET, BY VOLTAGE, 2025-2032 (USD MILLION)

- TABLE 85 LOW VOLTAGE: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 86 LOW VOLTAGE: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 87 LOW VOLTAGE: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 LOW VOLTAGE: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 89 MEDIUM VOLTAGE: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 90 MEDIUM VOLTAGE: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 91 MEDIUM VOLTAGE: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 MEDIUM VOLTAGE: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 93 HIGH VOLTAGE: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 94 HIGH VOLTAGE: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 95 HIGH VOLTAGE: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 HIGH VOLTAGE: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 97 EV CONNECTOR MARKET: BY CONNECTION, 2021-2024 (MILLION UNITS)

- TABLE 98 EV CONNECTOR MARKET: BY CONNECTION, 2025-2032 (MILLION UNITS)

- TABLE 99 EV CONNECTOR MARKET: BY CONNECTION, 2021-2024 (USD MILLION)

- TABLE 100 EV CONNECTOR MARKET: BY CONNECTION, 2025-2032 (USD MILLION)

- TABLE 101 WIRE-TO-WIRE: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 102 WIRE-TO-WIRE: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 103 WIRE-TO-WIRE: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 WIRE-TO-WIRE: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 105 WIRE-TO-BOARD: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 106 WIRE-TO-BOARD: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 107 WIRE-TO-BOARD: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 WIRE-TO-BOARD: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 109 BOARD-TO-BOARD: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 110 BOARD-TO-BOARD: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 111 BOARD-TO-BOARD: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 BOARD-TO-BOARD: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 113 OTHER CONNECTION TYPES: EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 114 OTHER CONNECTION TYPES: EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 115 OTHER CONNECTION TYPES: EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 OTHER CONNECTION TYPES: EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 117 EV CONNECTOR MARKET, BY PROPULSION, 2021-2024 (MILLION UNITS)

- TABLE 118 EV CONNECTOR MARKET, BY PROPULSION, 2025-2032 (MILLION UNITS)

- TABLE 119 EV CONNECTOR MARKET, BY PROPULSION, 2021-2024 (USD MILLION)

- TABLE 120 EV CONNECTOR MARKET, BY PROPULSION, 2025-2032 (USD MILLION)

- TABLE 121 BEV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 122 BEV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 123 BEV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 124 BEV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 125 PHEV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 126 PHEV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 127 PHEV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 128 PHEV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 129 FCEV CONNECTOR MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 130 FCEV CONNECTOR MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 131 FCEV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 132 FCEV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 133 FEATURES OF EV CONNECTOR COMPONENTS

- TABLE 134 EV CONNECTOR MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 135 EV CONNECTOR MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 136 EV CONNECTOR MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 137 EV CONNECTOR MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 138 ASIA PACIFIC: EV CONNECTOR MARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 139 ASIA PACIFIC: EV CONNECTOR MARKET, BY COUNTRY, 2025-2032 (MILLION UNITS)

- TABLE 140 ASIA PACIFIC: EV CONNECTOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 141 ASIA PACIFIC: EV CONNECTOR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 142 CHINA: TOP SELLING EV MODELS, 2024

- TABLE 143 CHINA: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 144 CHINA: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 145 CHINA: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 146 CHINA: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 147 INDIA: TOP SELLING EV MODELS, 2024

- TABLE 148 INDIA: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 149 INDIA: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 150 INDIA: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 151 INDIA: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 152 JAPAN: TOP SELLING EV MODELS, 2024

- TABLE 153 JAPAN: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 154 JAPAN: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 155 JAPAN: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 156 JAPAN: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 157 SOUTH KOREA: TOP SELLING EV MODELS, 2024

- TABLE 158 SOUTH KOREA: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 159 SOUTH KOREA: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 160 SOUTH KOREA: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 161 SOUTH KOREA: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 162 EUROPE: EV CONNECTOR MARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 163 EUROPE: EV CONNECTOR MARKET, BY COUNTRY, 2025-2032 (MILLION UNITS)

- TABLE 164 EUROPE: EV CONNECTOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 165 EUROPE: EV CONNECTOR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 166 NETHERLANDS: TOP SELLING EV MODELS, 2024

- TABLE 167 NETHERLANDS: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 168 NETHERLANDS: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 169 NETHERLANDS: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 170 NETHERLANDS: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 171 GERMANY: TOP SELLING EV MODELS, 2024

- TABLE 172 GERMANY: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 173 GERMANY: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 174 GERMANY: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 175 GERMANY: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 176 FRANCE: TOP SELLING EV MODELS, 2024

- TABLE 177 FRANCE: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 178 FRANCE: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 179 FRANCE: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 180 FRANCE: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 181 NORWAY: TOP SELLING EV MODELS, 2024

- TABLE 182 NORWAY: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 183 NORWAY: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 184 NORWAY: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 185 NORWAY: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 186 AUSTRIA: TOP SELLING EV MODELS, 2024

- TABLE 187 AUSTRIA: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 188 AUSTRIA: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 189 AUSTRIA: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 190 AUSTRIA: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 191 UK: TOP SELLING EV MODELS, 2024

- TABLE 192 UK: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 193 UK: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 194 UK: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 195 UK: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 196 SPAIN: TOP SELLING EV MODELS, 2024

- TABLE 197 SPAIN: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 198 SPAIN: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 199 SPAIN: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 200 SPAIN: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 201 SWEDEN: TOP SELLING EV MODELS, 2024

- TABLE 202 SWEDEN: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 203 SWEDEN: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 204 SWEDEN: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 205 SWEDEN: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 206 SWITZERLAND: TOP SELLING EV MODELS, 2024

- TABLE 207 SWITZERLAND: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 208 SWITZERLAND: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 209 SWITZERLAND: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 210 SWITZERLAND: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 211 DENMARK: TOP SELLING EV MODELS, 2024

- TABLE 212 DENMARK: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 213 DENMARK: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 214 DENMARK: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 215 DENMARK: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 216 NORTH AMERICA: EV CONNECTOR MARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 217 NORTH AMERICA: EV CONNECTOR MARKET, BY COUNTRY, 2025-2032 (MILLION UNITS)

- TABLE 218 NORTH AMERICA: EV CONNECTOR MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 219 NORTH AMERICA: EV CONNECTOR MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 220 US: TOP SELLING EV MODELS, 2024

- TABLE 221 US: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 222 US: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 223 US: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 224 US: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 225 CANADA: TOP SELLING EV MODELS, 2024

- TABLE 226 CANADA: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 227 CANADA: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 228 CANADA: EV CONNECTOR MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 229 CANADA: EV CONNECTOR MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 230 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 231 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- TABLE 232 REGION FOOTPRINT

- TABLE 233 SYSTEM FOOTPRINT

- TABLE 234 CONNECTION FOOTPRINT

- TABLE 235 LIST OF START-UPS/SMES

- TABLE 236 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 237 EV CONNECTOR MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2021-2025

- TABLE 238 EV CONNECTOR MARKET: DEALS, 2021-2025

- TABLE 239 EV CONNECTOR MARKET: EXPANSIONS, 2021-2025

- TABLE 240 EV CONNECTOR MARKET: OTHERS, 2021-2025

- TABLE 241 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 242 TE CONNECTIVITY: PRODUCTS OFFERED

- TABLE 243 TE CONNECTIVITY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 244 TE CONNECTIVITY: DEALS

- TABLE 245 TE CONNECTIVITY: EXPANSIONS

- TABLE 246 TE CONNECTIVITY: OTHERS

- TABLE 247 APTIV: COMPANY OVERVIEW

- TABLE 248 APTIV: PRODUCTS OFFERED

- TABLE 249 APTIV: DEALS

- TABLE 250 APTIV: EXPANSIONS

- TABLE 251 APTIV: OTHERS

- TABLE 252 YAZAKI CORPORATION: COMPANY OVERVIEW

- TABLE 253 YAZAKI CORPORATION: PRODUCTS OFFERED

- TABLE 254 YAZAKI CORPORATION: DEALS

- TABLE 255 YAZAKI CORPORATION: EXPANSIONS

- TABLE 256 MOLEX: COMPANY OVERVIEW

- TABLE 257 MOLEX: PRODUCTS OFFERED

- TABLE 258 MOLEX: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 259 MOLEX: DEALS

- TABLE 260 MOLEX: EXPANSIONS

- TABLE 261 HIROSE ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 262 HIROSE ELECTRIC CO., LTD.: PRODUCTS OFFERED

- TABLE 263 HIROSE ELECTRIC CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 264 HIROSE ELECTRIC CO., LTD.: DEALS

- TABLE 265 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 266 SUMITOMO ELECTRIC INDUSTRIES, LTD.: PRODUCTS OFFERED

- TABLE 267 SUMITOMO ELECTRIC INDUSTRIES, LTD.: DEALS

- TABLE 268 SUMITOMO ELECTRIC INDUSTRIES, LTD.: EXPANSIONS

- TABLE 269 SUMITOMO ELECTRIC INDUSTRIES, LTD.: OTHERS

- TABLE 270 JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.: COMPANY OVERVIEW

- TABLE 271 JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.: PRODUCTS OFFERED

- TABLE 272 JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 273 JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.: EXPANSIONS

- TABLE 274 JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.: OTHERS

- TABLE 275 AMPHENOL CORPORATION: COMPANY OVERVIEW

- TABLE 276 AMPHENOL CORPORATION: PRODUCTS OFFERED

- TABLE 277 ROSENBERGER GROUP: COMPANY OVERVIEW

- TABLE 278 ROSENBERGER GROUP: PRODUCTS OFFERED

- TABLE 279 ROSENBERGER GROUP: DEALS

- TABLE 280 ROSENBERGER GROUP: EXPANSIONS

- TABLE 281 KYOCERA CORPORATION: COMPANY OVERVIEW

- TABLE 282 KYOCERA CORPORATION: PRODUCTS OFFERED

- TABLE 283 KYOCERA CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 284 KYOCERA CORPORATION: DEALS

- TABLE 285 KYOCERA CORPORATION: OTHERS

- TABLE 286 FURUKAWA ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 287 FURUKAWA ELECTRIC CO., LTD.: PRODUCTS OFFERED

- TABLE 288 FURUKAWA ELECTRIC CO., LTD.: DEALS

- TABLE 289 FURUKAWA ELECTRIC CO., LTD.: EXPANSIONS

- TABLE 290 LUXSHARE PRECISION INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 291 LUXSHARE PRECISION INDUSTRY CO., LTD.: PRODUCTS OFFERED

- TABLE 292 LUXSHARE PRECISION INDUSTRY CO., LTD.: DEALS

- TABLE 293 LUXSHARE PRECISION INDUSTRY CO., LTD.: EXPANSIONS

- TABLE 294 LUXSHARE PRECISION INDUSTRY CO., LTD.: OTHERS

- TABLE 295 JST MFG. CO., LTD.: COMPANY OVERVIEW

- TABLE 296 LITTELFUSE, INC.: COMPANY OVERVIEW

- TABLE 297 SHENGLAN TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 298 KINSUN INDUSTRIES INC.: COMPANY OVERVIEW

- TABLE 299 TXGA LLC: COMPANY OVERVIEW

- TABLE 300 THB GROUP: COMPANY OVERVIEW

- TABLE 301 LUMBERG HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 302 LEONI AG: COMPANY OVERVIEW

- TABLE 303 SAMTEC: COMPANY OVERVIEW

- TABLE 304 FUJIKURA LTD.: COMPANY OVERVIEW

- TABLE 305 ITT INC.: COMPANY OVERVIEW

- TABLE 306 WURTH ELEKTRONIK EISOS GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 307 HUBER+SUHNER: COMPANY OVERVIEW

List of Figures

- FIGURE 1 EV CONNECTOR MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 PRIMARY INSIGHTS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 RESEARCH APPROACH

- FIGURE 9 MARKET SIZE ESTIMATION NOTES

- FIGURE 10 DATA TRIANGULATION

- FIGURE 11 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- FIGURE 12 EV CONNECTOR MARKET OUTLOOK

- FIGURE 13 EV CONNECTOR MARKET, BY REGION

- FIGURE 14 EV CONNECTOR MARKET, BY SYSTEM

- FIGURE 15 KEY PLAYERS IN EV CONNECTOR MARKET

- FIGURE 16 INTEGRATION OF ADVANCED TECHNOLOGIES IN EV CONNECTORS TO DRIVE MARKET

- FIGURE 17 ASIA PACIFIC TO BE LARGEST MARKET FOR EV CONNECTORS DURING FORECAST PERIOD

- FIGURE 18 ADAS & SAFETY SYSTEMS TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 19 BOARD-TO-BOARD TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 20 BEV TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 21 HIGH VOLTAGE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 22 SEALED TO HOLD HIGHER SHARE THAN UNSEALED DURING FORECAST PERIOD

- FIGURE 23 EV CONNECTOR MARKET DYNAMICS

- FIGURE 24 EVOLUTION OF AUTOMATED SAFETY TECHNOLOGIES

- FIGURE 25 EV CONNECTORS IN IN-VEHICLE CONNECTIVITY SYSTEM

- FIGURE 26 GLOBAL AVERAGE PRICE OF COPPER (USD/METRIC TON)

- FIGURE 27 AUTONOMOUS DRIVING CONNECTORS, BY LEVEL OF AUTONOMY

- FIGURE 28 AVERAGE SELLING PRICE TREND OF EV CONNECTORS IN ASIA PACIFIC, 2022-2024 (USD)

- FIGURE 29 AVERAGE SELLING PRICE TREND OF EV CONNECTORS IN EUROPE, 2022-2024 (USD)

- FIGURE 30 AVERAGE SELLING PRICE TREND OF EV CONNECTORS IN NORTH AMERICA, 2022-2024 (USD)

- FIGURE 31 IMPORT DATA FOR HS CODE 853670-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 32 EXPORT DATA FOR HS CODE 853670-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 33 ECOSYSTEM ANALYSIS

- FIGURE 34 SUPPLY CHAIN ANALYSIS

- FIGURE 35 HIGH-FREQUENCY AND HIGH-SPEED CONNECTORS

- FIGURE 36 MINIATURIZED CONNECTOR SYSTEM APPLICATIONS

- FIGURE 37 PATENT ANALYSIS

- FIGURE 38 INVESTMENT AND FUNDING SCENARIO, 2022-2024

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE COMPONENTS

- FIGURE 40 KEY BUYING CRITERIA FOR TOP THREE COMPONENTS

- FIGURE 41 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 42 CHINESE VS. FOREIGN PLAYERS IN CHINA'S EV CONNECTOR MARKET

- FIGURE 43 STRATEGIES BY LEADING EV CONNECTOR MANUFACTURERS FOR AUTONOMOUS VEHICLES

- FIGURE 44 EV CONNECTOR MARKET, BY APPLICATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 45 EV CONNECTOR MARKET, BY SYSTEM, 2025 VS. 2032 (USD MILLION)

- FIGURE 46 EV CONNECTOR MARKET, BY VOLTAGE, 2025 VS. 2032 (USD MILLION)

- FIGURE 47 EV CONNECTOR MARKET, BY CONNECTION, 2025 VS. 2032 (USD MILLION)

- FIGURE 48 EV CONNECTOR MARKET, BY PROPULSION, 2025 VS. 2032 (USD MILLION)

- FIGURE 49 COMPONENTS OF EV CONNECTORS

- FIGURE 50 EV CONNECTOR MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 51 ASIA PACIFIC: EV CONNECTOR MARKET SNAPSHOT

- FIGURE 52 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 53 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 54 ASIA PACIFIC: INFLATION RATE IN TERMS OF AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 55 ASIA PACIFIC: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 56 EUROPE: EV CONNECTOR MARKET, BY COUNTRY, 2025 VS. 2032 (USD MILLION)

- FIGURE 57 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 58 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 59 EUROPE: INFLATION RATE IN TERMS OF AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 60 EUROPE: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 61 NORTH AMERICA: EV CONNECTOR MARKET SNAPSHOT

- FIGURE 62 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 63 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 64 NORTH AMERICA: INFLATION RATE IN TERMS OF AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 65 NORTH AMERICA: MANUFACTURING INDUSTRY CONTRIBUTION TO GDP, BY COUNTRY, 2024

- FIGURE 66 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 67 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2020-2024

- FIGURE 68 COMPANY VALUATION (USD BILLION)

- FIGURE 69 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 70 BRAND/PRODUCT COMPARISON

- FIGURE 71 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 72 COMPANY FOOTPRINT

- FIGURE 73 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 74 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 75 APTIV: COMPANY SNAPSHOT

- FIGURE 76 YAZAKI CORPORATION: COMPANY SNAPSHOT

- FIGURE 77 HIROSE ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 78 SUMITOMO ELECTRIC INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 79 JAPAN AVIATION ELECTRONICS INDUSTRY, LTD.: COMPANY SNAPSHOT

- FIGURE 80 AMPHENOL CORPORATION: COMPANY SNAPSHOT

- FIGURE 81 KYOCERA CORPORATION: COMPANY SNAPSHOT

- FIGURE 82 FURUKAWA ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- FIGURE 83 LUXSHARE PRECISION INDUSTRY CO., LTD.: COMPANY SNAPSHOT