PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1777936

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1777936

Food Inspection Devices Market by X-ray Inspection Devices, Metal Detectors, Checkweighers, Vision Inspection Systems, Meat, Bakery & Confectionery, Catering & Ready-to-Eat Meals, Food Packaging, Retail Chains & Hypermarkets - Global Forecast to 2030

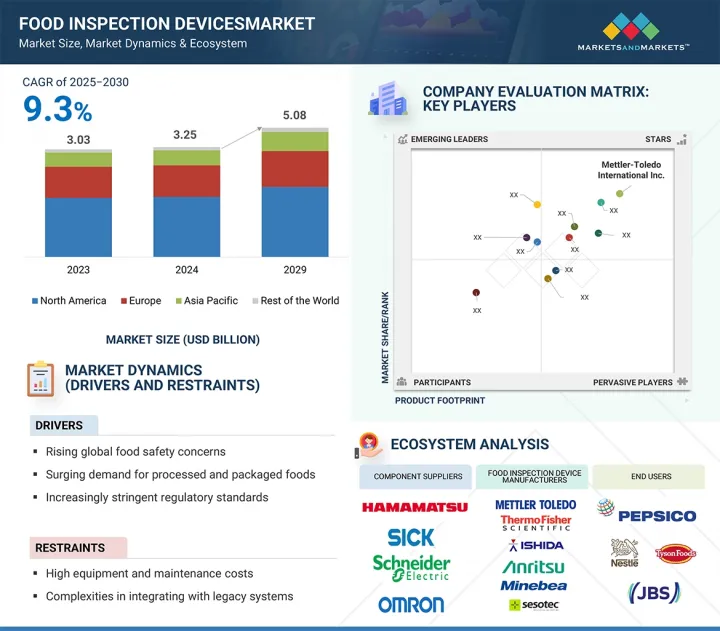

The food inspection devices market is projected to reach USD 5.08 billion by 2030 from USD 3.25 billion in 2025 at a CAGR of 9.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Product, Technology, Vertical, Food Category, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Several key factors are fueling the rapid growth of the food inspection devices market. Rising concerns over food safety, increased cases of contamination, and stricter global regulations are compelling food manufacturers to adopt advanced inspection technologies. The growing demand for packaged and processed foods, along with consumer preference for clean-label and allergen-free products, further boosts the need for precise inspection systems. Technologies such as AI, IoT, and hyperspectral imaging are enhancing real-time detection and traceability. However, high initial costs and maintenance expenses of advanced inspection devices limit adoption among small and mid-sized enterprises. Additionally, lack of technical expertise, data integration challenges, and limited awareness of regulatory compliance in some regions hinder the widespread implementation of these systems.

"By technology, the automated/computerized systems segment is expected to register the highest CAGR during the forecast period."

The automated/computerized systems segment is projected to register a higher CAGR in the food inspection devices market during the forecast period, driven by increasing demand for accuracy, speed, and consistency in food quality assurance. These systems integrate advanced technologies such as artificial intelligence, machine vision, IoT, and real-time data analytics to enable precise detection of contaminants, packaging defects, and weight deviations. Automated inspection systems offer significant advantages over manual methods, including reduced human error, higher throughput, and better compliance with stringent food safety standards set by regulatory bodies like the FDA, EFSA, and FSSAI.

The adoption of computerized systems is rising across large and mid-sized food processing facilities due to their ability to streamline quality control, improve traceability, and reduce product recalls. Additionally, the shift toward Industry 4.0 and smart manufacturing practices in the food sector is further accelerating this trend. Cloud connectivity, predictive maintenance, and remote monitoring are enhancing the value proposition of automated systems. Companies such as Thermo Fisher Scientific, Mettler-Toledo, and ISHIDA are offering intelligent, modular solutions tailored for diverse production environments. As digital transformation advances, automated food inspection systems will continue to gain traction globally, particularly in high-volume and compliance-sensitive operations.

By food category, the meat segment is projected to account for the largest market share during the forecast period."

The meat segment is expected to hold the largest market share in the overall food inspection devices market during the forecast period. This large market share is primarily attributed to the high risk of contamination, strict hygiene standards, and rigorous regulatory oversight associated with meat processing. Regulatory bodies such as the USDA, EFSA, and FSSAI mandate comprehensive inspection protocols for meat products to prevent the spread of foodborne illnesses and ensure consumer safety.

Due to the perishable nature of meat and its susceptibility to pathogens, processors are increasingly adopting advanced inspection technologies such as X-ray systems, metal detectors, and spectroscopy-based tools to detect bone fragments, foreign objects, and microbial contamination. Furthermore, automated inspection systems enable real-time monitoring and high-throughput analysis, which are essential for maintaining product quality and meeting safety requirements in large-scale meat processing facilities.

With rising global meat consumption and growing concerns over food safety, the demand for accurate, reliable, and efficient inspection solutions continues to grow. Key players are offering industry-specific technologies and compliance-ready systems to cater to this segment, further strengthening the meat category's leading position in the market.

"Asia Pacific is projected to account for the largest market share during the forecast period."

The Asia Pacific region is projected to hold the largest share of the global food inspection devices market during the forecast period, driven by rapid industrialization of the food processing sector, rising consumer awareness, and strengthening regulatory frameworks. Countries such as China, India, Japan, South Korea, and Australia are witnessing substantial growth in packaged and processed food consumption, prompting manufacturers to invest in advanced inspection technologies to ensure safety, quality, and compliance with evolving food safety standards.

Regulatory agencies across the region, including the Food Safety and Standards Authority of India (FSSAI) and China's National Health Commission, are enforcing stricter inspection mandates, compelling producers to adopt X-ray systems, metal detectors, and vision inspection solutions. Moreover, increasing food exports from Asia Pacific require adherence to international safety protocols, further boosting demand for high-precision inspection systems.

Cost-effective manufacturing, government support for food safety modernization, and the growing presence of local and global players are making inspection technologies more accessible across small and medium enterprises. As urbanization, population growth, and food safety consciousness continue to rise, Asia Pacific is expected to remain the largest and most dynamic region in the global food inspection devices market.

The break-up of the profile of primary participants in the food inspection devices market is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, Tier 3 - 25%

- By Designation Type: C Level - 40%, Director Level - 30%, Others - 30%

- By Region Type: Asia Pacific - 35%, North America - 25%, Europe - 25%, Rest of the World - 15%

Notes: Other designations include sales, marketing, and product managers.

The three tiers of the companies are based on their total revenues as of 2024; Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million.

The major players in the food inspection devices market with a significant geographical presence include Mettler-Toledo International Inc. (US), Thermo Fisher Scientific Inc. (US), Ishida Co., Ltd. (Japan), Anritsu Corporation (Japan), Loma Systems (UK), and others.

Research Coverage

The report segments the food inspection devices market and forecasts its size by product, vertical, technology, food category, and region. It also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing the market growth. The report covers qualitative aspects in addition to quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall food inspection devices market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising global food safety concerns driving mandatory inspection adoption, Surging demand for processed and packaged foods, Increasingly stringent regulatory standards), restraints (High equipment and maintenance costs, complexities in integration with legacy systems), opportunities (Technological advancements in inspection systems, Rising demand for advanced contaminant detection, Growing demand for portable and rapid testing tools in on-site applications), and challenges (Difficulty in standardizing inspection across varied diverse food products, growing cybersecurity risks associated with data-driven inspection infrastructure)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the food inspection devices market

- Market Development: Comprehensive information about lucrative markets -the report analyses the food inspection devices market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the food inspection devices market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including include Mettler-Toledo International Inc. (US), Thermo Fisher Scientific Inc. (US), Ishida Co., Ltd. (Japan), Anritsu Corporation (Japan), Fortress Technology Inc. (Canada), Sesotec GmbH (Germany), Loma Systems (UK), Minebea Intec GmbH (Germany), Bizerba SE & Co. KG (Germany), and Multivac Group (Germany)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FOOD INSPECTION DEVICES MARKET

- 4.2 FOOD INSPECTION DEVICES MARKET, BY PRODUCT

- 4.3 FOOD INSPECTION MARKET, BY TECHNOLOGY

- 4.4 FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY

- 4.5 FOOD INSPECTION DEVICES MARKET, BY VERTICAL

- 4.6 FOOD INSPECTION DEVICES MARKET, BY REGION

- 4.7 FOOD INSPECTION DEVICES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising global food safety concerns

- 5.2.1.2 Surging demand for processed and packaged foods

- 5.2.1.3 Increasingly stringent regulatory standards

- 5.2.2 RESTRAINTS

- 5.2.2.1 High equipment and maintenance costs

- 5.2.2.2 Complexities in integrating with legacy systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements in inspection systems

- 5.2.3.2 Rising demand for advanced contaminant detection

- 5.2.3.3 Growing adoption of portable and rapid testing tools in on-site applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Difficulty in standardizing inspection across varied food products

- 5.2.4.2 Growing cybersecurity risks associated with data-driven inspection infrastructure

- 5.2.4.3 Skills shortage and low regulatory awareness

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Ultrasound imaging

- 5.7.1.2 Machine vision

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Artificial intelligence & machine learning

- 5.7.2.2 Data analytics & cloud platforms

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Food safety testing kits

- 5.7.3.2 3D scanning

- 5.7.3.3 Digital twins

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF METAL DETECTORS, BY KEY PLAYER, 2021-2024

- 5.8.2 AVERAGE SELLING PRICE TREND OF METAL DETECTORS, BY REGION, 2021-2024

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 FOOD INSPECTION UPGRADE AT NESTLE

- 5.11.2 QUALITY CONTROL AT TESCO WITH HYPERSPECTRAL IMAGING

- 5.11.3 AUTOMATED INSPECTION AT UNILEVER

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 9031)

- 5.12.2 EXPORT SCENARIO (HS CODE 9031)

- 5.13 PATENT ANALYSIS

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF ANALYSIS (HS CODE 9031)

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 IMPACT OF AI/GEN AI ON FOOD INSPECTION DEVICES MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON FOOD INSPECTION DEVICES MARKET - OVERVIEW

- 5.17.1 PRICE IMPACT ANALYSIS

- 5.17.2 KEY IMPACTS ON COUNTRIES/REGIONS

- 5.17.3 US

- 5.17.4 EUROPE

- 5.17.5 ASIA PACIFIC

- 5.17.6 IMPACT ON VERTICALS

6 FOOD INSPECTION DEVICES MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 X-RAY INSPECTION DEVICES

- 6.2.1 DEMAND FOR NON-DESTRUCTIVE, HIGH-SENSITIVITY DETECTION TO PROPEL MARKET GROWTH

- 6.3 METAL DETECTORS

- 6.3.1 NEED FOR REGULATORY COMPLIANCE AND COST-EFFECTIVENESS TO DRIVE ADOPTION

- 6.4 CHECKWEIGHERS

- 6.4.1 PRECISION AND REGULATORY MANDATES FUELING ADOPTION IN FOOD PRODUCTION

- 6.5 VISION INSPECTION SYSTEMS

- 6.5.1 AI-POWERED DEFECT DETECTION AND LABEL VERIFICATION DRIVING DEMAND

- 6.6 MICROBIAL DETECTION SYSTEMS

- 6.6.1 NEED FOR STRENGTHENING HYGIENE ASSURANCE ACROSS PACKAGING LINES TO DRIVE DEMAND

- 6.7 SPECTROSCOPY DEVICES

- 6.7.1 REAL-TIME, NON-DESTRUCTIVE MATERIAL VERIFICATION TO ACCELERATE DEMAND FOR SPECTROSCOPY DEVICES

- 6.8 OTHER DEVICES

7 FOOD INSPECTION DEVICES MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 AUTOMATED/COMPUTERIZED SYSTEMS

- 7.2.1 RISING FOOD SAFETY REGULATIONS AND LABOR SHORTAGES TO DRIVE ADOPTION OF COMPUTERIZED INSPECTION DEVICES

- 7.3 MANUAL INSPECTION DEVICES

- 7.3.1 COST-EFFECTIVENESS AND OPERATIONAL SIMPLICITY TO SUSTAIN DEMAND

8 FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY

- 8.1 INTRODUCTION

- 8.2 MEAT

- 8.2.1 STRINGENT HYGIENE AND CONTAMINANT DETECTION NEEDS TO FUEL ADOPTION OF ADVANCED FOOD INSPECTION DEVICES

- 8.3 POULTRY & SEAFOOD

- 8.3.1 DIGITAL ADVANCES IN FOOD INSPECTION DRIVING MARKET GROWTH

- 8.4 DAIRY

- 8.4.1 RISING REGULATORY AND QUALITY ASSURANCE NEEDS IN DAIRY INDUSTRY ACCELERATING FOOD INSPECTION DEVICE ADOPTION

- 8.5 BAKERY & CONFECTIONERY

- 8.5.1 RISING GLOBAL REGULATORY ENFORCEMENT FUELING PUBLIC SECTOR DEMAND FOR FOOD INSPECTION DEVICES

- 8.6 CATERING & READY-TO-EAT MEALS

- 8.6.1 SURGE IN URBAN LIFESTYLES AND ON-THE-GO CONSUMPTION FUELING DEMAND

- 8.7 OTHERS

9 FOOD INSPECTION DEVICES MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.2 FOOD MANUFACTURERS & PROCESSORS

- 9.2.1 RISING FOCUS ON HACCP COMPLIANCE AND YIELD OPTIMIZATION DRIVING ADOPTION

- 9.3 FOOD PACKAGING COMPANIES

- 9.3.1 STRINGENT LABELLING AND SEAL INTEGRITY NORMS DRIVING ADOPTION

- 9.4 RETAIL CHAINS & HYPERMARKETS

- 9.4.1 RISING ON-SITE QUALITY ASSURANCE ACCELERATING ADOPTION ACROSS RETAIL CHAINS & HYPERMARKETS

- 9.5 GOVERNMENT AGENCIES, FOOD SAFETY AUTHORITIES, AND OTHER VERTICALS

- 9.5.1 DIGITAL TRACEABILITY AND INSTITUTIONAL HYGIENE STANDARDS DRIVING ADOPTION IN PUBLIC AND ALTERNATIVE FOOD VERTICALS

10 FOOD INSPECTION DEVICES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Regulatory rigor and technological leadership driving inspection system adoption

- 10.2.3 CANADA

- 10.2.3.1 Regulatory compliance and export-oriented food industry fueling demand for inspection technology

- 10.2.4 MEXICO

- 10.2.4.1 Export growth and food safety modernization advancing inspection device adoption

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Advanced engineering and strict regulations powering market leadership

- 10.3.3 UK

- 10.3.3.1 Post-Brexit reforms and food safety priorities driving adoption

- 10.3.4 FRANCE

- 10.3.4.1 Traceability and labeling compliance shaping inspection system demand

- 10.3.5 ITALY

- 10.3.5.1 Heritage food industry increasingly embracing automation and quality control

- 10.3.6 SPAIN

- 10.3.6.1 Export-oriented economy and increased hygiene controls bolstering demand

- 10.3.7 POLAND

- 10.3.7.1 EU compliance and industrial modernization fueling market growth

- 10.3.8 NORDICS

- 10.3.8.1 Technological sophistication and sustainability standards driving adoption

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Regulatory overhaul and smart manufacturing accelerating device adoption

- 10.4.3 JAPAN

- 10.4.3.1 Precision standards and technological maturity driving demand for high-end systems

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Export-oriented food industry and digital innovation strengthening market growth

- 10.4.5 INDIA

- 10.4.5.1 Regulatory reforms and F&B sector expansion driving market

- 10.4.6 AUSTRALIA

- 10.4.6.1 Emphasis on automation and export standards to support market growth

- 10.4.7 INDONESIA

- 10.4.7.1 Growing processed food sector and regulatory push driving adoption

- 10.4.8 THAILAND

- 10.4.8.1 Increased food export and infrastructure upgrades advancing market growth

- 10.4.9 MALAYSIA

- 10.4.9.1 Halal certification and export compliance boosting inspection demand

- 10.4.10 VIETNAM

- 10.4.10.1 Export-driven modernization accelerating adoption of inspection devices

- 10.4.11 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Increasingly stringent regulatory policies and food security initiatives driving market growth

- 10.5.2.2 Bahrain

- 10.5.2.2.1 Quality standards and import reliance supporting system adoption

- 10.5.2.3 Kuwait

- 10.5.2.3.1 Regulatory alignment and food sector expansion driving growth

- 10.5.2.4 Oman

- 10.5.2.4.1 Infrastructure development and import controls fueling demand

- 10.5.2.5 Qatar

- 10.5.2.5.1 Food safety modernization and FIFA legacy advancing inspection technologies

- 10.5.2.6 Saudi Arabia

- 10.5.2.6.1 Vision 2030 and food industry diversification supporting growth

- 10.5.2.7 UAE

- 10.5.2.7.1 High standards and global trade driving innovation in food inspection

- 10.5.2.7.2 Rest of Middle East

- 10.5.3 AFRICA

- 10.5.3.1 Strengthening food safety and export readiness to expand Africa's emerging market

- 10.5.3.2 South Africa

- 10.5.3.3 Rest of Africa

- 10.5.4 SOUTH AMERICA

- 10.5.4.1 Regulatory harmonization and export-oriented food processing supporting market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2020-2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Food category footprint

- 11.6.5.4 Technology footprint

- 11.6.5.5 Vertical footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 METTLER-TOLEDO INTERNATIONAL INC.

- 12.2.1.1 Business overview

- 12.2.1.2 Products offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Product launches

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 ANRITSU CORPORATION

- 12.2.2.1 Business overview

- 12.2.2.2 Products offered

- 12.2.2.3 MnM view

- 12.2.2.3.1 Key strengths

- 12.2.2.3.2 Strategic choices

- 12.2.2.3.3 Weaknesses and competitive threats

- 12.2.3 THERMO FISHER SCIENTIFIC INC.

- 12.2.3.1 Business overview

- 12.2.3.2 Products offered

- 12.2.3.3 MnM view

- 12.2.3.3.1 Key strengths

- 12.2.3.3.2 Strategic choices

- 12.2.3.3.3 Weaknesses and competitive threats

- 12.2.4 ISHIDA CO., LTD.

- 12.2.4.1 Business overview

- 12.2.4.2 Products offered

- 12.2.4.3 Recent developments

- 12.2.4.3.1 Product launches

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses and competitive threats

- 12.2.5 LOMA SYSTEMS

- 12.2.5.1 Business overview

- 12.2.5.2 Products offered

- 12.2.5.3 Recent developments

- 12.2.5.3.1 Product launches

- 12.2.5.4 MnM view

- 12.2.5.4.1 Key strengths

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses and competitive threats

- 12.2.6 FORTRESS TECHNOLOGY INC.

- 12.2.6.1 Business overview

- 12.2.6.2 Products offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Product launches

- 12.2.7 SESOTEC GMBH

- 12.2.7.1 Business overview

- 12.2.7.2 Products offered

- 12.2.7.3 Recent developments

- 12.2.7.3.1 Product launches

- 12.2.8 MINEBEA INTEC GMBH

- 12.2.8.1 Business overview

- 12.2.8.2 Products offered

- 12.2.8.3 Recent developments

- 12.2.8.3.1 Product launches

- 12.2.9 BIZERBA SE & CO. KG

- 12.2.9.1 Business overview

- 12.2.9.2 Products offered

- 12.2.10 MULTIVAC GROUP

- 12.2.10.1 Business overview

- 12.2.10.2 Products offered

- 12.2.1 METTLER-TOLEDO INTERNATIONAL INC.

- 12.3 OTHER PLAYERS

- 12.3.1 KEY TECHNOLOGY

- 12.3.2 COGNEX CORPORATION

- 12.3.3 WIPOTEC-OCS

- 12.3.4 PECO INSPX

- 12.3.5 SHANGHAI TECHIK INSTRUMENT CO., LTD.

- 12.3.6 MARLEN INTERNATIONAL

- 12.3.7 EAGLE PRODUCT INSPECTION

- 12.3.8 CEIA

- 12.3.9 CASSEL MESSTECHNIK GMBH

- 12.3.10 HEAT AND CONTROL, INC.

- 12.3.11 MEKITEC GROUP

- 12.3.12 FT SYSTEMS S.R.L.

- 12.3.13 DYLOG HITECH S.P.A.

- 12.3.14 JUZHENG ELECTRONIC TECHNOLOGY CO., LTD.

- 12.3.15 ERIEZ MANUFACTURING CO.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

List of Tables

- TABLE 1 FOOD INSPECTION DEVICES MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 FOOD INSPECTION DEVICES MARKET: RISK ASSESSMENT

- TABLE 3 FOOD INSPECTION DEVICES MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE TREND OF METAL DETECTORS OFFERED BY KEY PLAYERS, 2021-2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF METAL DETECTORS, BY REGION, 2021-2024 (USD)

- TABLE 6 FOOD INSPECTION DEVICES MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE VERTICALS (%)

- TABLE 8 KEY BUYING CRITERIA OF TOP THREE VERTICALS

- TABLE 9 IMPORT DATA FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 LIST OF MAJOR PATENTS, 2021-2024

- TABLE 12 MFN IMPORT TARIFFS FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 FOOD INSPECTION DEVICES MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 18 FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 19 FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 20 X-RAY INSPECTION DEVICES: FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 21 X-RAY INSPECTION DEVICES: FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 22 X-RAY INSPECTION DEVICES: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 23 X-RAY INSPECTION DEVICES: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 24 METAL DETECTORS: FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 25 METAL DETECTORS: FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 26 METAL DETECTORS: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 27 METAL DETECTORS: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 28 METAL DETECTORS: FOOD INSPECTION DEVICES MARKET, 2021-2024 (THOUSAND UNITS)

- TABLE 29 METAL DETECTORS: FOOD INSPECTION DEVICES MARKET, 2025-2030 (THOUSAND UNITS)

- TABLE 30 CHECKWEIGHERS: FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 31 CHECKWEIGHERS: FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 32 CHECKWEIGHERS: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 33 CHECKWEIGHERS: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 34 VISION INSPECTION SYSTEMS: FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 35 VISION INSPECTION SYSTEMS: FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 36 VISION INSPECTION SYSTEMS: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 37 VISION INSPECTION SYSTEMS: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 38 MICROBIAL DETECTION SYSTEMS: FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 39 MICROBIAL DETECTION SYSTEMS: FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 40 MICROBIAL DETECTION SYSTEMS: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 41 MICROBIAL DETECTION SYSTEMS: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 42 SPECTROSCOPY DEVICES: FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 43 SPECTROSCOPY DEVICES: FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 44 SPECTROSCOPY DEVICES: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 45 SPECTROSCOPY DEVICES: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 46 OTHER DEVICES: FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 47 OTHER DEVICES: FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 48 OTHER DEVICES: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 49 OTHER DEVICES: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 50 FOOD INSPECTION DEVICES MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 51 FOOD INSPECTION DEVICES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 52 AUTOMATED/COMPUTERIZED SYSTEMS: FOOD INSPECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 AUTOMATED/COMPUTERIZED SYSTEMS: FOOD INSPECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 MANUAL INSPECTION DEVICES: FOOD INSPECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 MANUAL INSPECTION DEVICES: FOOD INSPECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 57 FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 58 MEAT: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 59 MEAT: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 60 MEAT: FOOD INSPECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 MEAT: FOOD INSPECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 POULTRY & SEAFOOD: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 63 POULTRY & SEAFOOD: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 64 POULTRY & SEAFOOD: FOOD INSPECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 POULTRY & SEAFOOD: FOOD INSPECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 DAIRY: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 67 DAIRY: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 68 DAIRY: FOOD INSPECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 DAIRY: FOOD INSPECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 BAKERY & CONFECTIONERY: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 71 BAKERY & CONFECTIONERY: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 72 BAKERY & CONFECTIONERY: FOOD INSPECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 BAKERY & CONFECTIONERY: FOOD INSPECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 CATERING & READY-TO-EAT MEALS: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 75 CATERING & READY-TO-EAT MEALS: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 76 CATERING & READY-TO-EAT MEALS: FOOD INSPECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 CATERING & READY-TO-EAT MEALS: FOOD INSPECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 OTHERS: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 79 OTHERS: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 80 OTHERS: FOOD INSPECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 OTHERS: FOOD INSPECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 83 FOOD INSPECTION DEVICES MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 84 FOOD MANUFACTURERS & PROCESSORS: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 85 FOOD MANUFACTURERS & PROCESSORS: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 86 FOOD PACKAGING COMPANIES: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 87 FOOD PACKAGING COMPANIES: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 88 RETAIL CHAINS & HYPERMARKETS: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 89 RETAIL CHAINS & HYPERMARKETS: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 90 GOVERNMENT AGENCIES, FOOD SAFETY AUTHORITIES, AND OTHER VERTICALS: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 91 GOVERNMENT AGENCIES, FOOD SAFETY AUTHORITIES, AND OTHER VERTICALS: FOOD INSPECTION DEVICES MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 92 FOOD INSPECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 93 FOOD INSPECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: FOOD INSPECTION DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: FOOD INSPECTION DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: FOOD INSPECTION DEVICES MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: FOOD INSPECTION DEVICES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 100 US: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 101 US: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 102 CANADA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 103 CANADA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 104 MEXICO: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 105 MEXICO: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 106 EUROPE: FOOD INSPECTION DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 107 EUROPE: FOOD INSPECTION DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 108 EUROPE: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 109 EUROPE: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 110 EUROPE: FOOD INSPECTION DEVICES MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 111 EUROPE: FOOD INSPECTION DEVICES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 112 GERMANY: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 113 GERMANY: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 114 UK: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 115 UK: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 116 FRANCE: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 117 FRANCE: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 118 ITALY: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 119 ITALY: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 120 SPAIN: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 121 SPAIN: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 122 POLAND: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 123 POLAND: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 124 NORDICS: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 125 NORDICS: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 126 REST OF EUROPE: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 127 REST OF EUROPE: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 128 ASIA PACIFIC: FOOD INSPECTION DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 129 ASIA PACIFIC: FOOD INSPECTION DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 130 ASIA PACIFIC: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 131 ASIA PACIFIC: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: FOOD INSPECTION DEVICES MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 133 ASIA PACIFIC: FOOD INSPECTION DEVICES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 134 CHINA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 135 CHINA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 136 JAPAN: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 137 JAPAN: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 138 SOUTH KOREA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 139 SOUTH KOREA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 140 INDIA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 141 INDIA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 142 AUSTRALIA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 143 AUSTRALIA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 144 INDONESIA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 145 INDONESIA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 146 THAILAND: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 147 THAILAND: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 148 MALAYSIA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 149 MALAYSIA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 150 VIETNAM: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 151 VIETNAM: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 154 ROW: FOOD INSPECTION DEVICES MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 155 ROW: FOOD INSPECTION DEVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 156 ROW: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 157 ROW: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 158 ROW: FOOD INSPECTION DEVICES MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 159 ROW: FOOD INSPECTION DEVICES MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 160 MIDDLE EAST: FOOD INSPECTION DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 161 MIDDLE EAST: FOOD INSPECTION DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 162 MIDDLE EAST: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 163 MIDDLE EAST: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 164 AFRICA: FOOD INSPECTION DEVICES MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 165 AFRICA: FOOD INSPECTION DEVICES MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 166 AFRICA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 167 AFRICA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 168 SOUTH AMERICA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2021-2024 (USD MILLION)

- TABLE 169 SOUTH AMERICA: FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY, 2025-2030 (USD MILLION)

- TABLE 170 FOOD INSPECTION DEVICES MARKET: KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 171 FOOD INSPECTION DEVICES MARKET: MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- TABLE 172 FOOD INSPECTION DEVICES MARKET: REGION FOOTPRINT

- TABLE 173 FOOD INSPECTION DEVICES MARKET: FOOD CATEGORY FOOTPRINT

- TABLE 174 FOOD INSPECTION DEVICES MARKET: TECHNOLOGY FOOTPRINT

- TABLE 175 FOOD INSPECTION DEVICES MARKET: VERTICAL FOOTPRINT

- TABLE 176 FOOD INSPECTION DEVICES MARKET: KEY STARTUPS/SMES

- TABLE 177 FOOD INSPECTION DEVICES MARKET: PRODUCT LAUNCHES, JANUARY 2021-JUNE 2025

- TABLE 178 METTLER-TOLEDO INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 179 METTLER-TOLEDO INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 180 METTLER-TOLEDO INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 181 ANRITSU CORPORATION: COMPANY OVERVIEW

- TABLE 182 ANRITSU CORPORATION: PRODUCTS/SOLUTIONS OFFERED

- TABLE 183 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 184 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 185 ISHIDA CO., LTD.: COMPANY OVERVIEW

- TABLE 186 ISHIDA CO., LTD.: PRODUCTS OFFERED

- TABLE 187 ISHIDA CO., LTD.: PRODUCT LAUNCHES

- TABLE 188 LOMA SYSTEMS: COMPANY OVERVIEW

- TABLE 189 LOMA SYSTEMS: PRODUCTS OFFERED

- TABLE 190 LOMA SYSTEMS: PRODUCT LAUNCHES

- TABLE 191 FORTRESS TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 192 FORTRESS TECHNOLOGY INC.: PRODUCTS OFFERED

- TABLE 193 FORTRESS TECHNOLOGY INC.: PRODUCT LAUNCHES

- TABLE 194 SESOTEC GMBH: COMPANY OVERVIEW

- TABLE 195 SESOTEC GMBH: PRODUCTS OFFERED

- TABLE 196 SESOTEC GMBH: PRODUCT LAUNCHES

- TABLE 197 MINEBEA INTEC GMBH: COMPANY OVERVIEW

- TABLE 198 MINEBEA INTEC GMBH: PRODUCTS OFFERED

- TABLE 199 MINEBEA INTEC GMBH: PRODUCT LAUNCHES

- TABLE 200 BIZERBA SE & CO. KG: COMPANY OVERVIEW

- TABLE 201 BIZERBA SE & CO. KG: PRODUCTS OFFERED

- TABLE 202 MULTIVAC GROUP: COMPANY OVERVIEW

- TABLE 203 MULTIVAC GROUP: PRODUCTS OFFERED

List of Figures

- FIGURE 1 FOOD INSPECTION DEVICES MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 FOOD INSPECTION DEVICES MARKET: RESEARCH DESIGN

- FIGURE 3 FOOD INSPECTION DEVICES MARKET: BOTTOM-UP APPROACH

- FIGURE 4 FOOD INSPECTION DEVICES MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 7 FOOD INSPECTION DEVICES MARKET: DATA TRIANGULATION

- FIGURE 8 FOOD INSPECTION DEVICES MARKET SNAPSHOT

- FIGURE 9 X-RAY INSPECTION DEVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 AUTOMATED/COMPUTERIZED SYSTEMS SEGMENT TO DOMINATE FOOD INSPECTION DEVICES MARKET DURING FORECAST PERIOD

- FIGURE 11 RETAIL CHAINS & HYPERMARKETS SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 CATERING & READY-TO-EAT MEALS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 14 ADVANCING FOOD SAFETY STANDARDS AND TECHNOLOGY INTEGRATION DRIVING DEMAND FOR INSPECTION DEVICES

- FIGURE 15 X-RAY INSPECTION DEVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 AUTOMATED/COMPUTERIZED SYSTEMS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 17 MEAT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 FOOD MANUFACTURERS & PROCESSORS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF FOOD INSPECTION DEVICES MARKET

- FIGURE 19 ASIA PACIFIC TO BE LARGEST FOOD INSPECTION DEVICES MARKET DURING FORECAST PERIOD

- FIGURE 20 MALAYSIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 IMPACT ANALYSIS OF DRIVERS ON FOOD INSPECTION DEVICES MARKET

- FIGURE 23 IMPACT ANALYSIS OF RESTRAINTS ON FOOD INSPECTION DEVICES MARKET

- FIGURE 24 IMPACT ANALYSIS OF OPPORTUNITIES ON FOOD INSPECTION DEVICES MARKET

- FIGURE 25 IMPACT ANALYSIS OF CHALLENGES ON FOOD INSPECTION DEVICES MARKET

- FIGURE 26 FOOD INSPECTION DEVICE VALUE CHAIN PARTICIPANTS

- FIGURE 27 FOOD INSPECTION DEVICES MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 29 TRENDS AND DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 30 AVERAGE SELLING PRICE TREND OF METAL DETECTORS OFFERED BY KEY PLAYERS, 2021-2024

- FIGURE 31 AVERAGE SELLING PRICE TREND OF METAL DETECTORS, BY REGION, 2021-2024

- FIGURE 32 FOOD INSPECTION DEVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 IMPACT OF PORTER'S FIVE FORCES IN FOOD INSPECTION DEVICES MARKET

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE VERTICALS

- FIGURE 35 KEY BUYING CRITERIA OF TOP THREE VERTICALS

- FIGURE 36 IMPORT SCENARIO FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 37 EXPORT SCENARIO FOR HS CODE 9031-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 38 PATENTS ANALYSIS

- FIGURE 39 IMPACT OF AI/GEN AI ON FOOD INSPECTION DEVICES MARKET

- FIGURE 40 X-RAY INSPECTION DEVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 41 AUTOMATED/COMPUTERIZED SYSTEMS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 42 CATERING & READY-TO-EAT MEALS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 RETAIL CHAINS & HYPERMARKETS SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN FOOD INSPECTION DEVICES MARKET BETWEEN 2025 AND 2030

- FIGURE 45 NORTH AMERICA: FOOD INSPECTION DEVICES MARKET SNAPSHOT

- FIGURE 46 EUROPE: FOOD INSPECTION DEVICES MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: FOOD INSPECTION DEVICES MARKET SNAPSHOT

- FIGURE 48 FOOD INSPECTION DEVICES MARKET SHARE ANALYSIS, 2024

- FIGURE 49 REVENUE ANALYSIS OF KEY PLAYERS IN FOOD INSPECTION DEVICES MARKET, 2020-2024

- FIGURE 50 COMPANY VALUATION, 2025

- FIGURE 51 FINANCIAL METRICS, 2025

- FIGURE 52 FOOD INSPECTION DEVICES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 53 FOOD INSPECTION DEVICES MARKET: COMPANY FOOTPRINT

- FIGURE 54 FOOD INSPECTION DEVICES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 55 FOOD INSPECTION DEVICES MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 56 METTLER-TOLEDO INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 57 ANRITSU CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT