PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1777937

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1777937

North America Molded Case Circuit Breaker Market by rated current, End User, and Country - Forecast to 2030

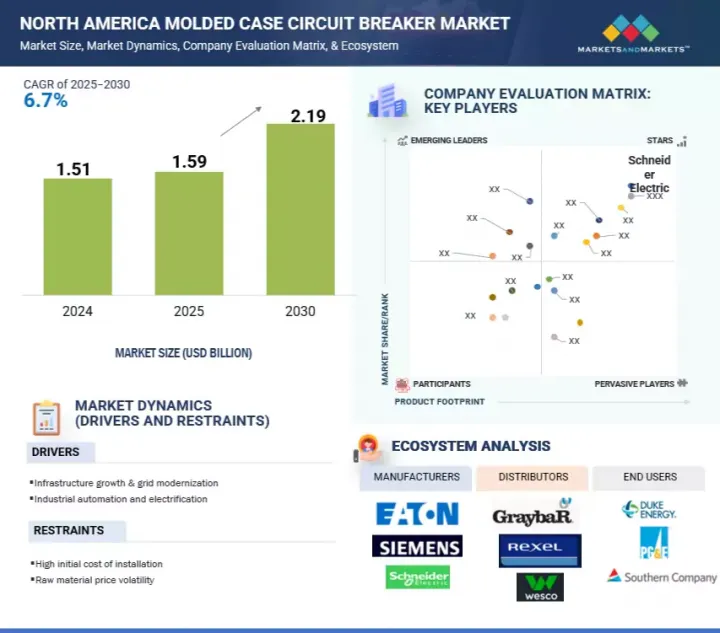

The North America molded case circuit breaker market is projected to grow from USD 1.59 billion in 2025 to USD 2.19 billion by 2030, at a CAGR of 6.7%. One of the primary factors contributing to the growth of the molded case circuit breaker market is the increasing need for reliable and safe power distribution systems in the industrial, commercial, and residential sectors.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million), Volume (Units) |

| Segments | North America molded case circuit breaker market. by rated current and end user |

| Regions covered | North America |

Rapid growth in electrification, urbanization, and infrastructure projects, particularly in developing economies, has resulted in electrical systems needing to be adequately protected from overloads and short circuits. MCCBs are widely known for their longevity and the ability to manage higher current loads, making them vital in modern power distribution systems. However, the high first cost for modern MCCBs is a significant constraint to market penetration, as current, traditional, or basic circuit breakers can be acquired very inexpensively. Smart MCCBs that offer digital protection, monitoring, and communication features generally command an even higher price, making them inaccessible for more small-scale users or those focusing primarily on price, or those using them in lower budget environments (particularly in emerging economies, which usually allocate significantly lower budgets for electrical installation upgrades).

By end user, the manufacturing and process industry is projected to be the fastest-growing segment during the forecast period.

The manufacturing and processing industry is the second-largest end user segment in the North America molded case circuit breaker market. This growth is fueled by the ongoing wave of industrial electrification, coupled with increased investments in automation, robotics, and energy efficiency across sectors such as automotive, food processing, pharmaceuticals, and chemicals. With the US manufacturing sector rebounding post-COVID and reshoring initiatives gaining momentum, electrical safety and protection infrastructure-such as MCCBs-has become a critical component in new and retrofitted facilities. Additionally, the adoption of Industry 4.0 technologies and smart manufacturing practices has driven demand for MCCBs equipped with features like digital trip units, real-time diagnostics, and remote monitoring. These systems are essential to protect sensitive equipment, reduce downtime, and comply with stringent OSHA and NFPA electrical safety standards. The need for uninterrupted operations, asset protection, and energy optimization further contributes to the segment's rapid expansion across North America.

By rated current, 21-75A is expected to exhibit the highest CAGR during the forecast period.

The 21-75A rated current segment is the fastest-growing category in the North America molded case circuit breaker market due to its wide applicability in commercial buildings, light industrial facilities, and small-scale power systems. This current range offers an optimal balance between protection capacity and cost-effectiveness, making it ideal for HVAC systems, lighting panels, and distribution boards in retail spaces, offices, and educational institutions. Additionally, the expansion of commercial infrastructure, data centers, and EV charging stations across the US and Canada is increasing demand for MCCBs in this range. The segment also benefits from ongoing renovations and upgrades of electrical systems in aging buildings, where 21-75A MCCBs are often the preferred choice for ensuring safe and efficient electrical distribution.

"By country, Canada is projected to be the second fastest-growing market during the forecast period."

Canada is poised to be the second-fastest-growing region in the North America molded case circuit breaker market from 2025 to 2030, driven by a confluence of infrastructure modernization, clean energy expansion, and industrial transformation. The Canadian government's strong commitment to net-zero emissions by 2050 is pushing public and private sectors to invest heavily in renewable energy projects, particularly in provinces like Alberta, Ontario, and British Columbia. These large-scale solar, wind, and hydro projects require robust circuit protection systems, thereby boosting demand for advanced MCCBs. Moreover, electrification of transport networks-including mass transit upgrades and electric vehicle (EV) charging infrastructure-requires reliable and smart circuit breakers for protection and load management. Additionally, Canada's industrial sector is undergoing digital transformation, incorporating automation and energy-efficient machinery, which necessitates the use of MCCBs with smart diagnostics and remote monitoring capabilities. Government incentives under programs like the Canada Infrastructure Bank (CIB) and investments in grid resilience and clean technology are further accelerating the market. This combination of environmental policy, technological adoption, and infrastructure development positions Canada as a key high-growth MCCB market in the region.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the North America molded case circuit breaker market.

By Company Type: Tier 1 - 30%, Tier 2 - 55%, and Tier 3 - 15%

By Designation: C-level Executives - 30%, Directors - 20%, and Others - 50%

Note: Other designations include engineers, sales, and regional managers.

The tiers of the companies are defined based on their total revenue as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: <USD 500 million.

A few major players with extensive regional presence dominate the North America molded case circuit breaker market. The leading players are ABB (Switzerland), Schneider Electric (France), Mitsubishi Electric (Japan), Eaton (Ireland), and Siemens (Germany).

Research Coverage:

The report defines, describes, and forecasts the North America molded case circuit breaker market by end user (transmission and distribution, manufacturing and process industry, infrastructure, power generation, transportation, and others), rated current (0A-20A, 21A-75A, 76A-250A, 251A-800A, and above 800A) and country. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. A comprehensive analysis of the key players in the RIP & RIF bushings market has been conducted. This analysis provides insights into their business overview, solutions and services, and key strategies. It also covers relevant contracts, partnerships, and agreements, along with new product launches, mergers, acquisitions, and other recent developments in the market.

Reasons to Buy This Report:

This report is a strategic resource for industry leaders and new entrants, offering a comprehensive analysis of the market and its subsegments. It equips stakeholders with a thorough understanding of the competitive landscape, enabling them to refine their business positioning and devise effective go-to-market strategies. Additionally, the report elucidates the current market dynamics, highlighting critical drivers, constraints, challenges, and opportunities that inform strategic decision-making.

The report provides insights on the following points:

- Analysis of key drivers (infrastructure growth & grid modernization), restraints (high initial cost of installation), opportunities (smart & IoT-enabled breakers), and challenges (skilled installation & technical complexity) influencing the growth.

- Product Development/Innovation: Product innovation is a competitive driving force with manufacturers prioritizing reliability, safety, and digital capability. Businesses are incorporating features of arc fault detection, smart trip units, IoT-based condition monitoring, and remote control to enable the requirements of the modern grid. MCCBs are designed with low energy release of arcs, increased interrupting capacity, and compact, modular enclosures for simplified maintenance and installation. Advancements in contact systems, thermal sensors, and adaptive protection settings enhance energy efficiency and fault response. Such advancements are significant in industrial and utility customers who require high uptime and protection for high-value operations, such as data centers, EV charging infrastructure, and renewable integration.

- Market Development: The North America molded case circuit breaker market is experiencing robust growth throughout the United States, Canada, and Mexico, fueled by growing investment in industrial automation, renewable energy initiatives, and grid modernization. In the United States, federal initiatives like the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA) promote upgrades to substation and distribution infrastructure. This is resulting in a significant demand for medium-voltage molded case circuit breakers. Additionally, Canada's need for clean energy and Mexico's growth in energy-intensive sectors fuel the adoption of Molded case circuit breakers in both low- and medium-voltage market segments. The rise of distributed generation systems and the implementation of smart substations across the region further drive the demand for advanced molded case circuit breakers equipped with digital diagnostic and remote operability features.

- Market Diversification: End user of molded case circuit breakers are expanding beyond conventional utility and industrial uses to rapidly growing markets like electric vehicle charging stations, huge commercial buildings, healthcare institutions, data centers, and molded case ports. These applications demand high-performance breakers with features such as fast fault clearance, compactness, arc protection, and low maintenance. The industry is replying with intelligent, panel-mounted MCCBs and modular solutions with remote test and auto-reset options. Moving toward distributed energy resources and energy storage systems further requires circuit protection systems with real-time analysis, diversifying molded case circuit breaker applications.

- Competitive Assessment: Market leaders such as ABB (Switzerland), Schneider Electric (France), Mitsubishi Electric (Japan), Eaton (Ireland), and Siemens (Germany) hold a substantial share of the North America molded case circuit breaker market. They utilize strong regional footprints, R&D excellence, and strategic partnerships with OEMs and utilities. These players supply many low- and medium-voltage MCCBs with intelligent trip units, high breaking capacity, and remote diagnostic facilities. Domestic production hubs and local service centers in the US help these companies address the increased demand for rapid delivery and tailored solutions. Investment in digital switchgear solutions, cybersecure communication systems, and predictive fault detection systems helps them lead a market influenced by smart grid deployment, energy transition, and changing safety regulations.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key insights from industry experts

- 2.1.2.4 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 DEMAND-SIDE ANALYSIS

- 2.2.3.1 Regional analysis

- 2.2.3.2 Country-level analysis

- 2.2.3.3 Demand-side assumptions

- 2.2.3.4 Demand-side calculations

- 2.2.4 SUPPLY-SIDE ANALYSIS

- 2.2.4.1 Supply-side assumptions

- 2.2.4.2 Supply-side calculations

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET

- 4.2 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY

- 4.3 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY END USE AND COUNTRY

- 4.4 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY RATED CURRENT

- 4.5 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY END USE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Emphasis on modernizing grid infrastructure

- 5.2.1.2 Reliance on automated systems and digital technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High upfront cost of advanced MCCBs

- 5.2.2.2 Volatile raw material prices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of smart and IoT-enabled breakers

- 5.2.3.2 Rapid expansion of renewable energy generation and EV infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Skilled installation and technical complexities

- 5.2.4.2 Exposure to cyber attacks

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 PRICING RANGE OF MOLDED CASE CIRCUIT BREAKERS, BY RATED CURRENT

- 5.3.2 PRICING ANALYSIS OF MOLDED CASE CIRCUIT BREAKERS, BY COUNTRY

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Arc quenching

- 5.6.2 ADJACENT TECHNOLOGIES

- 5.6.2.1 Electronic (microprocessor-based) trip units

- 5.6.3 COMPLEMENTARY TECHNOLOGIES

- 5.6.3.1 Communication and monitoring systems

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PATENT ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 853620)

- 5.8.2 EXPORT SCENARIO (HS CODE 853620)

- 5.9 TARIFFS AND REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 CODES AND REGULATIONS

- 5.9.2.1 Tariffs related to molded case circuit breakers in North America

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.11.1 INTRODUCTION

- 5.12 KEY TARIFF RATES

- 5.12.1 IMPACT ON COUNTRY/REGION

- 5.12.1.1 US

- 5.12.1.2 Mexico

- 5.12.1.3 Canada

- 5.12.2 BILL OF MATERIALS ANALYSIS

- 5.12.1 IMPACT ON COUNTRY/REGION

6 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY END USE

- 6.1 INTRODUCTION

- 6.2 TRANSMISSION & DISTRIBUTION

- 6.2.1 GROWING INVESTMENTS IN GRID MODERNIZATION, SMART GRID TECHNOLOGIES, AND EXPANSION OF RURAL ELECTRIFICATION PROGRAMS TO FUEL MARKET GROWTH

- 6.3 MANUFACTURING & PROCESS INDUSTRIES

- 6.3.1 RISE OF INDUSTRY 4.0 AND INDUSTRIAL AUTOMATION TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 6.4 INFRASTRUCTURE

- 6.4.1 INCREASING DEMAND FOR RELIABLE AND COMPACT ELECTRICAL PROTECTION IN MODERN BUILDING ENVIRONMENTS TO DRIVE MARKET

- 6.5 POWER GENERATION

- 6.5.1 INTEGRATION OF DIGITAL TECHNOLOGIES FOR REAL-TIME MONITORING AND FAULT DIAGNOSTICS TO SUPPORT MARKET GROWTH

- 6.6 TRANSPORTATION

- 6.6.1 GROWING INVESTMENTS IN EV INFRASTRUCTURE TO BOOST DEMAND

- 6.7 OTHERS

7 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY RATED CURRENT

- 7.1 INTRODUCTION

- 7.2 0-20 A

- 7.2.1 COMPATIBILITY WITH STANDARD DISTRIBUTION PANELS TO DRIVE MARKET

- 7.3 21-75 A

- 7.3.1 EMPHASIS ON ADVANCEMENTS IN INTELLIGENT MCCBS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 7.4 76-250 A

- 7.4.1 INTEGRATION WITH SMART MONITORING TECHNOLOGIES TO FOSTER MARKET GROWTH

- 7.5 251-800 A

- 7.5.1 INCREASING IMPLEMENTATION OF MICROGRIDS AND DECENTRALIZED ENERGY SYSTEMS TO DRIVE MARKET

- 7.6 ABOVE 800 A

- 7.6.1 RISE OF HYPERSCALE DATA CENTERS AND HIGH-PERFORMANCE COMPUTING INFRASTRUCTURE TO SUPPORT MARKET GROWTH

8 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY

- 8.1 NORTH AMERICA

- 8.1.1 US

- 8.1.1.1 Ongoing push toward smart grid technologies to offer lucrative growth opportunities

- 8.1.2 CANADA

- 8.1.2.1 Emphasis on energy efficiency and infrastructure modernization to fuel market growth

- 8.1.3 MEXICO

- 8.1.3.1 Adoption of smart technologies and factory automation to foster market growth

- 8.1.1 US

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 9.3 MARKET SHARE ANALYSIS, 2024

- 9.4 REVENUE ANALYSIS, 2020-2024

- 9.5 COMPANY VALUATION AND FINANCIAL METRICS

- 9.6 BRAND/PRODUCT COMPARISON

- 9.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 9.7.1 STARS

- 9.7.2 EMERGING LEADERS

- 9.7.3 PERVASIVE PLAYERS

- 9.7.4 PARTICIPANTS

- 9.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 9.7.5.1 Company footprint

- 9.7.5.2 Country footprint

- 9.7.5.3 Rating current footprint

- 9.7.5.4 End use footprint

- 9.8 COMPETITIVE SCENARIO

- 9.8.1 PRODUCT LAUNCH

- 9.8.2 DEALS

- 9.8.3 EXPANSIONS

- 9.8.4 OTHER DEVELOPMENTS

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 EATON

- 10.1.1.1 Business overview

- 10.1.1.2 Products/Solutions/Services offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Expansions

- 10.1.1.4 MnM view

- 10.1.1.4.1 Key strengths/Right to win

- 10.1.1.5 Strategic choices

- 10.1.1.6 Weaknesses/Competitive threats

- 10.1.2 SIEMENS

- 10.1.2.1 Business overview

- 10.1.2.2 Products/Solutions/Services offered

- 10.1.2.3 Recent developments

- 10.1.2.3.1 Deals

- 10.1.2.4 MnM view

- 10.1.2.4.1 Key strengths/Right to win

- 10.1.2.4.2 Strategic choices

- 10.1.2.4.3 Weaknesses/Competitive threats

- 10.1.3 SCHNEIDER ELECTRIC

- 10.1.3.1 Business overview

- 10.1.3.2 Products/Solutions/Services offered

- 10.1.3.3 Recent developments

- 10.1.3.4 MnM view

- 10.1.3.4.1 Key strengths/Right to win

- 10.1.3.4.2 Strategic choices

- 10.1.3.4.3 Weaknesses/Competitive threats

- 10.1.4 ABB

- 10.1.4.1 Business overview

- 10.1.4.2 Products/Solutions/Services offered

- 10.1.4.3 Recent developments

- 10.1.4.3.1 Expansions

- 10.1.4.4 MnM view

- 10.1.4.4.1 Key strengths/Right to win

- 10.1.4.4.2 Strategic choices

- 10.1.4.4.3 Weaknesses/Competitive threats

- 10.1.5 GE VERNOVA

- 10.1.5.1 Business overview

- 10.1.5.2 Products/Solutions/Services offered

- 10.1.5.3 Recent developments

- 10.1.5.3.1 Developments

- 10.1.5.4 MnM view

- 10.1.5.4.1 Key strengths/Right to win

- 10.1.5.4.2 Strategic choices

- 10.1.5.4.3 Weaknesses/Competitive threats

- 10.1.6 MITSUBISHI ELECTRIC CORPORATION

- 10.1.6.1 Business overview

- 10.1.6.2 Products/Solutions/Services offered

- 10.1.6.3 Recent developments

- 10.1.7 ROCKWELL AUTOMATION

- 10.1.7.1 Business overview

- 10.1.7.2 Products/Solutions/Services offered

- 10.1.7.3 Recent developments

- 10.1.7.3.1 Deals

- 10.1.8 CHINT GROUP

- 10.1.8.1 Business overview

- 10.1.8.2 Products/Solutions/Services offered

- 10.1.9 WEG

- 10.1.9.1 Business overview

- 10.1.9.2 Products/Solutions/Services offered

- 10.1.10 HAGER GROUP

- 10.1.10.1 Business overview

- 10.1.10.2 Products/Solutions/Services offered

- 10.1.11 LS ELECTRIC CO., LTD

- 10.1.11.1 Business overview

- 10.1.11.2 Products/Solutions/Services offered

- 10.1.11.2.1 Deals

- 10.1.11.2.2 Expansions

- 10.1.1 EATON

11 APPENDIX

- 11.1 INSIGHTS FROM INDUSTRY EXPERTS

- 11.2 DISCUSSION GUIDE

- 11.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.4 CUSTOMIZATION OPTIONS

- 11.5 RELATED REPORTS

- 11.6 AUTHOR DETAILS

List of Tables

- TABLE 1 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: RISK ASSESSMENT

- TABLE 2 NORTH AMERICA MOLED CASE CIRCUIT BREAKER MARKET SNAPSHOT

- TABLE 3 ROLE OF COMPANIES IN NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET ECOSYSTEM

- TABLE 4 LIST OF MAJOR PATENTS PERTAINING TO MOLDED CASE CIRCUIT BREAKER MARKET, 2020-2024

- TABLE 5 IMPORT SCENARIO FOR HS CODE 853620-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 6 EXPORT SCENARIO FOR HS CODE 853620-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER: CODES AND REGULATIONS

- TABLE 9 IMPORT TARIFFS FOR HS CODE 853620-COMPLIANT PRODUCTS, 2024

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE (%)

- TABLE 11 KEY BUYING CRITERIA, BY END USE

- TABLE 12 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 13 BILL OF MATERIALS ANALYSIS OF MOLDED CASE CIRCUIT BREAKER

- TABLE 14 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 15 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 16 TRANSMISSION & DISTRIBUTION: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 17 TRANSMISSION & DISTRIBUTION: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 18 MANUFACTURING & PROCESS INDUSTRIES: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 19 MANUFACTURING & PROCESS INDUSTRIES: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 20 INFRASTRUCTURE: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 21 INFRASTRUCTURE NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 22 POWER GENERATION: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 23 POWER GENERATION: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 24 TRANSPORTATION: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 25 TRANSPORTATION: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 26 OTHERS: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 27 OTHERS: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 28 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY RATED CURRENT, 2020-2024 (USD MILLION)

- TABLE 29 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY RATED CURRENT, 2025-2030 (USD MILLION)

- TABLE 30 0-20 A: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 31 0-20 A: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 32 21-75 A: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 33 21-75 A: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 34 76-250 A: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 35 76-250 A: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 36 251-800 A: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 37 251-800 A: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 38 ABOVE 800 A: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 39 ABOVE 800 A: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 40 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY RATING CURRENT, 2020-2024 (USD MILLION)

- TABLE 41 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY RATING CURRENT, 2025-2030 (USD MILLION)

- TABLE 42 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 43 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 45 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY RATED CURRENT, 2020-2024 (THOUSAND UNITS)

- TABLE 47 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY RATED CURRENT, 2025-2030 (THOUSAND UNITS)

- TABLE 48 US: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY RATED CURRENT, 2020-2024 (USD MILLION)

- TABLE 49 US: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY RATED CURRENT, 2025-2030 (USD MILLION)

- TABLE 50 US: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 51 US: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 52 CANADA: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY RATED CURRENT, 2020-2024 (USD MILLION)

- TABLE 53 CANADA: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY RATED CURRENT, 2025-2030 (USD MILLION)

- TABLE 54 CANADA: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 55 CANADA: MOLDED CASE CIRCUIT BREAKER MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 56 MEXICO: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY RATED CURRENT, 2020-2024 (USD MILLION)

- TABLE 57 MEXICO: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY RATED CURRENT, 2025-2030 (USD MILLION)

- TABLE 58 MEXICO: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY END USE, 2020-2024 (USD MILLION)

- TABLE 59 MEXICO: NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 60 OVERVIEW OF KEY STRATEGIES ADOPTED BY KEY PLAYERS, DECEMBER 2021-APRIL 2025

- TABLE 61 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: DEGREE OF COMPETITION

- TABLE 62 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: COUNTRY FOOTPRINT

- TABLE 63 MARKET: RATING CURRENT FOOTPRINT

- TABLE 64 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: END USE FOOTPRINT

- TABLE 65 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: PRODUCT LAUNCHES, DECEMBER 2021-APRIL 2025

- TABLE 66 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: DEALS, DECEMBER 2021-APRIL 2025

- TABLE 67 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: EXPANSIONS, DECEMBER 2021-APRIL 2025

- TABLE 68 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: OTHER DEVELOPMENTS, DECEMBER 2021-APRIL 2025

- TABLE 69 EATON: COMPANY OVERVIEW

- TABLE 70 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 71 EATON: DEALS

- TABLE 72 EATON: EXPANSIONS

- TABLE 73 SIEMENS: COMPANY OVERVIEW

- TABLE 74 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 75 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 76 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 77 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 78 ABB: COMPANY OVERVIEW

- TABLE 79 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 80 ABB: EXPANSIONS

- TABLE 81 GE VERNOVA: COMPANY OVERVIEW

- TABLE 82 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 83 GE VERNOVA: DEVELOPMENTS

- TABLE 84 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 85 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 86 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 87 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 88 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 89 CHINT GROUP: COMPANY OVERVIEW

- TABLE 90 CHINT GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 91 WEG: COMPANY OVERVIEW

- TABLE 92 WEG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 93 HAGER GROUP: COMPANY OVERVIEW

- TABLE 94 HAGER GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 95 LS ELECTRIC CO., LTD: COMPANY OVERVIEW

- TABLE 96 LS ELECTRIC CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 97 LS ELECTRIC CO., LTD: DEALS

- TABLE 98 LS ELECTRIC CO., LTD: EXPANSIONS

List of Figures

- FIGURE 1 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: RESEARCH DESIGN

- FIGURE 3 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR MOLDED CASE CIRCUIT BREAKERS IN NORTH AMERICA

- FIGURE 4 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: BOTTOM-UP APPROACH

- FIGURE 5 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: TOP-DOWN APPROACH

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF MOLDED CASE CIRCUIT BREAKERS IN NORTH AMERICA

- FIGURE 7 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 8 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: DATA TRIANGULATION

- FIGURE 9 US CLAIMED LARGEST MARKET SHARE IN 2024

- FIGURE 10 76-250 A CURRENT SEGMENT TO LEAD MARKET IN 2030

- FIGURE 11 TRANSMISSION & DISTRIBUTION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 12 ELECTRIFICATION AND INFRASTRUCTURE MODERNIZATION TO DRIVE MARKET

- FIGURE 13 US TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 TRANSMISSION & DISTRIBUTION AND US HELD LARGEST MARKET SHARES IN 2024

- FIGURE 15 76-250 A SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 16 TRANSMISSION & DISTRIBUTION SEGMENT TO LEAD MARKET IN 2030

- FIGURE 17 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 US DATA CENTER ENERGY CONSUMPTION, 2023-2030

- FIGURE 19 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET ECOSYSTEM ANALYSIS

- FIGURE 21 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: PATENTS GRANTED AND APPLIED, 2015-2024

- FIGURE 22 IMPORT DATA FOR HS CODE 853620-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 23 EXPORT DATA FOR HS CODE 853620-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USES

- FIGURE 25 KEY BUYING CRITERIA OF TOP END USES

- FIGURE 26 TRANSMISSION & DISTRIBUTION SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 27 76-250 A SEGMENT SECURED LARGEST MARKET SHARE IN 2024

- FIGURE 28 US TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET SHARE, BY COUNTRY, 2024

- FIGURE 30 NORTH AMERICA: MOLDED CASE CIRCUIT BREAKER MARKET SNAPSHOT

- FIGURE 31 MARKET SHARE ANALYSIS OF COMPANIES OFFERING MOLDED CASE CIRCUIT BREAKERS IN NORTH AMERICA, 2024

- FIGURE 32 NORTH AMERICA MOLDED CASE BREAKER MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2020-2024

- FIGURE 33 COMPANY VALUATION

- FIGURE 34 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 35 BRAND/PRODUCT COMPARISON

- FIGURE 36 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 37 NORTH AMERICA MOLDED CASE CIRCUIT BREAKER MARKET: COMPANY FOOTPRINT

- FIGURE 38 EATON: COMPANY SNAPSHOT

- FIGURE 39 SIEMENS: COMPANY SNAPSHOT

- FIGURE 40 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 41 ABB: COMPANY SNAPSHOT

- FIGURE 42 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 43 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 45 WEG: COMPANY SNAPSHOT

- FIGURE 46 LS ELECTRIC CO., LTD: COMPANY SNAPSHOT