PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1781108

PUBLISHER: MarketsandMarkets | PRODUCT CODE: 1781108

Rail Asset Management Market by Offering (Solutions (Condition Monitoring, Predictive Maintenance, Security, Asset Planning & Scheduling) and Services), Application (Rolling Stock and Infrastructure), and Region - Global Forecast to 2030

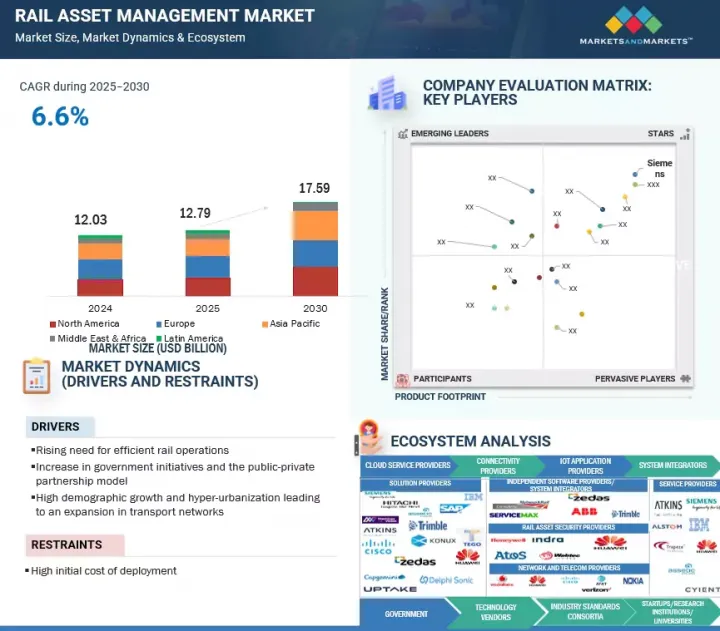

The global rail asset management market size is expected to grow from USD 12.79 billion in 2025 to USD 17.59 billion by 2030, at a Compound Annual Growth Rate (CAGR) of 6.6% during the forecast period. A nation's financial and economic status is greatly influenced by its rail sector. It makes enormous profits every day and transports billions of people and freight.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | Offering, Solution, analytics, asset planning and scheduling, security, workforce management, network management, others), Service, Application, and Region |

| Regions covered | North America, Europe, APAC, MEA, and Latin America |

The simplicity and comfort of transportation have led to a fast increase in the reliance on railroads for both passenger and freight transit. Most nations are making significant investments in train infrastructure to give their inhabitants a smooth travel experience. Because of its enormous carrying capacity in a single run, railways also assist governments in reducing the cost of moving both passengers and commodities. The demand on the current rail system is rising as a result of our increased reliance on railroads.

"By Asset Performance Management (APM), the condition monitoring segment is expected to account for the largest market size during the forecast period."

APM is a software solution that helps optimize railway industry processes, minimize costs, and maximize productivity by reducing the downtime of assets and operating them to attain their peak performance. Condition monitoring solutions help rail companies to automate condition measurements and report asset failures of an asset. Condition monitoring uses sensors to gain insights into the current health of various devices or items of equipment used in railways. These sensors collect data that helps them to monitor crucial operating parameters, such as vibrations, sound anomalies, airflow, and current. The various types of predictive maintenance enhance condition-based maintenance. With the help of this sensor data, predictive maintenance uses advanced analytics and artificial intelligence to predict machine failures before they happen or to anticipate maintenance needs before they become urgent.

"By application, the rolling stock segment is expected to hold the largest market size during the forecast period."

The rolling stock segment is expected to hold the largest market size. The railway is an asset-intensive industry, and rolling stock is one of the most important asset categories in the railway industry. Efficiently managing rolling stock can save a significant amount of resources for the rail operator. Rolling stocks usually have a long service life, hence keeping a vehicle in operation for such a long period of time can create various servicing challenges, such as securing parts, unplanned maintenance, etc. Asset management solutions for rolling stocks can provide better control over asset performance, more efficient use of resources, and more effective risk management. Many rail operators are investing in rolling stock.

"By region, Middle East & Africa to grow at the highest CAGR during the forecast period"

The Middle East and Africa (MEA) is seeing a sharp rise in demand for rail asset management due to significant infrastructure investments, the expansion of urban transit, and a focus on digitization. Effective asset tracking and maintenance solutions are required as Saudi Arabia, the United Arab Emirates, and Egypt build extensive rail networks, including high-speed lines and metro systems. Public-private partnerships and regulatory mandates are also driving the uptake of sophisticated asset performance management systems. Dubai Metro Blue Line (UAE), which has been under construction since June 2025, with a 30 km extension, has 14 new stations and comprises the tallest metro station in the world at Dubai Creek Harbor. The line will be connected with other existing metro lines and is expected to have 200,000-320,000 daily passengers by 2040

Breakdown of Primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company: Tier 1 - 35%, Tier 2 - 39%, and Tier 3 - 26%

- By Designation: C-Level Executives - 40%, Directors- 35%, Others*-25%

- By Region: North America - 38%, Europe - 20%, Asia Pacific - 30%, Rest of the World - 12%

Note: Tier 1 companies have revenues over USD 1 billion; tier 2 companies have revenues ranging from USD 500 million to USD 1 billion, and tier 3 companies have revenues ranging from USD 100 million to USD 500 million.

Others include sales managers, marketing managers, and product managers.

*Rest of the World (RoW) includes MEA and Latin America.

The major players in the rail asset management market include Siemens (Germany), Alstom (France), Hitachi (Japan), Wabtec (US), IBM (US), SAP (Germany), Capgemini (France), Cisco (US), Huawei (China), Accenture (Ireland), Trimble (US), Bentley Systems (US), Atkins (UK), DXC (US), Trapeze Group (Canada), Tego (US), KONUX (Germany), L&T Technology Services (India), Cyient (India), Assetic (Australia), Machines With Vision (UK), 3Squared (UK), Uptake (US), Delphisonic (US), ZEDAS (Germany), Aitek S.p.A (Italy), Simpleway (US), GIV Solutions (US), CloudMoyo (US), and WSP (Canada). These players have adopted various growth strategies, such as partnerships, agreements, collaborations, product launches/enhancements, and acquisitions, to expand their market footprint.

Research Coverage

The rail asset management market is segmented into offering (solutions and services), application (rolling stock and infrastructure), and region. The solutions segment in the rail asset management market has been further segmented into APM, analytics, asset planning and scheduling, security, workforce management, network management, and other solutions (incident management, warranty management, and material management). The services studied under the rail asset management market include professional services (consulting, system integration and deployment, support, and maintenance) and managed services. A detailed analysis of the key industry players has been undertaken to provide insights into their business overviews, services, key strategies, new service and product launches, partnerships, agreements, collaborations, business expansions, and competitive landscape associated with the rail asset management market.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global rail asset management market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape, gain insights, and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides the following insights.

1. Analysis of key drivers (rising need for efficient rail operations, increase in government initiatives and public-private partnership model, high demographic growth and hyper-urbanization leading to an expansion in transport networks, adoption of IoT and other automation technologies to enhance optimization, rise in congestion due to aging railway infrastructure), restraints (high initial cost of deployment), opportunities (growing need for advanced transportation infrastructure, increasing demand for cloud-based services, emerging trend of smart cities), and challenges (integration complexities with legacy infrastructure, disruption in logistics and supply chain of IoT devices, data security and privacy issues related to IoT devices) influencing the growth of the rail asset management market.

2. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the rail asset management market.

3. Market Development: The report provides comprehensive information about lucrative markets, analyzing the rail asset management market across various regions.

4. Market Diversification: Comprehensive information about new products and services, untapped geographies, recent developments, and investments in the rail asset management market.

5. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players Siemens (Germany), Alstom (France), Hitachi (Japan), Wabtec (US), IBM (US), SAP (Germany), Capgemini (France), Cisco (US), Huawei (China), Accenture (Ireland), Trimble (US), Bentley Systems (US), Atkins (UK), DXC (US), Trapeze Group (Canada), Tego (US), KONUX (Germany), L&T Technology Services (India), Cyient (India), Assetic (Australia), Machines With Vision (UK), 3Squared (UK), Uptake (US), Delphisonic (US), ZEDAS (Germany), Aitek S.p.A (Italy), Simpleway (US), GIV Solutions (US), CloudMoyo (US), and WSP (Canada).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primaries

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.3.3 RAIL ASSET MANAGEMENT MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN RAIL ASSET MANAGEMENT MARKET

- 4.2 EUROPE: RAIL ASSET MANAGEMENT MARKET, BY OFFERING AND COUNTRY

- 4.3 ASIA PACIFIC: RAIL ASSET MANAGEMENT MARKET, BY OFFERING AND COUNTRY

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising need for efficient rail operations

- 5.2.1.2 Increase in government initiatives and public-private partnership model

- 5.2.1.3 High demographic growth and hyper-urbanization leading to an expansion in transport networks

- 5.2.1.4 Adoption of IoT and other automation technologies for process optimization

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial cost of deployment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing need for advanced transportation infrastructure

- 5.2.3.2 Increasing demand for cloud-based services

- 5.2.3.3 Emerging trend of smart cities

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration complexities with legacy infrastructure

- 5.2.4.2 Data security and privacy issues related to IoT devices

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.4 BRIEF HISTORY OF RAIL ASSET MANAGEMENT

- 5.4.1 1980S-1990S: LAYING THE FOUNDATIONS

- 5.4.2 2000S: RISE OF INTELLIGENT INFRASTRUCTURE

- 5.4.3 2010S: DIGITAL TRANSFORMATION AND CONNECTIVITY

- 5.4.4 2020-PRESENT: AI-DRIVEN AND AUTONOMOUS INNOVATIONS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 RAIL ASSET MANAGEMENT MARKET: ECOSYSTEM ANALYSIS

- 5.7 PATENT ANALYSIS

- 5.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 KEY REGULATIONS

- 5.9.2.1 North America

- 5.9.2.1.1 SCR 17: Artificial Intelligence Bill (California)

- 5.9.2.1.2 S1103: Artificial Intelligence Automated Decision Bill (Connecticut)

- 5.9.2.1.3 National Artificial Intelligence Initiative Act (NAIIA)

- 5.9.2.1.4 Artificial Intelligence and Data Act (AIDA) - Canada

- 5.9.2.2 Europe

- 5.9.2.2.1 European Union (EU) - Artificial Intelligence Act (AIA)

- 5.9.2.2.2 General Data Protection Regulation (Europe)

- 5.9.2.3 Asia Pacific

- 5.9.2.3.1 Interim Administrative Measures for Generative Artificial Intelligence Services (China)

- 5.9.2.3.2 National AI Strategy (Singapore)

- 5.9.2.3.3 Hiroshima AI Process Comprehensive Policy Framework (Japan)

- 5.9.2.4 Middle East & Africa

- 5.9.2.4.1 National Strategy for Artificial Intelligence (UAE)

- 5.9.2.4.2 National Artificial Intelligence Strategy (Qatar)

- 5.9.2.4.3 AI Ethics Principles and Guidelines (Dubai)

- 5.9.2.5 Latin America

- 5.9.2.5.1 Santiago Declaration (Chile)

- 5.9.2.5.2 Brazilian Artificial Intelligence Strategy (EBIA)

- 5.9.2.6 ISO/IEC

- 5.9.2.6.1 ISO/IEC JTC 1

- 5.9.2.6.2 ISO/IEC 27001

- 5.9.2.6.3 ISO/IEC 19770-1

- 5.9.2.6.4 ISO/IEC JTC 1/SWG 5

- 5.9.2.6.5 ISO/IEC JTC 1/SC 31

- 5.9.2.6.6 ISO/IEC JTC 1/SC 27

- 5.9.2.6.7 ISO/IEC JTC 1/WG 7 sensors

- 5.9.2.7 GDPR

- 5.9.2.8 FMCSA

- 5.9.2.9 FHWA

- 5.9.2.10 MARAD

- 5.9.2.11 FAA

- 5.9.2.12 FRA

- 5.9.2.13 IEEE-SA

- 5.9.2.14 CEN/ISO

- 5.9.2.15 CEN/CENELEC

- 5.9.2.16 ETSI

- 5.9.2.17 ITU-T

- 5.9.2.1 North America

- 5.10 PRICING MODEL ANALYSIS

- 5.10.1 INDICATIVE PRICING ANALYSIS OF RAIL ASSET MANAGEMENT SOLUTION, 2024

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Internet of Things (IoT)

- 5.12.1.2 Big data analytics and cloud computing

- 5.12.1.3 Artificial intelligence (AI) & machine learning (ML)

- 5.12.1.4 Advanced signaling systems

- 5.12.1.5 Communication-based train control (CBTC)

- 5.12.2 ADJACENT TECHNOLOGIES

- 5.12.2.1 Augmented reality (AR) & virtual reality (VR)

- 5.12.2.2 Blockchain

- 5.12.2.3 Drones

- 5.12.3 COMPLEMENTARY TECHNOLOGIES

- 5.12.3.1 Edge computing

- 5.12.3.2 Digital twin

- 5.12.3.3 Cybersecurity

- 5.12.3.4 5G and wireless communication networks

- 5.12.1 KEY TECHNOLOGIES

- 5.13 PORTER'S FIVE FORCES MODEL

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 BARGAINING POWER OF SUPPLIERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 USE CASES

- 5.15.1 CASE STUDY 1: SIEMENS PROVIDES MAINTENANCE SERVICES TO GOVIA THAMESLINK RAILWAY

- 5.15.2 CASE STUDY 2: UPTAKE THROUGH UPTAKE COMPASS TO AUTOMATE A NORTH AMERICAN FREIGHT RAILWAY COMPANY'S MESSY AND MISLABELED MAINTENANCE WORK ORDER DATA

- 5.15.3 CASE STUDY 3: SIEMENS TO PROVIDE MAINTENANCE SERVICES FOR RHINE-RUHR EXPRESS

- 5.15.4 CASE STUDY 4: ASSETIC HELPED SYDNEY TRAINS VISUALIZE RAIL ASSETS FOR OPTIMIZED ASSET MANAGEMENT

- 5.15.5 CASE STUDY 5: SIEMENS TO PROVIDE MAINTENANCE SERVICES FOR RUSSIAN RAILWAYS

- 5.15.6 CASE STUDY 6: ATLANTA STREETCAR PIONEERS A NEW APPROACH TO MANAGING ITS LIGHT-RAIL VEHICLES IN PARTNERSHIP WITH SIEMENS DIGITAL RAIL SERVICES

- 5.15.7 CASE STUDY 7: TAIWAN HIGH SPEED RAIL CORPORATION SELECTED IBM MAXIMO TO BUILD AN ADVANCED MAINTENANCE MANAGEMENT SOLUTION

- 5.16 BEST PRACTICES IN RAIL ASSET MANAGEMENT MARKET

- 5.17 TECHNOLOGY ROADMAP FOR RAIL ASSET MANAGEMENT MARKET

- 5.17.1 SHORT-TERM ROADMAP (2023-2025)

- 5.17.2 MID-TERM ROADMAP (2026-2028)

- 5.17.3 LONG-TERM ROADMAP (2029-2030)

- 5.18 INVESTMENT AND FUNDING SCENARIO

- 5.19 BUSINESS MODELS OF RAIL ASSET MANAGEMENT

- 5.19.1 CURRENT BUSINESS MODELS

- 5.19.2 EMERGING BUSINESS MODELS

- 5.20 IMPACT OF AI/GENERATIVE AI ON RAIL ASSET MANAGEMENT MARKET

- 5.20.1 USE CASES OF GENERATIVE AI IN RAIL ASSET MANAGEMENT

- 5.21 IMPACT OF 2025 US TARIFF - RAIL ASSET MANAGEMENT MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON COUNTRY/REGION

- 5.21.4.1 US

- 5.21.4.2 Europe

- 5.21.4.3 Asia Pacific

- 5.21.5 IMPACT ON RAIL ASSET MANAGEMENT MARKET SEGMENTS

6 RAIL ASSET MANAGEMENT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 ASSET PERFORMANCE MANAGEMENT

- 6.2.1.1 Enabling data-driven asset performance management to reduce failures and improve service quality

- 6.2.1.2 Condition monitoring

- 6.2.1.3 Predictive maintenance

- 6.2.2 ANALYTICS

- 6.2.2.1 Unlocking operational resilience through predictive rail asset management and lifecycle optimization

- 6.2.3 ASSET PLANNING & SCHEDULING

- 6.2.3.1 Enhancing asset planning and scheduling to drive rail network efficiency and cost control

- 6.2.4 SECURITY

- 6.2.4.1 Strengthening rail infrastructure security through integrated surveillance and real-time threat detection

- 6.2.5 WORKFORCE MANAGEMENT

- 6.2.5.1 Optimizing workforce management to improve field productivity and maintenance turnaround times

- 6.2.6 NETWORK MANAGEMENT

- 6.2.6.1 Streamlining rail network management to boost operational continuity and minimize service disruptions

- 6.2.7 OTHER SOLUTIONS

- 6.2.1 ASSET PERFORMANCE MANAGEMENT

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Delivering expert-driven professional services to support strategic asset planning and regulatory compliance

- 6.3.1.2 Consulting & training

- 6.3.1.3 System integration & deployment

- 6.3.1.4 Support & maintenance

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Deploying managed services to ensure continuous asset monitoring and optimize lifecycle operations

- 6.3.1 PROFESSIONAL SERVICES

7 RAIL ASSET MANAGEMENT MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION: MARKET DRIVERS

- 7.2 ROLLING STOCK

- 7.2.1 IMPROVING ROLLING STOCK PERFORMANCE THROUGH CONDITION-BASED MAINTENANCE AND FLEET MODERNIZATION STRATEGIES

- 7.3 INFRASTRUCTURE

- 7.3.1 ENHANCING RAIL INFRASTRUCTURE RELIABILITY THROUGH PROACTIVE MAINTENANCE AND DIGITAL ASSET TRACKING

8 RAIL ASSET MANAGEMENT MARKET, BY REGION

- 8.1 INTRODUCTION

- 8.2 NORTH AMERICA

- 8.2.1 NORTH AMERICA: MARKET DRIVERS

- 8.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 8.2.3 US

- 8.2.3.1 Increasing need for modern rail infrastructure to drive market

- 8.2.4 CANADA

- 8.2.4.1 Government initiatives and policies to drive market

- 8.3 EUROPE

- 8.3.1 EUROPE: MARKET DRIVERS

- 8.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 8.3.3 UK

- 8.3.3.1 Government investments in rail infrastructure development to drive market

- 8.3.4 GERMANY

- 8.3.4.1 Rising need for efficient rail operations to drive market

- 8.3.5 FRANCE

- 8.3.5.1 Advancements in robotics and adoption of IoT to drive market

- 8.3.6 REST OF EUROPE

- 8.4 ASIA PACIFIC

- 8.4.1 ASIA PACIFIC: MARKET DRIVERS

- 8.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 8.4.3 CHINA

- 8.4.3.1 Government investments in rail infrastructure and global trade to drive market

- 8.4.4 JAPAN

- 8.4.4.1 Increasing adoption of new technologies for rail Infrastructure to drive market

- 8.4.5 INDIA

- 8.4.5.1 Government investments in rail infrastructure development to drive market

- 8.4.6 AUSTRALIA & NEW ZEALAND

- 8.4.6.1 Government initiatives and policies to drive market

- 8.4.7 REST OF ASIA PACIFIC

- 8.5 MIDDLE EAST & AFRICA

- 8.5.1 MIDDLE EAST & AFRICA: MARKET DRIVERS

- 8.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 8.5.3 NIGERIA

- 8.5.3.1 Public-private partnerships in rail infrastructure development to drive market

- 8.5.4 SOUTH AFRICA

- 8.5.4.1 Increasing requirement for transportation services to drive market

- 8.5.5 REST OF MIDDLE EAST & AFRICA

- 8.6 LATIN AMERICA

- 8.6.1 LATIN AMERICA: MARKET DRIVERS

- 8.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 8.6.3 BRAZIL

- 8.6.3.1 Increased need for the development of rail infrastructure

- 8.6.4 MEXICO

- 8.6.4.1 Increasing need for modern and advanced infrastructure to drive market

- 8.6.5 REST OF LATIN AMERICA

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 9.3 MARKET SHARE ANALYSIS, 202

- 9.4 MARKET RANKING ANALYSIS

- 9.5 REVENUE ANALYSIS, 2020-2024

- 9.6 COMPANY BENCHMARKING

- 9.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 9.7.1 STARS

- 9.7.2 EMERGING LEADERS

- 9.7.3 PERVASIVE PLAYERS

- 9.7.4 PARTICIPANTS

- 9.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 9.7.5.1 Company footprint

- 9.7.5.2 Region footprint

- 9.7.5.3 Offering footprint

- 9.7.5.4 Application footprint

- 9.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 9.8.1 PROGRESSIVE COMPANIES

- 9.8.2 RESPONSIVE COMPANIES

- 9.8.3 DYNAMIC COMPANIES

- 9.8.4 STARTING BLOCKS

- 9.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 9.8.5.1 Detailed list of key startups/SMEs

- 9.8.5.2 Competitive benchmarking of key startups/SMEs

- 9.9 COMPETITIVE SCENARIO

- 9.9.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 9.9.2 DEALS

- 9.10 BRAND/PRODUCT COMPARISON

- 9.11 COMPANY VALUATION AND FINANCIAL METRICS

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 SIEMENS

- 10.1.1.1 Business overview

- 10.1.1.2 Products/Solutions/Services offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Product launches & enhancements

- 10.1.1.3.2 Deals

- 10.1.1.3.3 Other developments

- 10.1.1.4 MnM view

- 10.1.1.4.1 Key strengths

- 10.1.1.4.2 Strategic choices

- 10.1.1.4.3 Weaknesses and competitive threats

- 10.1.2 HITACHI

- 10.1.2.1 Business overview

- 10.1.2.2 Products/Solutions/Services offered

- 10.1.2.3 Recent developments

- 10.1.2.3.1 Product launches & enhancements

- 10.1.2.3.2 Deals

- 10.1.2.3.3 Other developments

- 10.1.2.4 MnM view

- 10.1.2.4.1 Key strengths

- 10.1.2.4.2 Strategic choices

- 10.1.2.4.3 Weaknesses and competitive threats

- 10.1.3 ALSTOM

- 10.1.3.1 Business overview

- 10.1.3.2 Products/Solutions/Services offered

- 10.1.3.3 Recent developments

- 10.1.3.3.1 Deals

- 10.1.3.3.2 Other developments

- 10.1.3.4 MnM view

- 10.1.3.4.1 Key strengths

- 10.1.3.4.2 Strategic choices

- 10.1.3.4.3 Weaknesses and competitive threats

- 10.1.4 IBM

- 10.1.4.1 Business overview

- 10.1.4.2 Products/Solutions/Services offered

- 10.1.4.3 Recent developments

- 10.1.4.3.1 Product launches & enhancements

- 10.1.4.3.2 Deals

- 10.1.4.4 MNM view

- 10.1.4.4.1 Key strengths

- 10.1.4.4.2 Strategic choices

- 10.1.4.4.3 Weaknesses and competitive threats

- 10.1.5 WABTEC

- 10.1.5.1 Business overview

- 10.1.5.2 Products/Solutions/Services offered

- 10.1.5.3 Recent developments

- 10.1.5.3.1 Deals

- 10.1.5.4 MnM view

- 10.1.5.4.1 Key strengths

- 10.1.5.4.2 Strategic choices

- 10.1.5.4.3 Weaknesses and competitive threats

- 10.1.6 SAP

- 10.1.6.1 Business overview

- 10.1.6.2 Products/Solutions/Services offered

- 10.1.6.3 Recent developments

- 10.1.6.3.1 Product launches & enhancements

- 10.1.7 CAPGEMINI

- 10.1.7.1 Business overview

- 10.1.7.2 Products/Solutions/Services offered

- 10.1.7.3 Recent developments

- 10.1.7.3.1 Deals

- 10.1.8 CISCO

- 10.1.8.1 Business overview

- 10.1.8.2 Products/Solutions/Services offered

- 10.1.8.3 Recent developments

- 10.1.8.3.1 Product launches & enhancements

- 10.1.8.3.2 Deals

- 10.1.9 HUAWEI

- 10.1.9.1 Business overview

- 10.1.9.2 Products/Solutions/Services offered

- 10.1.9.3 Recent developments

- 10.1.9.3.1 Product launches & enhancements

- 10.1.10 ACCENTURE

- 10.1.10.1 Business overview

- 10.1.10.2 Products/Solutions/Services offered

- 10.1.10.3 Recent developments

- 10.1.10.3.1 Deals

- 10.1.11 TRIMBLE

- 10.1.12 BENTLEY SYSTEMS

- 10.1.13 ATKINS

- 10.1.14 DXC TECHNOLOGY

- 10.1.15 TRAPEZE GROUP

- 10.1.16 L&T TECHNOLOGY SERVICES

- 10.1.17 CYIENT

- 10.1.18 WSP

- 10.1.1 SIEMENS

- 10.2 STARTUPS/SMES

- 10.2.1 3SQUARED

- 10.2.1.1 Business overview

- 10.2.1.2 Products/Solutions/Services offered

- 10.2.1.3 Recent developments

- 10.2.1.3.1 Product launches & enhancements

- 10.2.1.3.2 Deals

- 10.2.1.3.3 Other developments

- 10.2.2 TEGO

- 10.2.3 KONUX

- 10.2.4 ASSETIC

- 10.2.5 MACHINES WITH VISION

- 10.2.6 UPTAKE

- 10.2.7 DELPHISONIC

- 10.2.8 ZEDAS

- 10.2.9 SIMPLEWAY

- 10.2.10 AITEK S.P.A.

- 10.2.11 CLOUDMOYO

- 10.2.12 GIV SOLUTION

- 10.2.1 3SQUARED

11 ADJACENT/RELATED MARKET

- 11.1 INTRODUCTION

- 11.1.1 LIMITATIONS

- 11.2 SMART RAILWAYS MARKET-GLOBAL FORECAST TO 2030

- 11.2.1 MARKET DEFINITION

- 11.2.2 MARKET OVERVIEW

- 11.2.3 SMART RAILWAYS MARKET, BY OFFERING

- 11.2.4 SMART RAILWAYS MARKET, BY SOLUTION

- 11.2.5 SMART RAILWAYS MARKET, BY SERVICE

- 11.2.6 SMART RAILWAYS MARKET, BY PROFESSIONAL SERVICE

- 11.2.7 SMART RAILWAYS MARKET, BY REGION

- 11.3 RAILWAY MANAGEMENT SYSTEM MARKET - GLOBAL FORECAST TO 2025

- 11.3.1 MARKET DEFINITION

- 11.3.2 MARKET OVERVIEW

- 11.3.3 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING

- 11.3.4 RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTION

- 11.3.5 RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION

- 11.4 RAILWAY PLATFORM SECURITY MARKET - GLOBAL FORECAST TO 2024

- 11.4.1 MARKET DEFINITION

- 11.4.2 MARKET OVERVIEW

- 11.4.3 RAILWAY PLATFORM SECURITY MARKET, BY COMPONENT

- 11.4.4 RAILWAY PLATFORM SECURITY MARKET, BY SOLUTION

- 11.4.5 RAILWAY PLATFORM SECURITY MARKET, BY SERVICE

- 11.4.6 RAILWAY PLATFORM SECURITY MARKET, BY PROFESSIONAL SERVICE

- 11.4.7 RAILWAY PLATFORM SECURITY MARKET, BY APPLICATION

- 11.4.8 RAILWAY PLATFORM SECURITY MARKET, BY REGION

- 11.5 DIGITAL RAILWAY MARKET - GLOBAL FORECAST TO 2030

- 11.5.1 MARKET DEFINITION

- 11.5.2 MARKET OVERVIEW

- 11.5.3 DIGITAL RAILWAY MARKET, BY SOLUTION

- 11.5.4 DIGITAL RAILWAY MARKET, BY SERVICE

- 11.5.5 DIGITAL RAILWAY MARKET, BY PROFESSIONAL SERVICE

- 11.5.6 DIGITAL RAILWAY MARKET, BY APPLICATION

- 11.5.7 DIGITAL RAILWAY MARKET, BY REGION

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 RAIL ASSET MANAGEMENT MARKET ECOSYSTEM ANALYSIS

- TABLE 5 RAIL ASSET MANAGEMENT MARKET: LIST OF TOP PATENTS, 2024

- TABLE 6 RAIL ASSET MANAGEMENT MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 INDICATIVE PRICING ANALYSIS OF RAIL ASSET MANAGEMENT SOLUTIONS, BY KEY PLAYER, 2024

- TABLE 12 IMPACT OF EACH FORCE ON RAIL ASSET MANAGEMENT MARKET

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SOLUTIONS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE SOLUTIONS

- TABLE 15 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 16 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 17 RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 18 RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 19 OFFERING: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 20 OFFERING: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 21 SOLUTIONS: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 22 SOLUTIONS: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 SOLUTIONS: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 24 SOLUTIONS: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 25 ASSET PERFORMANCE MANAGEMENT: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 ASSET PERFORMANCE MANAGEMENT: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 CONDITION MONITORING: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 CONDITION MONITORING: RAIL ASSET MANAGEMENT MARKET BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 PREDICTIVE MAINTENANCE: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 PREDICTIVE MAINTENANCE: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 ANALYTICS: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 ANALYTICS: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 ASSET PLANNING AND SCHEDULING: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 ASSET PLANNING AND SCHEDULING: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 SECURITY: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 SECURITY: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 WORKFORCE MANAGEMENT: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 38 WORKFORCE MANAGEMENT: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 NETWORK MANAGEMENT: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 NETWORK MANAGEMENT: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 OTHER SOLUTIONS: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 OTHER SOLUTIONS: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 OFFERING: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 44 OFFERING: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 45 SERVICES: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 SERVICES: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 SERVICES: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 48 SERVICES: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 49 PROFESSIONAL SERVICES: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 PROFESSIONAL SERVICES: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 CONSULTING & TRAINING: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 CONSULTING & TRAINING: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 SYSTEM INTEGRATION & DEPLOYMENT: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 SYSTEM INTEGRATION & DEPLOYMENT: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 SUPPORT & MAINTENANCE: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 SUPPORT & MAINTENANCE: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 MANAGED SERVICES: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 MANAGED SERVICES: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 60 RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 61 ROLLING STOCK: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 ROLLING STOCK: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 INFRASTRUCTURE: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 INFRASTRUCTURE: RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 RAIL ASSET MANAGEMENT MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 RAIL ASSET MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 68 NORTH AMERICA: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 70 NORTH AMERICA: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 72 NORTH AMERICA: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 73 NORTH AMERICA: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 74 NORTH AMERICA: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: RAIL ASSET MANAGEMENT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 80 NORTH AMERICA: RAIL ASSET MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 US: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 82 US: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 83 US: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 84 US: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 85 US: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 86 US: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 87 US: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 88 US: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 89 US: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 90 US: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 91 US: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 92 US: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 CANADA: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 94 CANADA: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 95 CANADA: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 96 CANADA: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 97 CANADA: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 98 CANADA: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 99 CANADA: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 100 CANADA: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 101 CANADA: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 102 CANADA: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 103 CANADA: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 104 CANADA: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 106 EUROPE: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 108 EUROPE: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 110 EUROPE: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 112 EUROPE: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 113 EUROPE: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 114 EUROPE: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: RAIL ASSET MANAGEMENT MARKET BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 116 EUROPE: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: RAIL ASSET MANAGEMENT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 118 EUROPE: RAIL ASSET MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 UK: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 120 UK: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 121 UK: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 122 UK: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 123 UK: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 124 UK: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 125 UK: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 126 UK: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 127 UK: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 128 UK: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 129 UK: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 130 UK: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 ASIA PACIFIC: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 132 ASIA PACIFIC: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 134 ASIA PACIFIC: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 135 ASIA PACIFIC: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 136 ASIA PACIFIC: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 140 ASIA PACIFIC: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: RAIL ASSET MANAGEMENT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: RAIL ASSET MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 145 CHINA: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 146 CHINA: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 147 CHINA: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 148 CHINA: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 149 CHINA: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 150 CHINA: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 151 CHINA: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 152 CHINA: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 153 CHINA: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 154 CHINA: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 155 CHINA: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 156 CHINA: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 157 AUSTRALIA & NEW ZEALAND: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 158 AUSTRALIA & NEW ZEALAND: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 159 AUSTRALIA & NEW ZEALAND: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 160 AUSTRALIA & NEW ZEALAND: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 161 AUSTRALIA & NEW ZEALAND: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 162 AUSTRALIA & NEW ZEALAND: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 163 AUSTRALIA & NEW ZEALAND: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 164 AUSTRALIA & NEW ZEALAND: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 165 AUSTRALIA & NEW ZEALAND: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 166 AUSTRALIA & NEW ZEALAND: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 167 AUSTRALIA & NEW ZEALAND: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 168 AUSTRALIA & NEW ZEALAND: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: RAIL ASSET MANAGEMENT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: RAIL ASSET MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 183 NIGERIA: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 184 NIGERIA: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 185 NIGERIA: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 186 NIGERIA: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 187 NIGERIA: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 188 NIGERIA: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 189 NIGERIA: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 190 NIGERIA: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 191 NIGERIA: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 192 NIGERIA: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 193 NIGERIA: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 194 NIGERIA: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 195 LATIN AMERICA: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 196 LATIN AMERICA: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 197 LATIN AMERICA: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 198 LATIN AMERICA: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 199 LATIN AMERICA: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 200 LATIN AMERICA: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 201 LATIN AMERICA: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 202 LATIN AMERICA: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 203 LATIN AMERICA: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 204 LATIN AMERICA: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 205 LATIN AMERICA: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 206 LATIN AMERICA: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 207 LATIN AMERICA: RAIL ASSET MANAGEMENT MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 208 LATIN AMERICA: RAIL ASSET MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 209 BRAZIL: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 210 BRAZIL: RAIL ASSET MANAGEMENT MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 211 BRAZIL: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 212 BRAZIL: RAIL ASSET MANAGEMENT MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 213 BRAZIL: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2020-2024 (USD MILLION)

- TABLE 214 BRAZIL: RAIL ASSET MANAGEMENT MARKET, BY ASSET PERFORMANCE MANAGEMENT TYPE, 2025-2030 (USD MILLION)

- TABLE 215 BRAZIL: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 216 BRAZIL: RAIL ASSET MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 217 BRAZIL: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 218 BRAZIL: RAIL ASSET MANAGEMENT MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 219 BRAZIL: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 220 BRAZIL: RAIL ASSET MANAGEMENT MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 221 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MARKET PLAYERS, 2022-JUNE 2025

- TABLE 222 RAIL ASSET MANAGEMENT MARKET: DEGREE OF COMPETITION

- TABLE 223 RAIL ASSET MANAGEMENT MARKET: REGION FOOTPRINT

- TABLE 224 RAIL ASSET MANAGEMENT MARKET: OFFERING FOOTPRINT

- TABLE 225 RAIL ASSET MANAGEMENT MARKET: APPLICATION FOOTPRINT

- TABLE 226 RAIL ASSET MANAGEMENT MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 227 RAIL ASSET MANAGEMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 228 RAIL ASSET MANAGEMENT MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, 2020-JULY 2025

- TABLE 229 RAIL ASSET MANAGEMENT MARKET: DEALS, 2020-JULY 2025

- TABLE 230 SIEMENS: COMPANY OVERVIEW

- TABLE 231 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 SIEMENS: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 233 SIEMENS: DEALS

- TABLE 234 SIEMENS: OTHER DEVELOPMENTS

- TABLE 235 HITACHI: COMPANY OVERVIEW

- TABLE 236 HITACHI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 HITACHI: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 238 HITACHI: DEALS

- TABLE 239 HITACHI: OTHER DEVELOPMENTS

- TABLE 240 ALSTOM: COMPANY OVERVIEW

- TABLE 241 ALSTOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 ALSTOM: DEALS

- TABLE 243 ALSTOM: OTHER DEVELOPMENTS

- TABLE 244 IBM: COMPANY OVERVIEW

- TABLE 245 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 IBM: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 247 IBM: DEALS

- TABLE 248 WABTEC: COMPANY OVERVIEW

- TABLE 249 WABTEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 WABTEC: DEALS

- TABLE 251 SAP: COMPANY OVERVIEW

- TABLE 252 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 SAP: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 254 CAPGEMINI: COMPANY OVERVIEW

- TABLE 255 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 CAPGEMINI: DEALS

- TABLE 257 CISCO: COMPANY OVERVIEW

- TABLE 258 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 CISCO: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 260 CISCO: DEALS

- TABLE 261 HUAWEI: COMPANY OVERVIEW

- TABLE 262 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 HUAWEI: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 264 ACCENTURE: COMPANY OVERVIEW

- TABLE 265 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 ACCENTURE: DEALS

- TABLE 267 3SQUARED: COMPANY OVERVIEW

- TABLE 268 3SQUARED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 3SQUARED: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 270 3SQUARED: DEALS

- TABLE 271 3SQUARED: OTHER DEVELOPMENTS

- TABLE 272 SMART RAILWAYS MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 273 SMART RAILWAYS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 274 SOLUTIONS: SMART RAILWAYS MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 275 SOLUTIONS: SMART RAILWAYS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 276 SERVICES: SMART RAILWAYS MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 277 SERVICES: SMART RAILWAYS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 278 PROFESSIONAL SERVICES: SMART RAILWAYS MARKET, BY TYPE, 2019-2024 (USD MILLION)

- TABLE 279 PROFESSIONAL SERVICES: SMART RAILWAYS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 280 SMART RAILWAYS MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 281 SMART RAILWAYS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 282 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 283 RAILWAY MANAGEMENT SYSTEM MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 284 RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTIONS, 2018-2023 (USD MILLION)

- TABLE 285 RAILWAY MANAGEMENT SYSTEM MARKET, BY SOLUTIONS, 2024-2029 (USD MILLION)

- TABLE 286 RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 287 RAILWAY MANAGEMENT SYSTEM MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 288 RAILWAY PLATFORM SECURITY MARKET, BY COMPONENT, 2017-2024 (USD MILLION)

- TABLE 289 SOLUTIONS: RAILWAY PLATFORM SECURITY MARKET, BY TYPE, 2017-2024 (USD MILLION)

- TABLE 290 SERVICES: RAILWAY PLATFORM SECURITY MARKET, BY TYPE, 2017-2024 (USD MILLION)

- TABLE 291 PROFESSIONAL SERVICES MARKET, BY TYPE, 2017-2024 (USD MILLION)

- TABLE 292 RAILWAY PLATFORM SECURITY MARKET, BY APPLICATION, 2017-2024 (USD MILLION)

- TABLE 293 RAILWAY PLATFORM SECURITY MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 294 DIGITAL RAILWAY MARKET, BY SOLUTION, 2019-2024 (USD BILLION)

- TABLE 295 DIGITAL RAILWAY MARKET, BY SOLUTION, 2025-2030 (USD BILLION)

- TABLE 296 DIGITAL RAILWAY MARKET, BY SERVICE, 2019-2024 (USD BILLION)

- TABLE 297 DIGITAL RAILWAY MARKET, BY SERVICE, 2025-2030 (USD BILLION)

- TABLE 298 PROFESSIONAL SERVICES: DIGITAL RAILWAY MARKET, BY TYPE, 2019-2024 (USD BILLION)

- TABLE 299 PROFESSIONAL SERVICES: DIGITAL RAILWAY MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 300 DIGITAL RAILWAY MARKET, BY APPLICATION, 2019-2024 (USD BILLION)

- TABLE 301 DIGITAL RAILWAY MARKET, BY APPLICATION, 2025-2030 (USD BILLION)

- TABLE 302 DIGITAL RAILWAY MARKET, BY REGION, 2019-2024 (USD BILLION)

- TABLE 303 DIGITAL RAILWAY MARKET, BY REGION, 2025-2030 (USD BILLION)

List of Figures

- FIGURE 1 RAIL ASSET MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 RAIL ASSET MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE): REVENUE OF VENDORS IN RAIL ASSET MANAGEMENT MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (DEMAND SIDE): RAIL ASSET MANAGEMENT MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- FIGURE 8 RAIL ASSET MANAGEMENT MARKET, 2023-2030 (USD MILLION)

- FIGURE 9 LEADING SEGMENTS IN RAIL ASSET MANAGEMENT MARKET IN 2025

- FIGURE 10 RAIL ASSET MANAGEMENT MARKET ANALYSIS

- FIGURE 11 GROWING NEED FOR ADVANCED TRANSPORTATION INFRASTRUCTURE TO DRIVE RAIL ASSET MANAGEMENT MARKET

- FIGURE 12 SOLUTIONS SEGMENT AND UK TO ACCOUNT FOR SIGNIFICANT SHARES IN EUROPEAN RAIL ASSET MANAGEMENT MARKET IN 2025

- FIGURE 13 SOLUTIONS SEGMENT AND CHINA TO ACCOUNT FOR SIGNIFICANT SHARES IN ASIA PACIFIC RAIL ASSET MANAGEMENT MARKET IN 2025

- FIGURE 14 RAIL ASSET MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 GLOBAL URBANIZATION TREND, 1960-2020

- FIGURE 16 BRIEF HISTORY OF RAIL ASSET MANAGEMENT

- FIGURE 17 RAIL ASSET MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 RAIL ASSET MANAGEMENT MARKET: ECOSYSTEM

- FIGURE 19 RAIL ASSET MANAGEMENT MARKET: PATENTS APPLIED AND GRANTED, 2015-2025

- FIGURE 20 AVERAGE SELLING PRICE OF RAIL ASSET MANAGEMENT SERVICES, BY KEY PLAYER, 2024

- FIGURE 21 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 RAIL ASSET MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE SOLUTIONS

- FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE SOLUTIONS

- FIGURE 25 INVESTMENT IN LEADING GLOBAL RAIL ASSET MANAGEMENT, BY STARTUPS/ SMES (USD MILLION)

- FIGURE 26 USE CASES OF GENERATIVE AI IN RAIL ASSET MANAGEMENT

- FIGURE 27 SERVICES SEGMENT TO REGISTER HIGHER CAGR THAN SOLUTIONS SEGMENT FROM 2025 TO 2030

- FIGURE 28 ANALYTICS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 PREDICTIVE MAINTENANCE SEGMENT TO REGISTER HIGHER CAGR THAN CONDITION MONITORING SEGMENT DURING FORECAST PERIOD

- FIGURE 30 MANAGED SERVICES SEGMENT TO REGISTER HIGHER CAGR THAN PROFESSIONAL SERVICES SEGMENT DURING FORECAST PERIOD

- FIGURE 31 SUPPORT & MAINTENANCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 INFRASTRUCTURE SEGMENT TO REGISTER HIGHER CAGR THAN ROLLING STOCK SEGMENT DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC ESTIMATED TO LEAD RAIL ASSET MANAGEMENT MARKET IN 2025

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 36 SHARES OF LEADING COMPANIES IN RAIL ASSET MANAGEMENT MARKET, 2024

- FIGURE 37 RANKING OF KEY PLAYERS IN THE RAIL ASSET MANAGEMENT MARKET, 2024

- FIGURE 38 REVENUE ANALYSIS OF LEADING PLAYERS, 2020-2024

- FIGURE 39 RAIL ASSET MANAGEMENT MARKET, COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 RAIL ASSET MANAGEMENT MARKET: COMPANY FOOTPRINT

- FIGURE 41 RAIL ASSET MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 42 RAIL ASSET MANAGEMENT MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 43 COMPANY VALUATION, 2025

- FIGURE 44 FINANCIAL METRICS OF KEY VENDORS, 2025

- FIGURE 45 SIEMENS: COMPANY SNAPSHOT

- FIGURE 46 HITACHI: COMPANY SNAPSHOT

- FIGURE 47 ALSTOM: COMPANY SNAPSHOT

- FIGURE 48 IBM: COMPANY SNAPSHOT

- FIGURE 49 WABTEC: COMPANY SNAPSHOT

- FIGURE 50 SAP: COMPANY SNAPSHOT

- FIGURE 51 CAPGEMINI: COMPANY SNAPSHOT

- FIGURE 52 CISCO: COMPANY SNAPSHOT

- FIGURE 53 HUAWEI: COMPANY SNAPSHOT

- FIGURE 54 ACCENTURE: COMPANY SNAPSHOT